Answered step by step

Verified Expert Solution

Question

1 Approved Answer

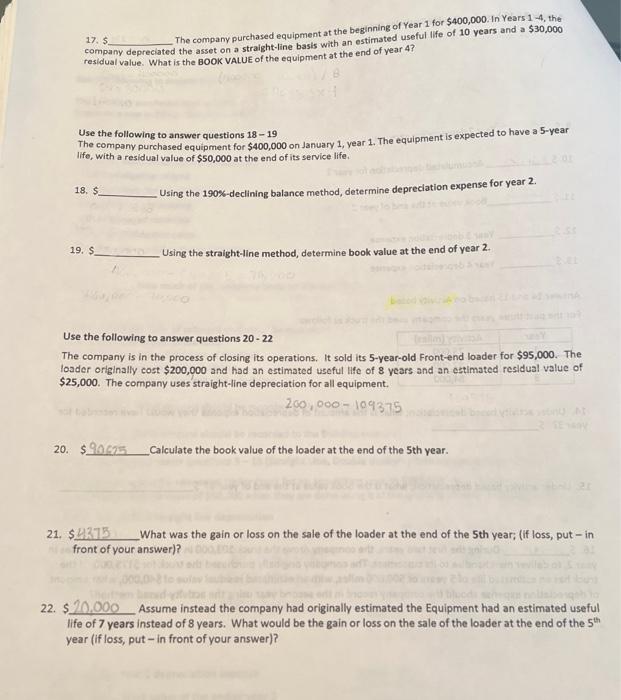

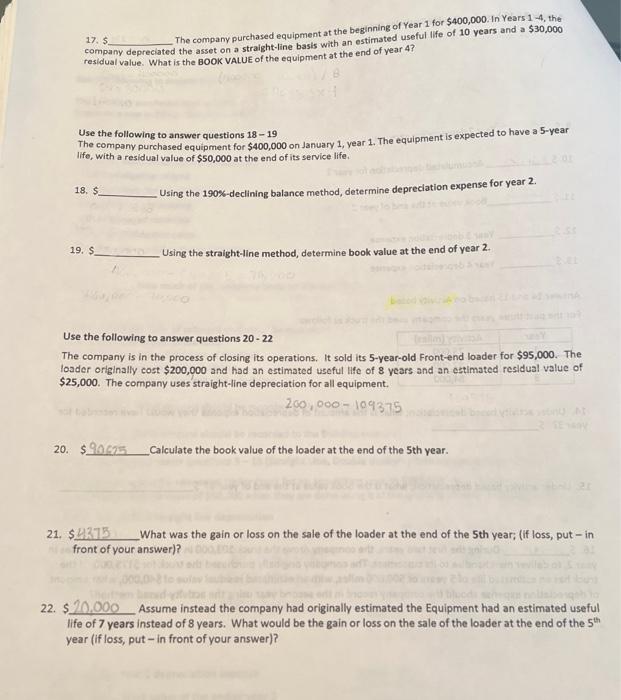

please help! did it, and got it wrong. thanks. 17. 5 The company purchased equipment at the beginning of Year 1 for $400,000. In Years

please help! did it, and got it wrong. thanks.

17. 5 The company purchased equipment at the beginning of Year 1 for $400,000. In Years 14, the residual value. What is the BOOK VALUE of the equipment at the end of year 4 ? Use the following to answer questions 1819 The company purchased equipment for $400,000 on January 1 , year 1 . The equipment is expected to have a 5 -year life, with a residual value of $50,000 at the end of its service life. 18. 5 Using the 190\%-declining balance method, determine depreciation expense for year 2. 19. $ Using the straight-line method, determine book value at the end of year 2. Use the following to answer questions 2022 The company is in the process of closing its operations. It sold its 5-year-old Front-end loader for $95,000. The loader originally cost $200,000 and had an estimated useful life of 8 years and an estimated residual value of $25,000. The company uses straight-line depreciation for all equipment. 200,000109375 20. $90c25 Calculate the book value of the loader at the end of the 5th year. 21. $4275 What was the gain or loss on the sale of the loader at the end of the 5 th year; (if loss, put - in front of your answer)? 22. $20,000 Assume instead the company had originally estimated the Equipment had an estimated useful life of 7 years instead of 8 years. What would be the gain or loss on the sale of the loader at the end of the 5th year (if loss, put - in front of your answer)? 17. 5 The company purchased equipment at the beginning of Year 1 for $400,000. In Years 14, the residual value. What is the BOOK VALUE of the equipment at the end of year 4 ? Use the following to answer questions 1819 The company purchased equipment for $400,000 on January 1 , year 1 . The equipment is expected to have a 5 -year life, with a residual value of $50,000 at the end of its service life. 18. 5 Using the 190\%-declining balance method, determine depreciation expense for year 2. 19. $ Using the straight-line method, determine book value at the end of year 2. Use the following to answer questions 2022 The company is in the process of closing its operations. It sold its 5-year-old Front-end loader for $95,000. The loader originally cost $200,000 and had an estimated useful life of 8 years and an estimated residual value of $25,000. The company uses straight-line depreciation for all equipment. 200,000109375 20. $90c25 Calculate the book value of the loader at the end of the 5th year. 21. $4275 What was the gain or loss on the sale of the loader at the end of the 5 th year; (if loss, put - in front of your answer)? 22. $20,000 Assume instead the company had originally estimated the Equipment had an estimated useful life of 7 years instead of 8 years. What would be the gain or loss on the sale of the loader at the end of the 5th year (if loss, put - in front of your answer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started