Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! Exercise 1(7 points) A group of investors consider the acquisition of a firm through a LBO of 3 years. It is assumed the

Please help!

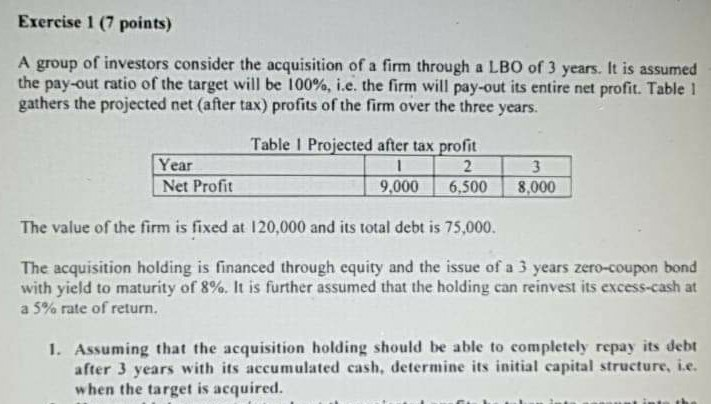

Exercise 1(7 points) A group of investors consider the acquisition of a firm through a LBO of 3 years. It is assumed the pay-out ratio of the target will be 100%, i.e. the firm will pay-out its entire net profit. Table 1 gathers the projected net (after tax) profits of the firm over the three years. Year Table 1 Projected after tax profit 1 2 9,000 6,500 3 8,000 Net Profit The value of the firm is fixed at 120,000 and its total debt is 75,000. The acquisition holding is financed through equity and the issue of a 3 years zero-coupon bond with yield to maturity of 8%. It is further assumed that the holding can reinvest its excess-cash at a 5% rate of return. 1. Assuming that the acquisition holding should be able to completely repay its debt after 3 years with its accumulated cash, determine its initial capital structure, i.e. when the target is acquiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started