Answered step by step

Verified Expert Solution

Question

1 Approved Answer

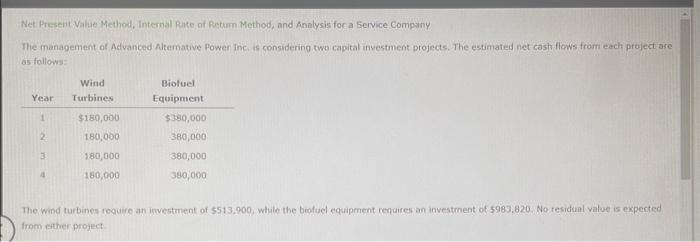

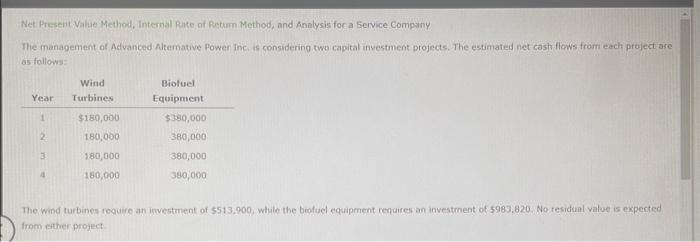

PLEASE HELP ASAP Net Present Value Method, Intemal Rate of Return Method, and Analysis for a Service Compiny The management of Advanced Altemative Power ine

PLEASE HELP ASAP

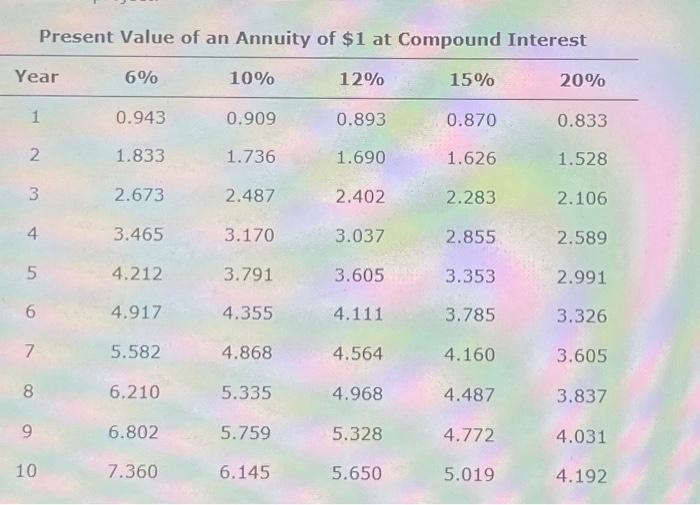

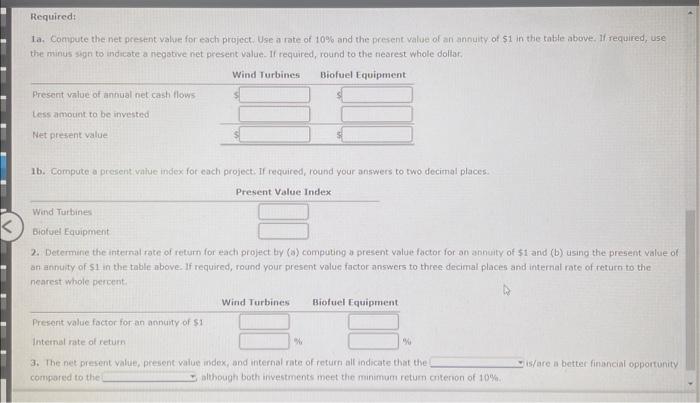

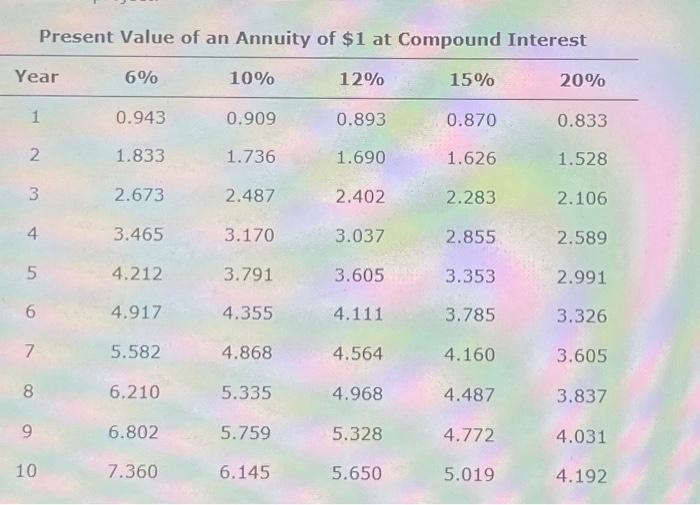

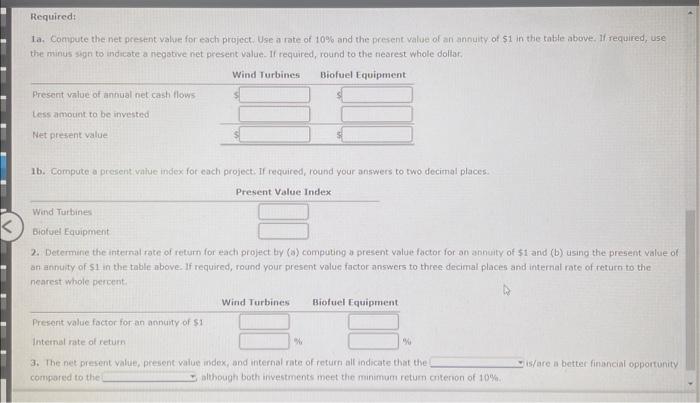

Net Present Value Method, Intemal Rate of Return Method, and Analysis for a Service Compiny The management of Advanced Altemative Power ine is considering two capital investment profects. The estimated net cash flows from each project are as follows: The wind turbines require an imvestment of 5513,900, while the brofuel equipenent requires an investment of 5983,820 . No residual value is expected from either project Precant Value of an Annuitur of d at Cnmmnnd Tntamont 1a. Compute the net present value for each project. Use a rate of 10% and the present value of an annuity of $1 in the table above. If required, use the minus sign to indicate a riegative net present value. If required, round to the nearest whole dolitar. 16. Compute a present value index for each project: If required, round your answers to two decimal places: 2. Determine the intemal rate of return for each project by (a) computing a present value factor for an annuty of $1 and (b) asing the present value of an annuity of $1 in the-table-above- If required, round your present volue factor-answers to three decimal places and internal rate of return to the nearest: whole percent. 3. The net prestent yalue, present value index, and internal rate of return all indicate that the cormpored to the although both investments meet the munimun retum cuterron of 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started