please help

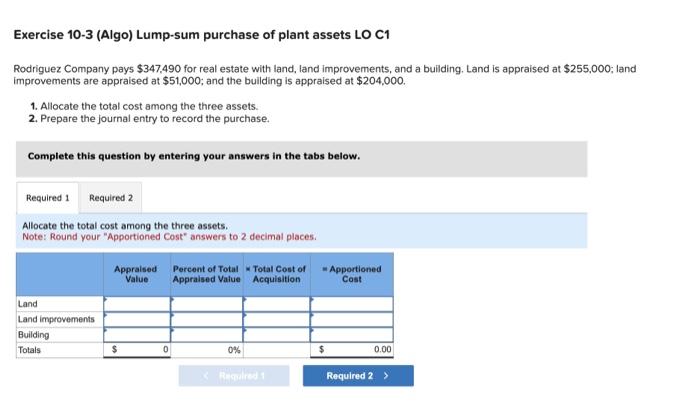

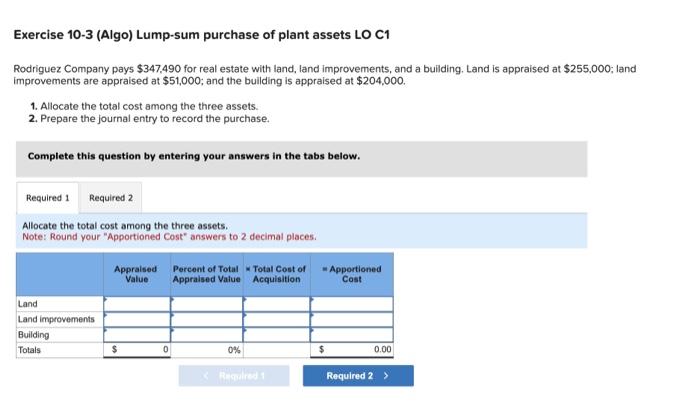

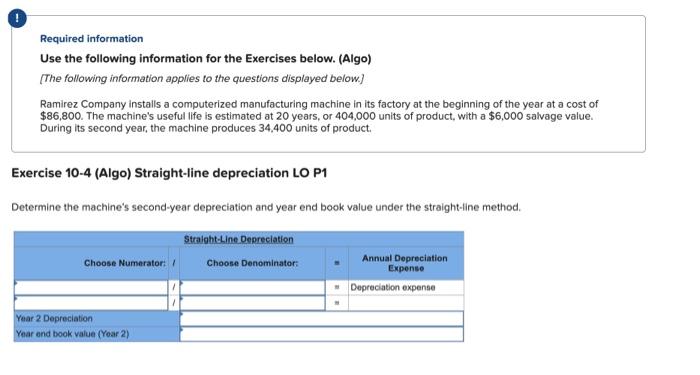

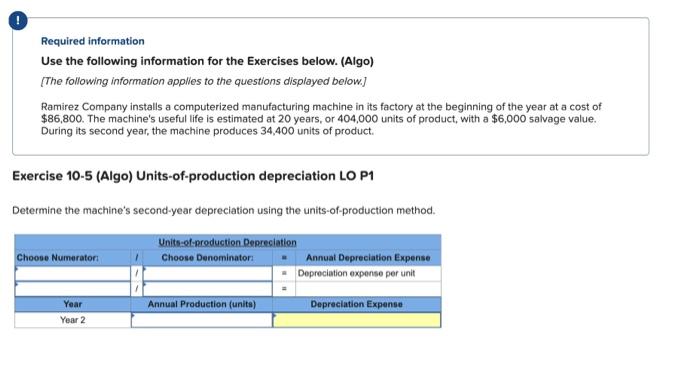

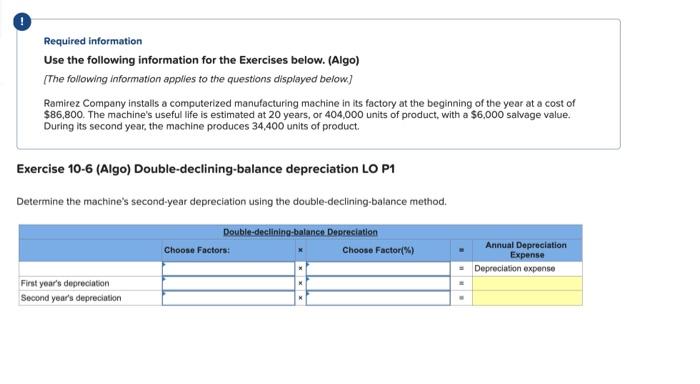

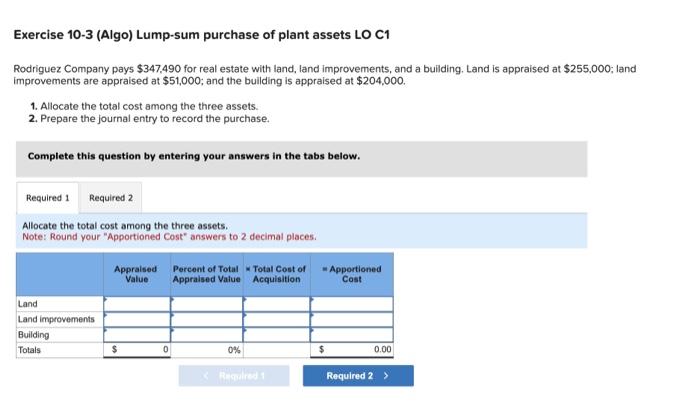

Exercise 10-3 (Algo) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $347,490 for real estate with land, land improvements, and a building. Land is appraised at $255,000; land improvements are appraised at $51,000; and the building is appraised at $204,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Allocate the total cost among the three assets. Note: Round your "Apportioned Cost" answers to 2 decimal places. Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $86,800. The machine's useful life is estimated at 20 years, or 404,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 34,400 units of product. Exercise 10-4 (Algo) Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method. Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $86,800. The machine's useful life is estimated at 20 years, or 404,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 34,400 units of product. Exercise 10-5 (Algo) Units-of-production depreciation LO P1 Determine the machine's second-year depreciation using the units-of-production method. Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $86,800. The machine's useful life is estimated at 20 years, or 404,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 34,400 units of product. Exercise 10-6 (Algo) Double-declining-balance depreciation LO P1 Determine the machine's second-year depreciation using the double-declining-balance method