Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help Company analysis. Given the financial data in the popup window, 5, for Disney (DIS) and McDonald's (MCD), compare these two companies using the

Please Help

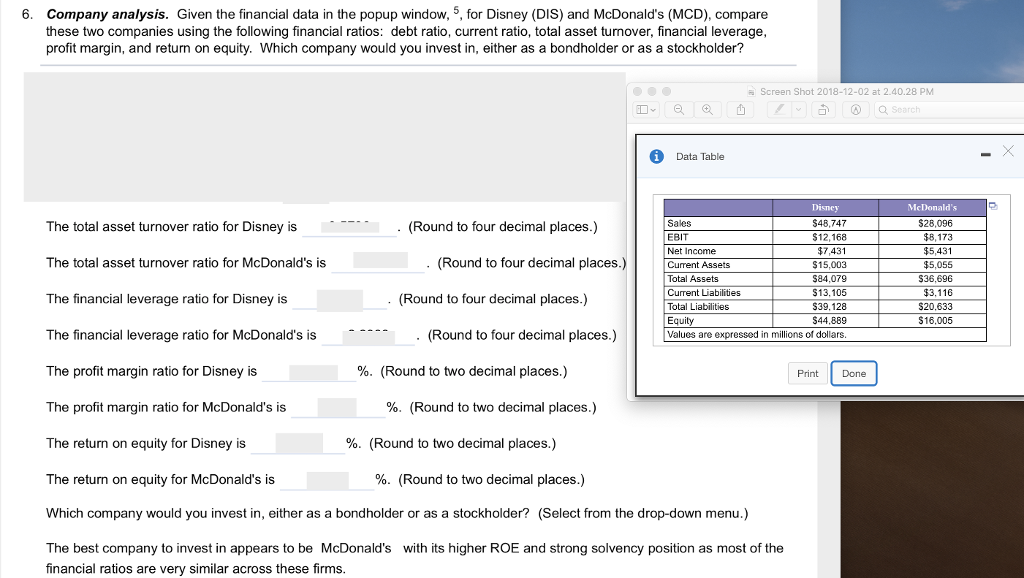

Company analysis. Given the financial data in the popup window, 5, for Disney (DIS) and McDonald's (MCD), compare these two companies using the following financial ratios: debt ratio, current ratio, total asset turnover, financial leverage profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? 6. Screen Shot 2018-12-02 at 2.40.28 PM Data Table Disney $48,747 $12,168 $7,431 S15,003 S84,079 S13,105 $39,128 $44.889 McDonald's $28,096 $8,173 $5,431 $5,055 S36,696 $3.116 $20.633 $16,005 Sales The total asset turnover ratio for Disney is The total asset turnover ratio for McDonald's is The financial leverage ratio for Disney is The financial leverage ratio for McDonald's is The profit margin ratio for Disney is The profit margin ratio for McDonald's is The return on equity for Disney is The return on equity for McDonald's is Which company would you invest in, either as a bondholder or as a stockholder? (Select from the drop-down menu.) The best company to invest in appears to be McDonald's wth its higher ROE and strong solvency position as most of the . (Round to four decimal places.) Net Income . (Round to four decimal places) urrent Assets Total Assets Current Liabilities Total Liabilities Equity Values are expressed in millions of dollars (Round to four decimal places.) . (Round to four decimal places.) %. (Round to two decimal places.) PrintDone %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) financial ratios are very similar across these firmsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started