Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help. DIRECTIONS for Flexible Budget Performance Report: 1. Cell reference all of the line items (account names) from the master budget into the Flexible

Please help.

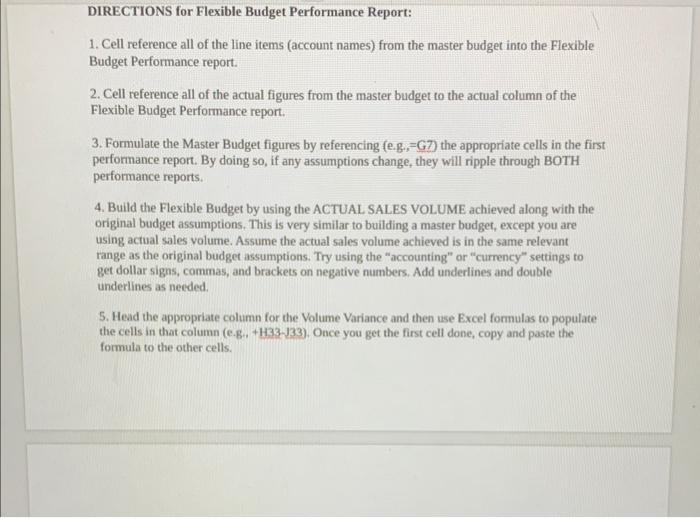

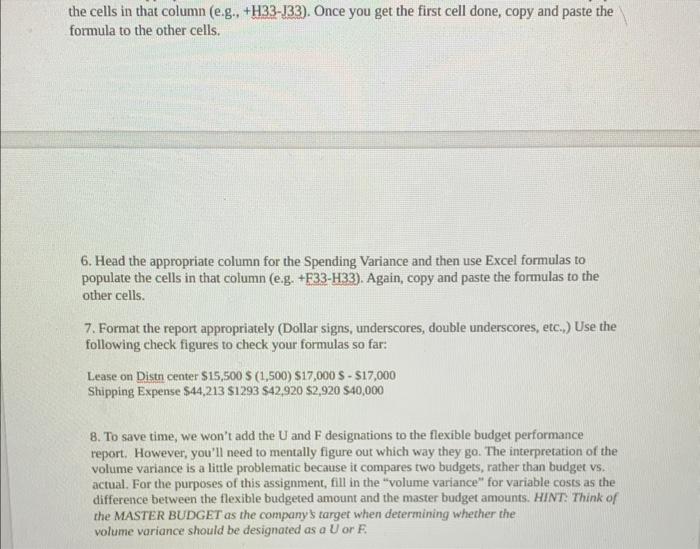

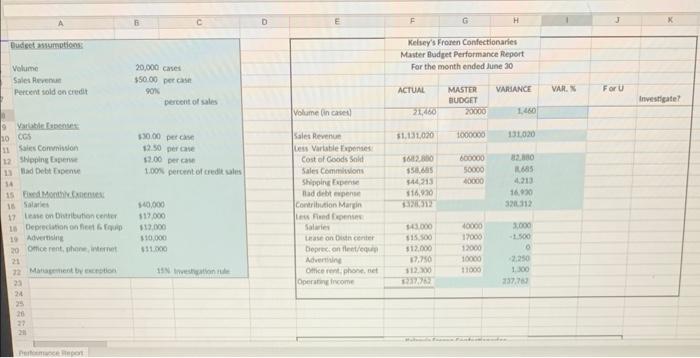

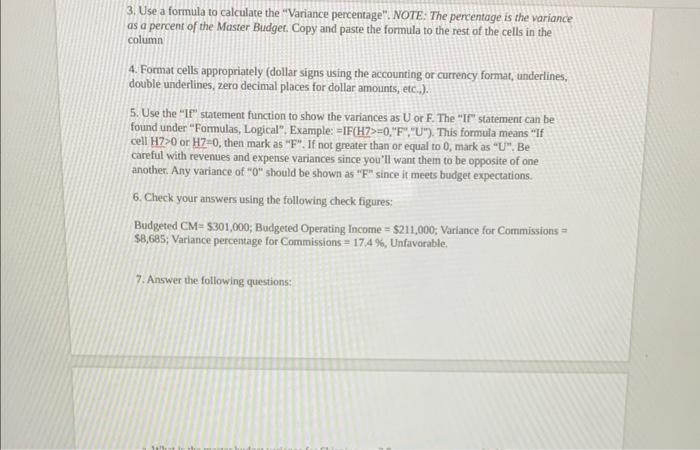

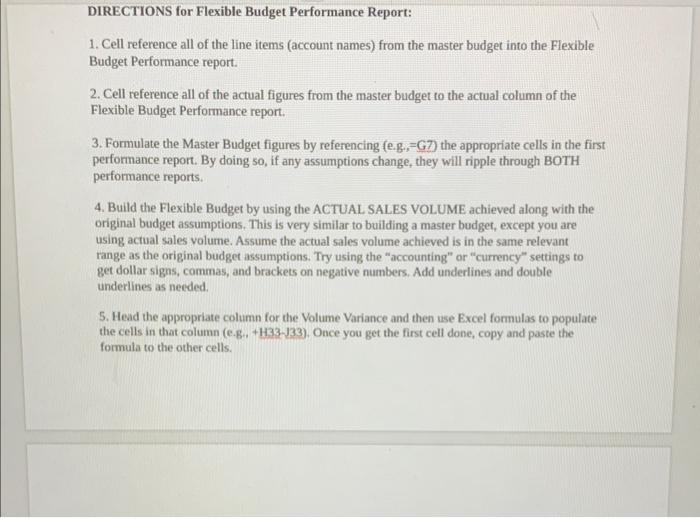

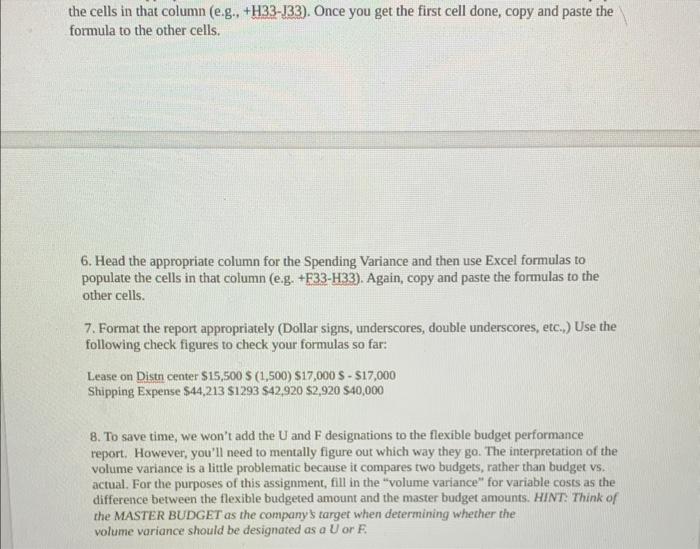

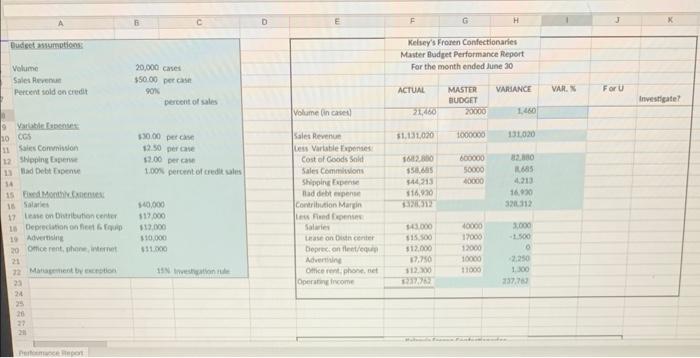

DIRECTIONS for Flexible Budget Performance Report: 1. Cell reference all of the line items (account names) from the master budget into the Flexible Budget Performance report. 2. Cell reference all of the actual figures from the master budget to the actual column of the Flexible Budget Performance report. 3. Formulate the Master Budget figures by referencing (e.g,=G7) the appropriate cells in the first performance report. By doing so, if any assumptions change, they will ripple through BOTH performance reports. 4. Build the Flexible Budget by using the ACTUAL SALES VOLUME achieved along with the original budget assumptions. This is very similar to building a master budget, except you are using actual sales volume. Assume the actual sales volume achieved is in the same relevant range as the original budget assumptions. Try using the "accounting" or "currency" settings to get dollar signs, commas, and brackets on negative numbers. Add underlines and double underlines as needed. 5. Head the appropriate column for the Volume Variance and then use Excel formulas to populate the cells in that column (e.g.+ +H33J33 ). Once you get the first cell done, copy and paste the formula to the other cells. the cells in that column (e.g., +H33J33 ). Once you get the first cell done, copy and paste the formula to the other cells. 6. Head the appropriate column for the Spending Variance and then use Excel formulas to populate the cells in that column (e.g. +F33H33). Again, copy and paste the formulas to the other cells. 7. Format the report appropriately (Dollar signs, underscores, double underscores, etc.) Use the following check figures to check your formulas so far: Lease on Distn center $15,500$(1,500)$17,000 S - $17,000 Shipping Expense $44,213$1293$42,920$2,920$40,000 8. To save time, we won't add the U and F designations to the flexible budget performance report. However, you'll need to mentally figure out which way they go. The interpretation of the volume variance is a little problematic because it compares two budgets, rather than budget vs. actual. For the purposes of this assignment, fill in the "volume variance" for variable cosis as the difference between the flexible budgeted amount and the master budget amounts. HINT. Think of the MASTER BUDGET as the companys target when determining whether the volume variance should be designated as aU or F. Eudest assumptiens B C D. E F G 1 J x Kelsey's Frozen Confectionarles Fexible Budget Performance Report For the month ended fune 30 ACTUAL FLDCELE MAster BupcEI BUDGET 3. Use a formula to calculate the "Variance percentage". NOTE: The percentage is the variance. as a percent of the Master Budget. Copy and paste the formula to the rest of the cells in the column 4. Format cells appropriately (dollar signs using the accounting or currency format, underlines, double underlines, zero decimal places for dollar amounts, etc.). 5. Use the "If" statement function to show the variances as U or F. The "If" statement can be found under "Formulas, Logical". Example: =IF(HZ>=0, "F", "U"). This formula means "If cell H7>0 or H7=0, then mark as "F". If not greater than or equal to 0 , mark as "U". Be careful with revenues and expense variances since you'll want them to be opposite of one another. Any variance of " 0 " should be shown as " F " since it meets budget expectations. 6. Check your answers using the following check figures: Budgeted CM=$301,000; Budgeted Operating Income =$211,000; Variance for Commissions = $8,685; Variance percentage for Commissions =17.4%, Unfavorable. 7. Answer the following questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started