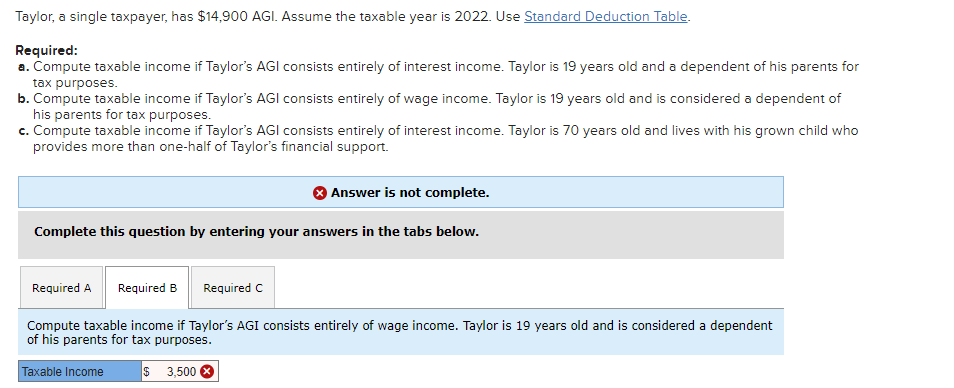

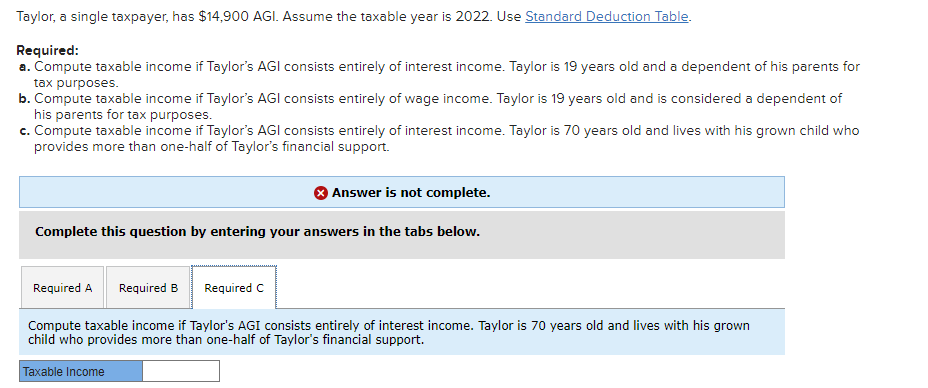

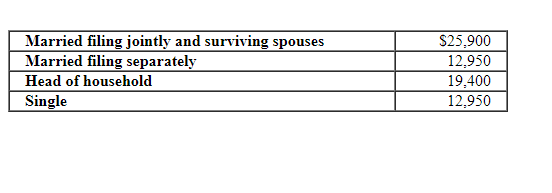

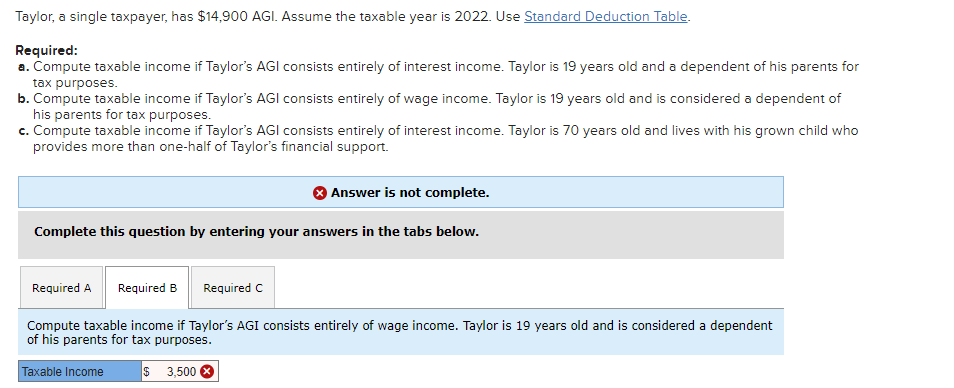

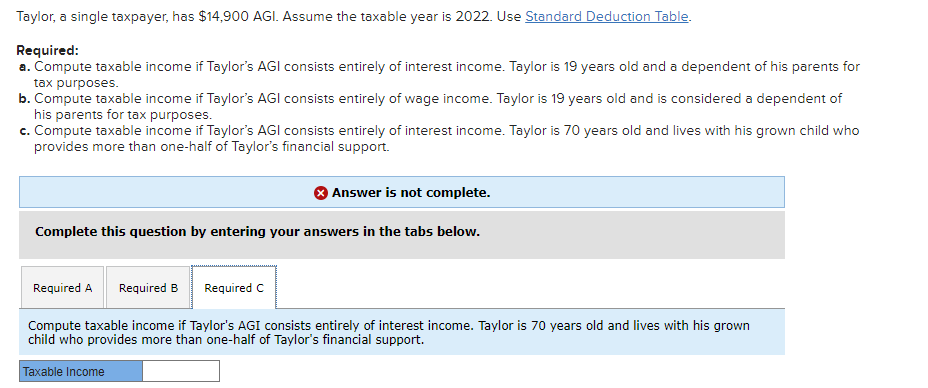

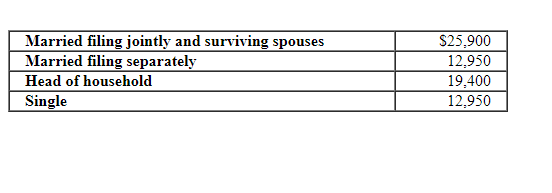

Taylor, a single taxpayer, has $14,900AGl. Assume the taxable year is 2022 . Use Standard Deduction Table. Required: a. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 19 years old and a dependent of his parents for tax purposes. b. Compute taxable income if Taylor's AGI consists entirely of wage income. Taylor is 19 years old and is considered a dependent of his parents for tax purposes. c. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute taxable income if Taylor's AGI consists entirely of wage income. Taylor is 19 years old and is considered a dependent of his parents for tax purposes. Taylor, a single taxpayer, has $14,900AGl. Assume the taxable year is 2022 . Use Standard Deduction Table. Required: a. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 19 years old and a dependent of his parents for tax purposes. b. Compute taxable income if Taylor's AGI consists entirely of wage income. Taylor is 19 years old and is considered a dependent of his parents for tax purposes. c. Compute taxable income if Taylor's AGl consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. \begin{tabular}{|l|r|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular}