Please Help!

EXAMPLE - How to do Question

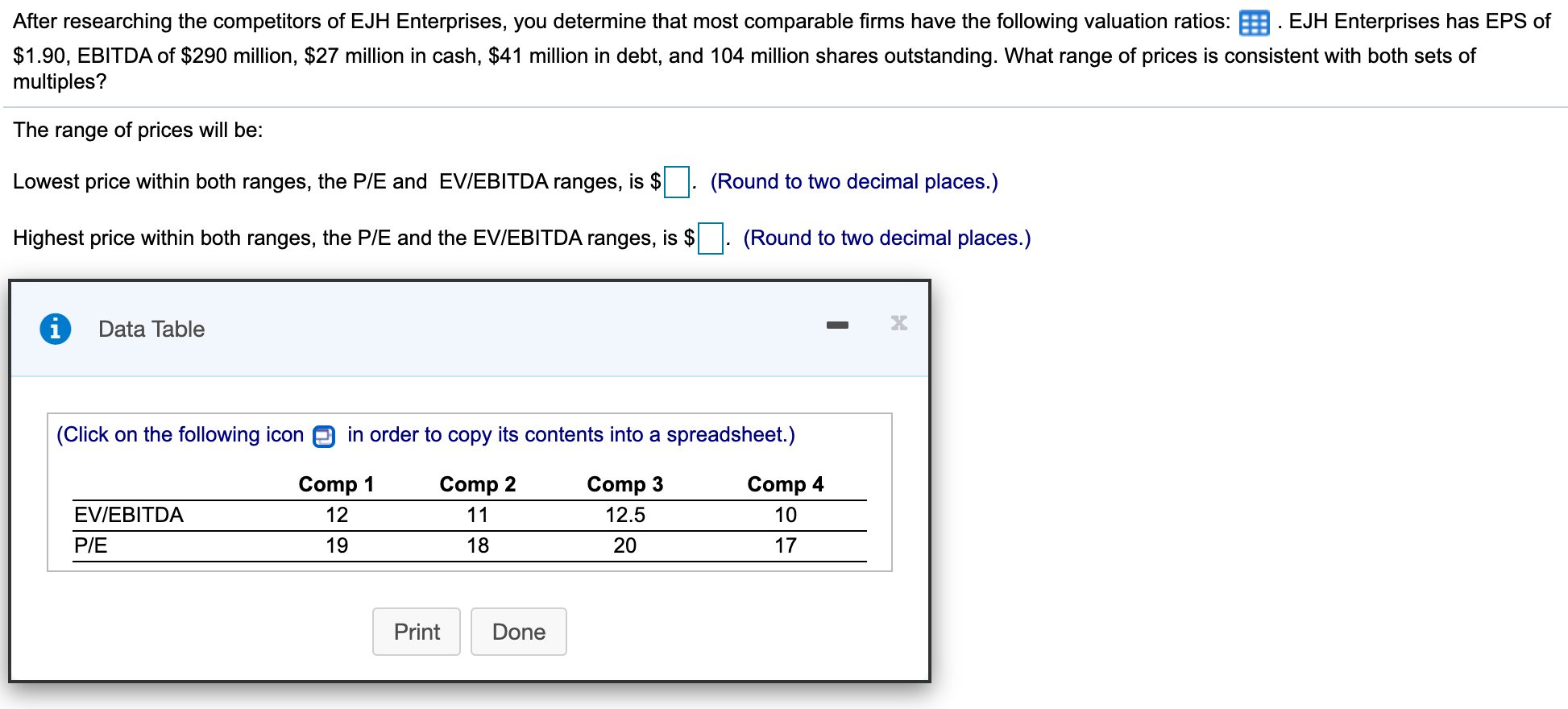

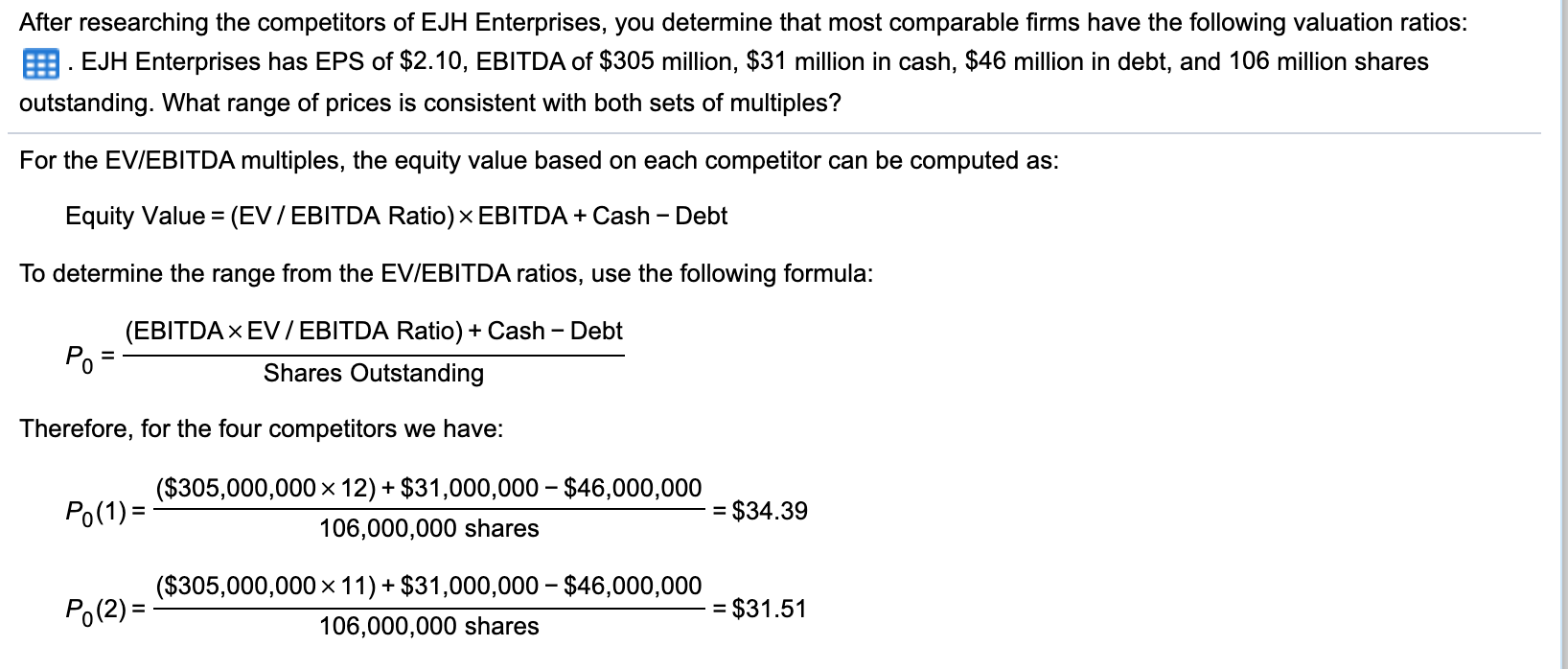

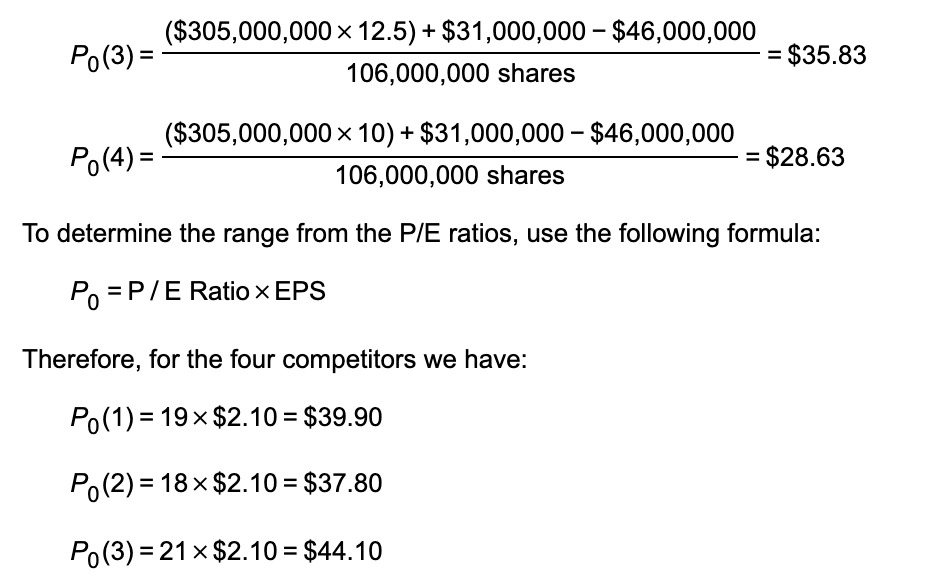

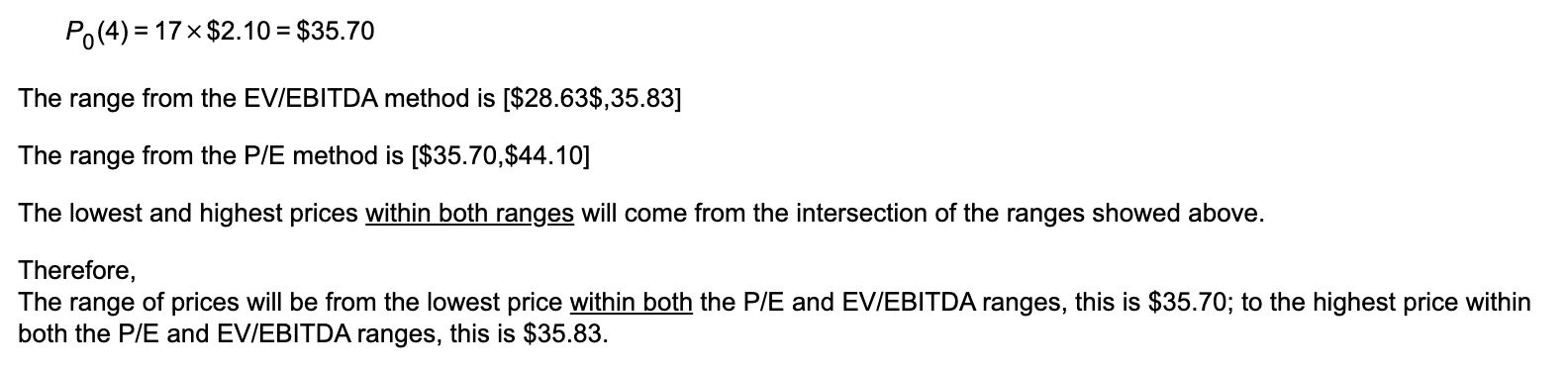

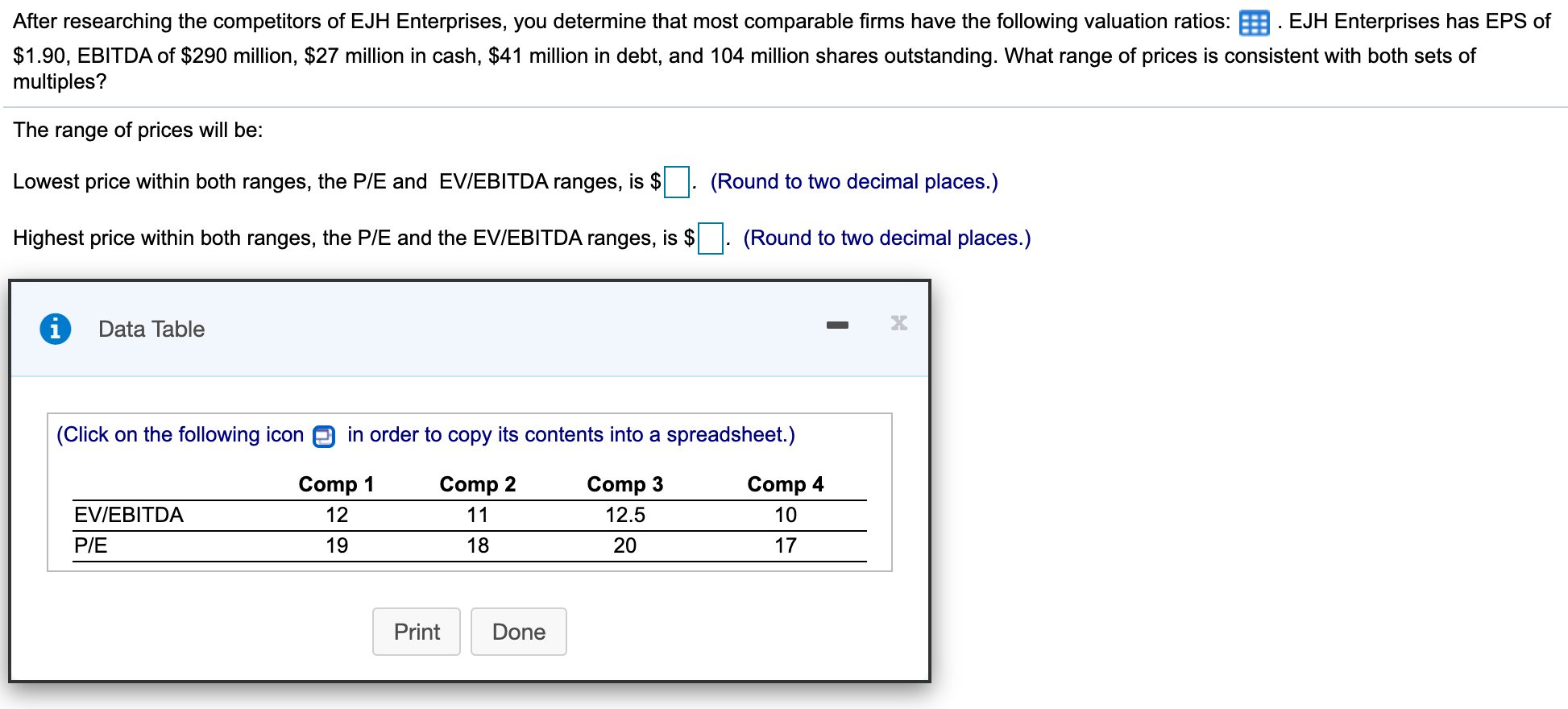

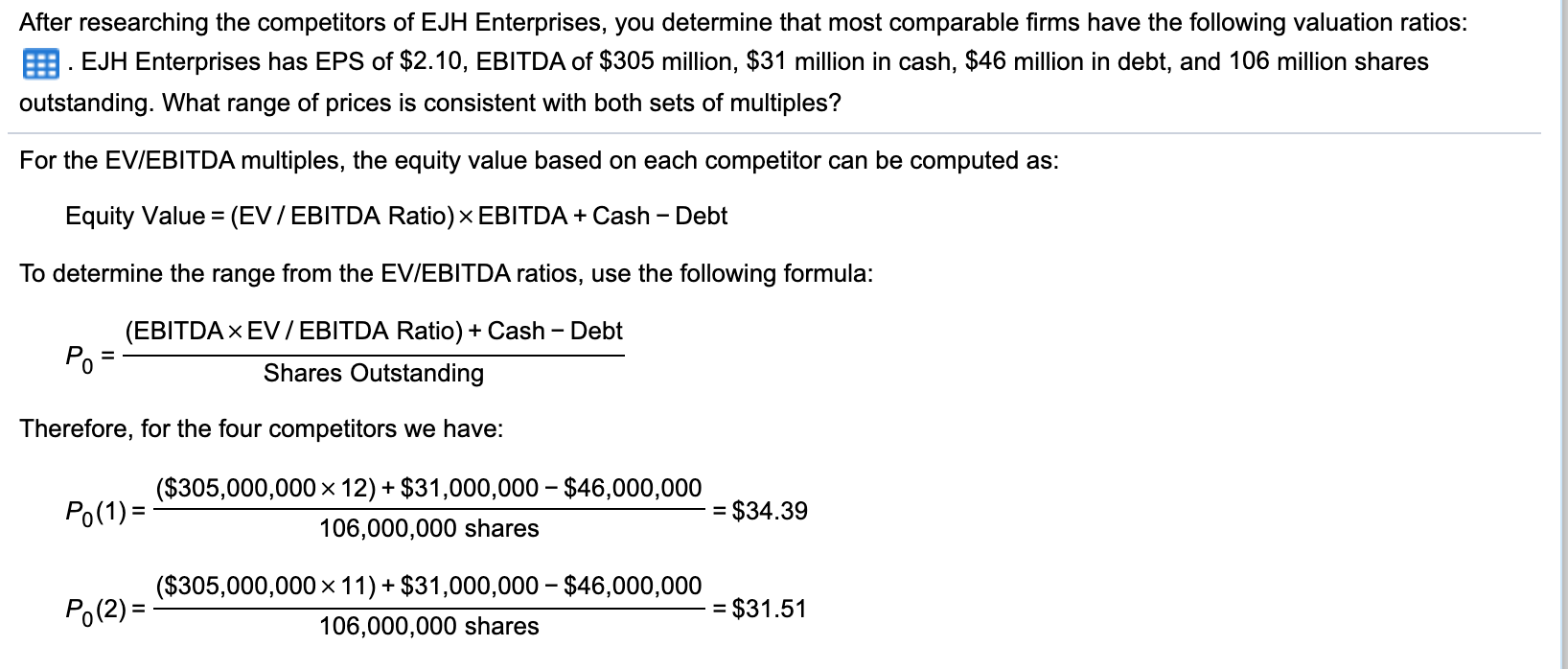

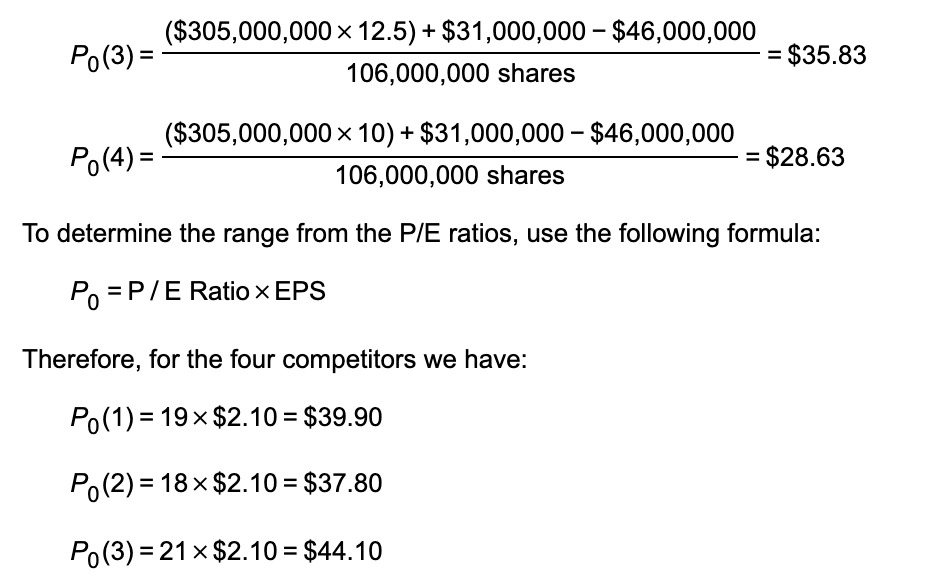

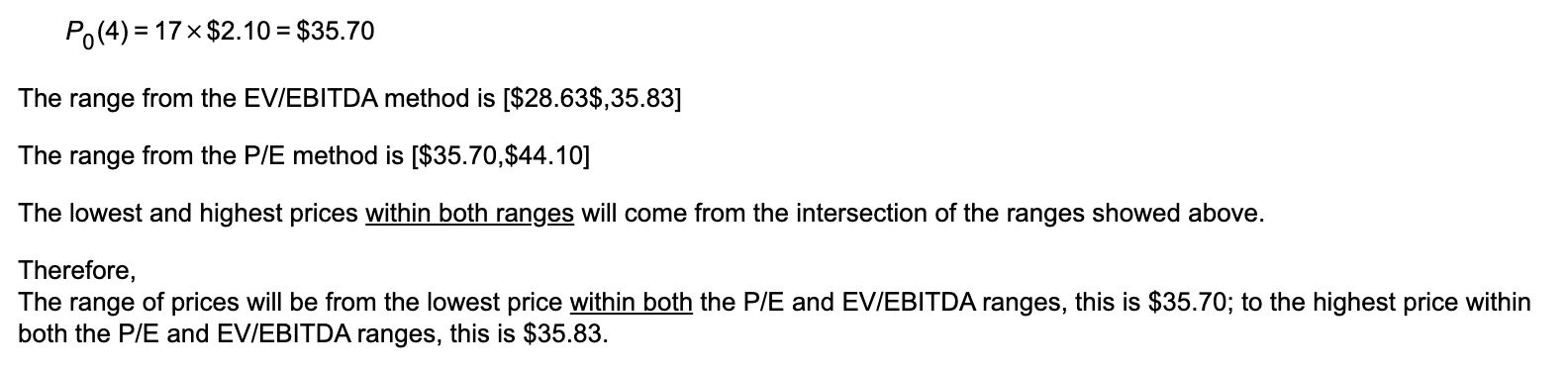

After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: E. EJH Enterprises has EPS of $1.90, EBITDA of $290 million, $27 million in cash, $41 million in debt, and 104 million shares outstanding. What range of prices is consistent with both sets of multiples? The range of prices will be: Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $ (Round to two decimal places.) Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $ | (Round to two decimal places.) i Data Table X (Click on the following icon in order to copy its contents into a spreadsheet.) Comp 1 Comp 2 Comp 3 Comp 4 EV/EBITDA 12 11 12.5 10 P/E 19 18 20 17 Print Done After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: B. EJH Enterprises has EPS of $2.10, EBITDA of $305 million, $31 million in cash, $46 million in debt, and 106 million shares outstanding. What range of prices is consistent with both sets of multiples? For the EV/EBITDA multiples, the equity value based on each competitor can be computed as: Equity Value = (EV/EBITDA Ratio) * EBITDA + Cash - Debt To determine the range from the EV/EBITDA ratios, use the following formula: Po (EBITDA X EV/EBITDA Ratio) + Cash - Debt Shares Outstanding Therefore, for the four competitors we have: ($305,000,000 x 12) + $31,000,000 - $46,000,000 Po(1) = = $34.39 106,000,000 shares ($305,000,000 x 11) + $31,000,000 - $46,000,000 Po(2) = = $31.51 106,000,000 shares ($305,000,000 x 12.5) + $31,000,000 - $46,000,000 Po(3) = = $35.83 106,000,000 shares P.(4) ($305,000,000 x 10) + $31,000,000 - $46,000,000 -= $28.63 106,000,000 shares To determine the range from the P/E ratios, use the following formula: Po = P/E Ratio x EPS Therefore, for the four competitors we have: Po(1) = 19* $2.10 = $39.90 Po(2) = 18 $2.10 = $37.80 Po(3) = 21 $2.10 = $44.10 Po(4) = 17 * $2.10 = $35.70 The range from the EV/EBITDA method is [$28.63$,35.83] The range from the P/E method is [$35.70,$44.10] The lowest and highest prices within both ranges will come from the intersection of the ranges showed above. Therefore, The range of prices will be from the lowest price within both the P/E and EV/EBITDA ranges, this is $35.70; to the highest price within both the P/E and EV/EBITDA ranges, this is $35.83