Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help ebook YouTube B Booking.com 53% + 5. In 2018, FJU Company purchased land and a building at a cost of $350,000, of which

please help

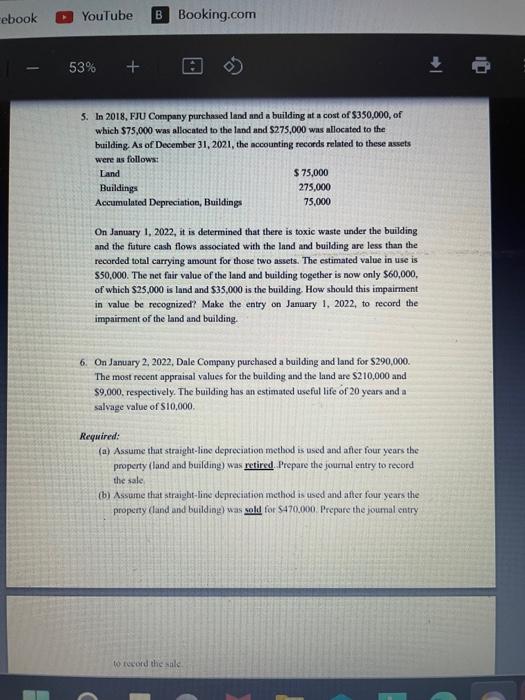

ebook YouTube B Booking.com 53% + 5. In 2018, FJU Company purchased land and a building at a cost of $350,000, of which $75,000 was allocated to the land and $275,000 was allocated to the building. As of December 31, 2021, the accounting records related to these assets were as follows: Land $75,000 Buildings 275,000 Accumulated Depreciation, Buildings 75,000 On January 1, 2022, it is determined that there is toxic waste under the building. and the future cash flows associated with the land and building are less than the recorded total carrying amount for those two assets. The estimated value in use is $50,000. The net fair value of the land and building together is now only $60,000, of which $25,000 is land and $35,000 is the building. How should this impairment in value be recognized? Make the entry on January 1, 2022, to record the impairment of the land and building. 6. On January 2, 2022, Dale Company purchased a building and land for $290,000. The most recent appraisal values for the building and the land are $210,000 and $9,000, respectively. The building has an estimated useful life of 20 years and a salvage value of $10,000. Required: (a) Assume that straight-line depreciation method is used and after four years the property (land and building) was retired. Prepare the journal entry to record the sale, (b) Assume that straight-line depreciation method is used and after four years the property (land and building) was sold for $470,000. Prepare the journal entry to record the sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started