Answered step by step

Verified Expert Solution

Question

1 Approved Answer

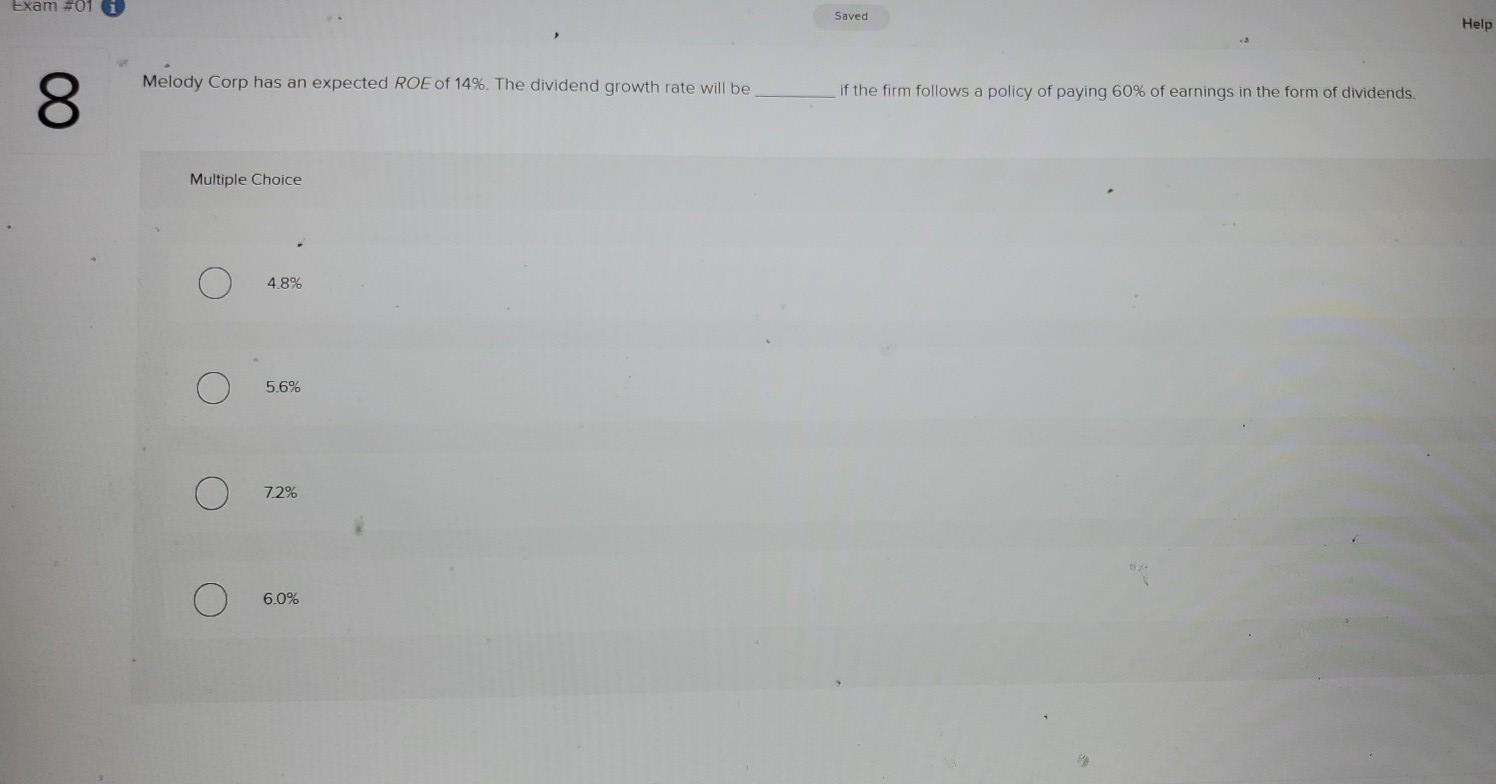

please help. Exam +01 i Saved Help Melody Corp has an expected ROE of 14%. The dividend growth rate will be 8 if the firm

please help.

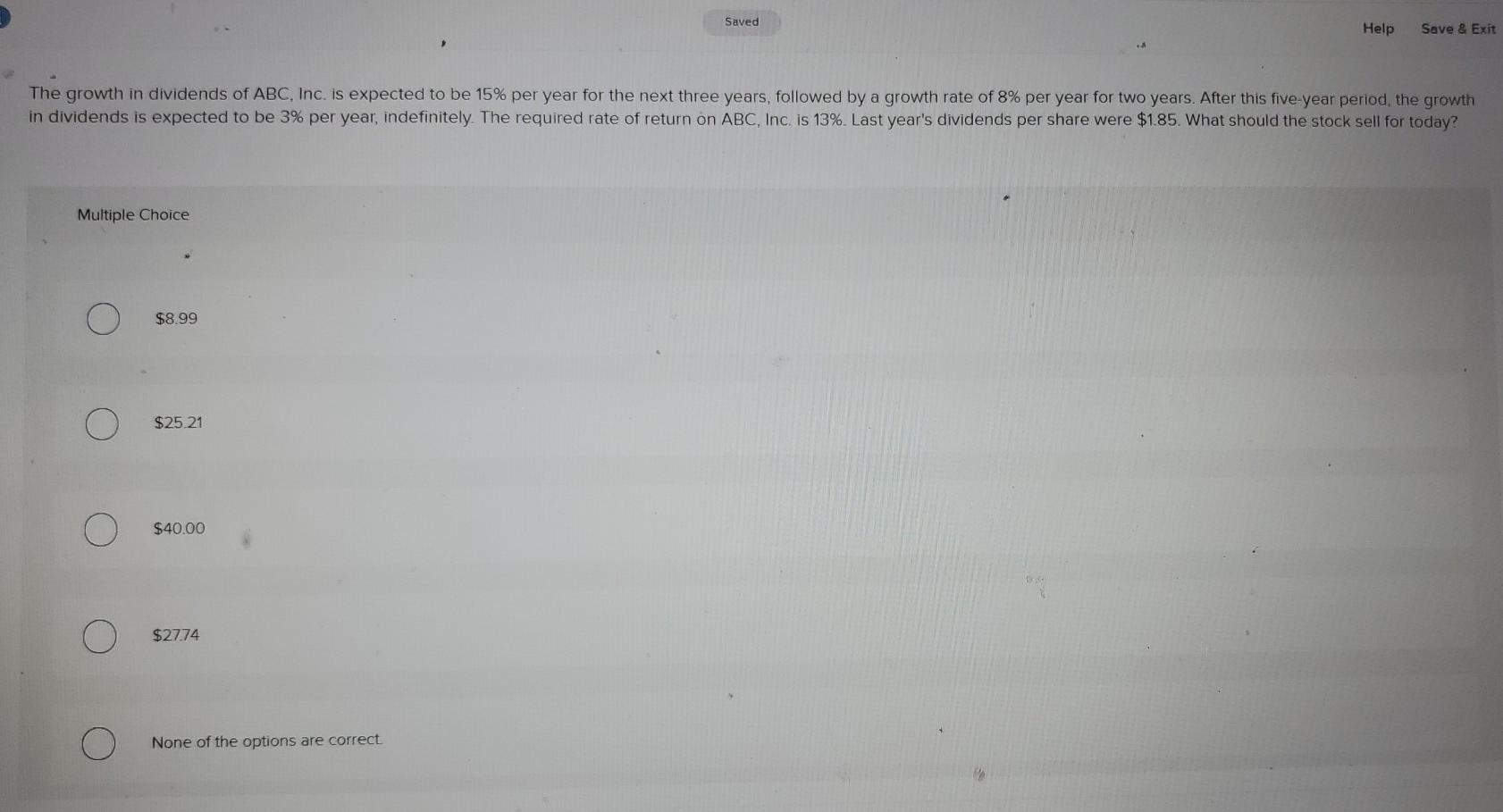

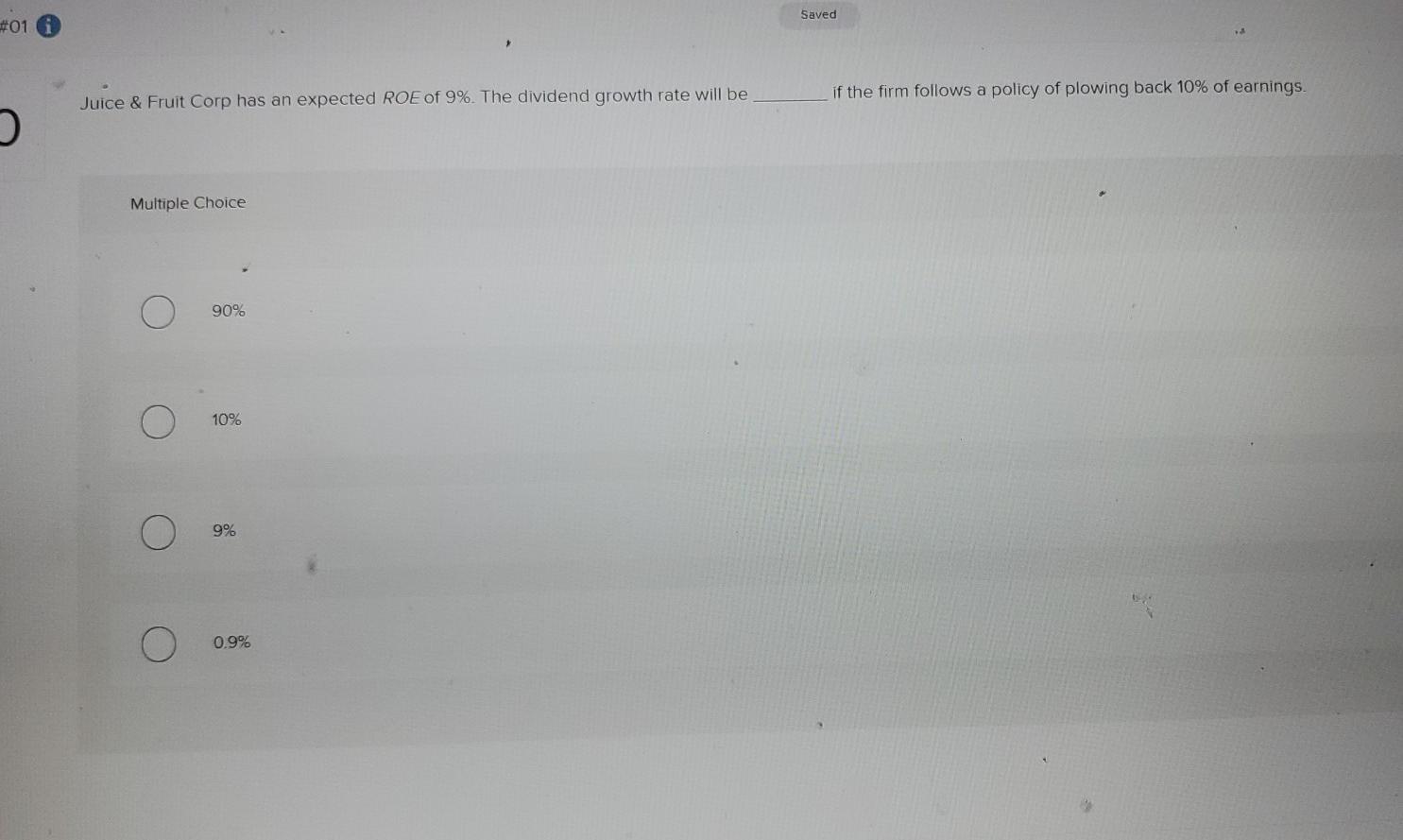

Exam +01 i Saved Help Melody Corp has an expected ROE of 14%. The dividend growth rate will be 8 if the firm follows a policy of paying 60% of earnings in the form of dividends. Multiple Choice 4.8% O 5.6% O 72% O 6.0% Saved Help Save & Exit The growth in dividends of ABC, Inc. is expected to be 15% per year for the next three years, followed by a growth rate of 8% per year for two years. After this five-year period, the growth in dividends is expected to be 3% per year, indefinitely. The required rate of return on ABC, Inc. is 13%. Last year's dividends per share were $185. What should the stock sell for today? Multiple Choice $8.99 $25.21 $40.00 $27.74 None of the options are correct Saved #01 if the firm follows a policy of plowing back 10% of earnings. Juice & Fruit Corp has an expected ROE of 9%. The dividend growth rate will be Multiple Choice 90% 10% o 9% O 0.9%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started