Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Bobs Framers LTD, a long time client of NaitBank, has requested a bank loan for a one-year period to refinance most of its

please help

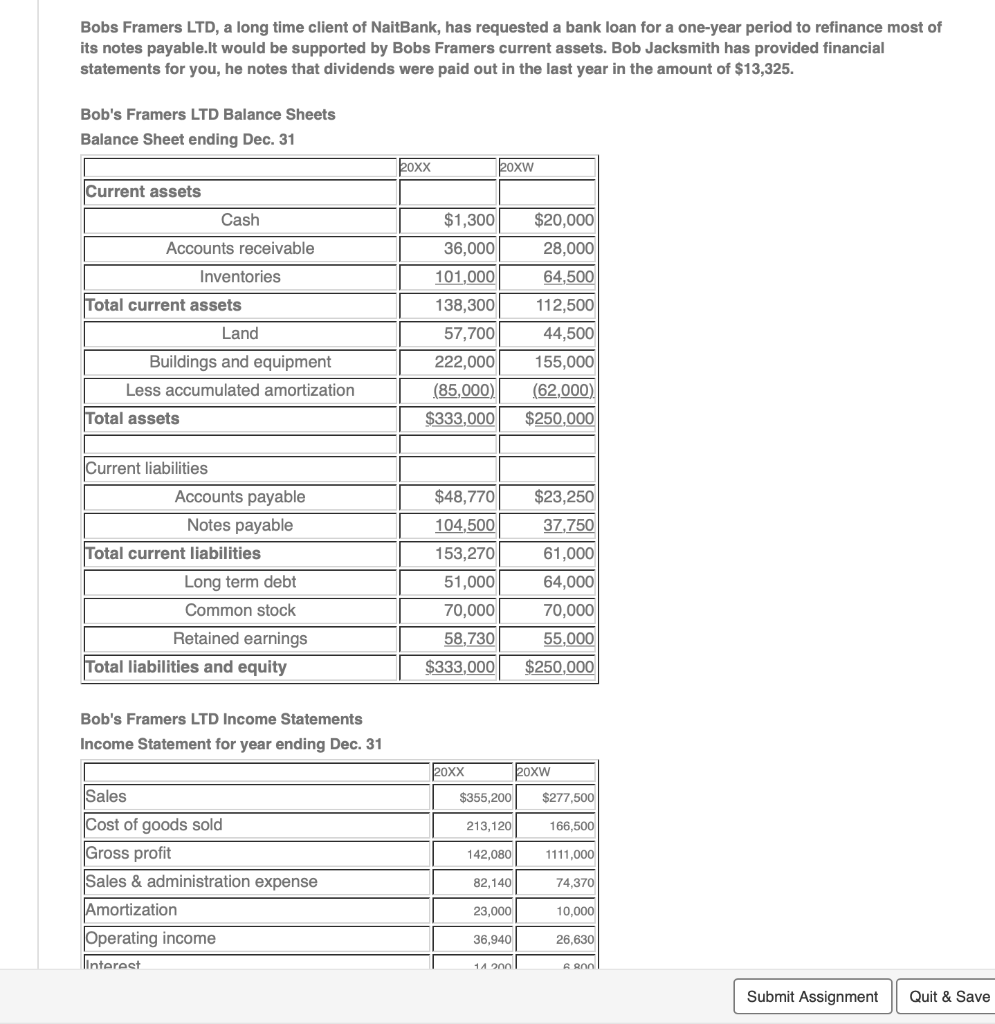

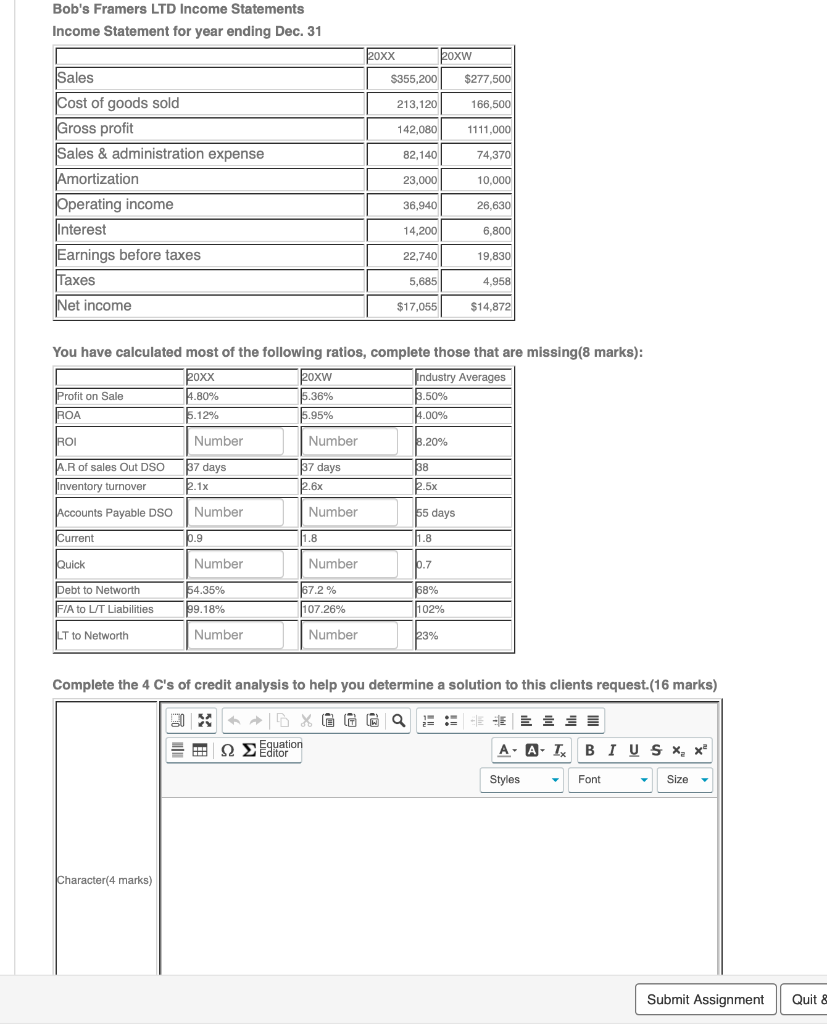

Bobs Framers LTD, a long time client of NaitBank, has requested a bank loan for a one-year period to refinance most of its notes payable.It would be supported by Bobs Framers current assets. Bob Jacksmith has provided financial statements for you, he notes that dividends were paid out in the last year in the amount of $13,325. Bob's Framers LTD Balance Sheets Balance Sheet ending Dec. 31 Roxx 20xw Current assets Cash $1,300 $20,000 28,000 64,500 Accounts receivable Inventories Total current assets Land 112,500 36,000 101,000 138,300 57,700 222,000 (85,000) $333,000 Buildings and equipment Less accumulated amortization 44,500 155,000 (62,000) Total assets $250,000 $48,770 104,500 153,270 Current liabilities Accounts payable Notes payable Total current liabilities Long term debt Common stock Retained earnings Total liabilities and equity 51,000 $23,250 37,750 61,000 64,000 70,000 55,000 $250,000 70,000 58,730 $333,000 Bob's Framers LTD Income Statements Income Statement for year ending Dec. 31 120XX 20XW $355,200 $277,500 213, 120 166,500 142,080 1111,000 Sales Cost of goods sold Gross profit Sales & administration expense Amortization Operating income linterest 82,140 74,370 23,000 10.000 36,940 26,630 14200 ARON Submit Assignment Quit & Save Bob's Framers LTD Income Statements Income Statement for year ending Dec. 31 20XX 20xw $355,200 $277,500 213, 120 166,500 142,080 1111,000 82,140 74,370 23,000 10,000 Sales Cost of goods sold Gross profit Sales & administration expense Amortization Operating income Interest Earnings before taxes Taxes Net income 36,940 26.630 14,200 6.800 22,740 19.830 5,685 4,958 $17,055 $14,872 You have calculated most of the following ratios, complete those that are missing(8 marks): 20xx 20XW Industry Averages Profit on Sale 4.80% 5.36% 3.50% ROA 5.12% 15.95% 14.00% ROI Number Number 3.20% A.R of sales Out DSO Inventory turnover 37 days 2.1x 37 days 2.6x 38 2.5x Accounts Payable DSO Number Number 55 days Current 0.9 11.8 11.8 Quick Number Number 0.7 Debt to Networth F/A to LT Liabilities 54.35% 99.18% 67.2% 107.26% 68% 102% LT to Networth Number Number 23% Complete the 4 C's of credit analysis to help you determine a solution to this clients request.(16 marks) XX @ Q - Equation ditor == = = = = = = A- A- IX BIUS X, X Styles Font Size - Character(4 marks) Submit Assignment Quit & Capacity (5 marks) Words: 0 US X GG Q LE 2 Equation Editor A A TL BIUS X Styles Font Size Capital (5 marks) Words: 0 0 IEEE X @ @ @ Equation 12 > Editor A A T BIUS X, X? Styles Font Size Conditions (2 marks) Words: 0 What is your recommendation? Do you grant credit?(1 mark) Yes Submit Assignment Quit & Save Bobs Framers LTD, a long time client of NaitBank, has requested a bank loan for a one-year period to refinance most of its notes payable.It would be supported by Bobs Framers current assets. Bob Jacksmith has provided financial statements for you, he notes that dividends were paid out in the last year in the amount of $13,325. Bob's Framers LTD Balance Sheets Balance Sheet ending Dec. 31 Roxx 20xw Current assets Cash $1,300 $20,000 28,000 64,500 Accounts receivable Inventories Total current assets Land 112,500 36,000 101,000 138,300 57,700 222,000 (85,000) $333,000 Buildings and equipment Less accumulated amortization 44,500 155,000 (62,000) Total assets $250,000 $48,770 104,500 153,270 Current liabilities Accounts payable Notes payable Total current liabilities Long term debt Common stock Retained earnings Total liabilities and equity 51,000 $23,250 37,750 61,000 64,000 70,000 55,000 $250,000 70,000 58,730 $333,000 Bob's Framers LTD Income Statements Income Statement for year ending Dec. 31 120XX 20XW $355,200 $277,500 213, 120 166,500 142,080 1111,000 Sales Cost of goods sold Gross profit Sales & administration expense Amortization Operating income linterest 82,140 74,370 23,000 10.000 36,940 26,630 14200 ARON Submit Assignment Quit & Save Bob's Framers LTD Income Statements Income Statement for year ending Dec. 31 20XX 20xw $355,200 $277,500 213, 120 166,500 142,080 1111,000 82,140 74,370 23,000 10,000 Sales Cost of goods sold Gross profit Sales & administration expense Amortization Operating income Interest Earnings before taxes Taxes Net income 36,940 26.630 14,200 6.800 22,740 19.830 5,685 4,958 $17,055 $14,872 You have calculated most of the following ratios, complete those that are missing(8 marks): 20xx 20XW Industry Averages Profit on Sale 4.80% 5.36% 3.50% ROA 5.12% 15.95% 14.00% ROI Number Number 3.20% A.R of sales Out DSO Inventory turnover 37 days 2.1x 37 days 2.6x 38 2.5x Accounts Payable DSO Number Number 55 days Current 0.9 11.8 11.8 Quick Number Number 0.7 Debt to Networth F/A to LT Liabilities 54.35% 99.18% 67.2% 107.26% 68% 102% LT to Networth Number Number 23% Complete the 4 C's of credit analysis to help you determine a solution to this clients request.(16 marks) XX @ Q - Equation ditor == = = = = = = A- A- IX BIUS X, X Styles Font Size - Character(4 marks) Submit Assignment Quit & Capacity (5 marks) Words: 0 US X GG Q LE 2 Equation Editor A A TL BIUS X Styles Font Size Capital (5 marks) Words: 0 0 IEEE X @ @ @ Equation 12 > Editor A A T BIUS X, X? Styles Font Size Conditions (2 marks) Words: 0 What is your recommendation? Do you grant credit?(1 mark) Yes Submit Assignment Quit & SaveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started