Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help ASAP Sager Company builds custom retaining walls for large commercial customers. On May 1, the company had no inventories of work in process

Please help ASAP

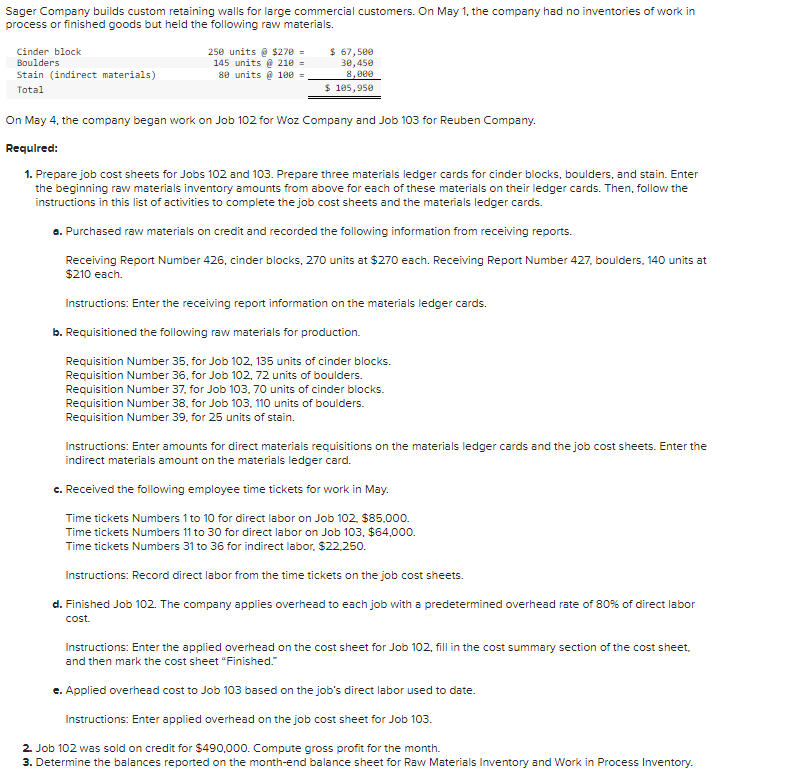

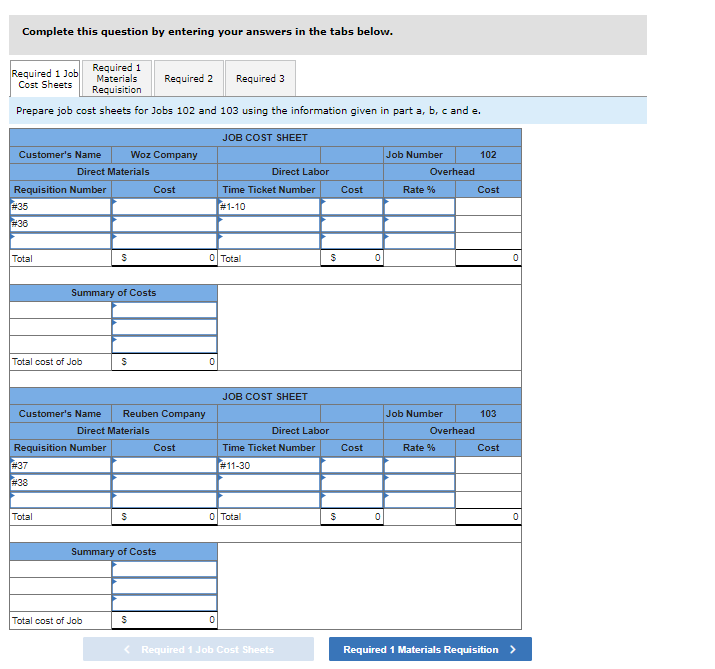

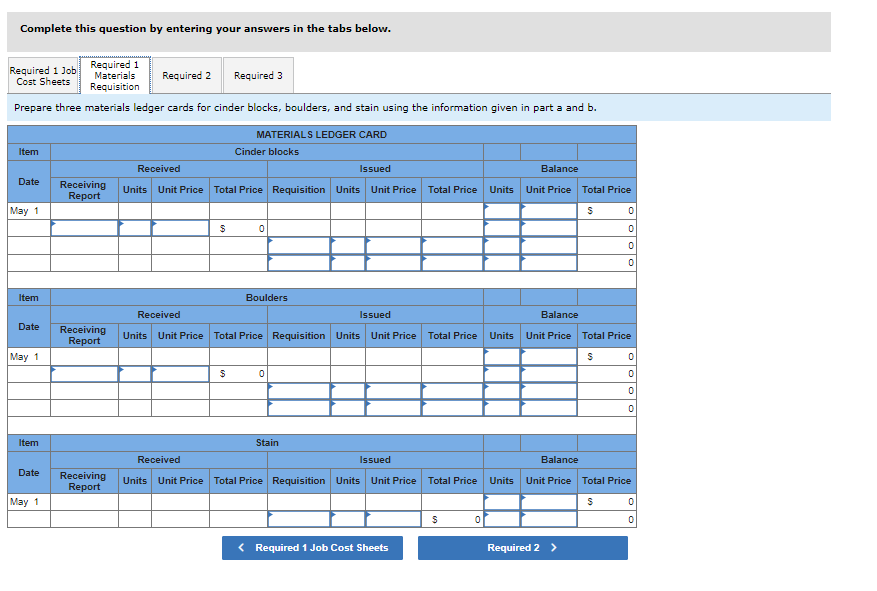

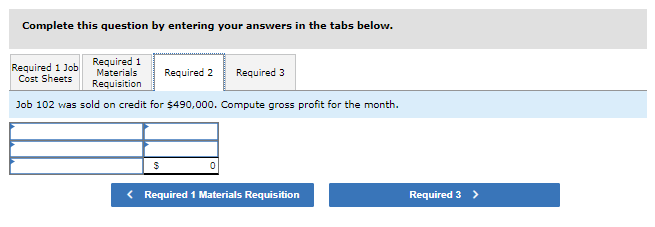

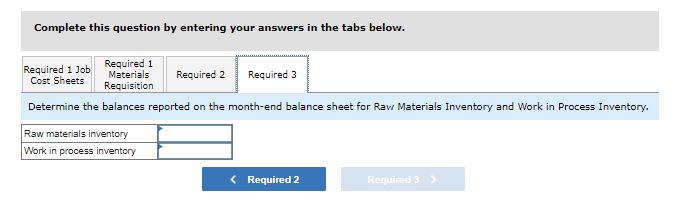

Sager Company builds custom retaining walls for large commercial customers. On May 1, the company had no inventories of work in process or finished goods but held the following raw materials. On May 4, the company began work on Job 102 for Woz Company and Job 103 for Reuben Company. Requlred: 1. Prepare job cost sheets for Jobs 102 and 103. Prepare three materials ledger cards for cinder blocks, boulders, and stain. Enter the beginning raw materials inventory amounts from above for each of these materials on their ledger cards. Then, follow the instructions in this list of activities to complete the job cost sheets and the materials ledger cards. o. Purchased raw materials on credit and recorded the following information from receiving reports. Receiving Report Number 426, cinder blocks, 270 units at $270 each. Receiving Report Number 427 , boulders, 140 units at $210 each. Instructions: Enter the receiving report information on the materials ledger cards. b. Requisitioned the following raw materials for production. Requisition Number 35, for Job 102, 135 units of cinder blocks. Requisition Number 36 , for Job 102, 72 units of boulders. Requisition Number 37, for Job 103, 70 units of cinder blocks. Requisition Number 38 , for Job 103, 110 units of boulders. Requisition Number 39 , for 25 units of stain. Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect materials amount on the materials ledger card. c. Received the following employee time tickets for work in May. Time tickets Numbers 1 to 10 for direct labor on Job 102, $85,000. Time tickets Numbers 11 to 30 for direct labor on Job 103, \$64,000. Time tickets Numbers 31 to 36 for indirect labor, $22,250. Instructions: Record direct labor from the time tickets on the job cost sheets. d. Finished Job 102 . The company applies overhead to each job with a predetermined overhead rate of 80% of direct labor cost Instructions: Enter the applied overhead on the cost sheet for Job 102, fill in the cost summary section of the cost sheet, and then mark the cost sheet "Finished." e. Applied overhead cost to Job 103 based on the job's direct labor used to date. Instructions: Enter applied overhead on the job cost sheet for Job 103. 2. Job 102 was sold on credit for $490,000. Compute gross profit for the month. 3. Determine the balances reported on the month-end balance sheet for Raw Materials Inventory and Work in Process Inventory. Complete this question by entering your answers in the tabs below. \begin{tabular}{|c|c|c|c|} \hline Required1JobCostSheets & Required1MaterialsRequisition & Required 2 & Required 3 \\ \hline \end{tabular} Prepare job cost sheets for Jobs 102 and 103 using the information given in part a,b, c and e. Required 1 Job Cost Sheets Required 1 Materials Requisition > Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Job 102 was sold on credit for $490,000. Compute gross profit for the month. Complete this question by entering your answers in the tabs below. Determine the balances reported on the month-end balance sheet for Raw Materials Inventory and Work in Process Inventory

Sager Company builds custom retaining walls for large commercial customers. On May 1, the company had no inventories of work in process or finished goods but held the following raw materials. On May 4, the company began work on Job 102 for Woz Company and Job 103 for Reuben Company. Requlred: 1. Prepare job cost sheets for Jobs 102 and 103. Prepare three materials ledger cards for cinder blocks, boulders, and stain. Enter the beginning raw materials inventory amounts from above for each of these materials on their ledger cards. Then, follow the instructions in this list of activities to complete the job cost sheets and the materials ledger cards. o. Purchased raw materials on credit and recorded the following information from receiving reports. Receiving Report Number 426, cinder blocks, 270 units at $270 each. Receiving Report Number 427 , boulders, 140 units at $210 each. Instructions: Enter the receiving report information on the materials ledger cards. b. Requisitioned the following raw materials for production. Requisition Number 35, for Job 102, 135 units of cinder blocks. Requisition Number 36 , for Job 102, 72 units of boulders. Requisition Number 37, for Job 103, 70 units of cinder blocks. Requisition Number 38 , for Job 103, 110 units of boulders. Requisition Number 39 , for 25 units of stain. Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect materials amount on the materials ledger card. c. Received the following employee time tickets for work in May. Time tickets Numbers 1 to 10 for direct labor on Job 102, $85,000. Time tickets Numbers 11 to 30 for direct labor on Job 103, \$64,000. Time tickets Numbers 31 to 36 for indirect labor, $22,250. Instructions: Record direct labor from the time tickets on the job cost sheets. d. Finished Job 102 . The company applies overhead to each job with a predetermined overhead rate of 80% of direct labor cost Instructions: Enter the applied overhead on the cost sheet for Job 102, fill in the cost summary section of the cost sheet, and then mark the cost sheet "Finished." e. Applied overhead cost to Job 103 based on the job's direct labor used to date. Instructions: Enter applied overhead on the job cost sheet for Job 103. 2. Job 102 was sold on credit for $490,000. Compute gross profit for the month. 3. Determine the balances reported on the month-end balance sheet for Raw Materials Inventory and Work in Process Inventory. Complete this question by entering your answers in the tabs below. \begin{tabular}{|c|c|c|c|} \hline Required1JobCostSheets & Required1MaterialsRequisition & Required 2 & Required 3 \\ \hline \end{tabular} Prepare job cost sheets for Jobs 102 and 103 using the information given in part a,b, c and e. Required 1 Job Cost Sheets Required 1 Materials Requisition > Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Job 102 was sold on credit for $490,000. Compute gross profit for the month. Complete this question by entering your answers in the tabs below. Determine the balances reported on the month-end balance sheet for Raw Materials Inventory and Work in Process Inventory Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started