Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Basic Stock Valuation: Free Cash Flow Valuation Model The recognition that dividends are dependent on earnings, so a reliable dividend forecast is based

please help

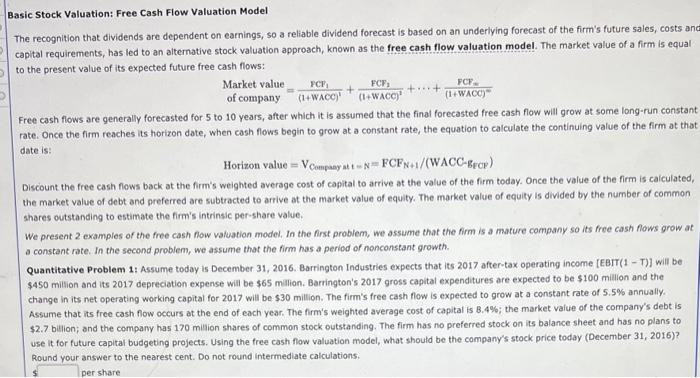

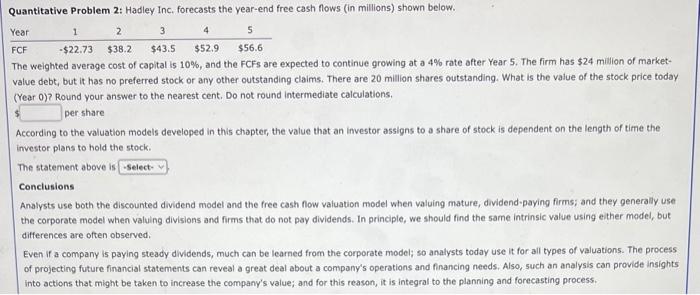

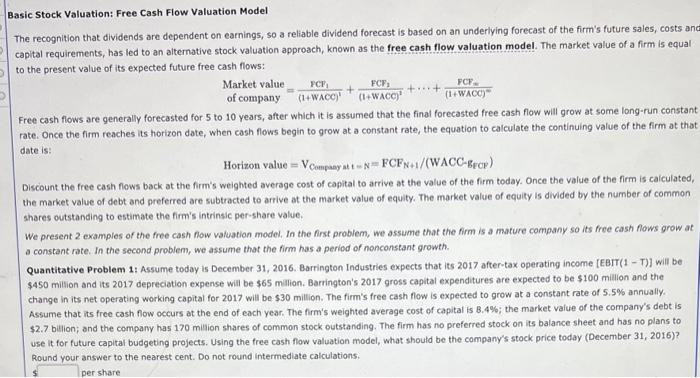

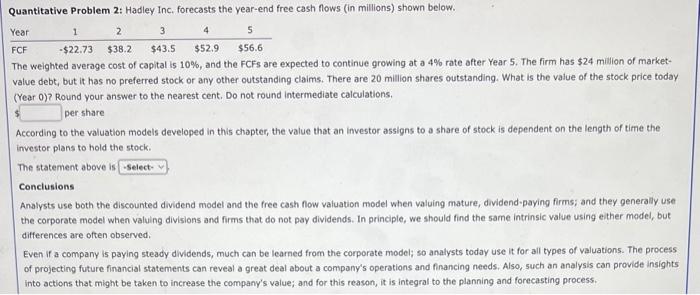

Basic Stock Valuation: Free Cash Flow Valuation Model The recognition that dividends are dependent on earnings, so a reliable dividend forecast is based on an underlying forecast of the firm's future sales, costs ani capital requirements, has led to an alternative stock valuation approach, known as the free cash flow valuation model. The market value of a firm is equal to the present value of its expected future free cash flows: Free cash flows are generally forecasted for 5 to 10 years, after which it is assumed that the final forecasted free cash flow will grow at some long-run constant rate. Once the firm reaches its horizon date, when cash flows begin to grow at a constant rate, the equation to calculate the continuing value of the firm at thot date is: Horizonvalue=VCompaayatt=N=FCFN+1/(WACCEFCF) Discount the free cash fiows back at the firm's weighted average cost of capital to arrive at the value of the firm today. Once the value of the firm is caiculated, the market value of debt and preferred are subtracted to arrive at the market value of equity. The market value of equity is divided by the number of common shares outstanding to estimate the firm's intrinsic per-share value. We present 2 examples of the free cash flow valuation model. In the first problem, we assume that the firm is a mature company so its free cash fows grow at a constant rate. In the second problem, we assume that the firm has a period of nonconstant growth. Quantitative Problem 1: Assume today is December 31, 2016. Barrington Industries expects that its 2017 after-tax operating income [EBIT(1 - T)] will be $450 million and its 2017 depreciation expense will be 565 milion. Barrington's 2017 gross capital expenditures are expected to be 5100 million and the change in its net operating working capital for 2017 will be $30 million. The firm's free cash flow is expected to grow at a constant rate of 5.5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is B.4\%; the market vaiue of the company's debt is $2.7 bilion; and the company has 170 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Using the free cash flow valuation model, what should be the company's stock price today (December 31 , 2016 )? Round your answer to the nearest cent. Do not round intermediate calculations: The weighted average cost of capital is 10%, and the FCFs are expected to continue growing at a 4% rate after Year 5 . The firm has $24 milion of marketvalue debt, but it has no preferred stock or any other outstanding claims. There are 20 miliion shares outstanding. What is the value of the stock price today (Year 0) ? Round your answer to the nearest cent, Do not round intermediate calculations. pershare According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is Conclusions Analysts use both the discounted dividend model and the free cash flow valuation model when valuing mature, dividend-paying firms; and they generally use the corporate model when valuing divisions and firms that do not pay dividends. In principle, we should find the same intrinsic value using either medel, but differences are often observed. Even if a company is paying steady dividends, much can be learned from the corporate model; so analysts today use it for all types of valuations. The process. of projecting future financial statements can reveal a great deal about a company's operations and financing needs. Also, such an analysis can provide insights into actions that might be taken to increase the company's value; and for this reason, it is integral to the planning and forecasting process

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started