Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help! E Task 1 Skylar Cab, the CEO, has asked you to meet with each product-line sales manager before meeting with him to get

Please Help!

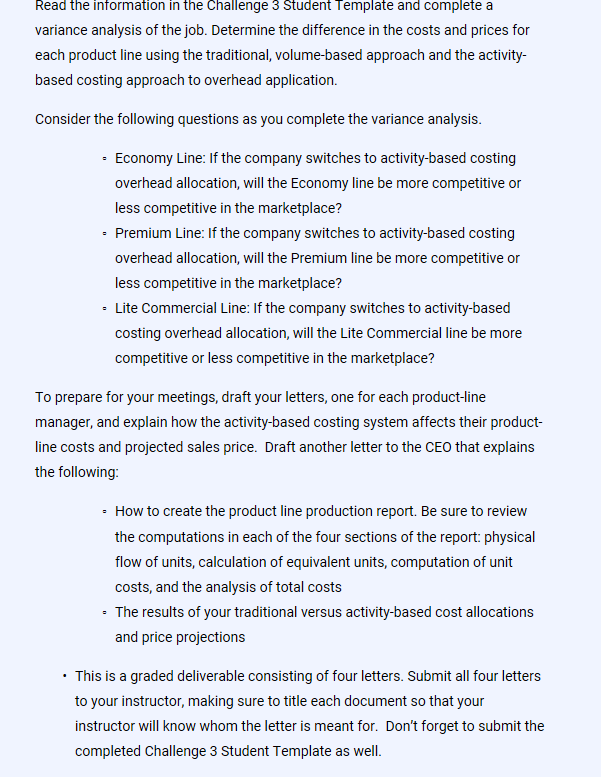

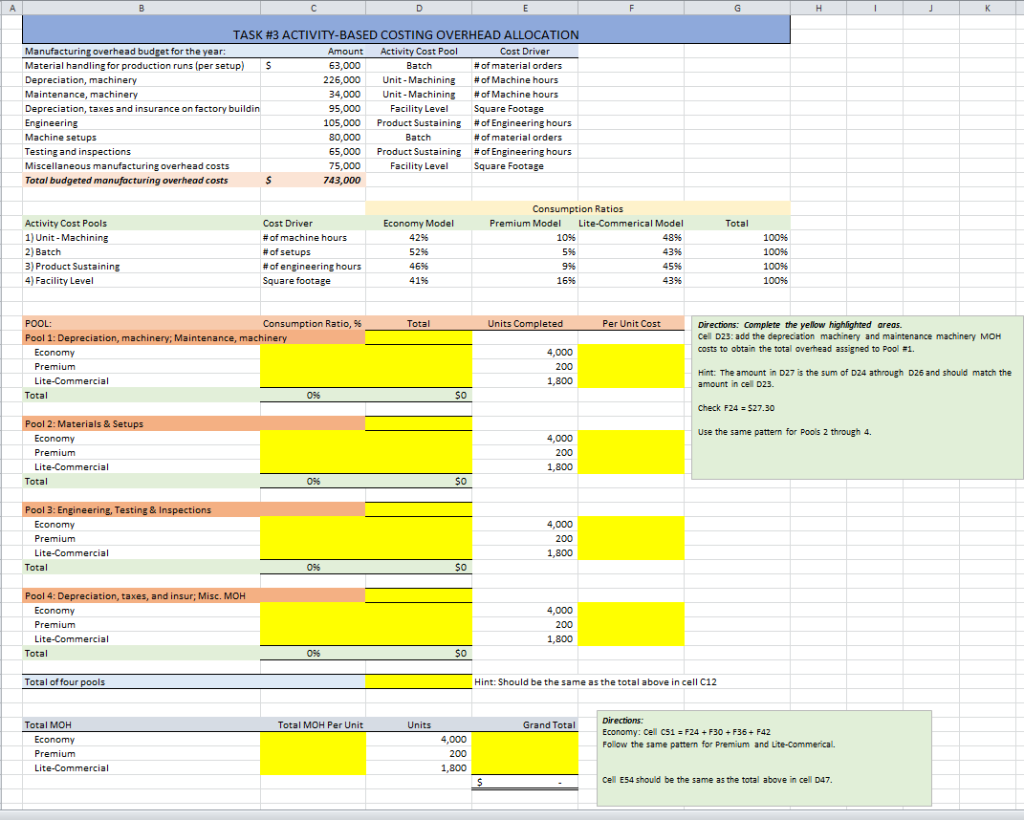

E Task 1 Skylar Cab, the CEO, has asked you to meet with each product-line sales manager before meeting with him to get their feedback on the activity-based costing results. You have a lot of work to do before meeting with each sales manager. The first step will be to compute the predetermined Manufacturing Overhead (MOH) application rate using direct labor hours as the cost driver Action Items To complete this task, use the Challenge 3 Student Template. Calculate the predetermined MOH application rate using direct labor hours as the cost driver. Read the information in the Challenge 3 Student Template and complete a variance analysis of the job. Determine the difference in the costs and prices for each product line using the traditional, volume-based approach and the activity based costing approach to overhead application Consider the following questions as you complete the variance analysis. Economy Line: If the company switches to activity-based costing overhead allocation, will the Economy line be more competitive or less competitive in the marketplace? Premium Line: If the company switches to activity-based costing overhead allocation, will the Premium line be more competitive or less competitive in the marketplace? Lite Commercial Line: If the company switches to activity-based costing overhead allocation, will the Lite Commercial line be more competitive or less competitive in the marketplace? e To prepare for your meetings, draft your letters, one for each product-line manager, and explain how the activity-based costing system affects their product- line costs and projected sales price. Draft another letter to the CEO that explains the following How to create the product line production report. Be sure to review the computations in each of the four sections of the report: physical flow of units, calculation of equivalent units, computation of unit costs, and the analysis of total costs The results of your traditional versus activity-based cost allocations and price projections . This is a graded deliverable consisting of four letters. Submit all four letters to your instructor, making sure to title each document so that your instructor will know whom the letter is meant for. Don't forget to submit the completed Challenge 3 Student Template as well TASK #3 ACTIVITY-BASED COSTING OVERHEAD ALLOCATION Manufacturing overhead budget for the year Material handling for production runs (per setup)S Depreciation, machinery Maintenance, machinery Depreciation, taxes and insurance on factory buildin Engineering Machine setups Testing and inspections Miscellaneous manufacturing overhead costs Total budgeted manufacturing overhead costs Amount 63,000 226,000 34,000 95,000 105,000 80,000 65,000 75,000 743,000 Activity Cost Pool Batch unit-Machining unit-Machining Cost Driver # of m a teri a l orders #Of Machine hours #Of Machine hours Facility Leve Square Footage Product Sustaining Batch Product Sustaining Facility Level #of Engineering hours # of material orders #Of Engineering hours Square Footage Consumption Ratios Total Activity Cost Pools 1)Unit-Machining 2) Batch 3) Product Sustaining )Facility Level Cost Driver # of machine hours # of setups # of engineering hours Square footage Economy Model 4296 52% Premium Model Lite-Commerical Model 108 5% 9% 1696 4396 45% 436 100 10096 100% 100 41% Consumption Ratio, % Total Units Per Unit Cost Directions: Complete the yellow highlighted areas Cel D23: add the depreciation machinery and maintenance machinery MOH costs to obtain the total overhead assigned to Pool #1. machinery; Maintenance, machinery 4,000 200 Hint: The amount in D27 is the sum of D24 athrough D26 and should match the amount in cel D23 Total Check F24 527.30 1 2: Materials & Setups Use the same patten for Pools 2 through 4. 4,000 200 1,800 Total 0% 50 3: Engineering, Testing & In 4,000 200 Total 4: Depreciation, taxes, and insur; Misc. MOH 4,000 200 1,800 Total 50 Total of four pools Hint: Should be the same as the total above in cell C12 Total MOH Total MOH Per Unit Grand Total Economy: Cell c51 -F24 F30+F36+F42 Follow the same pattern for Premium and Lite-Commerical Economy 4,000 Cel E54 should be the sane as the total above in ce D47 E Task 1 Skylar Cab, the CEO, has asked you to meet with each product-line sales manager before meeting with him to get their feedback on the activity-based costing results. You have a lot of work to do before meeting with each sales manager. The first step will be to compute the predetermined Manufacturing Overhead (MOH) application rate using direct labor hours as the cost driver Action Items To complete this task, use the Challenge 3 Student Template. Calculate the predetermined MOH application rate using direct labor hours as the cost driver. Read the information in the Challenge 3 Student Template and complete a variance analysis of the job. Determine the difference in the costs and prices for each product line using the traditional, volume-based approach and the activity based costing approach to overhead application Consider the following questions as you complete the variance analysis. Economy Line: If the company switches to activity-based costing overhead allocation, will the Economy line be more competitive or less competitive in the marketplace? Premium Line: If the company switches to activity-based costing overhead allocation, will the Premium line be more competitive or less competitive in the marketplace? Lite Commercial Line: If the company switches to activity-based costing overhead allocation, will the Lite Commercial line be more competitive or less competitive in the marketplace? e To prepare for your meetings, draft your letters, one for each product-line manager, and explain how the activity-based costing system affects their product- line costs and projected sales price. Draft another letter to the CEO that explains the following How to create the product line production report. Be sure to review the computations in each of the four sections of the report: physical flow of units, calculation of equivalent units, computation of unit costs, and the analysis of total costs The results of your traditional versus activity-based cost allocations and price projections . This is a graded deliverable consisting of four letters. Submit all four letters to your instructor, making sure to title each document so that your instructor will know whom the letter is meant for. Don't forget to submit the completed Challenge 3 Student Template as well TASK #3 ACTIVITY-BASED COSTING OVERHEAD ALLOCATION Manufacturing overhead budget for the year Material handling for production runs (per setup)S Depreciation, machinery Maintenance, machinery Depreciation, taxes and insurance on factory buildin Engineering Machine setups Testing and inspections Miscellaneous manufacturing overhead costs Total budgeted manufacturing overhead costs Amount 63,000 226,000 34,000 95,000 105,000 80,000 65,000 75,000 743,000 Activity Cost Pool Batch unit-Machining unit-Machining Cost Driver # of m a teri a l orders #Of Machine hours #Of Machine hours Facility Leve Square Footage Product Sustaining Batch Product Sustaining Facility Level #of Engineering hours # of material orders #Of Engineering hours Square Footage Consumption Ratios Total Activity Cost Pools 1)Unit-Machining 2) Batch 3) Product Sustaining )Facility Level Cost Driver # of machine hours # of setups # of engineering hours Square footage Economy Model 4296 52% Premium Model Lite-Commerical Model 108 5% 9% 1696 4396 45% 436 100 10096 100% 100 41% Consumption Ratio, % Total Units Per Unit Cost Directions: Complete the yellow highlighted areas Cel D23: add the depreciation machinery and maintenance machinery MOH costs to obtain the total overhead assigned to Pool #1. machinery; Maintenance, machinery 4,000 200 Hint: The amount in D27 is the sum of D24 athrough D26 and should match the amount in cel D23 Total Check F24 527.30 1 2: Materials & Setups Use the same patten for Pools 2 through 4. 4,000 200 1,800 Total 0% 50 3: Engineering, Testing & In 4,000 200 Total 4: Depreciation, taxes, and insur; Misc. MOH 4,000 200 1,800 Total 50 Total of four pools Hint: Should be the same as the total above in cell C12 Total MOH Total MOH Per Unit Grand Total Economy: Cell c51 -F24 F30+F36+F42 Follow the same pattern for Premium and Lite-Commerical Economy 4,000 Cel E54 should be the sane as the total above in ce D47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started