please help :))

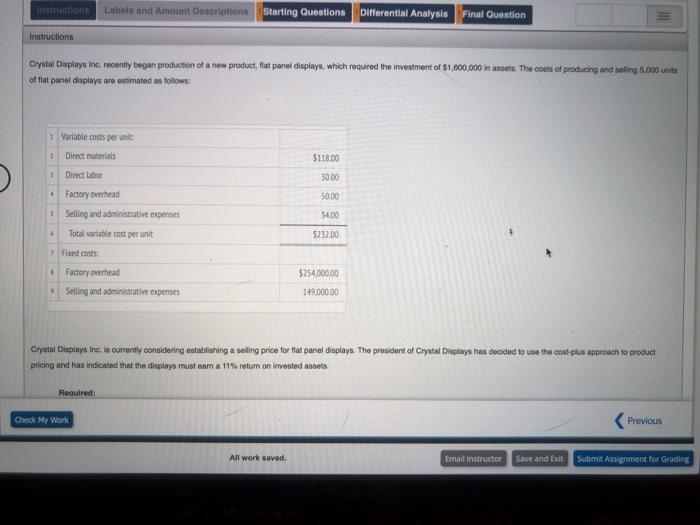

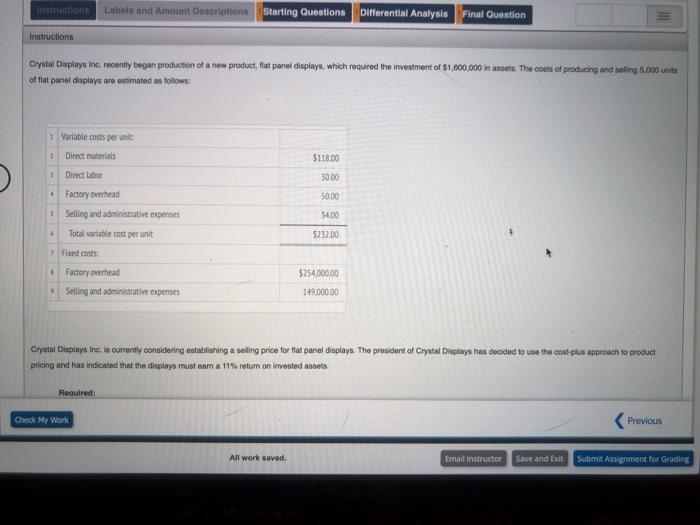

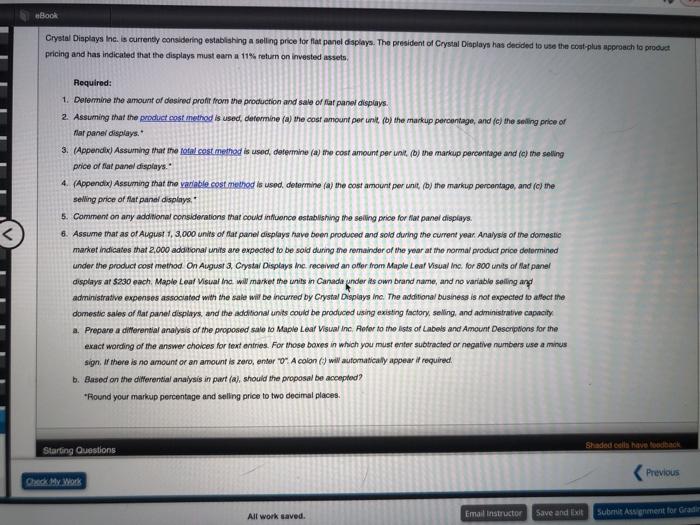

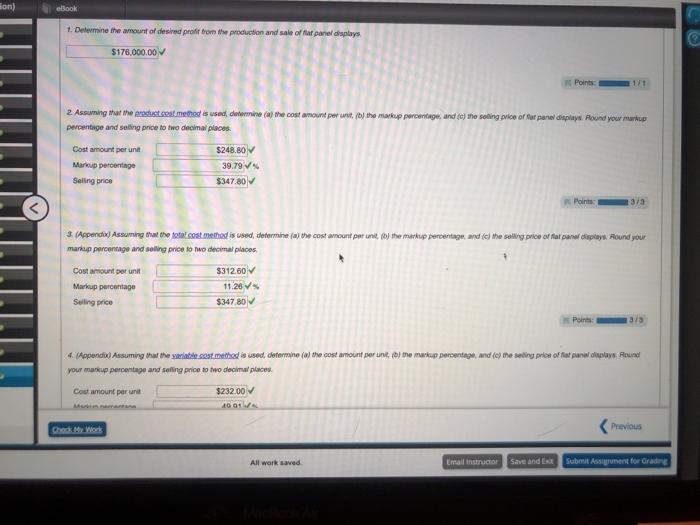

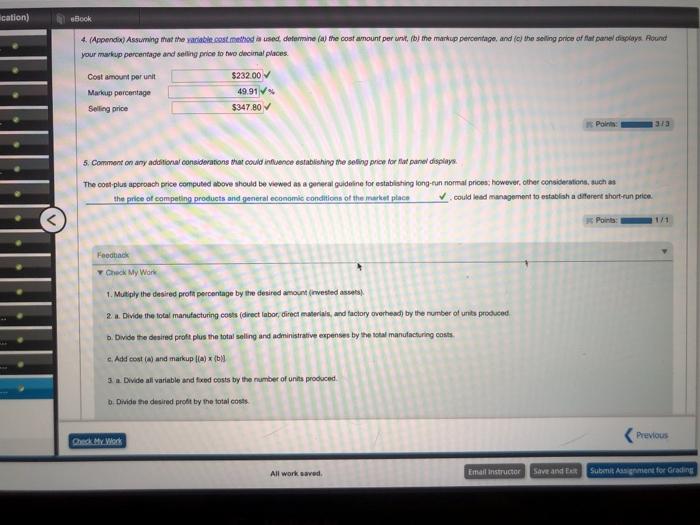

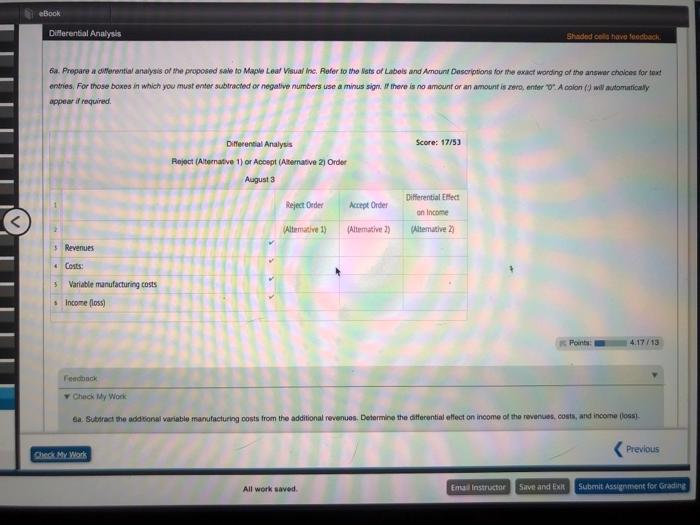

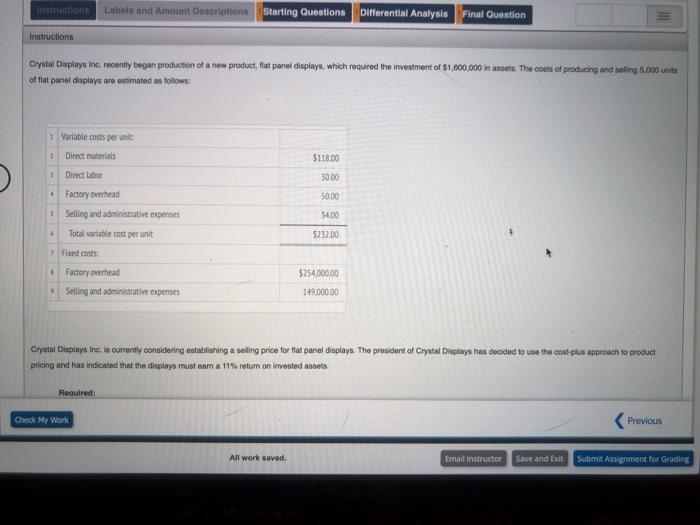

Book Crystal Displays Inc. is currently considering establishing a selling price for at panel displays. The president of Crystal Displays has decided to use the cost-plus approach to product pricing and has indicated that the displays must eam a 11% return on invested assets, Required: 1. Derermine the amount of desired prodrom the production and sale of Kuat panel displays. 2. Assuming that the product cost method is used, determine (a) The cost amount per unit (b) the markup percentage, and (c) the selling price of Alar panel displays.. 3. Appendix) Assurning that the total cost method is used determino (a) mw cost amount per unit. (b) the markup percentage and (c) the selling price of flat panel displays.. 4. (Appendix) Assuming that the variable cost method is used determine (a) the cost amount per unit (b) the markup percentage, and (c) the selling price of flat panaf displays, 5. Comment on any additional considerations that could influence establishing the selling price for at panel displays 6. Assume that as of August 1, 3,000 units of Nar panel displays have been produced and sold during the current year. Analysis of the domestic market indicates that 2,000 additional units are expected to be sold during the remainder of the year at the normal product price deformined under the product cost method On August 3, Crystal Displays Inc received an attor from Maple Leal Visual Inc. for 800 units of flat panel displays at 230 each. Maple Leaf Visual Inc. wil market the units in Canada under its own brand name, and no variable selling and administrative expenses associated with the sale will be incurred by Crystal Displays Inc. The additional business is not expected to affect the domestic sales of Nat panel displays, and the additional units could be produced using existing factory, selling and administrative capacity a. Prepare a differential analysis of the proposed sale to Maple Leaf Visual Inc. Pofer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign, there is no amount of an amount is zero, enter"0" A colon () will automatically appear it required b. Based on the differential analysis in part (a), should the proposal be accepted? *Round your markup percentage and selling price to two decimal places. Shaded cells have foodback Starting Questions Previous All work saved. Email Instructor Save and it Submit Assignment for Gradi on) eBook 1. Determine the amount of desired profit from the production and sale of Man panel displays $176.000.00 Points 2 Assuning at the product cost memos is used cotormire (a) the cost amount per unit, by the markup percentage, and (c) the selling price of Nur pares diaplay. Found your markup percentage and selling price to two decimal places. Cost amount per unit Markup percentage Selling price $248.80 39.79 $347.80 Point 1373 (Append) Assuming that the total cost method is used, determine (a) the cost amount per unit the markup percentage, and (c) the selling price of fat plays Hound your markup percentage and selling price to two decimal places Cost amount per unit Mariup percentage Sulling price $31260 11.28 $347.80 Point 13/3 4. (Appendiw) Assuming that the variable cost method is used, determine (a) the cost amount per unit, (b) the markup percentage, and les the seting price of flat panel dialove. Round your markup percentage and selling price to two decimal places Cost amount per $232.00 1001 Previous All work saved Emains Save and Submit Assignet for Grading cation) Book 4. (Appendix) Assuming that the variable cost method is used determine (a) the cost amount per unt. (b) the markup percentage, and to the selling price of flat panel displays Round your markup percentage and selling price to two decimal places Cost amount per unit Markup percentage Selling price $232.00 49.91V $347.80 Point 1313 5. Comment on any additional considerations that could intuence establishing the selling price for at panel displays The cont plus approach price computed above should be viewed as a general guideline for establishing long-run normal prices; however, other considerations, such as the price of competing products and general economic conditions of the marketplace could lead management to establish a different short-run price Points Feedback Check My Work 1. Multiply the desired proft percentage by the desired amount invested assets) 2 1. Divide the total manufacturing costs (direct labor, direct materials, and factory overhead by the number of units produced Divide the desired proft plus the total selling and administrative expenses by the tal manufacturing costs. c. Add cost and markup (a) (b) 3. Divide all variable and fixed costs by the number of onts produced o Divide the desired profit by the total costs Previous Check My Work All work saved Email instructor Save and Subotas gamint for Grading eBook Differential Analysis Shaded cold have feedback 6a. Prepare a cerevital analysis of the proposed sale to Maple Leal Visual Inc. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choice for test entries. For those boros in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "A calon () will automatically appear if required Score: 17/53 Differential Analysis Project (Alternative 1) or Accept (Alternative 21 Order August 3 Reject Order Accept Order Differential Elect on Income Alternative Alternative 1) (Alternative) 3 Revenues Costs: Variable manufacturing costs Income less 4.17/13 Femack Check My Work Sa Suttract the additional variable manufacturing costs from the additional revenues. Determine the differential effect on income of the revenues, cots, and income (ons)