please help

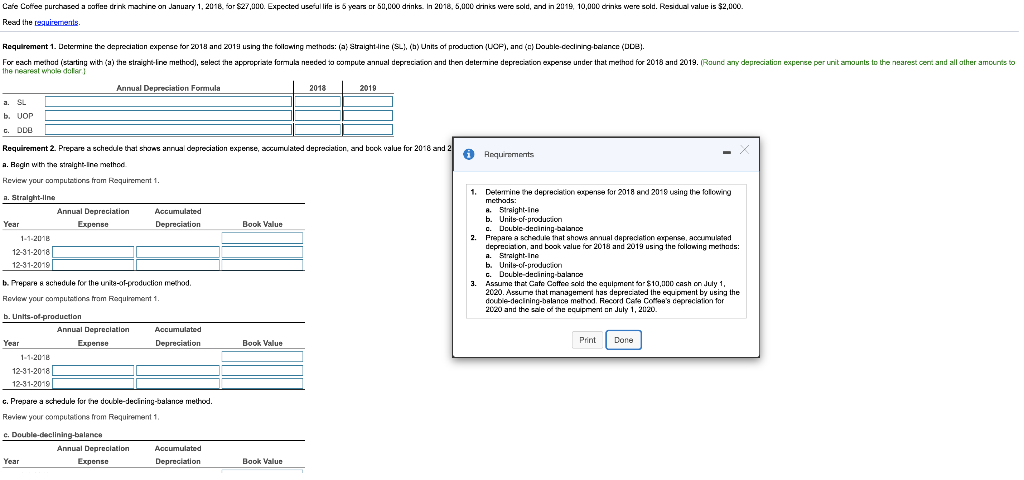

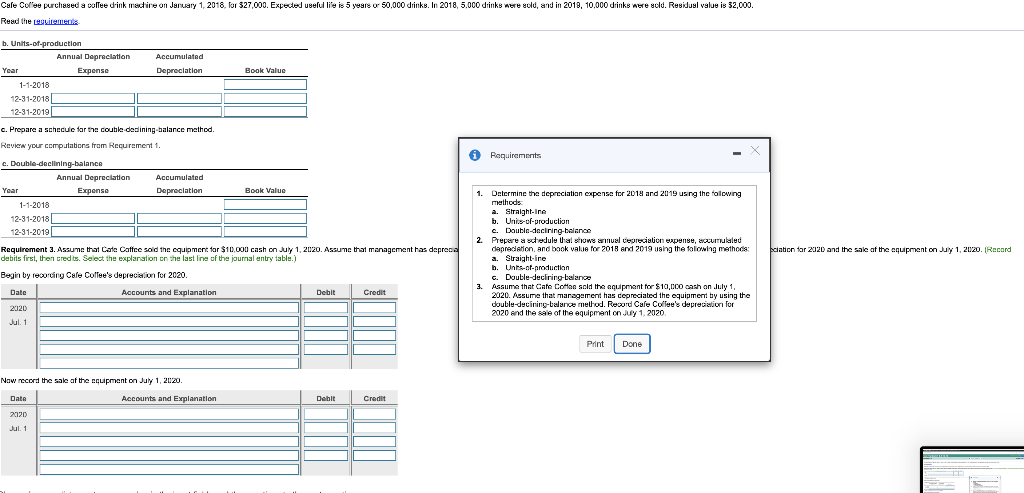

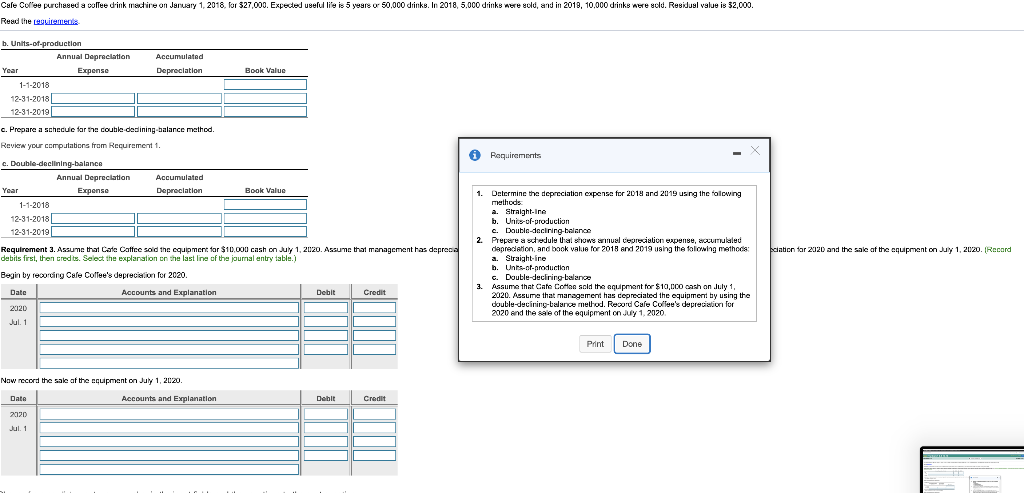

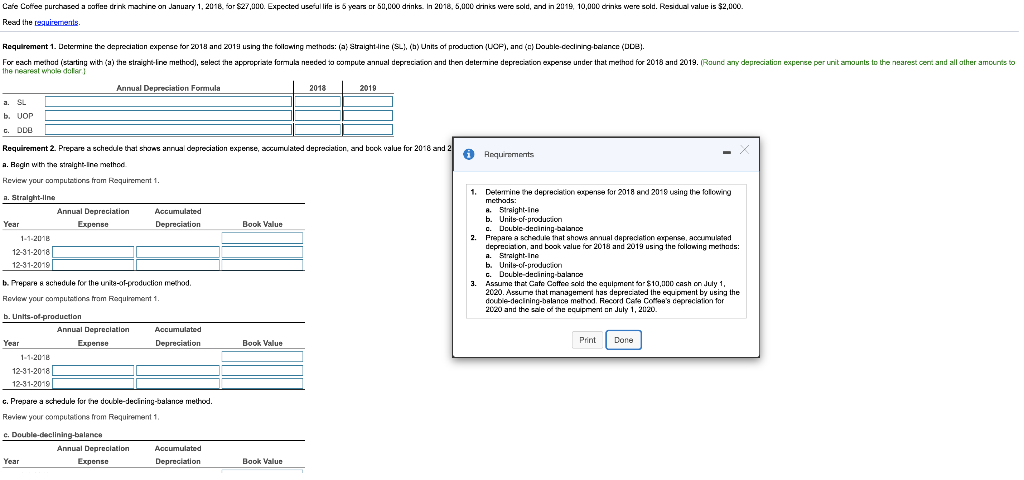

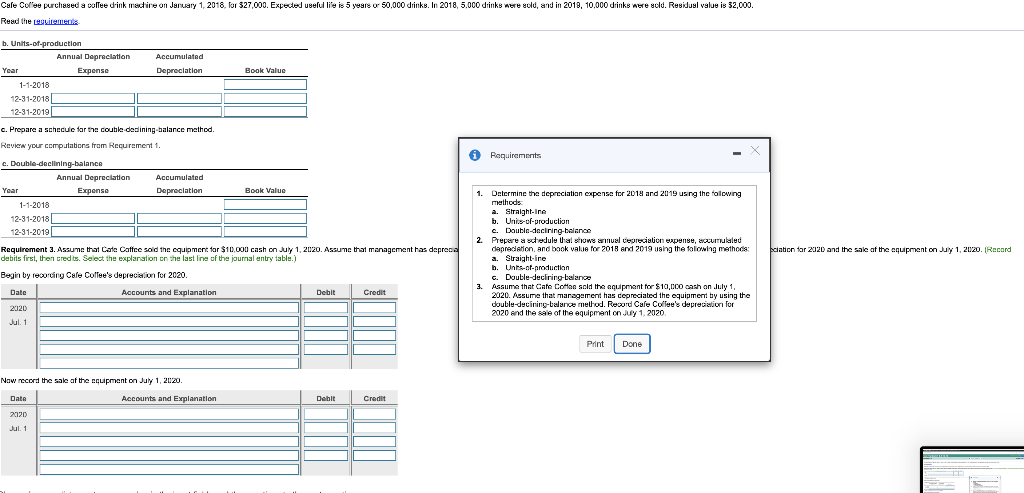

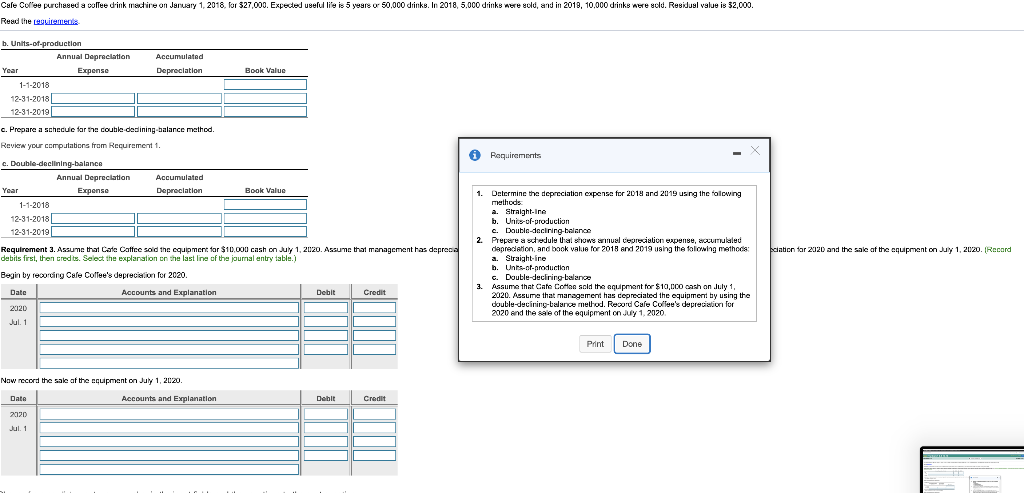

Cafe Coffee purchased a soffee drink machine on January 1, 2016. for $27,000. Expected use life is 5 years er 50,000 drinks. In 2018, 5.000 ans were sold, and in 2018. 10,000 anks were sold. Residual value is $2,000. Requirement 1. Determine the depreciation expense for 2018 and 2013 sng the folding methods: (aStraig (SLI.() Units of production (UCF), anc (Doblecening balance (DD). For each method starting with (a) the straigheine method, select the appropriate for reded to compleanual depreciation and then determine depreciation expense under that method for 2018 and 2019. Round any depreciation expense per un amounts to the nearest cent and all other amounts to The nearest whale deler Annual Depreciation Formula 2018 a SL b. VOP CODE i Requirements Requirement 2. Prepare a schedule that s annual depreciation expense, accumulated depreciation, and book value for 2016 and 2 a. Begin with the straight-Ine method Review your computations from Requirement1 a. Straight-line Annual Depreciation Accumulated Year Depreciation Book Value 1.1.2018 12-31-2018 12-31-20-90 1. Determine the depreciation expense for 2018 and 2018 waing the folowing methods: A. Straight-ine b. Units-of-producion c. Double-decining balanse Pre are a scheda that shows Anual deprecation expens, A w ad depreciation, and book value for 2018 and 2019 using the following methods: a. Straighting b. Unil-l-producion G. Double-decining balanse 3. Assume that Cate Coffee sold the animerer $10,000 cash on July 1, 2020. Asume that management has deprecated the equipment by using the double-deciring-balance method Record Cata Cola's depreciation for 2020 and the sale of the ecupment on July 1, 2020 Book Value Print Done b. Prepare a schedule for the unite-of-production method. Review your computations from Requirement 1. b. Units-of-production Annual Depreciation Accumulated Year Expense Depreciation 1-1-2018 12-31-2018 12-31-20-9 c. Prepare a schedule for the double-deciring-balance method. Review your computations from Requirement 1 c. Double-declining balance Annual Depreciation Accumulated Year Expense Depreciation Bok Value Cale Colore purchased a coffee drink wadhire on January 1, 2018. for $27.000. Expected Read thetuanimals is 5 years or 50.000 dinks. In 2018, 5.000 dinks were told, and in 2013, 10.000 drinks were sold. Residus value is $2,000. Accumulated Depreciation Book Value b. Units-of-production Annual Depreciation Year Expense 1-1-2018 12-31-2018 12-31-2019 c. Prepare a schedule for the couble declining balance method. Review your computations from Recurement 1. i Requirements Accumulated Depreciation Book Value c. Double-declining-balance Annual Depreciation Year Expense 1-1-2018 12-31-2018 12-31-2019 Requirement 3. Assume that Cala Cattee sold the equipment for $10.000 cash on July 1, 2020. Assume that management has depreca debits first, then credits. Select the explanation on the last line of the journal entry table.) 1. Determine the depreciation expense for 2018 ard 2019 usng the rolewing methods a. Straight-ine b. Unics-of-production c. Double-deciring-balance 2. Prepare a wedule that shows wmuul preciation spone, cumulated deprecation, and book value for 2018 Arv 2019 using the following methods: a. Straight-line b. Unins-ofproduction C. Double-duciring balance 3. Assume that cate Coon sold the equipment for $10,000 osh on July 1, 2020. Assume that management has depreciated the equipment by using the double-decining balance method. Record Cale Cullou's depresion for 2020 and the sale of the equipment on July 1, 2020 ciation for 2020 and the sale of the equipment on July 1, 2020. (Record Begin by reducing Cale Coffee's depreciation for 2020. Date Accounts and Explanation Debit Credit Jul. 1 Print Done Now record the sale at the equipment on July 1, 2020 Date Accounts and Explanation Jul 1 Cale Colore purchased a coffee drink wadhire on January 1, 2018. for $27.000. Expected Read thetuanimals is 5 years or 50.000 dinks. In 2018, 5.000 dinks were told, and in 2013, 10.000 drinks were sold. Residus value is $2,000. Accumulated Depreciation Book Value b. Units-of-production Annual Depreciation Year Expense 1-1-2018 12-31-2018 12-31-2019 c. Prepare a schedule for the couble declining balance method. Review your computations from Recurement 1. i Requirements Accumulated Depreciation Book Value c. Double-declining-balance Annual Depreciation Year Expense 1-1-2018 12-31-2018 12-31-2019 Requirement 3. Assume that Cala Cattee sold the equipment for $10.000 cash on July 1, 2020. Assume that management has depreca debits first, then credits. Select the explanation on the last line of the journal entry table.) 1. Determine the depreciation expense for 2018 ard 2019 usng the rolewing methods a. Straight-ine b. Unics-of-production c. Double-deciring-balance 2. Prepare a wedule that shows wmuul preciation spone, cumulated deprecation, and book value for 2018 Arv 2019 using the following methods: a. Straight-line b. Unins-ofproduction C. Double-duciring balance 3. Assume that cate Coon sold the equipment for $10,000 osh on July 1, 2020. Assume that management has depreciated the equipment by using the double-decining balance method. Record Cale Cullou's depresion for 2020 and the sale of the equipment on July 1, 2020 ciation for 2020 and the sale of the equipment on July 1, 2020. (Record Begin by reducing Cale Coffee's depreciation for 2020. Date Accounts and Explanation Debit Credit Jul. 1 Print Done Now record the sale at the equipment on July 1, 2020 Date Accounts and Explanation Jul 1