Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP CONFUSED In the CAPM world, an individual risky asset A has the following characteristics: and the risk-free rate is 2%. What is the

PLEASE HELP CONFUSED

In the CAPM world, an individual risky asset A has the following characteristics: and the risk-free rate is 2%. What is the expected market return in this economy?

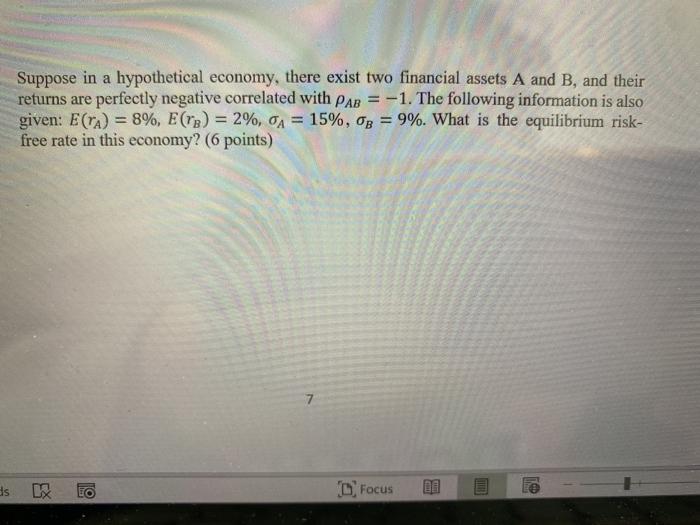

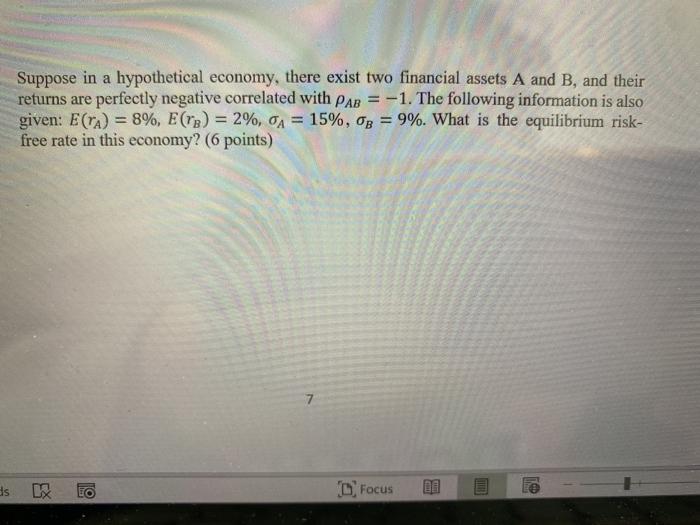

(2) Suppose in a hypothetical economy, there exist two financial assets A and B, and their returns are perfectly negative correlated with . The following information is also given: , What is the equilibrium risk-free rate in this economy?

Round your final answer to one decimal place if you use percentage, or three decimal places if you don't use percentage (e.g. 20.5\%, or 0.205).

sorry, i meant to only post question 2. heres additional information

Suppose in a hypothetical economy, there exist two financial assets A and B, and their returns are perfectly negative correlated with PAB = -1. The following information is also given: E(A) = 8%, E(B) = 2%, A = 15%, Op = 9%. What is the equilibrium risk- free rate in this economy? (6 points) ts DX Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started