please help!! Excel file needed :(( thanks!!!!

Requirements:

1. Journalize and post above events and transactions.

2. Journalize and post adjusting entries.

3. Post closing entries.

4. Prepare the income statement and balance sheet for Sun and Sand Corporation as of December 31, 1998.

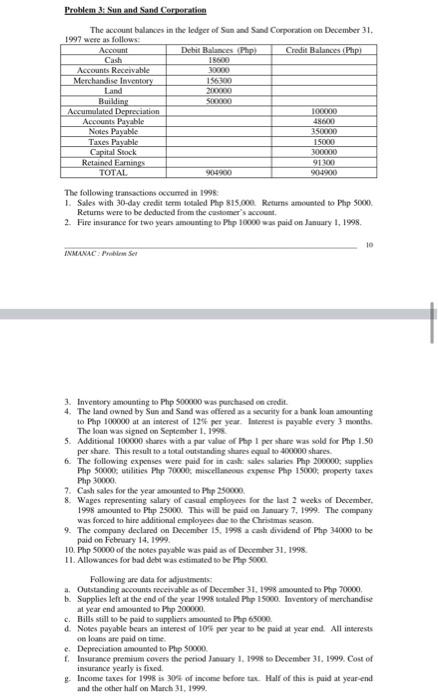

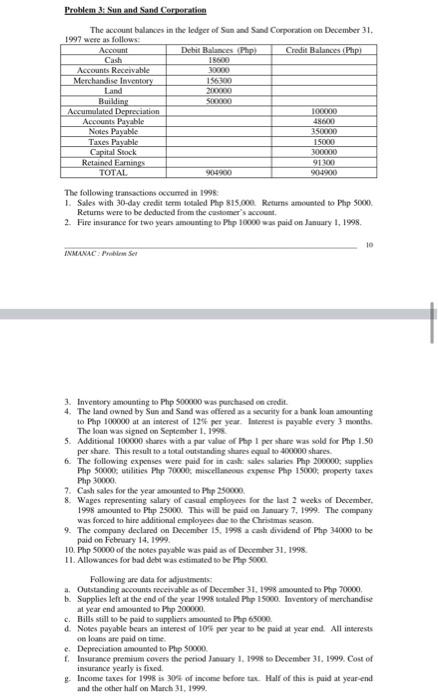

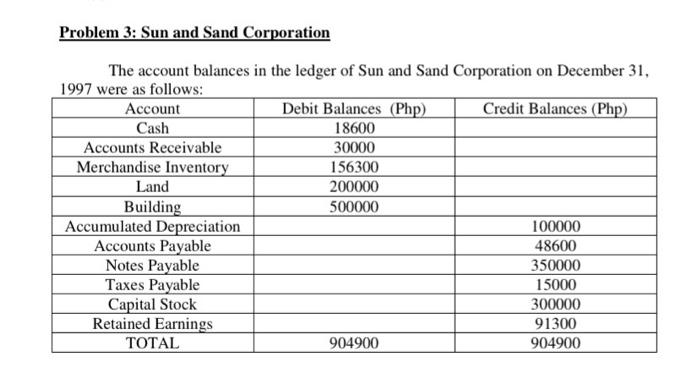

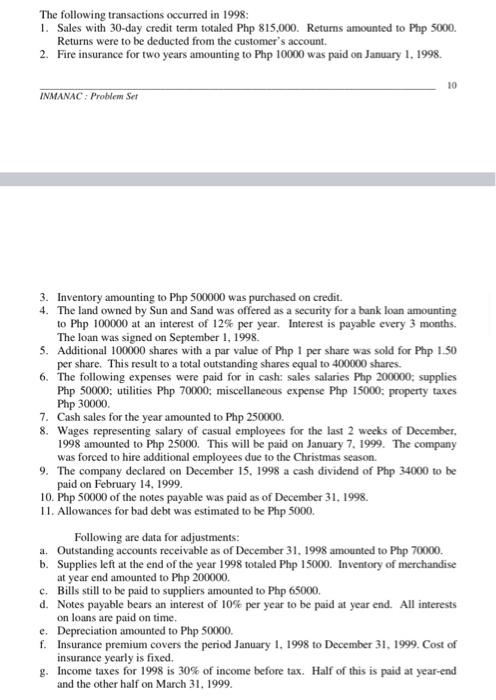

Problem 3: Sun and Sand Corporation The account balances in the lediger of Sun and Sand Corporation on December 31 1997 were as follows: Account Debit Balance Php Credit Balances (Php) Cash 18600 Accounts Receivable 30000 Merchandise Inventory 156300 Land 2000 Building SO0000 Accumulated Depreciation 100000 Accounts Payable 48600 Notes Payable 350000 Taxes Payable 15000 Capital Stock 300000 Retained Earnings 91100 TOTAL 904900 The following transactions occurred in 1998 1. Sales with 30-day credit term totaled Php 815.000 Returns amounted to Php 5000 Returns were to be deducted from the customer's account 2. Fire insurance for two years amounting to Php 10000 was paid on January 1, 1998 10 INMANAC P Ser 3. Inventory amounting to Php 500000 was purchased ce credit 4. The land owned by Sun and Sand was offered as a security for a bank loan amounting to Php 100000 at an interest of 12% per year. Interest is payable every 3 months The loan was signed on September 1.1998 5. Additional 100000 shares with a par value of Php 1 per share was sold for Php 1.50 per share. This result to a total outstanding shares equal to 400000 shares 6. The following expenses were paid for in case ale salaries Php 200000 supplies Php 50000, wtilities Php 7000 miscellanes espere Php 15000. property taxes Php 30000 7. Cash sales for the year amounted to Php 250000 8 Wages representing salary of casual employees for the last 2 weeks of December, 1998 amounted to Php 25000. This will be paid on January 7, 1999. The company was forced to hire additional employees dae to the Christmas season 9. The company declared on December 15. 1998 cash dividend of Php 34000 to be paid on February 14, 1999 10. Php 50000 of the notes payable was paid as of December 31, 1998 11. Allowances for bad debt was estimated to be Php 5000 Following are data for adjustments a. Outstanding accounts receivable as of December 31, 1998 amounted to Php 70000 b. Supplies Belt at the end of the year 1998 totaled Pp 15000. Inventory of merchandise al year end amounted to Php 20000 c. Bills still to be paid to suppliers amounted to Php 65000 Notes payable bears an interest of 10% per year to be paid at year end. All interests on loans are paid on time. e. Depreciation amounted to Php 50000 1. Insurance premium covers the period January 1, 1998 to December 31, 1999. Cost of insurance yearly is fixed Income taxes for 1998s 30% of income before te Hall of this is puid at yeur end and the other half on March 31, 1999. Problem 3: Sun and Sand Corporation The account balances in the ledger of Sun and Sand Corporation on December 31, 1997 were as follows: Account Debit Balances (Php) Credit Balances (Php) Cash 18600 Accounts Receivable 30000 Merchandise Inventory 156300 Land 200000 Building 500000 Accumulated Depreciation 100000 Accounts Payable 48600 Notes Payable 350000 Taxes Payable 15000 Capital Stock 300000 Retained Earnings 91300 TOTAL 904900 904900 The following transactions occurred in 1998: 1. Sales with 30-day credit term totaled Php 815,000. Returns amounted to Php 5000. Returns were to be deducted from the customer's account. 2. Fire insurance for two years amounting to Php 10000 was paid on January 1, 1998. 10 INMANAC : Problem Set 3. Inventory amounting to Php 500000 was purchased on credit. 4. The land owned by Sun and Sand was offered as a security for a bank loan amounting to Php 100000 at an interest of 12% per year. Interest is payable every 3 months. The loan was signed on September 1, 1998. 5. Additional 100000 shares with a par value of Php 1 per share was sold for Php 1.50 per share. This result to a total outstanding shares equal to 400000 shares. 6. The following expenses were paid for in cash: sales salaries Php 200000; supplies Php 50000; utilities Php 70000; miscellaneous expense Php 15000; property taxes Php 30000 7. Cash sales for the year amounted to Php 250000. 8. Wages representing salary of casual employees for the last 2 weeks of December, 1998 amounted to Php 25000. This will be paid on January 7, 1999. The company was forced to hire additional employees due to the Christmas season. 9. The company declared on December 15, 1998 a cash dividend of Php 34000 to be paid on February 14, 1999. 10. Php 50000 of the notes payable was paid as of December 31, 1998. 11. Allowances for bad debt was estimated to be Php 5000. Following are data for adjustments: a. Outstanding accounts receivable as of December 31. 1998 amounted to Php 70000. b. Supplies left at the end of the year 1998 totaled Php 15000. Inventory of merchandise at year end amounted to Php 200000. c. Bills still to be paid to suppliers amounted to Php 65000 d. Notes payable bears an interest of 10% per year to be paid at year end. All interests on loans are paid on time. e. Depreciation amounted to Php 50000 f. Insurance premium covers the period January 1, 1998 to December 31, 1999. Cost of insurance yearly is fixed. 8. Income taxes for 1998 is 30% of income before tax. Half of this is paid at year-end and the other half on March 31, 1999