Please help asap this assignment is due tomorrow and I am getting desperate, google and the textbook are no help.

Can someone please answer these questions asap, they are due tomorrow. the answers i have are probably wrong and i am clueless/desperate

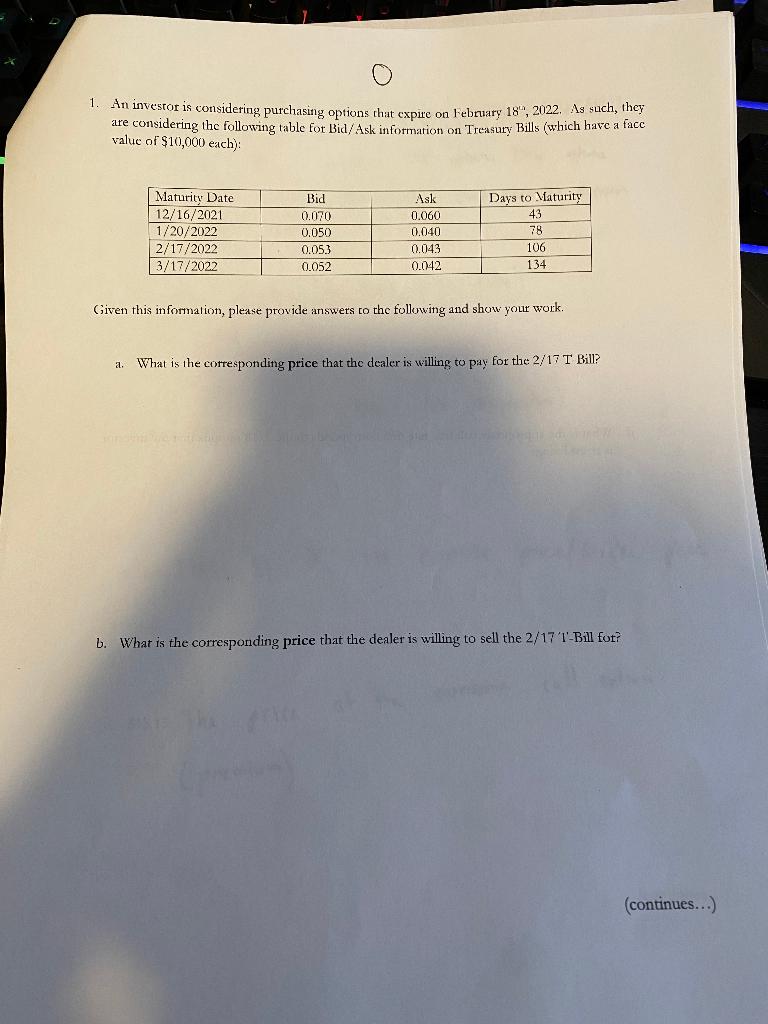

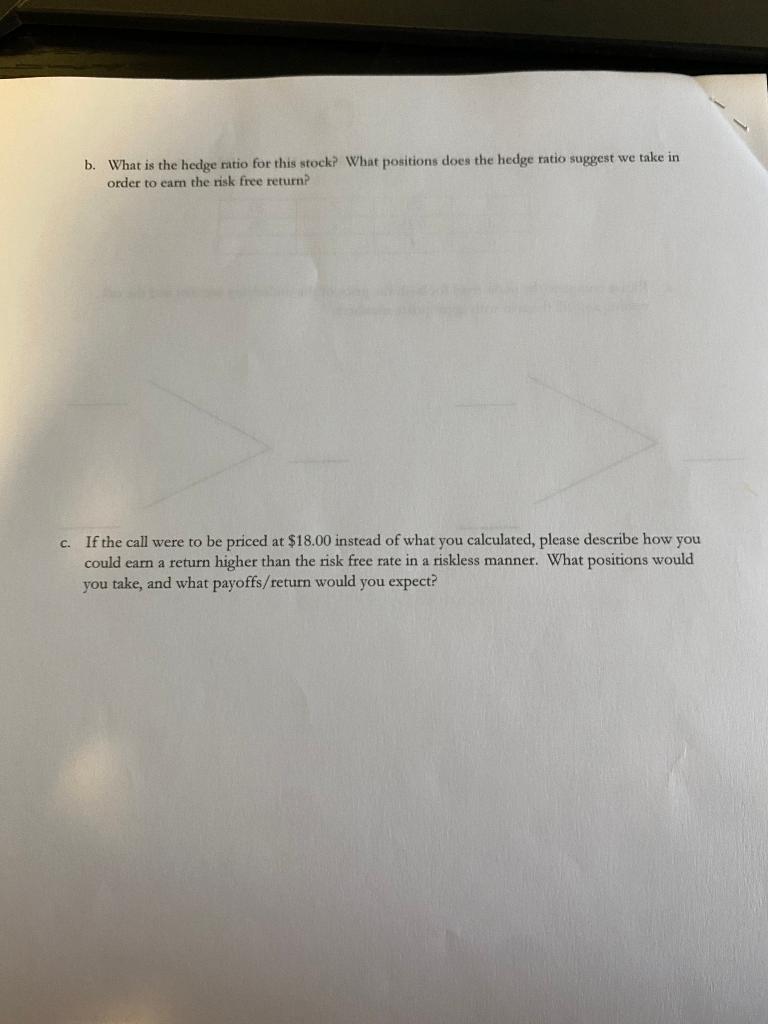

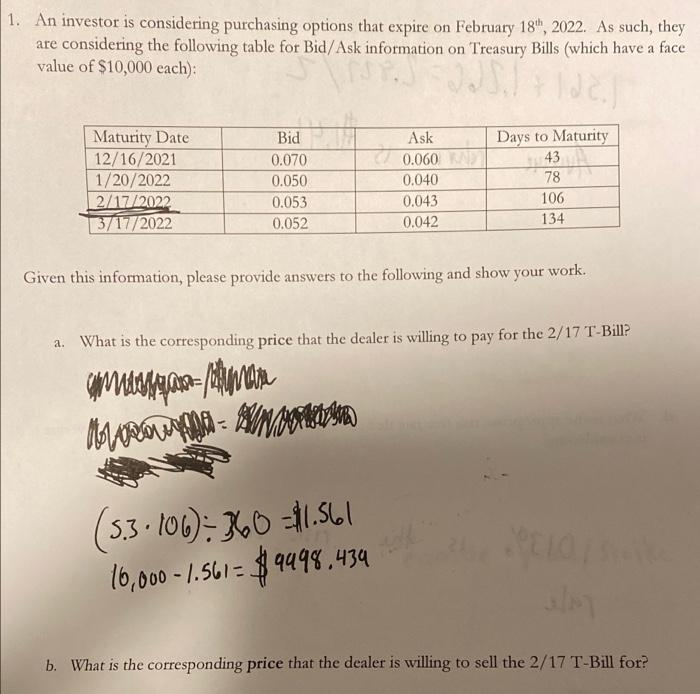

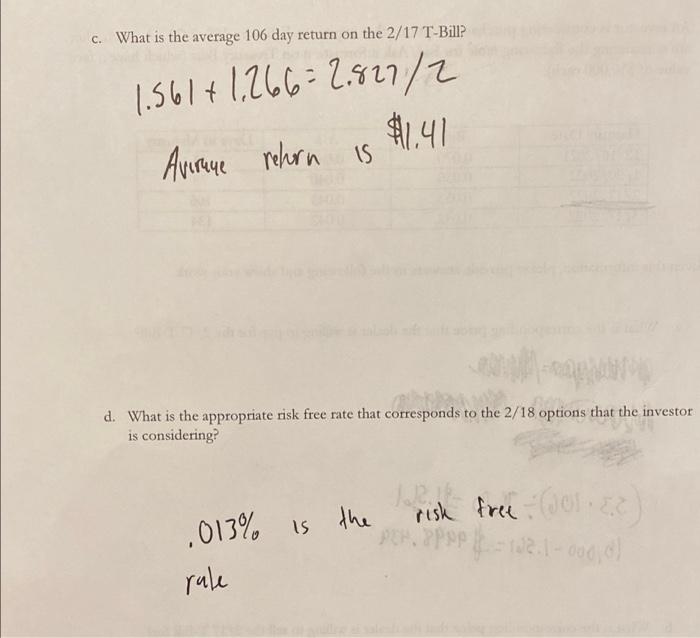

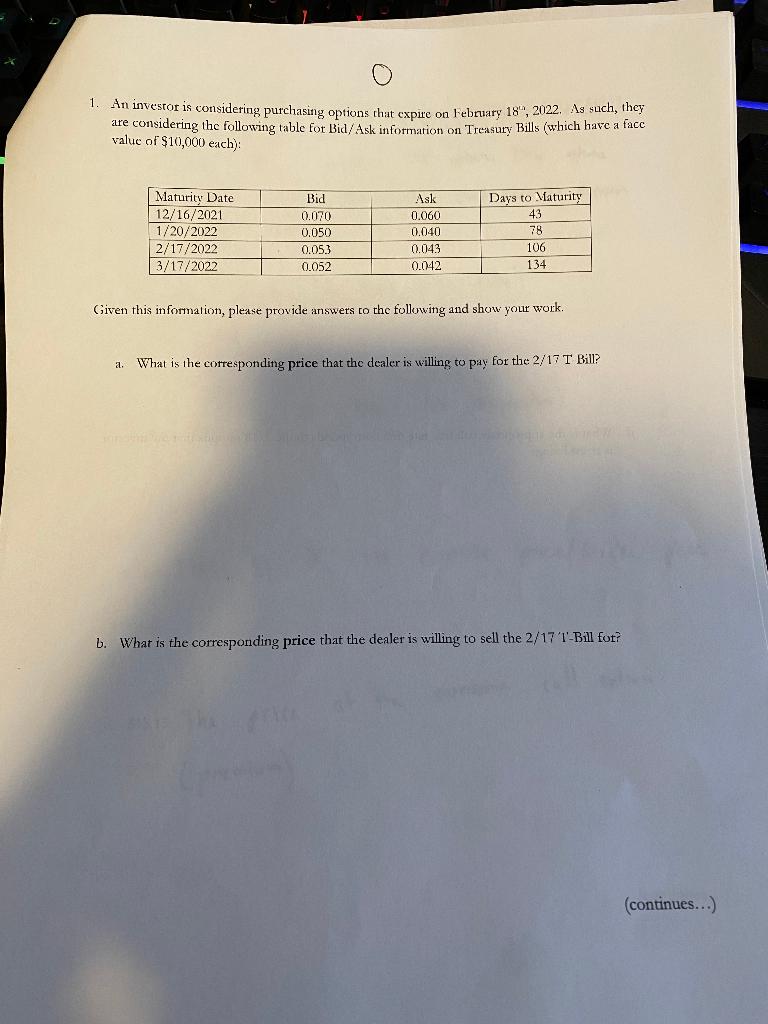

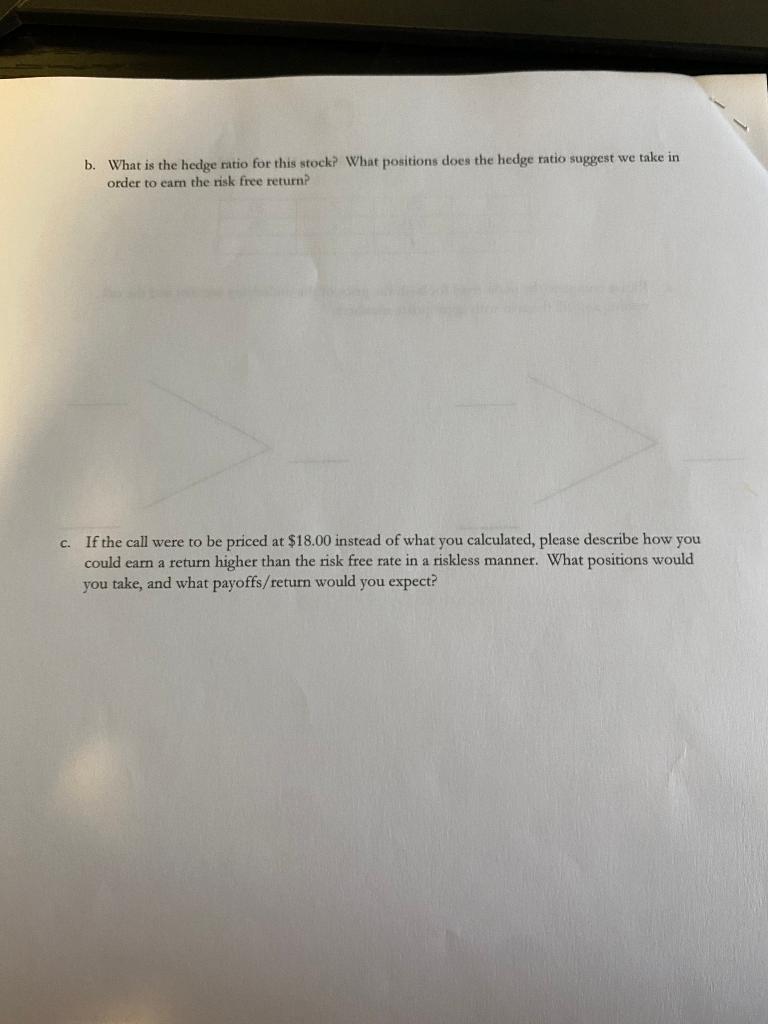

1 An investor is considering purchasing options that expire on February 18", 2022. As such, they are considering the following table for Bid/Ask information on Treasury Bills (which have a face value of $10,000 each): Maturity Date 12/16/2021 1/20/2022 2/17/2022 | 3/17/2022 Bid 0.070 0.050 0.060 0.040 Days to Maturity 43 78 106 134 0.053 0.043 0.052 0.042 Given this information, please provide answers to the following and show your work. a. What is the corresponding price that the dealer is willing to pay for the 2/17 T Bill? b. What is the corresponding price that the dealer is willing to sell the 2/17 T-Bill for? (continues...) b. What is the hedge ratio for this stock? What positions does the hedge ratio suggest we take in order to earn the risk free return? C. If the call were to be priced at $18.00 instead of what you calculated, please describe how you could earn a return higher than the risk free rate in a riskless manner. What positions would you take, and what payoffs/return would you expect? 1. An investor is considering purchasing options that expire on February 18th, 2022. As such, they are considering the following table for Bid/Ask information on Treasury Bills (which have a face value of $10,000 each): a Maturity Date 12/16/2021 1/20/2022 2/17/2022 3/17/2022 Bid 0.070 0.050 0.053 0.052 Ask 0.060 0.040 0.043 0.042 Days to Maturity 43 78 106 134 Given this information, please provide answers to the following and show your work. a. What is the corresponding price that the dealer is willing to pay for the 2/17 T-Bill? canvas pequena eman Moocan na naman (5,3 106)=360 = $1.561 16,000 - 1.561= $1498.439 PC b. What is the corresponding price that the dealer is willing to sell the 2/17 T-Bill for? C. What is the average 106 day return on the 2/17 T-Bill? 1.561+1,266-2.827/2 Avirane rehrn is #1.41 d. What is the appropriate risk free rate that corresponds to the 2/18 options that the investor is considering? 2 risk free on & 013% is the 2.1-000 rale 1 An investor is considering purchasing options that expire on February 18", 2022. As such, they are considering the following table for Bid/Ask information on Treasury Bills (which have a face value of $10,000 each): Maturity Date 12/16/2021 1/20/2022 2/17/2022 | 3/17/2022 Bid 0.070 0.050 0.060 0.040 Days to Maturity 43 78 106 134 0.053 0.043 0.052 0.042 Given this information, please provide answers to the following and show your work. a. What is the corresponding price that the dealer is willing to pay for the 2/17 T Bill? b. What is the corresponding price that the dealer is willing to sell the 2/17 T-Bill for? (continues...) b. What is the hedge ratio for this stock? What positions does the hedge ratio suggest we take in order to earn the risk free return? C. If the call were to be priced at $18.00 instead of what you calculated, please describe how you could earn a return higher than the risk free rate in a riskless manner. What positions would you take, and what payoffs/return would you expect? 1. An investor is considering purchasing options that expire on February 18th, 2022. As such, they are considering the following table for Bid/Ask information on Treasury Bills (which have a face value of $10,000 each): a Maturity Date 12/16/2021 1/20/2022 2/17/2022 3/17/2022 Bid 0.070 0.050 0.053 0.052 Ask 0.060 0.040 0.043 0.042 Days to Maturity 43 78 106 134 Given this information, please provide answers to the following and show your work. a. What is the corresponding price that the dealer is willing to pay for the 2/17 T-Bill? canvas pequena eman Moocan na naman (5,3 106)=360 = $1.561 16,000 - 1.561= $1498.439 PC b. What is the corresponding price that the dealer is willing to sell the 2/17 T-Bill for? C. What is the average 106 day return on the 2/17 T-Bill? 1.561+1,266-2.827/2 Avirane rehrn is #1.41 d. What is the appropriate risk free rate that corresponds to the 2/18 options that the investor is considering? 2 risk free on & 013% is the 2.1-000 rale