Answered step by step

Verified Expert Solution

Question

1 Approved Answer

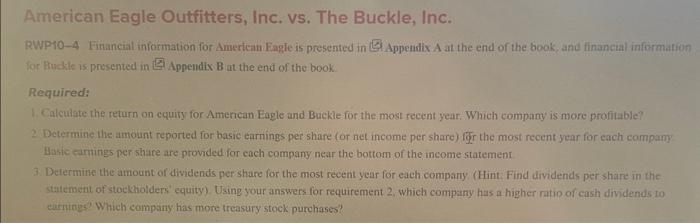

please help asap please help asap! American Eagle Outfitters, Inc. vs. The Buckle, Inc. RWP10-4 Financial information for American Fagle is presented in (B) Appendix

please help asap

please help asap!

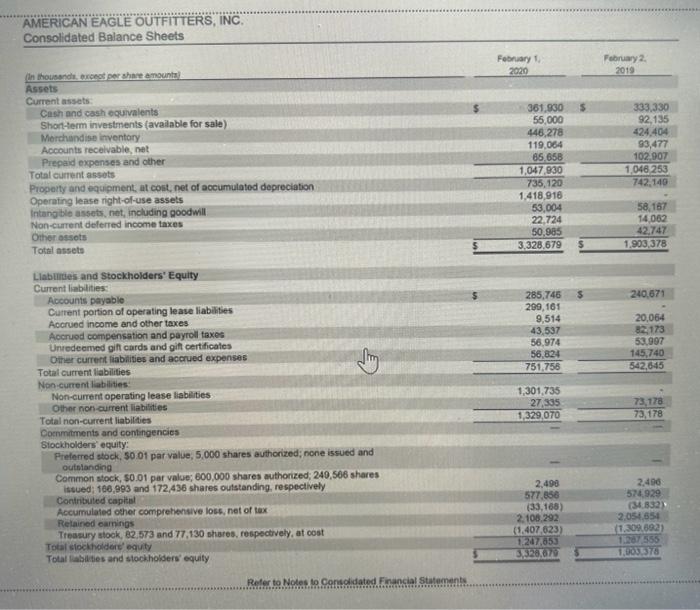

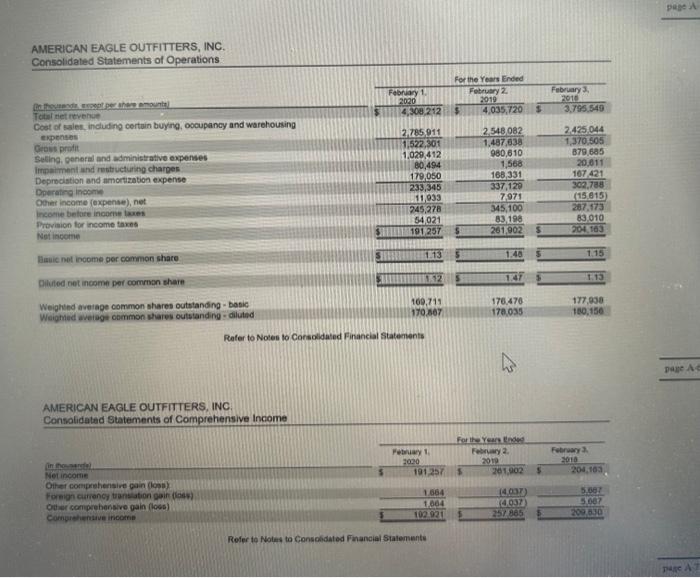

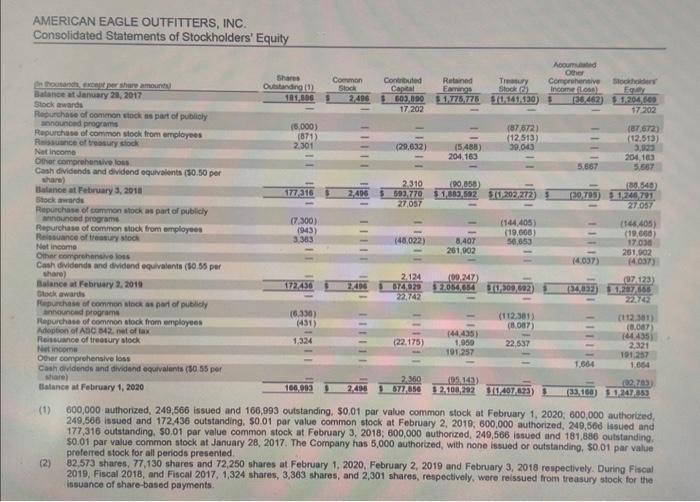

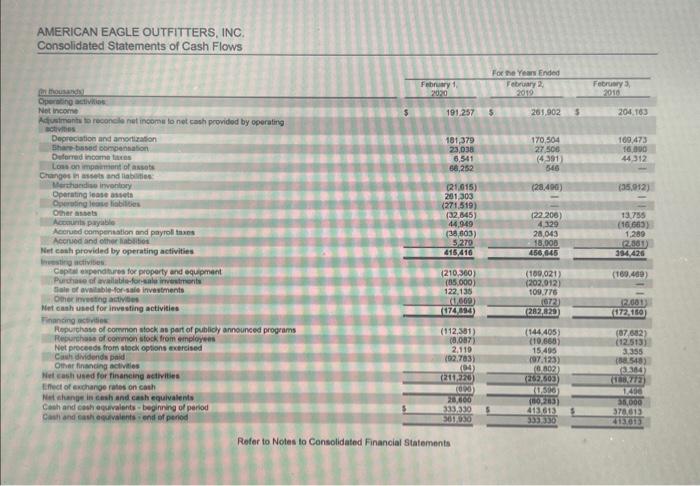

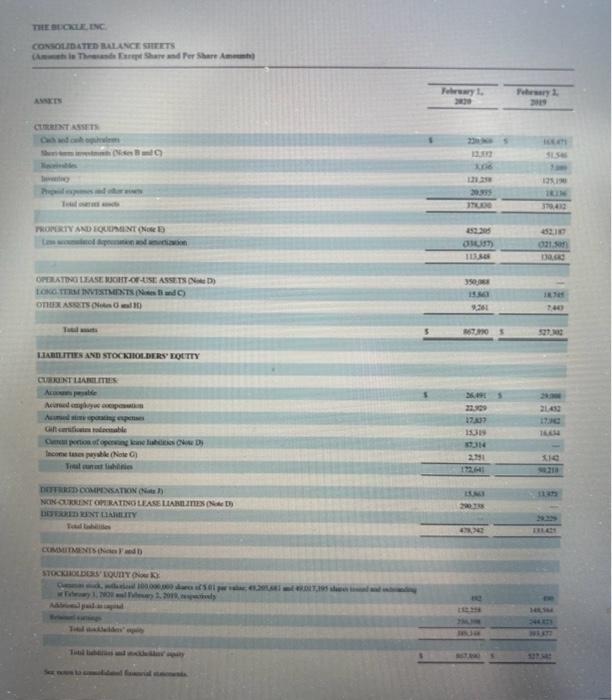

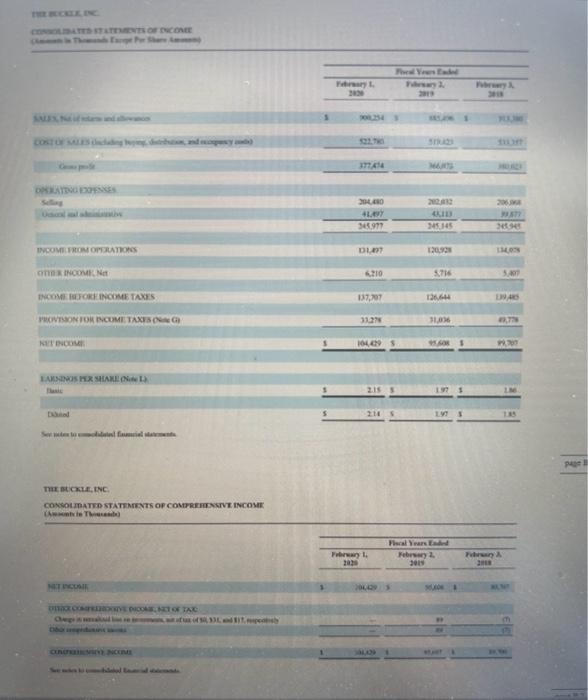

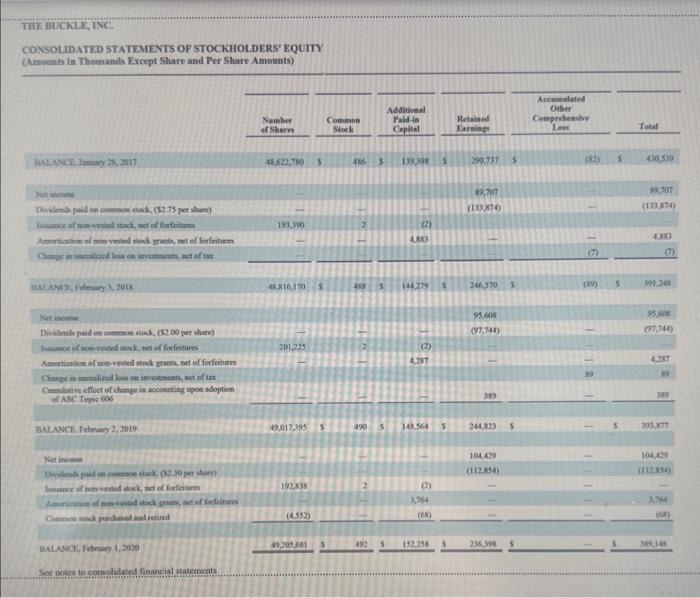

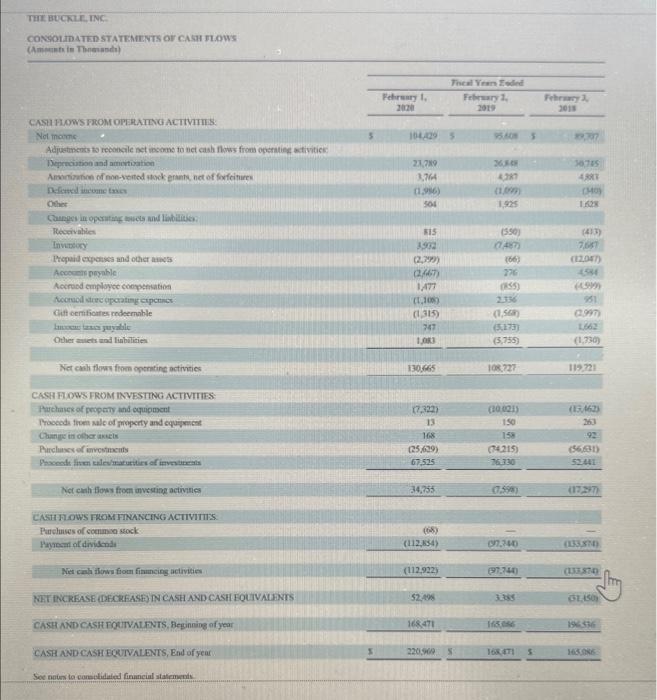

American Eagle Outfitters, Inc. vs. The Buckle, Inc. RWP10-4 Financial information for American Fagle is presented in (B) Appendix A at the end of the book, and financial information Sor fiuckle is presented in G Appendix B at the end of the book Required: 1. Calculate the return on cquity for Amencan Eagle and Buckle for the most recent year. Which company is more profitable? 2. Determine the amount reported for basic earnings per share (or net income per share) lor the most recent year for each campamy Bakic eartings per share are provided for cach company near the bottom of the income statemenr 3. Delermine the amount of dividends per share for the most recent year for edeh company. (Hint Find dividends per share in the statemenit of stockholders' equity). Using your answers for requirement 2 , which company has a higher ratio of cash dividends to caimings? Which compiny has more treasury stock purchases? AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets (n thousandi, brocost per shave amounts) Assets Current assets Cash and cash oquvalents Shontherm investments (avalable for sale) Wiorchandise itventory Accounts recelvable, net Total cument assets Proparty and equipment, at cost, net of accumulated depreciation Operating lease right-of-use assets Intang ble assets, net, including goodwill Non-current delerred income taxes Ohtier assets Total assets Llaburties and Stockholders' Equity Cument liablities: Accounts payable Cutrent portion of operating lease liabilities Accrued income and other taxes Accruod compensation and payroll taxes Unedeemed gif cards and gift certificales Other current fiabilities and accrued expenses Total current fiabilities Non-cument labilities: Non-current operating lease liabilies Othnr noricurrent liabisties Tolal non-current liabilties Cocnmitments and contingencies Slockholders' equity: Preferred stock, 50.01 par value, 5,000 shares authorized; none issued and outstanding Common stock, 50.01 par value; 600,000 shares authorized; 240,506 shares Contributed capitsl Accumulated other comprehensive loss, net of tax Retained camings Tressury stook, 82,573 and 77,130 shares, respectrvely, at oost Total slockholdere' equity Total labities and stockholders' equity Refer to Noles is Consolidated Financial Statements. Refer to Notes to Consoidated Financial Stalemunte AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Stockholders' Equity (1) 600,000 authorized, 249,566 issued and 166,093 outstanding, 50,01 par value common stock at Fobruary 1,2020 ; 600,000 authorixed 249,506 issued and 172,436 outstanding. 50.01 par value common stock at February 2, 2019, 600,000 authorized, 249,560 issued and 171,316 outstanding, 50,01 par value common stock at February 3, 2018; 800,000 authorzzed, 249,566 issued and 181,886 outstanding. 50.01 par value common stock at January 28,2017 . The Cornpany has 5,000 authorized, with none issued or outstanding, $0.01 par value preferred stock for all periods presented. (2) 82,573 shares, 77,130 shares and 72,250 shares at February 1, 2020, February 2, 2019 and February 3,2018 respectively. During Fiscal 2019, Fiscal 2018, and Fiscal 2017, 1,324 shares, 3,363 shares, and 2,301 shares, respectively, were reissued from treasury stock for the issuance of ehare-bosed payments . AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Cash Flows Reter to Notes to Consolidated Financial Statements Tht aticktritic: xverts ctoment assts C.KaNT 13hm rmes:- stockase bosy LoumY okse 8 : Taze ntcxum, DNE. Ih ientrie Thesenete) THE BICKliE, INC. CONSOLID ATED STATEMENTS OF STOCKHOLDERS' EQUTY (Amounts in Thousinds Excopt Share and Per Share Ameunts) BA1MANCR- Iumary 25 . 2017 4,622,760546651393985290,7375 (45) 543059 Wht incinew Dwilendi frid en cormos nad is2.75 per share? luance of noonested sock, bxt of fariciture 14k,ANTindracy 3 , 201s 48,51617054885144,279524.3705 (y) 5191,243 Nrtinane Divilenh puid on common wick, (\$2 00 per whare) failame of noevecilos itivk, net of finfoitures Chaspe in unralirad loa on invetrocets, sct of tar Cumbutative affict of change is accounting upen adoption al ASC Tepic e06 BAT.ANCL. Fetruacy 2,2019 Wer incoen Amonnicalion of ale tistud doel grante, nt of forfcitures (4552) (65) (6s) Ii ANCF, I If truary 1,2000 4.200.681 5 492 Soe notes to comsolidniod financial katements THE BECKIR. INC (Amibents in Thenesodi) CASt1 FLOWS FROM OPIARTVGACTVIIIS: Not inatre Adjugtinenis to reconcile net incorne fo net cash flows from operatief a tivitice Deprociution and amivitization Arowirimon of noe-veited wack erants. net of forfitures Defened inteune txcs Oher: Cansecs in eperatanf baces and liabilitice Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started