Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help Dan is a shareholder in Tucson Inc., a family-owned C-corporation. Tucson, Inc. has a deficit in current E&P of ($50,000) and accumulated E&P

Please Help

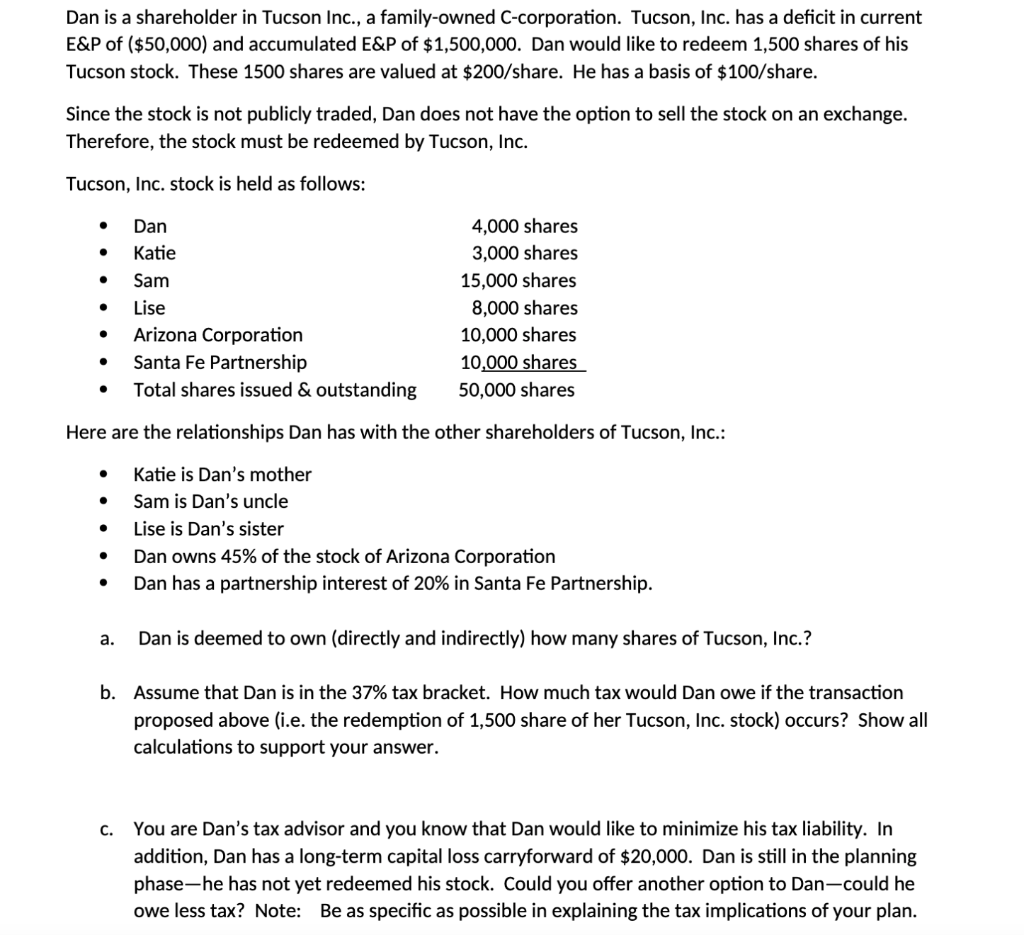

Dan is a shareholder in Tucson Inc., a family-owned C-corporation. Tucson, Inc. has a deficit in current E\&P of ($50,000) and accumulated E\&P of $1,500,000. Dan would like to redeem 1,500 shares of his Tucson stock. These 1500 shares are valued at $200 /share. He has a basis of $100/ share. Since the stock is not publicly traded, Dan does not have the option to sell the stock on an exchange. Therefore, the stock must be redeemed by Tucson, Inc. Tucson, Inc. stock is held as follows: Here are the relationships Dan has with the other shareholders of Tucson, Inc.: - Katie is Dan's mother - Sam is Dan's uncle - Lise is Dan's sister - Dan owns 45% of the stock of Arizona Corporation - Dan has a partnership interest of 20% in Santa Fe Partnership. a. Dan is deemed to own (directly and indirectly) how many shares of Tucson, Inc.? b. Assume that Dan is in the 37% tax bracket. How much tax would Dan owe if the transaction proposed above (i.e. the redemption of 1,500 share of her Tucson, Inc. stock) occurs? Show all calculations to support your answer. c. You are Dan's tax advisor and you know that Dan would like to minimize his tax liability. In addition, Dan has a long-term capital loss carryforward of $20,000. Dan is still in the planning phase-he has not yet redeemed his stock. Could you offer another option to Dan-could he owe less tax? Note: Be as specific as possible in explaining the tax implications of your plan. Dan is a shareholder in Tucson Inc., a family-owned C-corporation. Tucson, Inc. has a deficit in current E\&P of ($50,000) and accumulated E\&P of $1,500,000. Dan would like to redeem 1,500 shares of his Tucson stock. These 1500 shares are valued at $200 /share. He has a basis of $100/ share. Since the stock is not publicly traded, Dan does not have the option to sell the stock on an exchange. Therefore, the stock must be redeemed by Tucson, Inc. Tucson, Inc. stock is held as follows: Here are the relationships Dan has with the other shareholders of Tucson, Inc.: - Katie is Dan's mother - Sam is Dan's uncle - Lise is Dan's sister - Dan owns 45% of the stock of Arizona Corporation - Dan has a partnership interest of 20% in Santa Fe Partnership. a. Dan is deemed to own (directly and indirectly) how many shares of Tucson, Inc.? b. Assume that Dan is in the 37% tax bracket. How much tax would Dan owe if the transaction proposed above (i.e. the redemption of 1,500 share of her Tucson, Inc. stock) occurs? Show all calculations to support your answer. c. You are Dan's tax advisor and you know that Dan would like to minimize his tax liability. In addition, Dan has a long-term capital loss carryforward of $20,000. Dan is still in the planning phase-he has not yet redeemed his stock. Could you offer another option to Dan-could he owe less tax? Note: Be as specific as possible in explaining the tax implications of your planStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started