Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! Euromarket investment and fund raising A U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexican peso, MP) and one in

Please help!

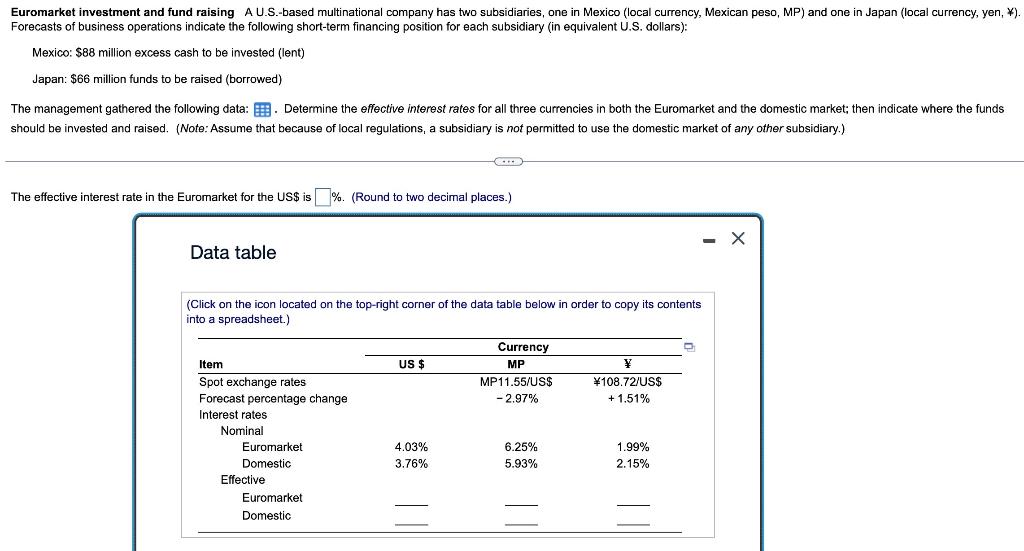

Euromarket investment and fund raising A U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexican peso, MP) and one in Japan (local currency, yen, ). Forecasts of business operations indicate the following short-term financing position for each subsidiary (in equivalent U.S. dollars): Mexico: $88 million excess cash to be invested (lent) Japan: $66 million funds to be raised (borrowed) The management gathered the following data: . Determine the effective interest rates for all three currencies in both the Euromarket and the domestic market; then indicate where the funds should be invested and raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic market of any other subsidiary.) The effective interest rate in the Euromarket for the US\$ is %. (Round to two decimal places.) Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started