Answered step by step

Verified Expert Solution

Question

1 Approved Answer

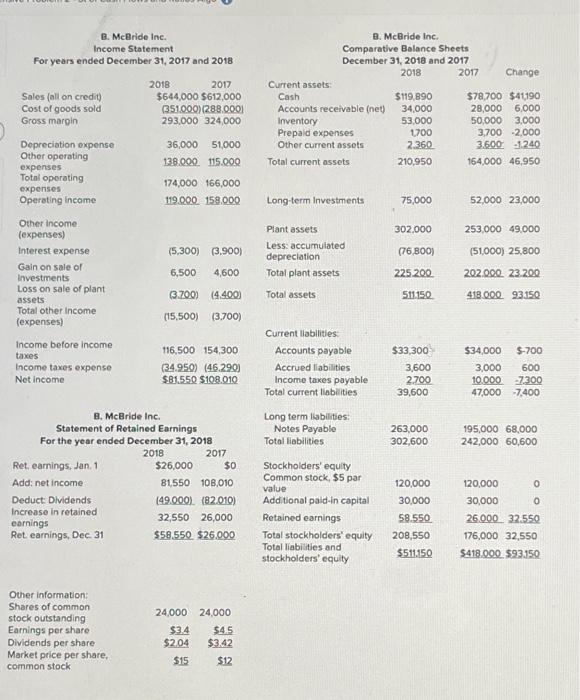

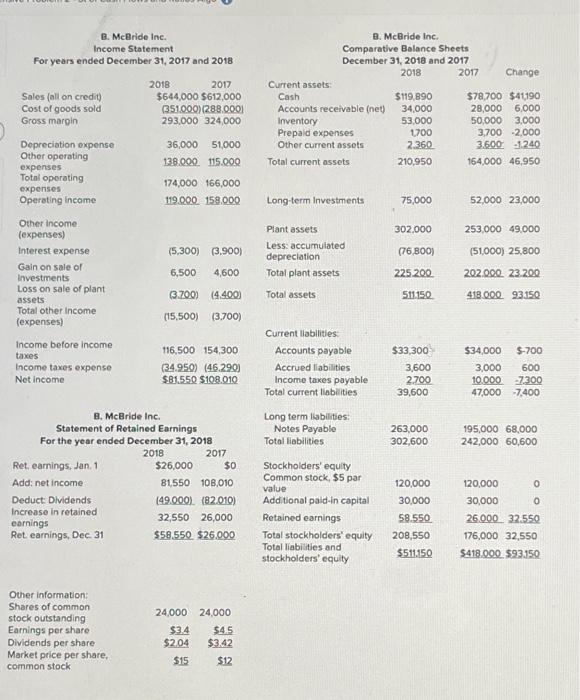

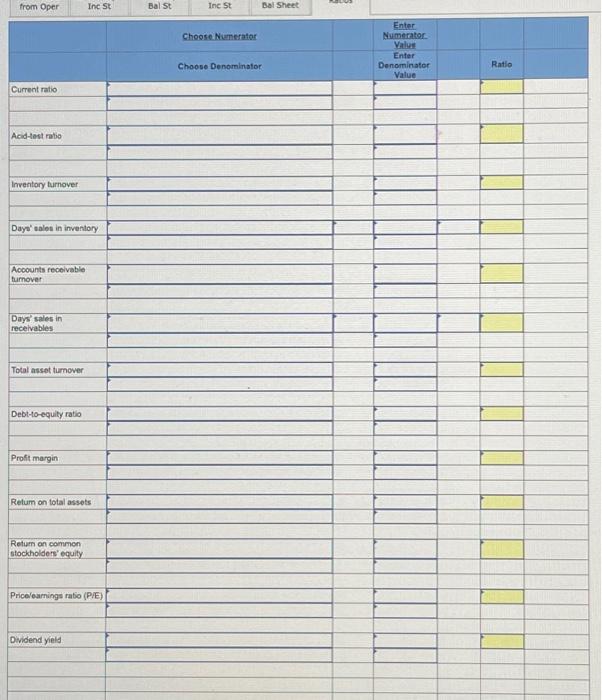

please help! B. MeBride Ine. Income Statement For years ended December 31, 2017 and 2018 2018$644,000(351,000)(288,000)293,00036,000138,000174,000119,0002017$612,000324,00051,000115.000166,000158,000 Other income (expenses) Interest expense Gain on sale of

please help!

B. MeBride Ine. Income Statement For years ended December 31, 2017 and 2018 2018$644,000(351,000)(288,000)293,00036,000138,000174,000119,0002017$612,000324,00051,000115.000166,000158,000 Other income (expenses) Interest expense Gain on sale of livestments Loss on sale of plant assets Total other income (expenses) Income before income taxes Income taxes expense Net income B. MeBride inc. Comparative Bulance Sheets December 31, 2018 and 2017 2018 2017 Change Current assets: Cash $119,890 Accounts receivable (net) 34,000 Inventory Prepaid expenses Other current assots Total current assets 210,950 $78,700$41,190 28,0006,000 50,0003,000 3,7002,000 3.6001.240 164,00046,950 Long-term Investments 75,000 52,00023,000 Plant assets 302.000 253,00049,000 Less: accumulated depreciation (76.800) (51,000) 25,800 Total plant assets 225200 202.00023 .200 Total assets 511.150 41800093150 Current llabilities: 116.500154.300 Accounts payable (34.950) (46.290) Accrued liabilities $81.550$108.010 Total current liabilities $33,300 $34,000 5-700 3,6002,70039,6003,00060010,00047,0007,3007,400 B. McBride Inc. Statement of Retained Earnings For the year ended December 31, 2018 2018 Long term liablities: Notes Payable Total liabilities 263,000 195,00068,000 302,600 242,00060,600 Stockhoiders' equity Ret. earnings, Jan. 1 $26,000 so Add: net income 81,550108,010 Deduct Dlvidends (49.000) (82.010) Common stock, \$5 par value Additional paid-in capital 32,55026,000 Retained earnings $58.550$26.000 Total stockholders' equity Total liabilities and stockholders' equity 24,00024,000 $15$12 Other information: Shares of common stock outstanding Earnings per share Dividends per share Market price per share, common stock $15$12 $418.000$93.150 B. MeBride Ine. Income Statement For years ended December 31, 2017 and 2018 2018$644,000(351,000)(288,000)293,00036,000138,000174,000119,0002017$612,000324,00051,000115.000166,000158,000 Other income (expenses) Interest expense Gain on sale of livestments Loss on sale of plant assets Total other income (expenses) Income before income taxes Income taxes expense Net income B. MeBride inc. Comparative Bulance Sheets December 31, 2018 and 2017 2018 2017 Change Current assets: Cash $119,890 Accounts receivable (net) 34,000 Inventory Prepaid expenses Other current assots Total current assets 210,950 $78,700$41,190 28,0006,000 50,0003,000 3,7002,000 3.6001.240 164,00046,950 Long-term Investments 75,000 52,00023,000 Plant assets 302.000 253,00049,000 Less: accumulated depreciation (76.800) (51,000) 25,800 Total plant assets 225200 202.00023 .200 Total assets 511.150 41800093150 Current llabilities: 116.500154.300 Accounts payable (34.950) (46.290) Accrued liabilities $81.550$108.010 Total current liabilities $33,300 $34,000 5-700 3,6002,70039,6003,00060010,00047,0007,3007,400 B. McBride Inc. Statement of Retained Earnings For the year ended December 31, 2018 2018 Long term liablities: Notes Payable Total liabilities 263,000 195,00068,000 302,600 242,00060,600 Stockhoiders' equity Ret. earnings, Jan. 1 $26,000 so Add: net income 81,550108,010 Deduct Dlvidends (49.000) (82.010) Common stock, \$5 par value Additional paid-in capital 32,55026,000 Retained earnings $58.550$26.000 Total stockholders' equity Total liabilities and stockholders' equity 24,00024,000 $15$12 Other information: Shares of common stock outstanding Earnings per share Dividends per share Market price per share, common stock $15$12 $418.000$93.150

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started