please help E-H

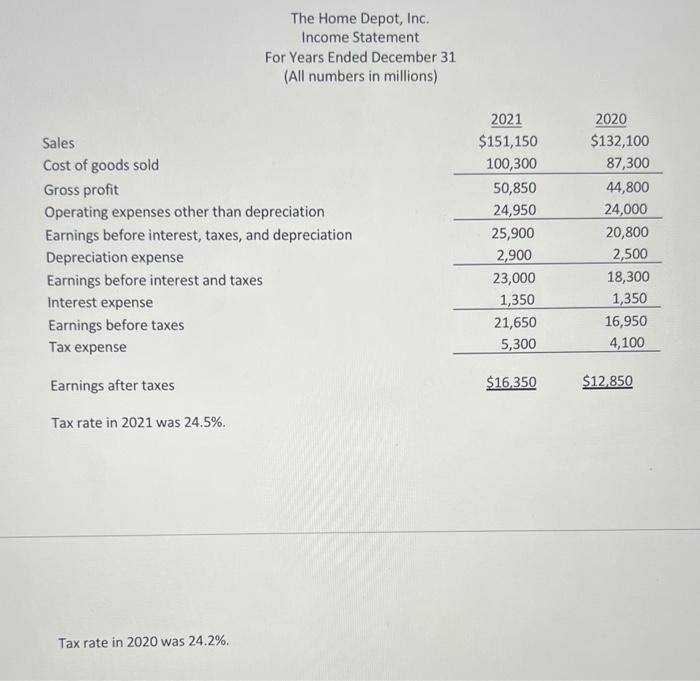

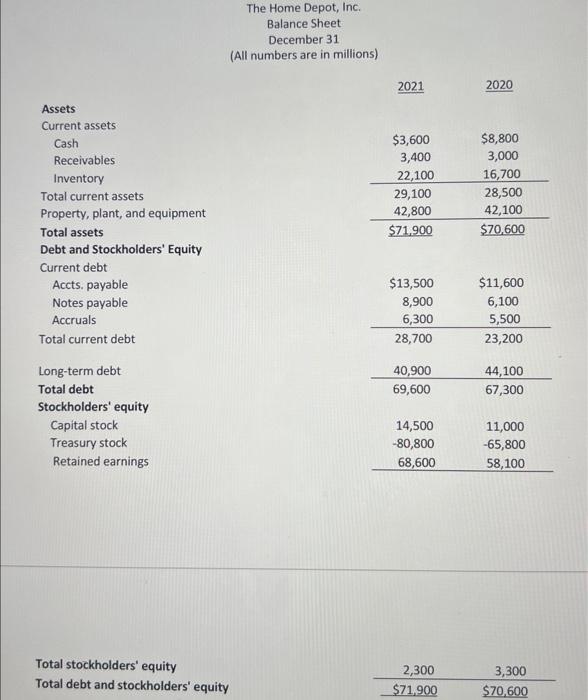

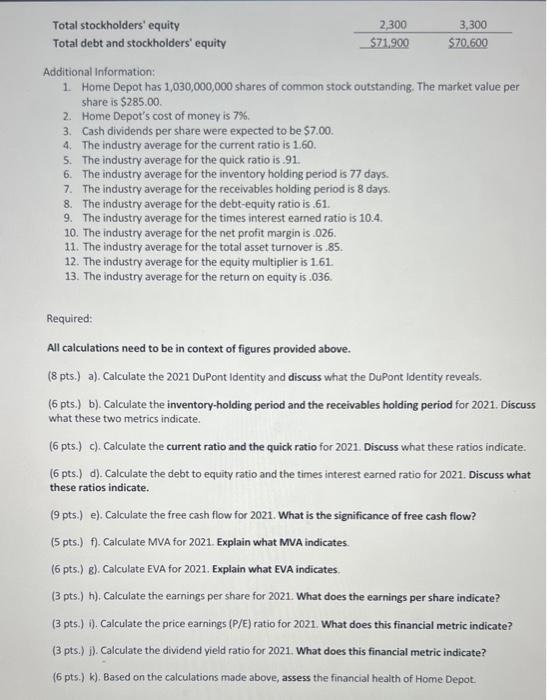

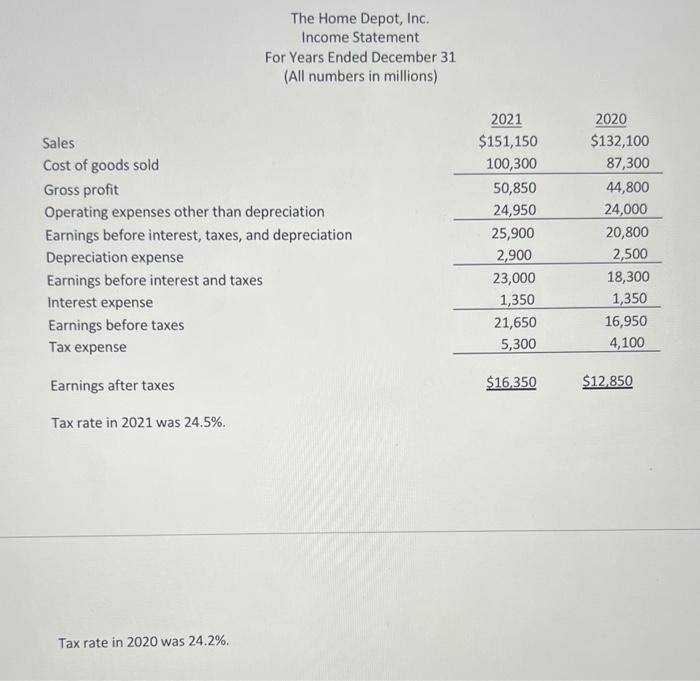

The Home Depot, Inc. Income Statement For Years Ended December 31 (All numbers in millions) Tax rate in 2020 was 24.2%. The Home Depot, Inc. Balance Sheet December 31 (All numbers are in millions) Total stockholders' equity Total debt and stockholders' equity \begin{tabular}{rr} 2,300 & 3,300 \\ \hline$71,900 & $70,600 \\ \hline \end{tabular} Additional Information: 1. Home Depot has 1,030,000,000 shares of common stock outstanding. The market value per share is $285.00. 2. Home Depot's cost of money is 7%. 3. Cash dividends per share were expected to be $7.00. 4. The industry average for the current ratio is 1.60. 5. The industry average for the quick ratio is .91. 6. The industry average for the inventory holding period is 77 days. 7. The industry average for the receivables holding period is 8 days. 8. The industry average for the debt-equity ratio is .61. 9. The industry average for the times interest earned ratio is 10.4. 10. The industry average for the net profit margin is 026 . 11. The industry average for the total asset turnover is .85. 12. The industry average for the equity multiplier is 1.61. 13. The industry average for the return on equity is .036. Required: All calculations need to be in context of figures provided above. (8 pts.) a). Calculate the 2021 DuPont Identity and discuss what the DuPont Identity reveals. (6 pts.) b). Calculate the inventory-holding period and the receivables hoiding period for 2021. Discuss what these two metrics indicate. (6 pts.) c). Calculate the current ratio and the quick ratio for 2021. Discuss what these ratios indicate. (6 pts.) d). Calculate the debt to equity ratio and the times interest earned ratio for 2021. Discuss what these ratios indicate. (9 pts.) e). Calculate the free cash flow for 2021. What is the significance of free cash flow? (5 pts.) f). Calculate MVA for 2021. Explain what MVA indicates. (6 pts.) g). Calculate EVA for 2021. Explain what EVA indicates. (3 pts.) h). Calculate the earnings per share for 2021 . What does the earnings per share indicate? (3 pts.) i). Calculate the price earnings (P/E) ratio for 2021. What does this financial metric indicate? (3 pts.) j). Calculate the dividend yield ratio for 2021. What does this financial metric indicate? (6 pts.) k). Based on the calculations made above, assess the financial health of Home Depot