Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help d, e and f sorry, the required rate of return is 20.2% as calculated from the preceeded question where the risk free rate

please help d, e and f

sorry, the required rate of return is 20.2% as calculated from the preceeded question

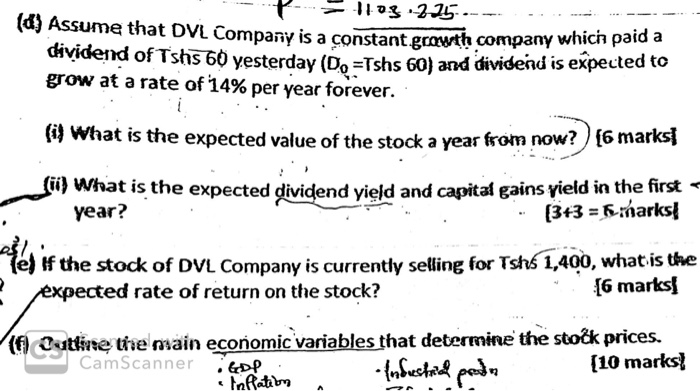

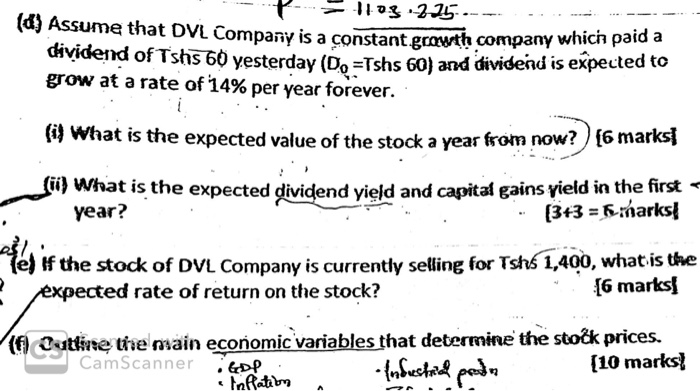

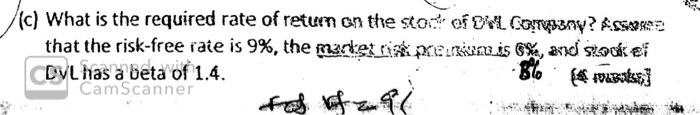

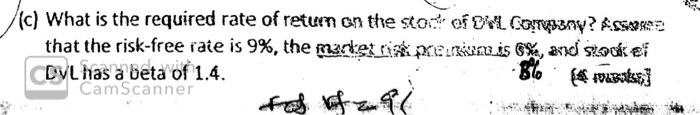

--- P 1 03 215 --- (d) Assume that DVL Company is a consta at DVL Company is a constant growth company which paid a dividend of Tshs 50 vesterday in the Sos 60 yesterday (Do =Tshs 60) and dividend is expected to grow at a rate of 14% per year forever. (i) What is the expected value of the stock a year from now? ) [6 marks year? the expected dividend yield and capital gains yield in the first . . (3+3 = 6 sharks! Teh If the stock of DVL Company is currently selling for Tshs 1,400, what is the expected rate of return on the stock? [6 marks! (6 Outline the main economic variables that determine the stock prices. CamScannerid emplatebing {nbestrid pendant (10 marks] (c) What is the required rate of return on the story of Company? Aseste that the risk-free raie is 9%, the market peciais Ex, and Slook ER CVL has a beta of 1.4. Blog UBIULE CamScanner of of ze een * where the risk free rate is 9%

market risk premium is 8%

beta is 1.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started