Answered step by step

Verified Expert Solution

Question

1 Approved Answer

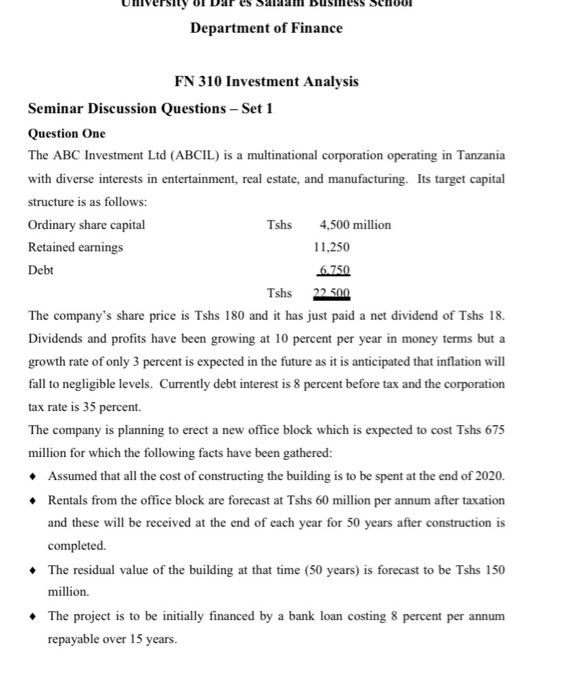

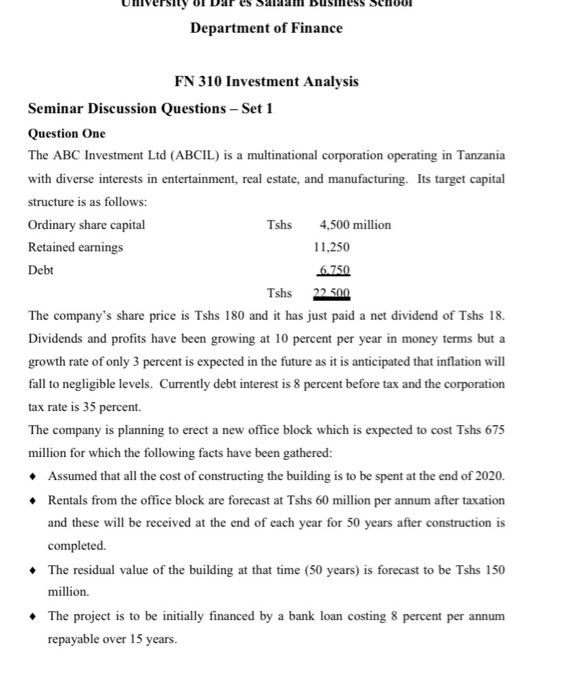

please help b and c this should be the first page i see its not clearly seen University of Dar es Salaam Business School Department

please help b and c

this should be the first page i see its not clearly seen

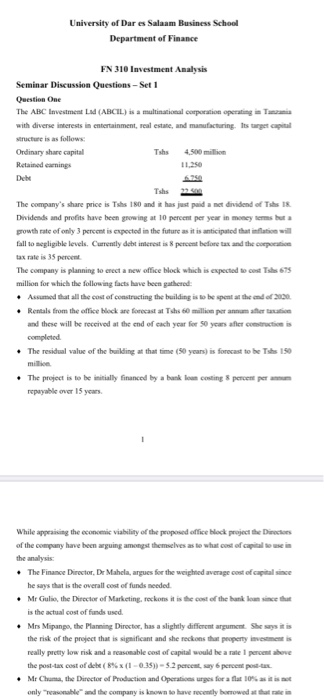

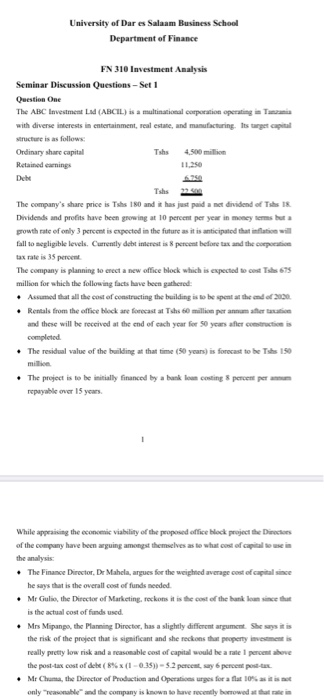

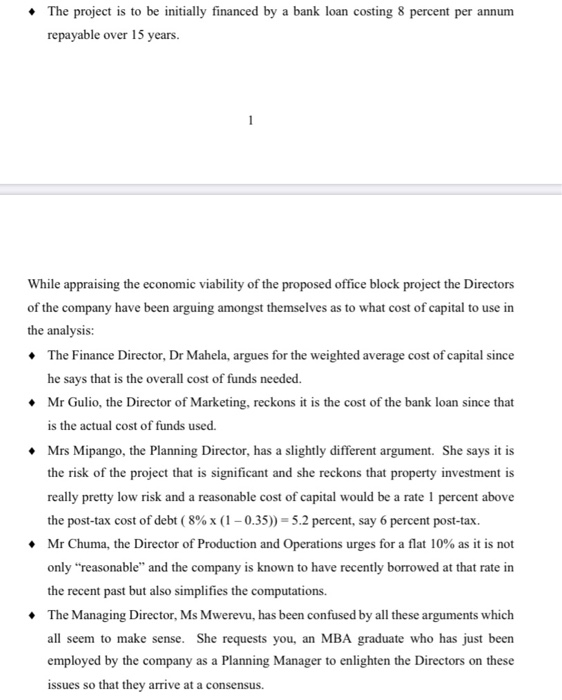

University of Dar es Salaam Business School Department of Finance FN 310 Investment Analysis Seminar Discussion Questions - Set 1 Question One The ABC Investment Ld (ABCIL) is a multinational corporation operating in Taman with diverse interests in entertainment, real estate, and manufacturing. Its target capital structure is as follows: Ordinary share capital Tshs 4.500 million Retained earnings Dich Tshs 22.60 The company's share price is Tshs 180 and it has just paid amet dividend of Tshs 18 Dividends and profits have been growing at 10 percent per year in menye but prowth rate of only 3 percent is expected in the future as it is anticipated that inflation will fall to negligible levels. Currently debt interest is 8 percent before tax and the corection tax rate is 35 per The company is planning to creat a new office block which is expected to cost Tshs 675 million for which the following facts have been gathered Assumed that all the cost of constructing the building is to be spent at the end of 2020 Rentals from the office block are forecast at Tshs 60 million per annum after taxation and there will be received at the end of each year for 50 years after constructii completed The residual value of the building at that time (50 years) is forecast to be Tshs 150 mille The project is to be initially financed by a bank loa cesting percent perm repayable over 15 years While appraising the economic viability of the proposed office block project the Directors of the company have been arguing amongst themselves as to what cost of capital soci the analysis The Finance Director, Dr Mahela, argues for the weighted average cost of capital since he says that is the overall cost of funds needed Mr Gulso, the Director of Marketing, reckons it is the cost of the bank loan since that is the actual cost of funds used Mrs Mipango, the Planning Director, has a slightly different argument. She says it is the risk of the project that is significant and she reckons that property investment is really pretty low risk and a reasonable cost of capital would be a male percent above the post-tax cost of debt (8% (-0.35)) - 5.2 percent, say 6 percent post-tex Mr Chuma, the Director of Production and Operations urges for a flat 10% only a ble and the company is known to have recently borrowed at that train The project is to be initially financed by a bank loan costing 8 percent per annum repayable over 15 years. While appraising the economic viability of the proposed office block project the Directors of the company have been arguing amongst themselves as to what cost of capital to use in the analysis: The Finance Director, Dr Mahela, argues for the weighted average cost of capital since he says that is the overall cost of funds needed. Mr Gulio, the Director of Marketing, reckons it is the cost of the bank loan since that is the actual cost of funds used. Mrs Mipango, the Planning Director, has a slightly different argument. She says it is the risk of the project that is significant and she reckons that property investment is really pretty low risk and a reasonable cost of capital would be a rate 1 percent above the post-tax cost of debt (8%x (1 -0.35)) = 5.2 percent, say 6 percent post-tax. Mr Chuma, the Director of Production and Operations urges for a flat 10% as it is not only "reasonable" and the company is known to have recently borrowed at that rate in the recent past but also simplifies the computations. . The Managing Director, Ms Mwerevu, has been confused by all these arguments which all seem to make sense. She requests you, an MBA graduate who has just been employed by the company as a Planning Manager to enlighten the Directors on these issues so that they arrive at a consensus. b) Calculate the weighted average cost of capital for ABCIL c) Comment on each of the Directors arguments concerning the appropriate discount rate. d) Compute the net present value of the project at the end of 2020 using what you consider to be the most suitable rate. (You can ignore the delay between the collection of rental income and tax payments and other tax complications) e) Describe how an expected inflation rate of 10 percent would affect the project (Hint: You are not required to re-calculate your figures). University or var es Salaam Business SCHOOL Department of Finance FN 310 Investment Analysis Seminar Discussion Questions - Set 1 Question One The ABC Investment Ltd (ABCIL) is a multinational corporation operating in Tanzania with diverse interests in entertainment, real estate, and manufacturing. Its target capital structure is as follows: Ordinary share capital Tshs 4,500 million Retained earnings 11,250 Debt 6.750 Tshs 22.500 The company's share price is Tshs 180 and it has just paid a net dividend of Tshs 18. Dividends and profits have been growing at 10 percent per year in money terms but a growth rate of only 3 percent is expected in the future as it is anticipated that inflation will fall to negligible levels. Currently debt interest is 8 percent before tax and the corporation tax rate is 35 percent. The company is planning to erect a new office block which is expected to cost Tshs 675 million for which the following facts have been gathered: Assumed that all the cost of constructing the building is to be spent at the end of 2020. Rentals from the office block are forecast at Tshs 60 million per annum after taxation and these will be received at the end of each year for 50 years after construction is completed The residual value of the building at that time (50 years) is forecast to be Tshs 150 million The project is to be initially financed by a bank loan costing 8 percent per annum repayable over 15 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started