Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help calculate the NPV of the project with a schedule The forecasted, ready to place into service, cost of the new system is $7,000,000

Please help calculate the NPV of the project with a schedule

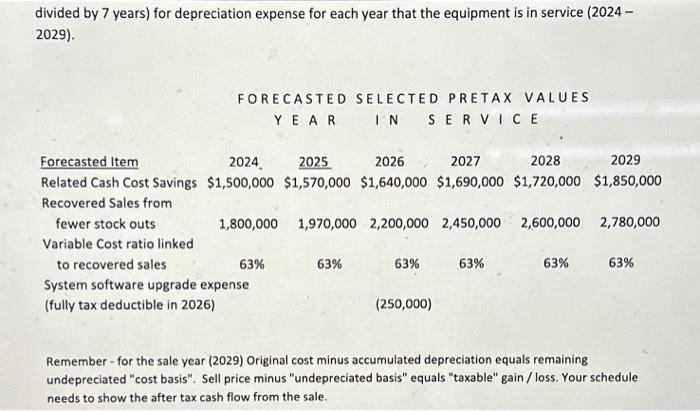

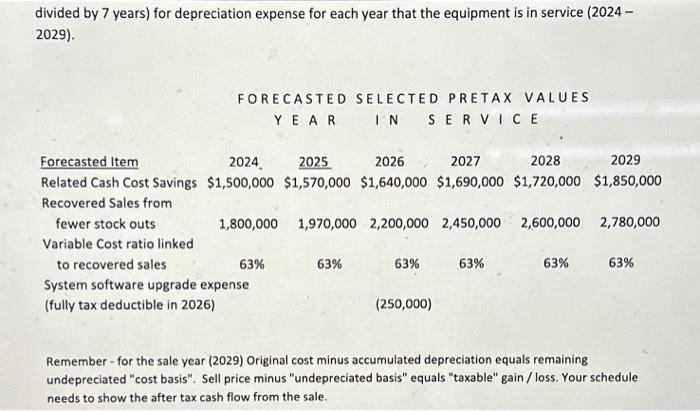

The forecasted, ready to place into service, cost of the new system is $7,000,000 (Installation completed on December 31, 2023). Expected labor and related cost savings as well as other key forecasts are displayed in the chart below. These amounts were provided to you by various sources and should be used in your first pass preparation (note FIRST PASS). Carter expects to have a six year (2024-2029) operational period for the equipment. At the end of 2029 Carter expects to sell the equipment for approximately 15% of the original in-service cost. Carter has historically used a hurdle rate of 14% to evaluate capital projects. The firm has never undertaken a project like this that was so dependent on the use of new technology. Existing staff does not possess the necessary technical skills to fully operate the new equipment. Between employee training and new hires, that expertise will hopefully be obtained. The forecasted cost of training existing staff and to be hired technical staff is included in the net annual cash values below. Many of these forecasts were developed with the help of the equipment manufacturer. The new equipment and operating software is expected to improve management's ability to plan inventory and thus reduce inventory stockouts and improve sales. Forecasted annual cash flow from "Related Cost Savings" below is net of annual operating costs associated with the use of the new equipment and technology. The firm's annual tax rate is expected to be 32% and the IRS requires a 7 year life be used for the tax return depreciation deduction (NOTE the IRS mandates a seven year depreciable life but Carter expects to selling after using the equipment for 6 years). Carter will deduct $1,000,000 annually ($7,000,000 divided by 7 years) for depreciation expense for each year that the equipment is in service (2024 - divided by 7 years) for depreciation expense for each year that the equipment is in service (2024 2029). Remember - for the sale year (2029) Original cost minus accumulated depreciation equals remaining undepreciated "cost basis". Sell price minus "undepreciated basis" equals "taxable" gain / loss. Your schedule needs to show the after tax cash flow from the sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started