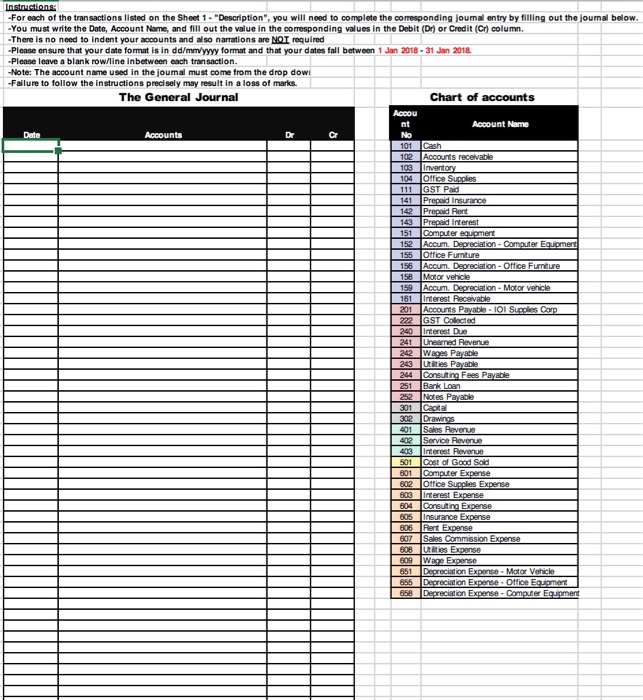

Please help complete the Journal.

GST is 10%

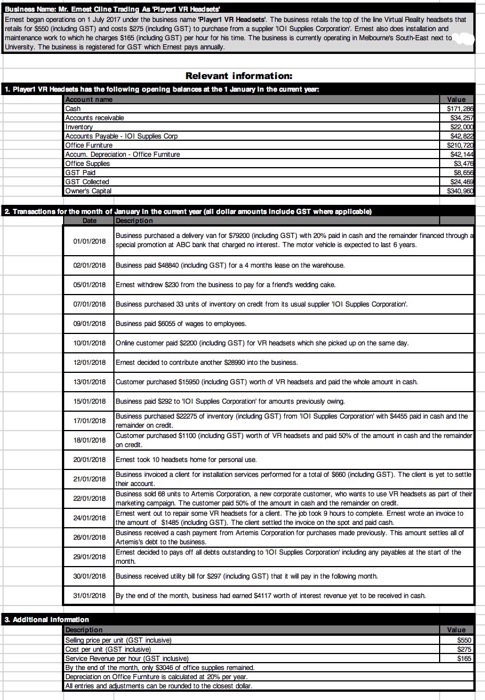

Business Name: Mr, Emest Cline T Emest began operat ons on 1 July 2017 under the business name Playert VR Headsets. The business retais the top of the ine Vitual Reailty headsets thar netails for $550 (including GST) and costs $275 (Including GST) to purchase from a supplier 10l Supples Corporation. Emest abo does installation and mairtenroe work to which he charges S165 (reudg GST) hour for his time The bsness curatly operating r istourne's ScuEhEast next to niversty, The bsiress is registered for GST which Enest pays annualy Relevant information: . Player VR Hondsets has the following opening balances at the 1 January In the aurrent year 2Transactions for the month of January In the ourent year Call dollar amounts Indude GSTwhore applicable) Busress prchased a Olvery van for S 200 rcidg GST) wth 20% pad n caen and the remanir fra od trough 0M02018 cial promation at ABC bank that charged no interest. The motor vehicle is expected to last 6 years 2018Business paid $43840 (nludingGST) for a 4 monthe lease on the warehouse 0502018 Ernest wrdow Sa torm tho tusness to pay for a trionds wodig cake N02018 Busness purchesed 30 unts of invenory on credt from ts usual supplier 1Ol Supplies Corporation 0 0/2018 Business paid SE055 of wags to emplbyees. 0 03018Onine customer paid s2200 (including GST) for VR heacsets wich she picked up on the same day 1201/2018 Ernest decided to contrbute another 528980 into the business. 1501'2018 Busress pud92 to 101 S4ckes Corporator for amorts prevously Business purchased S22275 of inventory (rcluding GST) from 101 Supplies Corporation with $4455 paid in cash and the emainder on cred g 02018 20/2018 Emest took 10 headsets home for personal use 21/0 2018 Business invoiced a clent for installet on services performed for a total o $860 (including GST). The ckent yet to settle Business sold 68 units to Artems Corporacion, a new corporace customer, who warts to use VR headsets as part of thei The customer Pad SO% of the anor1 cash ad the remander on cred 240 2018 2002018 2Vov2018 Ernest went out to repair some VR headsets for a clent. The joo took 9 hours to complte Ernest wrote an invoice to the amount of $1485(including GST). The clent settled the Business recoved a cash payment from Artemis Corporation for purchases made previously. This amount settles al of Artems's dabt so the bsiress involce on the spot and paid cash decided to pays oal detts outstanding to 10i Supplies Corporation including any peyatles athe sart othe O2018 Business received utility bill for $29 (ncluding GST) the t wil pay in the following month 310/2018 By the and of the month, business had earned $4117 worth of intrest revenue yet to be rocoived in cash