please help dunning out of tome

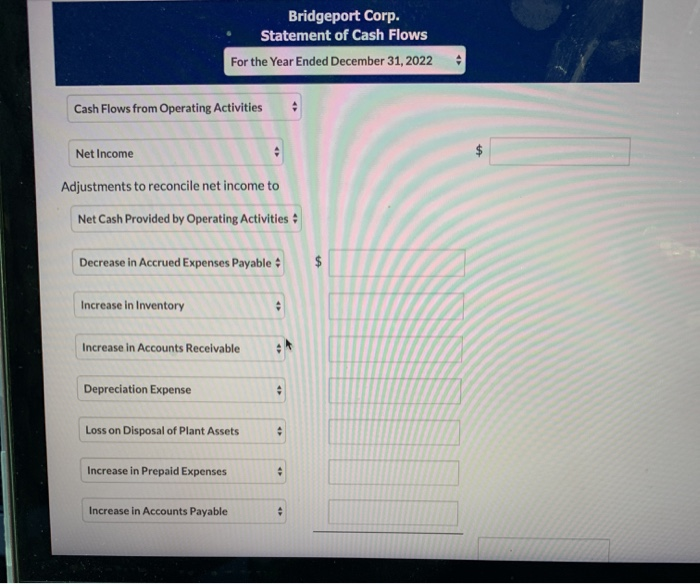

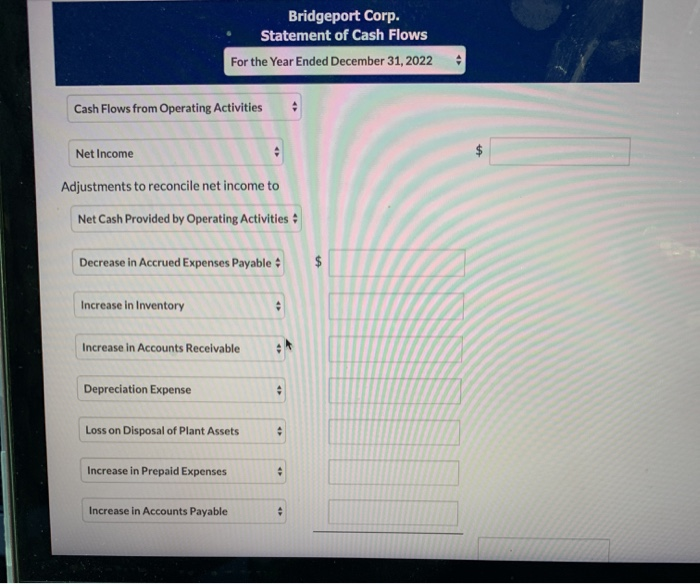

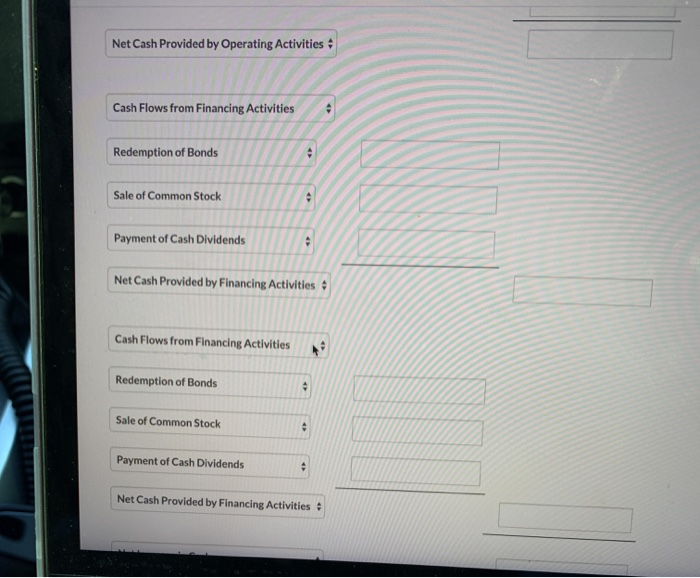

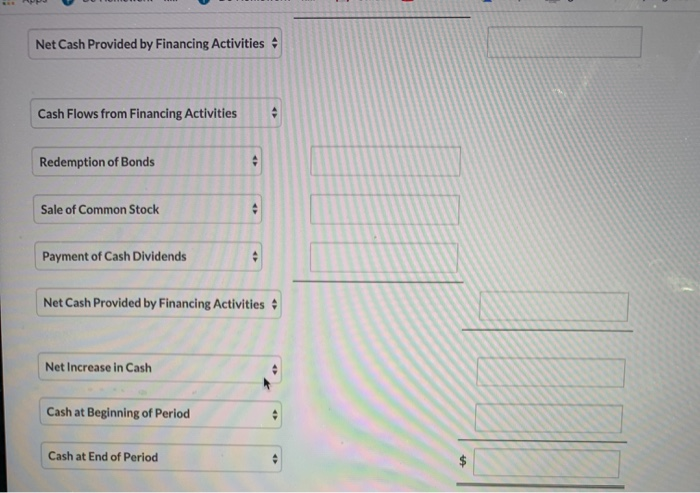

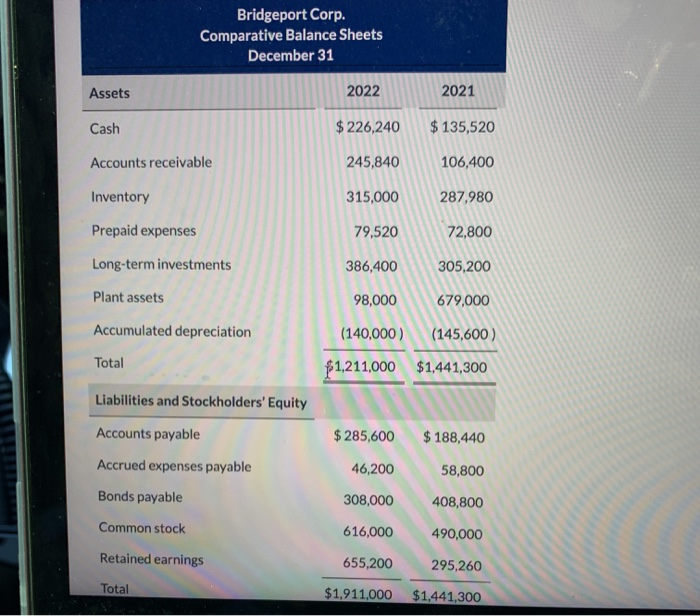

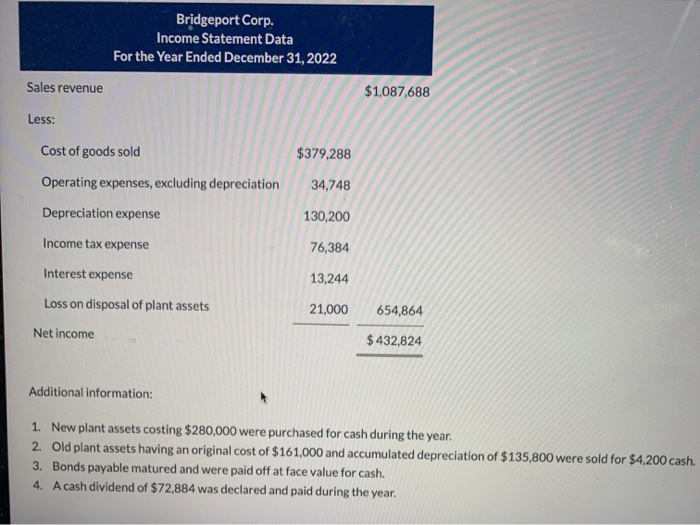

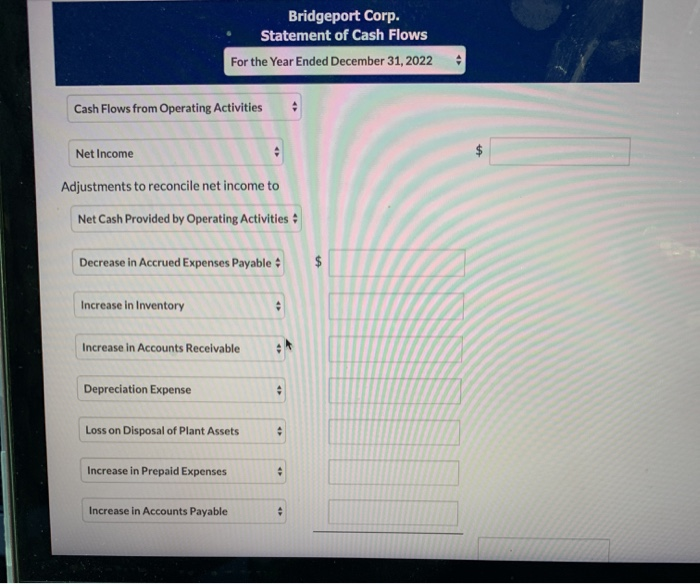

Bridgeport Corp. Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flows from Operating Activities Net Income $ Adjustments to reconcile net income to Net Cash Provided by Operating Activities Decrease in Accrued Expenses Payable $ Increase in Inventory Increase in Accounts Receivable Depreciation Expense Loss on Disposal of Plant Assets Increase in Prepaid Expenses Increase in Accounts Payable Net Cash Provided by Operating Activities Cash Flows from Financing Activities Redemption of Bonds Sale of Common Stock Payment of Cash Dividends Net Cash Provided by Financing Activities Cash Flows from Financing Activities Redemption of Bonds Sale of Common Stock Payment of Cash Dividends Net Cash Provided by Financing Activities Net Cash Provided by Financing Activities Cash Flows from Financing Activities Redemption of Bonds Sale of Common Stock > Payment of Cash Dividends Net Cash Provided by Financing Activities Net Increase in Cash Cash at Beginning of Period Cash at End of Period Bridgeport Corp. Comparative Balance Sheets December 31 Assets 2022 2021 Cash $ 226,240 $ 135,520 Accounts receivable 245,840 106,400 Inventory 315,000 287,980 Prepaid expenses 79,520 72,800 Long-term investments 386,400 305,200 Plant assets 98,000 679,000 Accumulated depreciation (140,000) (145,600) $1,211,000 $1,441,300 Total Liabilities and Stockholders' Equity Accounts payable $285,600 $ 188,440 Accrued expenses payable 46,200 58,800 Bonds payable 308,000 408,800 Common stock 616,000 490,000 Retained earnings 655,200 295,260 Total $1,911,000 $1,441,300 Bridgeport Corp. Income Statement Data For the Year Ended December 31, 2022 Sales revenue $1,087,688 Less: Cost of goods sold $379,288 Operating expenses, excluding depreciation 34,748 Depreciation expense 130,200 Income tax expense 76,384 13,244 Interest expense Loss on disposal of plant assets Net income 21,000 654,864 $432,824 Additional information: 1. New plant assets costing $280,000 were purchased for cash during the year. 2. Old plant assets having an original cost of $161,000 and accumulated depreciation of $135,800 were sold for $4,200 cash. 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $72,884 was declared and paid during the year