Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Exercise 1. The following expenditures relating to plant assets were made by Spaulding Company during the first 2 months of 201. Determine which

please help

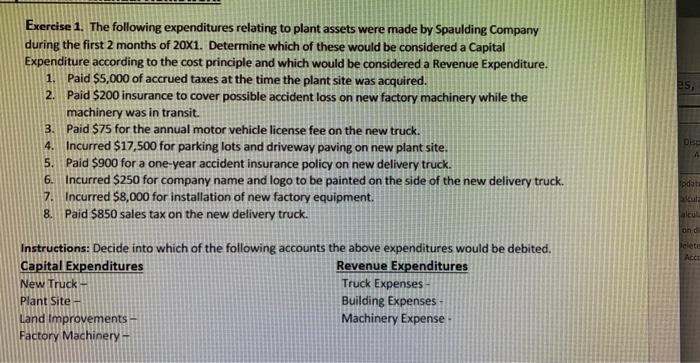

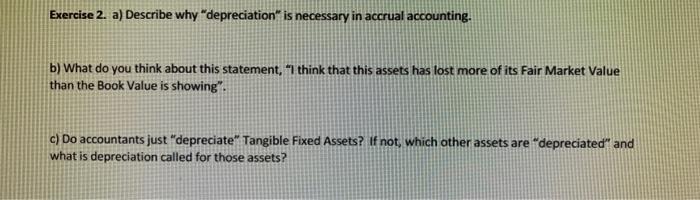

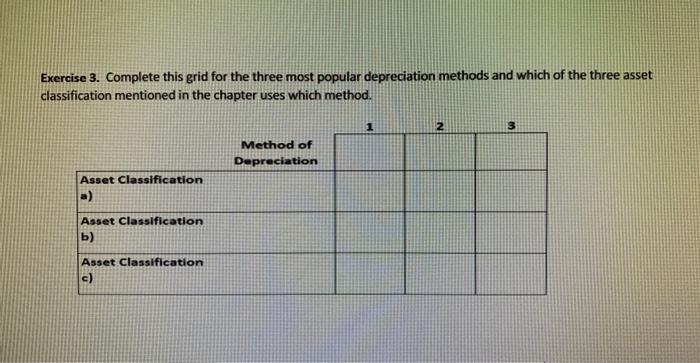

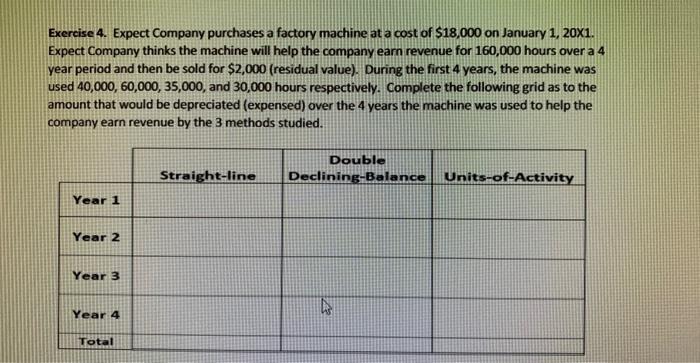

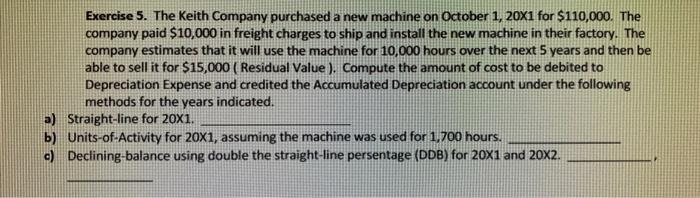

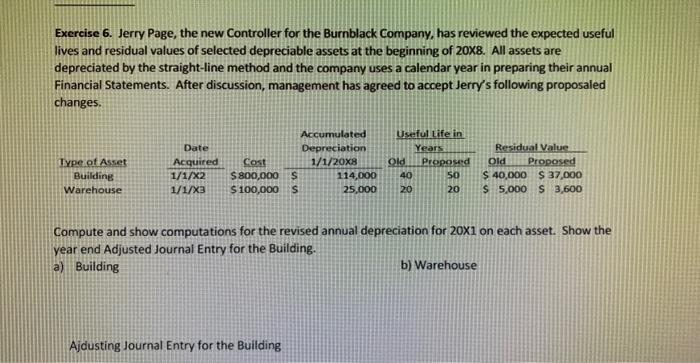

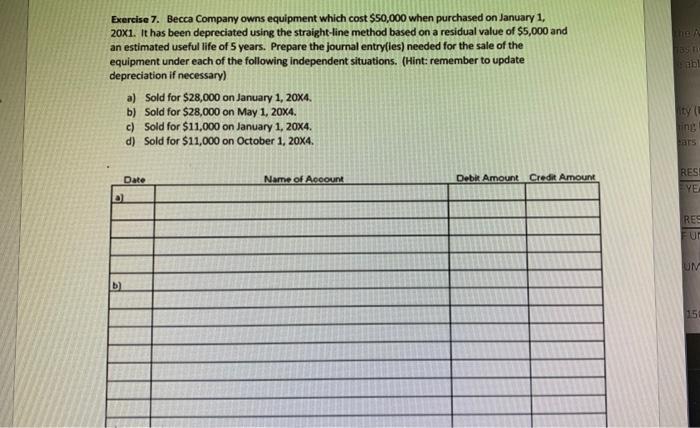

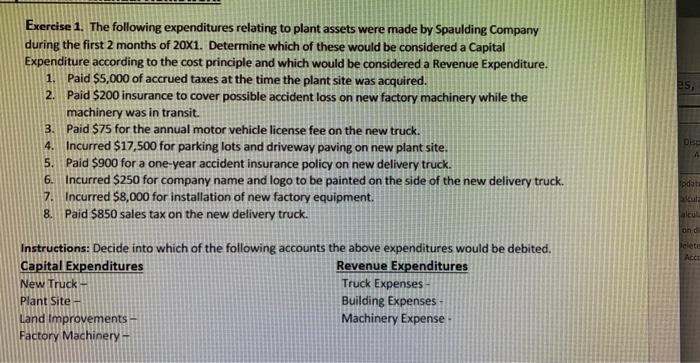

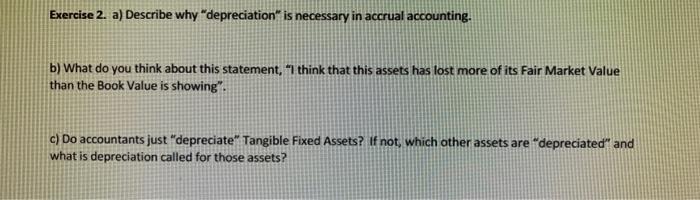

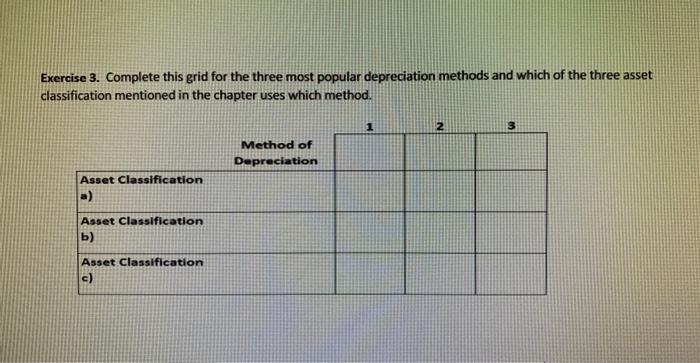

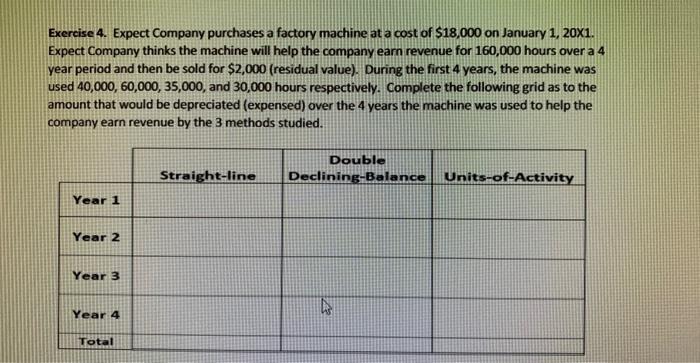

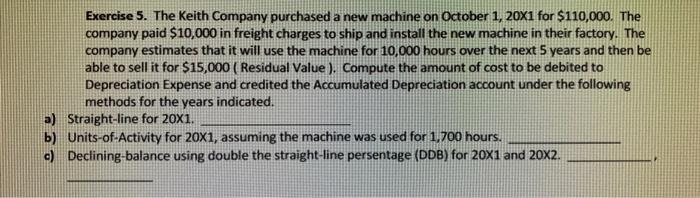

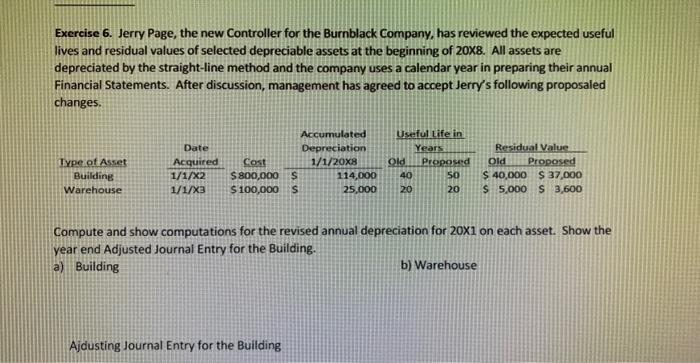

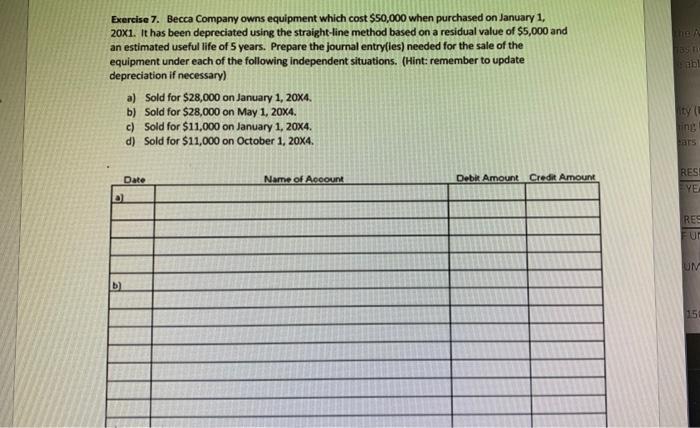

Exercise 1. The following expenditures relating to plant assets were made by Spaulding Company during the first 2 months of 201. Determine which of these would be considered a Capital Expenditure according to the cost principle and which would be considered a Revenue Expenditure. 1. Paid $5,000 of accrued taxes at the time the plant site was acquired. 2. Paid $200 insurance to cover possible accident loss on new factory machinery while the machinery was in transit. 3. Paid $75 for the annual motor vehicle license fee on the new truck. 4. Incurred $17,500 for parking lots and driveway paving on new plant site. 5. Paid $900 for a one-year accident insurance policy on new delivery truck. 6. Incurred $250 for company name and logo to be painted on the side of the new delivery truck. 7. Incurred $8,000 for installation of new factory equipment. 8. Paid $850 sales tax on the new delivery truck. Exercise 2. a) Describe why "depreciation" is necessary in accrual accounting. b) What do you think about this statement, 1 think that this assets has lost more of its Fair Market Value than the Book Value is showing". c) Do accountants just "depreciate" Tangible Fixed Assets? If not, which other assets are "depreciated" and what is depreciation called for those assets? Exercise 3. Complete this grid for the three most popular depreciation methods and which of the three asset classification mentioned in the chapter uses which method. Exercise 4. Expect Company purchases a factory machine at a cost of $18,000 on January 1,201. Expect Company thinks the machine will help the company earn revenue for 160,000 hours over a 4 year period and then be sold for $2,000 (residual value). During the first 4 years, the machine was used 40,000,60,000,35,000, and 30,000 hours respectively. Complete the following grid as to the amount that would be depreciated (expensed) over the 4 years the machine was used to help the company earn revenue by the 3 methods studied. Exercise 5. The Keith Company purchased a new machine on October 1,20X1 for $110,000. The company paid $10,000 in freight charges to ship and install the new machine in their factory. The company estimates that it will use the machine for 10,000 hours over the next 5 years and then be able to sell it for $15,000 (Residual Value ). Compute the amount of cost to be debited to Depreciation Expense and credited the Accumulated Depreciation account under the following methods for the years indicated. Straight-line for 20X1. Units-of-Activity for 201, assuming the machine was used for 1,700 hours. Declining-balance using double the straight-line persentage (DDB) for 201 and 202. Exercise 6. Jerry Page, the new Controller for the Burnblack Company, has reviewed the expected useful lives and residual values of selected depreciable assets at the beginning of 20X8. All assets are depreciated by the straight-line method and the company uses a calendar year in preparing their annual Financial Statements. After discussion, management has agreed to accept Jerry's following proposaled changes. Compute and show computations for the revised annual depreciation for 201 on each asset. Show the year end Adjusted Journal Entry for the Building. a) Building b) Warehouse Ajdusting Journal Entry for the Building Exercise 7. Becca Company owns equipment which cost $50,000 when purchased on January 1 , 20x1. It has been depreciated using the straight-line method based on a residual value of $5,000 and an estimated useful life of 5 years. Prepare the journal entry(ies) needed for the sale of the equipment under each of the following independent situations. (Hint: remember to update depreciation if necessary) a) Sold for $28,000 on January 1,204. b) Sold for $28,000 on May 1, 20x4. c) Sold for $11,000 on January 1,204. d) Sold for $11,000 on October 1, 20x4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started