Answered step by step

Verified Expert Solution

Question

1 Approved Answer

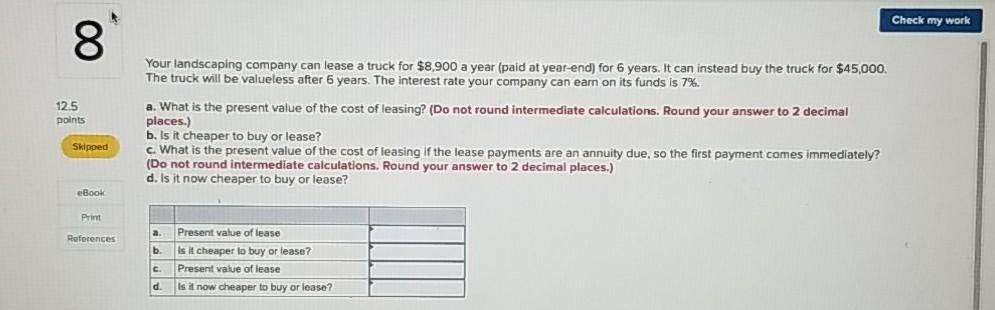

please help Check my work 8 Your landscaping company can lease a truck for $8,900 a year (paid at year-end) for 6 years. It can

please help

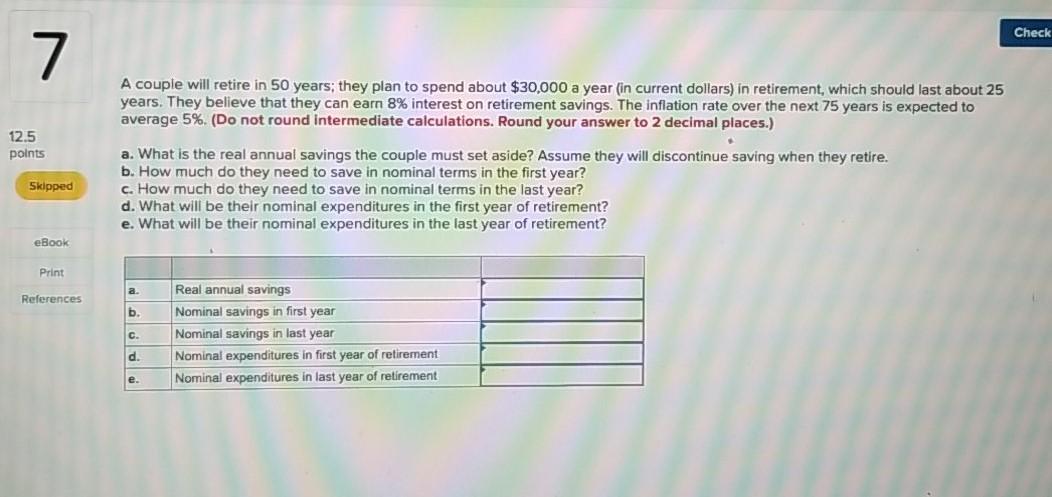

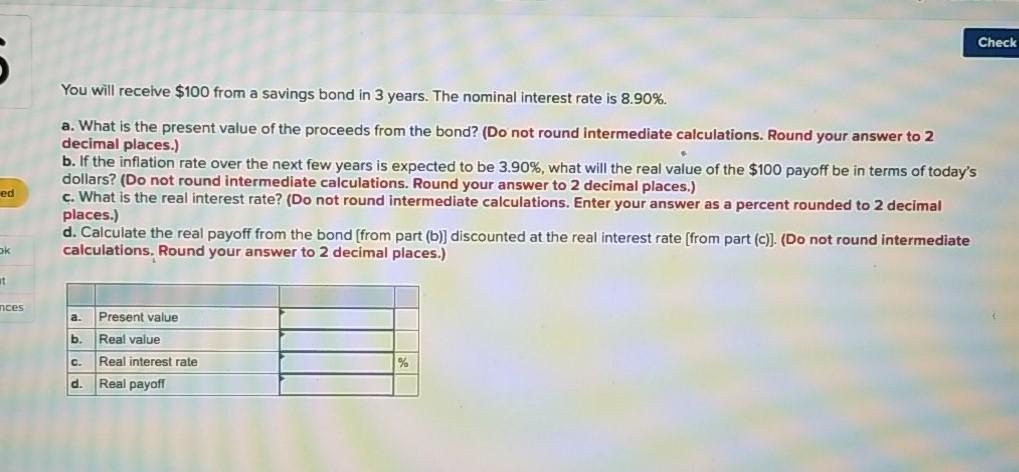

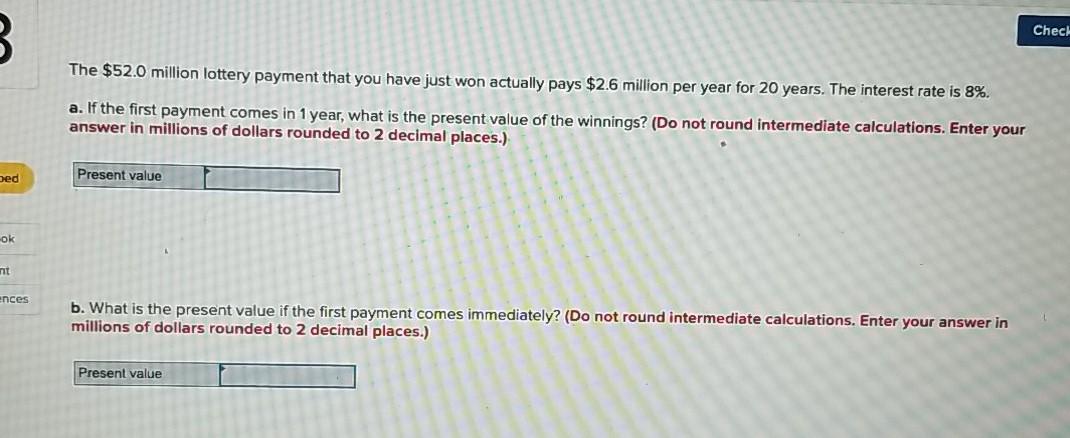

Check my work 8 Your landscaping company can lease a truck for $8,900 a year (paid at year-end) for 6 years. It can instead buy the truck for $45,000. The truck will be valueless after 6 years. The interest rate your company can earn on its funds is 7%. 12.5 points Skipped a. What is the present value of the cost of leasing? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Is it cheaper to buy or lease? c. What is the present value of the cost of leasing if the lease payments are an annuity due, so the first payment comes immediately? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. Is it now cheaper to buy or lease? Book Print a References b Present value of lease Is it cheaper to buy or lease? Present value lease Is it now cheaper to buy or lease? C d Check 7 A couple will retire in 50 years; they plan to spend about $30,000 a year (in current dollars) in retirement, which should last about 25 years. They believe that they can earn 8% interest on retirement savings. The inflation rate over the next 75 years is expected to average 5%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) 12.5 points Skipped a. What is the real annual savings the couple must set aside? Assume they will discontinue saving when they retire. b. How much do they need to save in nominal terms in the first year? c. How much do they need to save in nominal terms in the last year? d. What will be their nominal expenditures in the first year of retirement? e. What will be their nominal expenditures in the last year of retirement? eBook Print a References b c. Real annual savings Nominal savings in first year Nominal savings in last year Nominal expenditures in first year of retirement Nominal expenditures in last year of retirement d. e Check You will receive $100 from a savings bond in 3 years. The nominal Interest rate is 8.90%. a. What is the present value of the proceeds from the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. If the inflation rate over the next few years is expected to be 3.90%, what will the real value of the $100 payoff be in terms of today's dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. What is the real interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. Calculate the real payoff from the bond (from part (b)) discounted at the real interest rate (from part (C)). (Do not round intermediate calculations. Round your answer to 2 decimal places.) ed ok ut nces a b. Present value Real value Real interest rate Real payoff C. d. Check B The $52.0 million lottery payment that you have just won actually pays $2.6 million per year for 20 years. The interest rate is 8%. a. If the first payment comes in 1 year, what is the present value of the winnings? (Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 2 decimal places.) bed Present value ok ences b. What is the present value if the first payment comes immediately? (Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 2 decimal places.) Present valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started