Answered step by step

Verified Expert Solution

Question

1 Approved Answer

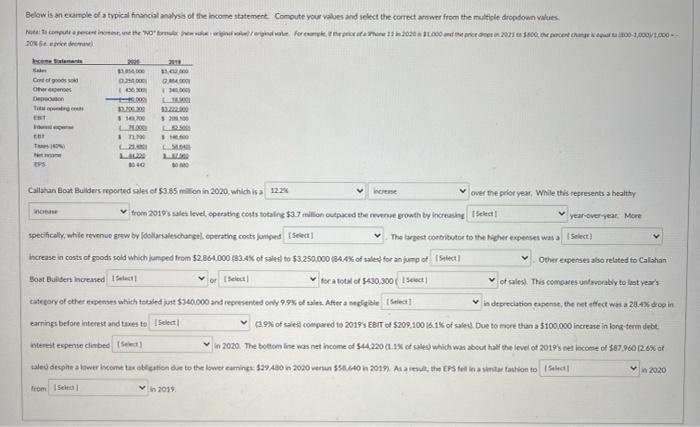

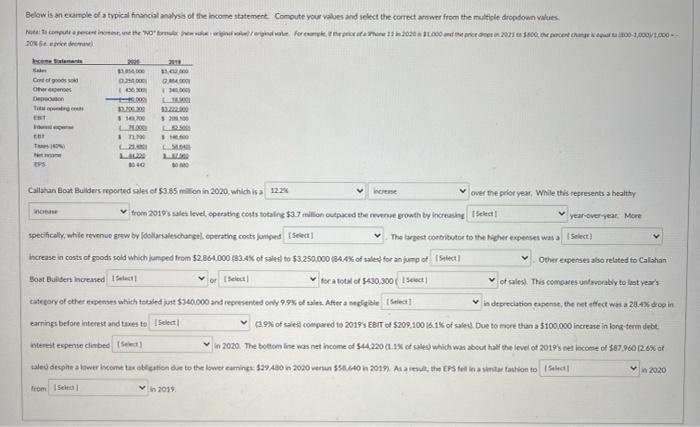

PLEASE HELP!!! Below is an emple of a typical financial analysis of the income statement Comoute your values and select the correct answer from the

PLEASE HELP!!!

Below is an emple of a typical financial analysis of the income statement Comoute your values and select the correct answer from the multiple dropdown values Pute: to computea percent ornare Orwerpedale Perem 1200 16000 and he andre in 2001 t. 5800 percent changer 100 1.000.000 DOO X GA Goos OS D Tu 200 31 1322000 ht L LG Ince os Callahan Boat Builders reported sales of $3.85 milion in 2020, which is a 12:24 over the prior year. While this represents a healthy trom 2019's sales tevel operating costs totaling $3.7 million outpaced the revenue growth by increasing Select year-overy More specifically, while revenue sew by Idollarsoles chant), operating costs jumped [Seet! The best contributor to the higher expenses was a Select Increase in costs of goods sold which need from $2.864.000 834 of sales to $3,250,000 (844% of sales for an jump or select Other expenses also related to Calishan Boat Builders increased Select or Select for a total of 1430.300 I Sect of salesThis comowes untsvorably to last year's category of other expenses which totsted just $340,000 and represented only 99% of talet. Altera necesei Select? is depreciation expense, the net effect was a 28.4% drop in Earnings before interest and taxes to select 0.9% of sites comowed to 2019 EBIT of $200.00 16,1% of sted. Due to more than a $100.000 increase in long-term debt interest experie climbed see in 2020. The bottom line was net income of $44.220.1% of sales which was about half the level of 2019% per income of $27.960 126% at led despite wer income tabletten dit to the lower caminex: $29.400 2020 venu 30/40 2019 Marest, Estel na sind fashion to Select Stelinas 2020 from See 2019 Below is an emple of a typical financial analysis of the income statement Comoute your values and select the correct answer from the multiple dropdown values Pute: to computea percent ornare Orwerpedale Perem 1200 16000 and he andre in 2001 t. 5800 percent changer 100 1.000.000 DOO X GA Goos OS D Tu 200 31 1322000 ht L LG Ince os Callahan Boat Builders reported sales of $3.85 milion in 2020, which is a 12:24 over the prior year. While this represents a healthy trom 2019's sales tevel operating costs totaling $3.7 million outpaced the revenue growth by increasing Select year-overy More specifically, while revenue sew by Idollarsoles chant), operating costs jumped [Seet! The best contributor to the higher expenses was a Select Increase in costs of goods sold which need from $2.864.000 834 of sales to $3,250,000 (844% of sales for an jump or select Other expenses also related to Calishan Boat Builders increased Select or Select for a total of 1430.300 I Sect of salesThis comowes untsvorably to last year's category of other expenses which totsted just $340,000 and represented only 99% of talet. Altera necesei Select? is depreciation expense, the net effect was a 28.4% drop in Earnings before interest and taxes to select 0.9% of sites comowed to 2019 EBIT of $200.00 16,1% of sted. Due to more than a $100.000 increase in long-term debt interest experie climbed see in 2020. The bottom line was net income of $44.220.1% of sales which was about half the level of 2019% per income of $27.960 126% at led despite wer income tabletten dit to the lower caminex: $29.400 2020 venu 30/40 2019 Marest, Estel na sind fashion to Select Stelinas 2020 from See 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started