Answered step by step

Verified Expert Solution

Question

1 Approved Answer

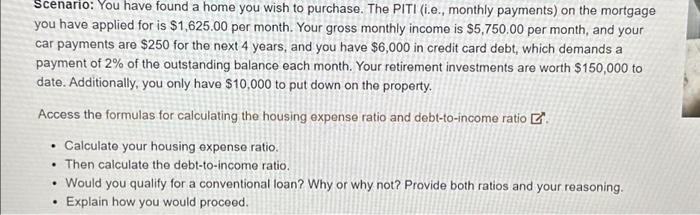

PLEASE HELP ASAP. Scenario: You have found a home you wish to purchase. The PITI (i.e., monthly payments) on the mortgage you have applied for

PLEASE HELP ASAP.

Scenario: You have found a home you wish to purchase. The PITI (i.e., monthly payments) on the mortgage you have applied for is $1,625.00 per month. Your gross monthly income is $5,750.00 per month, and your car payments are $250 for the next 4 years, and you have $6,000 in credit card debt, which demands a payment of 2% of the outstanding balance each month. Your retirement investments are worth $150,000 to date. Additionally, you only have $10,000 to put down on the property. Access the formulas for calculating the housing expense ratio and debt-to-income ratio . Calculate your housing expense ratio. Then calculate the debt-to-income ratio. Seces pe . Would you qualify for a conventional loan? Why or why not? Provide both ratios and your reasoning. Explain how you would proceed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started