Answered step by step

Verified Expert Solution

Question

1 Approved Answer

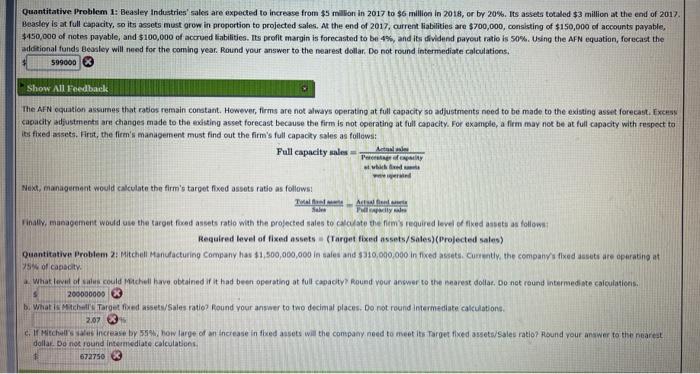

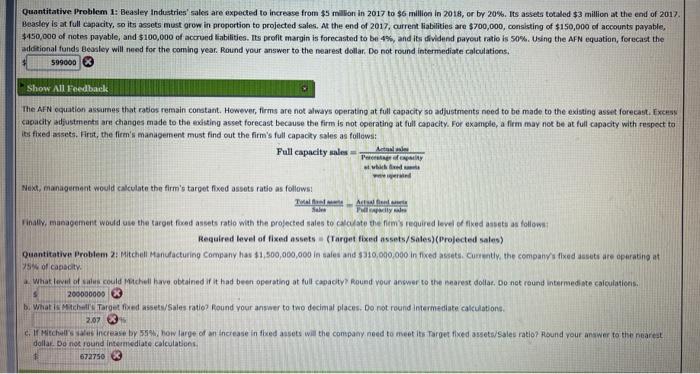

Please help! Cannot get the correct answers for these questions. Will upvote!! Thank you! :-) Quantitative Problem 1: Beasley Industries' sales are expeded to increase

Please help! Cannot get the correct answers for these questions. Will upvote!! Thank you! :-)

Quantitative Problem 1: Beasley Industries' sales are expeded to increase from $5 millon in 2017 to $6 millioe in 2018 , or by 20%. Its assets totaled $3 million at the end of 2017 Beasley is at full capacity, so its acsets must grow in proportion to projected sales, At the end of 2017, current liabilities are $700,000, consisting of $150,000 of accounts payable, $450,000 of notes payable, and $100,000 of accrued liabilities. Its prefli margin is forecasted to be 4%, and its tividend payout ratio is 50%. Using the AFN equation, forecast the additional funds Beosley will need for the coming year. Round your answor to the nearest dollar. Do not round intermediate calculations, Whow in trediback The AfN equation assumes that ratios remain constant. Hewever, firms are not always operating at full capacity so adjustments need to be made to the existieg asset forecast. Excess capacily adjustmentir are changes made to the boditing asset forecast because the firm is not operating at full capacity. For example, a firm may not be at full capaoty with respoct to its fixed assets. Hrst, the firm's management must find cut the firm's full capacky sales as follows: Next, managemeat would cakcolate the flrm's tarpet foxed assots ratio as follows: rinally, management would uie the target fixed assets ratlo with the projected sales to caculate the firm's required level of tixed asseti as follown: Reguired level of fixed assets a (Target fixed assets/sales) (Projected sales) Quantitative Problem 2: Mitchell Manulacturing Company has 11,500,000,000 in sales and $310,090,000 in fixed assets. Currentiy, the compaiy/s flxed asseti are operabing at 196 of copsety 4. What Leval of calue could tMchell have obtained if it had been operating at full capacty? kound vour answer to the pearest dollag, Do not reund intermedi mte caiculaticers. b. What is Michefli Taroet fixed assets/Sales ratio? Round your ansaer to two decimat places, Do rot round intermediate cakculations. dollae. Do nos round intermiediate calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started