Answered step by step

Verified Expert Solution

Question

1 Approved Answer

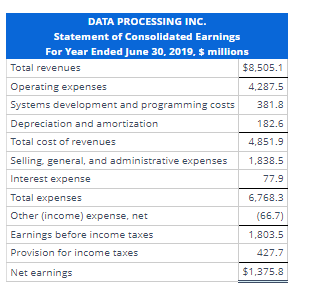

Please Help begin{tabular}{|l|r|} hline multicolumn{2}{|c|}{ DATA PROCESSING INC. } For Year Ended June 30, 2019, $ millions hline Total revenues & $8,505.1

Please Help

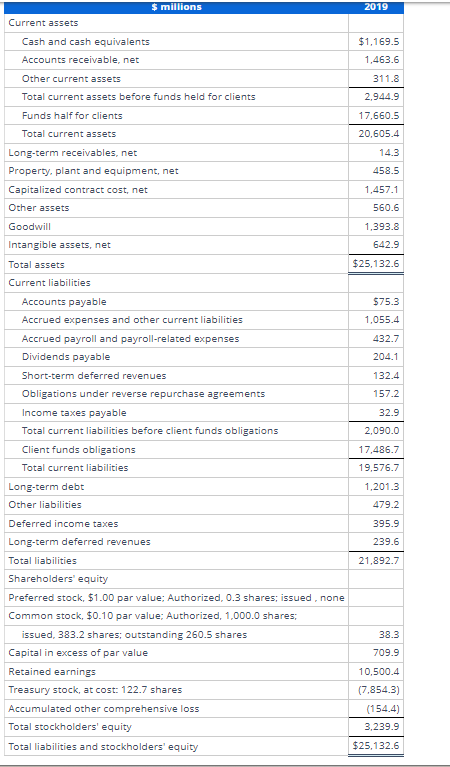

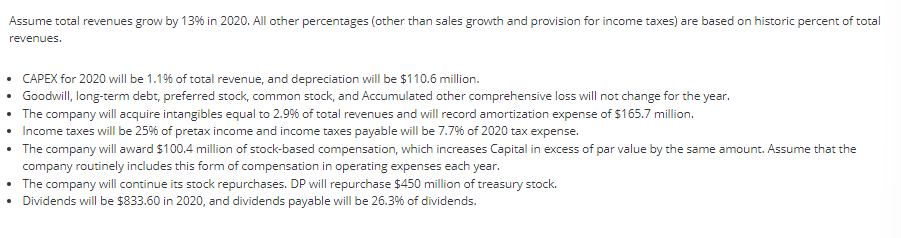

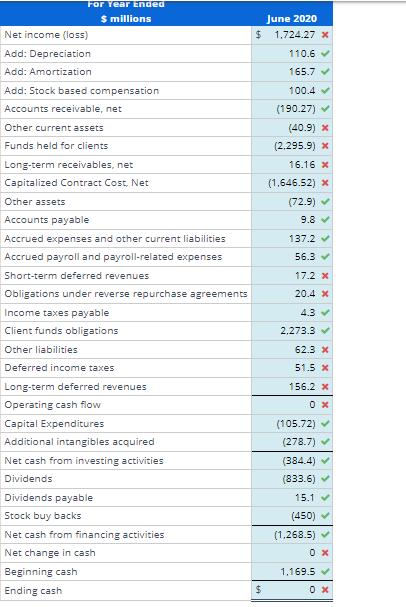

\begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ DATA PROCESSING INC. } \\ For Year Ended June 30, 2019, \$ millions \\ \hline Total revenues & $8,505.1 \\ \hline Operating expenses & 4,287.5 \\ \hline Systems development and programming costs & 381.8 \\ \hline Depreciation and amortization & 182.6 \\ \hline Total cost of revenues & 4,851.9 \\ \hline Selling. general, and administrative expenses & 1,838.5 \\ \hline Interest expense & 77.9 \\ \hline Total expenses & 6,768.3 \\ \hline Other (income) expense, net & (66.7) \\ \hline Earnings before income taxes & 1,803.5 \\ \hline Provision for income taxes & 427.7 \\ \hline Net earnings & $1,375.8 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline ForYearEnded$millions & June 2020 \\ \hline Net income (loss) & $1,724.27 \\ \hline Add: Depreciation & 110.6 \\ \hline Add: Amortization & 165.7 \\ \hline Add: Stock based compensation & 100.4 \\ \hline Accounts receivable, net & (190.27) \\ \hline Other current assets & (40.9) \\ \hline Funds held for clients & (2,295.9) \\ \hline Long-term receivables, net & 16.16 \\ \hline Capitalized Contract Cost, Net & (1,646.52) \\ \hline Other assets & (72.9) \\ \hline Accounts payable & 9.8 \\ \hline Accrued expenses and other current liabilities & 137.2 \\ \hline Accrued payroll and payroll-related expenses & 56.3 \\ \hline Short-term deferred revenues & 17.2 \\ \hline Obligations under reverse repurchase agreements & 20.4 \\ \hline Income taxes payable & 4.3 \\ \hline Client funds obligations & 2,273.3 \\ \hline Other liabilities & 62.3 \\ \hline Deferred income taxes & 51.5 \\ \hline Long-term deferred revenues & 156.2 \\ \hline Operating cash flow & 0 \\ \hline Capital Expenditures & (105.72) \\ \hline Additional intangibles acquired & (278.7) \\ \hline Net cash from investing activities & (384.4) \\ \hline Dividends & (833.6) \\ \hline Dividends payable & 15.1 \\ \hline Stock buy backs & (450) \\ \hline Net cash from financing activities & (1,268.5) \\ \hline Net change in cash & 0x \\ \hline Beginning cash & 1,169.5 \\ \hline Ending cash & 0x \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{\begin{tabular}{|l} millions \\ \end{tabular}} \\ \hline Current assets & \\ \hline Cash and cash equivalents & $1,169.5 \\ \hline Accounts receivable, net & 1,463.6 \\ \hline Other current assets & 311.8 \\ \hline Total current assets before funds held for clients & 2,944.9 \\ \hline Funds half for clients & 17,660.5 \\ \hline Total current assets & 20,605.4 \\ \hline Long-term receivables, net & 14.3 \\ \hline Property, plant and equipment, net & 458.5 \\ \hline Capitalized contract cost, net & 1,457.1 \\ \hline Other assets & 560.6 \\ \hline Goodwill & 1,393.8 \\ \hline Intangible assets, net & 642.9 \\ \hline Total assets & $25,132.6 \\ \hline Current liabilities & \\ \hline Accounts payable & $75.3 \\ \hline Accrued expenses and other current liabilities & 1,055.4 \\ \hline Accrued payroll and payroll-related expenses & 432.7 \\ \hline Dividends payable & 204.1 \\ \hline Short-term deferred revenues & 132.4 \\ \hline Obligations under reverse repurchase agreements & 157.2 \\ \hline Income taxes payable & 32.9 \\ \hline Total current liabilities before client funds obligations & 2,090.0 \\ \hline Client funds obligations & 17,486.7 \\ \hline Total current liabilities & 19,576.7 \\ \hline Long-term debt & 1,201.3 \\ \hline Other liabilities & 479.2 \\ \hline Deferred income taxes & 395.9 \\ \hline Long-term deferred revenues & 239.6 \\ \hline Total liabilities & 21,892.7 \\ \hline Shareholders' equity & \\ \hline Preferred stock, $1.00 par value; Authorized, 0.3 shares; issued, none & \\ \hline Common stock, $0.10 par value; Authorized, 1,000.0 shares; & \\ \hline issued, 383.2 shares; outstanding 260.5 shares & 38.3 \\ \hline Capital in excess of par value & 709.9 \\ \hline Retained earnings & 10,500.4 \\ \hline Treasury stock, at cost: 122.7 shares & (7,854.3) \\ \hline Accumulated other comprehensive loss & (154.4) \\ \hline Total stockholders' equity & 3,239.9 \\ \hline Total liabilities and stockholders' equity & $25,132.6 \\ \hline \end{tabular} Assume total revenues grow by 13% in 2020 . All other percentages (other than sales growth and provision for income taxes) are based on historic percent of total revenues. - CAPEX for 2020 will be 1.1% of total revenue, and depreciation will be $110.6 million. - Goodwill, long-term debt, preferred stock, common stock, and Accumulated other comprehensive loss will not change for the year. - The company will acquire intangibles equal to 2.9% of total revenues and will record amortization expense of $165.7million. - Income taxes will be 25% of pretax income and income taxes payable will be 7.7% of 2020 tax expense. - The company will award $100.4 million of stock-based compensation, which increases Capital in excess of par value by the same amount. Assume that the company routinely includes this form of compensation in operating expenses each year. - The company will continue its stock repurchases. DP will repurchase $450 million of treasury stock. - Dividends will be $833.60 in 2020 , and dividends payable will be 26.3% of dividends. \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ DATA PROCESSING INC. } \\ For Year Ended June 30, 2019, \$ millions \\ \hline Total revenues & $8,505.1 \\ \hline Operating expenses & 4,287.5 \\ \hline Systems development and programming costs & 381.8 \\ \hline Depreciation and amortization & 182.6 \\ \hline Total cost of revenues & 4,851.9 \\ \hline Selling. general, and administrative expenses & 1,838.5 \\ \hline Interest expense & 77.9 \\ \hline Total expenses & 6,768.3 \\ \hline Other (income) expense, net & (66.7) \\ \hline Earnings before income taxes & 1,803.5 \\ \hline Provision for income taxes & 427.7 \\ \hline Net earnings & $1,375.8 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline ForYearEnded$millions & June 2020 \\ \hline Net income (loss) & $1,724.27 \\ \hline Add: Depreciation & 110.6 \\ \hline Add: Amortization & 165.7 \\ \hline Add: Stock based compensation & 100.4 \\ \hline Accounts receivable, net & (190.27) \\ \hline Other current assets & (40.9) \\ \hline Funds held for clients & (2,295.9) \\ \hline Long-term receivables, net & 16.16 \\ \hline Capitalized Contract Cost, Net & (1,646.52) \\ \hline Other assets & (72.9) \\ \hline Accounts payable & 9.8 \\ \hline Accrued expenses and other current liabilities & 137.2 \\ \hline Accrued payroll and payroll-related expenses & 56.3 \\ \hline Short-term deferred revenues & 17.2 \\ \hline Obligations under reverse repurchase agreements & 20.4 \\ \hline Income taxes payable & 4.3 \\ \hline Client funds obligations & 2,273.3 \\ \hline Other liabilities & 62.3 \\ \hline Deferred income taxes & 51.5 \\ \hline Long-term deferred revenues & 156.2 \\ \hline Operating cash flow & 0 \\ \hline Capital Expenditures & (105.72) \\ \hline Additional intangibles acquired & (278.7) \\ \hline Net cash from investing activities & (384.4) \\ \hline Dividends & (833.6) \\ \hline Dividends payable & 15.1 \\ \hline Stock buy backs & (450) \\ \hline Net cash from financing activities & (1,268.5) \\ \hline Net change in cash & 0x \\ \hline Beginning cash & 1,169.5 \\ \hline Ending cash & 0x \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{\begin{tabular}{|l} millions \\ \end{tabular}} \\ \hline Current assets & \\ \hline Cash and cash equivalents & $1,169.5 \\ \hline Accounts receivable, net & 1,463.6 \\ \hline Other current assets & 311.8 \\ \hline Total current assets before funds held for clients & 2,944.9 \\ \hline Funds half for clients & 17,660.5 \\ \hline Total current assets & 20,605.4 \\ \hline Long-term receivables, net & 14.3 \\ \hline Property, plant and equipment, net & 458.5 \\ \hline Capitalized contract cost, net & 1,457.1 \\ \hline Other assets & 560.6 \\ \hline Goodwill & 1,393.8 \\ \hline Intangible assets, net & 642.9 \\ \hline Total assets & $25,132.6 \\ \hline Current liabilities & \\ \hline Accounts payable & $75.3 \\ \hline Accrued expenses and other current liabilities & 1,055.4 \\ \hline Accrued payroll and payroll-related expenses & 432.7 \\ \hline Dividends payable & 204.1 \\ \hline Short-term deferred revenues & 132.4 \\ \hline Obligations under reverse repurchase agreements & 157.2 \\ \hline Income taxes payable & 32.9 \\ \hline Total current liabilities before client funds obligations & 2,090.0 \\ \hline Client funds obligations & 17,486.7 \\ \hline Total current liabilities & 19,576.7 \\ \hline Long-term debt & 1,201.3 \\ \hline Other liabilities & 479.2 \\ \hline Deferred income taxes & 395.9 \\ \hline Long-term deferred revenues & 239.6 \\ \hline Total liabilities & 21,892.7 \\ \hline Shareholders' equity & \\ \hline Preferred stock, $1.00 par value; Authorized, 0.3 shares; issued, none & \\ \hline Common stock, $0.10 par value; Authorized, 1,000.0 shares; & \\ \hline issued, 383.2 shares; outstanding 260.5 shares & 38.3 \\ \hline Capital in excess of par value & 709.9 \\ \hline Retained earnings & 10,500.4 \\ \hline Treasury stock, at cost: 122.7 shares & (7,854.3) \\ \hline Accumulated other comprehensive loss & (154.4) \\ \hline Total stockholders' equity & 3,239.9 \\ \hline Total liabilities and stockholders' equity & $25,132.6 \\ \hline \end{tabular} Assume total revenues grow by 13% in 2020 . All other percentages (other than sales growth and provision for income taxes) are based on historic percent of total revenues. - CAPEX for 2020 will be 1.1% of total revenue, and depreciation will be $110.6 million. - Goodwill, long-term debt, preferred stock, common stock, and Accumulated other comprehensive loss will not change for the year. - The company will acquire intangibles equal to 2.9% of total revenues and will record amortization expense of $165.7million. - Income taxes will be 25% of pretax income and income taxes payable will be 7.7% of 2020 tax expense. - The company will award $100.4 million of stock-based compensation, which increases Capital in excess of par value by the same amount. Assume that the company routinely includes this form of compensation in operating expenses each year. - The company will continue its stock repurchases. DP will repurchase $450 million of treasury stock. - Dividends will be $833.60 in 2020 , and dividends payable will be 26.3% of dividends

\begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ DATA PROCESSING INC. } \\ For Year Ended June 30, 2019, \$ millions \\ \hline Total revenues & $8,505.1 \\ \hline Operating expenses & 4,287.5 \\ \hline Systems development and programming costs & 381.8 \\ \hline Depreciation and amortization & 182.6 \\ \hline Total cost of revenues & 4,851.9 \\ \hline Selling. general, and administrative expenses & 1,838.5 \\ \hline Interest expense & 77.9 \\ \hline Total expenses & 6,768.3 \\ \hline Other (income) expense, net & (66.7) \\ \hline Earnings before income taxes & 1,803.5 \\ \hline Provision for income taxes & 427.7 \\ \hline Net earnings & $1,375.8 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline ForYearEnded$millions & June 2020 \\ \hline Net income (loss) & $1,724.27 \\ \hline Add: Depreciation & 110.6 \\ \hline Add: Amortization & 165.7 \\ \hline Add: Stock based compensation & 100.4 \\ \hline Accounts receivable, net & (190.27) \\ \hline Other current assets & (40.9) \\ \hline Funds held for clients & (2,295.9) \\ \hline Long-term receivables, net & 16.16 \\ \hline Capitalized Contract Cost, Net & (1,646.52) \\ \hline Other assets & (72.9) \\ \hline Accounts payable & 9.8 \\ \hline Accrued expenses and other current liabilities & 137.2 \\ \hline Accrued payroll and payroll-related expenses & 56.3 \\ \hline Short-term deferred revenues & 17.2 \\ \hline Obligations under reverse repurchase agreements & 20.4 \\ \hline Income taxes payable & 4.3 \\ \hline Client funds obligations & 2,273.3 \\ \hline Other liabilities & 62.3 \\ \hline Deferred income taxes & 51.5 \\ \hline Long-term deferred revenues & 156.2 \\ \hline Operating cash flow & 0 \\ \hline Capital Expenditures & (105.72) \\ \hline Additional intangibles acquired & (278.7) \\ \hline Net cash from investing activities & (384.4) \\ \hline Dividends & (833.6) \\ \hline Dividends payable & 15.1 \\ \hline Stock buy backs & (450) \\ \hline Net cash from financing activities & (1,268.5) \\ \hline Net change in cash & 0x \\ \hline Beginning cash & 1,169.5 \\ \hline Ending cash & 0x \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{\begin{tabular}{|l} millions \\ \end{tabular}} \\ \hline Current assets & \\ \hline Cash and cash equivalents & $1,169.5 \\ \hline Accounts receivable, net & 1,463.6 \\ \hline Other current assets & 311.8 \\ \hline Total current assets before funds held for clients & 2,944.9 \\ \hline Funds half for clients & 17,660.5 \\ \hline Total current assets & 20,605.4 \\ \hline Long-term receivables, net & 14.3 \\ \hline Property, plant and equipment, net & 458.5 \\ \hline Capitalized contract cost, net & 1,457.1 \\ \hline Other assets & 560.6 \\ \hline Goodwill & 1,393.8 \\ \hline Intangible assets, net & 642.9 \\ \hline Total assets & $25,132.6 \\ \hline Current liabilities & \\ \hline Accounts payable & $75.3 \\ \hline Accrued expenses and other current liabilities & 1,055.4 \\ \hline Accrued payroll and payroll-related expenses & 432.7 \\ \hline Dividends payable & 204.1 \\ \hline Short-term deferred revenues & 132.4 \\ \hline Obligations under reverse repurchase agreements & 157.2 \\ \hline Income taxes payable & 32.9 \\ \hline Total current liabilities before client funds obligations & 2,090.0 \\ \hline Client funds obligations & 17,486.7 \\ \hline Total current liabilities & 19,576.7 \\ \hline Long-term debt & 1,201.3 \\ \hline Other liabilities & 479.2 \\ \hline Deferred income taxes & 395.9 \\ \hline Long-term deferred revenues & 239.6 \\ \hline Total liabilities & 21,892.7 \\ \hline Shareholders' equity & \\ \hline Preferred stock, $1.00 par value; Authorized, 0.3 shares; issued, none & \\ \hline Common stock, $0.10 par value; Authorized, 1,000.0 shares; & \\ \hline issued, 383.2 shares; outstanding 260.5 shares & 38.3 \\ \hline Capital in excess of par value & 709.9 \\ \hline Retained earnings & 10,500.4 \\ \hline Treasury stock, at cost: 122.7 shares & (7,854.3) \\ \hline Accumulated other comprehensive loss & (154.4) \\ \hline Total stockholders' equity & 3,239.9 \\ \hline Total liabilities and stockholders' equity & $25,132.6 \\ \hline \end{tabular} Assume total revenues grow by 13% in 2020 . All other percentages (other than sales growth and provision for income taxes) are based on historic percent of total revenues. - CAPEX for 2020 will be 1.1% of total revenue, and depreciation will be $110.6 million. - Goodwill, long-term debt, preferred stock, common stock, and Accumulated other comprehensive loss will not change for the year. - The company will acquire intangibles equal to 2.9% of total revenues and will record amortization expense of $165.7million. - Income taxes will be 25% of pretax income and income taxes payable will be 7.7% of 2020 tax expense. - The company will award $100.4 million of stock-based compensation, which increases Capital in excess of par value by the same amount. Assume that the company routinely includes this form of compensation in operating expenses each year. - The company will continue its stock repurchases. DP will repurchase $450 million of treasury stock. - Dividends will be $833.60 in 2020 , and dividends payable will be 26.3% of dividends. \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ DATA PROCESSING INC. } \\ For Year Ended June 30, 2019, \$ millions \\ \hline Total revenues & $8,505.1 \\ \hline Operating expenses & 4,287.5 \\ \hline Systems development and programming costs & 381.8 \\ \hline Depreciation and amortization & 182.6 \\ \hline Total cost of revenues & 4,851.9 \\ \hline Selling. general, and administrative expenses & 1,838.5 \\ \hline Interest expense & 77.9 \\ \hline Total expenses & 6,768.3 \\ \hline Other (income) expense, net & (66.7) \\ \hline Earnings before income taxes & 1,803.5 \\ \hline Provision for income taxes & 427.7 \\ \hline Net earnings & $1,375.8 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline ForYearEnded$millions & June 2020 \\ \hline Net income (loss) & $1,724.27 \\ \hline Add: Depreciation & 110.6 \\ \hline Add: Amortization & 165.7 \\ \hline Add: Stock based compensation & 100.4 \\ \hline Accounts receivable, net & (190.27) \\ \hline Other current assets & (40.9) \\ \hline Funds held for clients & (2,295.9) \\ \hline Long-term receivables, net & 16.16 \\ \hline Capitalized Contract Cost, Net & (1,646.52) \\ \hline Other assets & (72.9) \\ \hline Accounts payable & 9.8 \\ \hline Accrued expenses and other current liabilities & 137.2 \\ \hline Accrued payroll and payroll-related expenses & 56.3 \\ \hline Short-term deferred revenues & 17.2 \\ \hline Obligations under reverse repurchase agreements & 20.4 \\ \hline Income taxes payable & 4.3 \\ \hline Client funds obligations & 2,273.3 \\ \hline Other liabilities & 62.3 \\ \hline Deferred income taxes & 51.5 \\ \hline Long-term deferred revenues & 156.2 \\ \hline Operating cash flow & 0 \\ \hline Capital Expenditures & (105.72) \\ \hline Additional intangibles acquired & (278.7) \\ \hline Net cash from investing activities & (384.4) \\ \hline Dividends & (833.6) \\ \hline Dividends payable & 15.1 \\ \hline Stock buy backs & (450) \\ \hline Net cash from financing activities & (1,268.5) \\ \hline Net change in cash & 0x \\ \hline Beginning cash & 1,169.5 \\ \hline Ending cash & 0x \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{\begin{tabular}{|l} millions \\ \end{tabular}} \\ \hline Current assets & \\ \hline Cash and cash equivalents & $1,169.5 \\ \hline Accounts receivable, net & 1,463.6 \\ \hline Other current assets & 311.8 \\ \hline Total current assets before funds held for clients & 2,944.9 \\ \hline Funds half for clients & 17,660.5 \\ \hline Total current assets & 20,605.4 \\ \hline Long-term receivables, net & 14.3 \\ \hline Property, plant and equipment, net & 458.5 \\ \hline Capitalized contract cost, net & 1,457.1 \\ \hline Other assets & 560.6 \\ \hline Goodwill & 1,393.8 \\ \hline Intangible assets, net & 642.9 \\ \hline Total assets & $25,132.6 \\ \hline Current liabilities & \\ \hline Accounts payable & $75.3 \\ \hline Accrued expenses and other current liabilities & 1,055.4 \\ \hline Accrued payroll and payroll-related expenses & 432.7 \\ \hline Dividends payable & 204.1 \\ \hline Short-term deferred revenues & 132.4 \\ \hline Obligations under reverse repurchase agreements & 157.2 \\ \hline Income taxes payable & 32.9 \\ \hline Total current liabilities before client funds obligations & 2,090.0 \\ \hline Client funds obligations & 17,486.7 \\ \hline Total current liabilities & 19,576.7 \\ \hline Long-term debt & 1,201.3 \\ \hline Other liabilities & 479.2 \\ \hline Deferred income taxes & 395.9 \\ \hline Long-term deferred revenues & 239.6 \\ \hline Total liabilities & 21,892.7 \\ \hline Shareholders' equity & \\ \hline Preferred stock, $1.00 par value; Authorized, 0.3 shares; issued, none & \\ \hline Common stock, $0.10 par value; Authorized, 1,000.0 shares; & \\ \hline issued, 383.2 shares; outstanding 260.5 shares & 38.3 \\ \hline Capital in excess of par value & 709.9 \\ \hline Retained earnings & 10,500.4 \\ \hline Treasury stock, at cost: 122.7 shares & (7,854.3) \\ \hline Accumulated other comprehensive loss & (154.4) \\ \hline Total stockholders' equity & 3,239.9 \\ \hline Total liabilities and stockholders' equity & $25,132.6 \\ \hline \end{tabular} Assume total revenues grow by 13% in 2020 . All other percentages (other than sales growth and provision for income taxes) are based on historic percent of total revenues. - CAPEX for 2020 will be 1.1% of total revenue, and depreciation will be $110.6 million. - Goodwill, long-term debt, preferred stock, common stock, and Accumulated other comprehensive loss will not change for the year. - The company will acquire intangibles equal to 2.9% of total revenues and will record amortization expense of $165.7million. - Income taxes will be 25% of pretax income and income taxes payable will be 7.7% of 2020 tax expense. - The company will award $100.4 million of stock-based compensation, which increases Capital in excess of par value by the same amount. Assume that the company routinely includes this form of compensation in operating expenses each year. - The company will continue its stock repurchases. DP will repurchase $450 million of treasury stock. - Dividends will be $833.60 in 2020 , and dividends payable will be 26.3% of dividends Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started