Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Exercise 5-5 Larkspur Company has decided to expand its operations. The bookkeeper recently completed the following balance sheet in order to obtain additional

please help

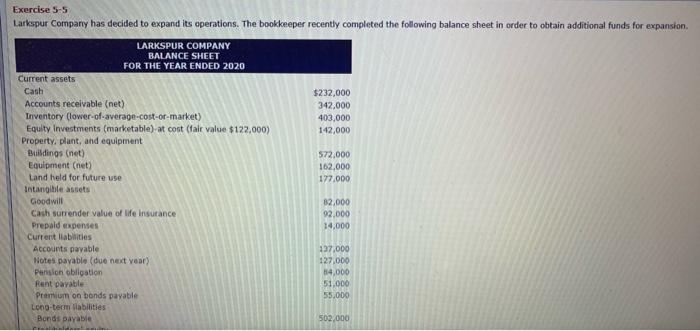

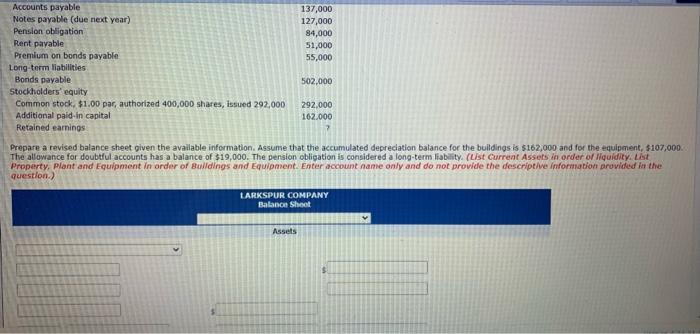

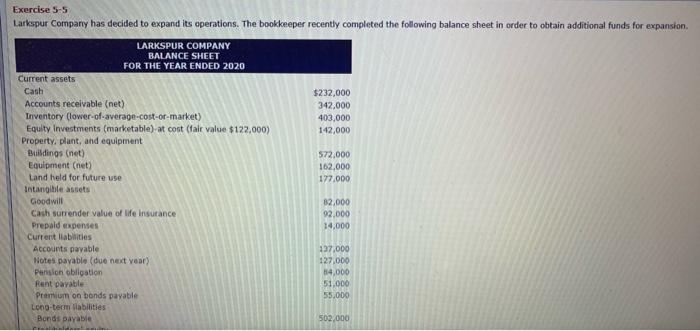

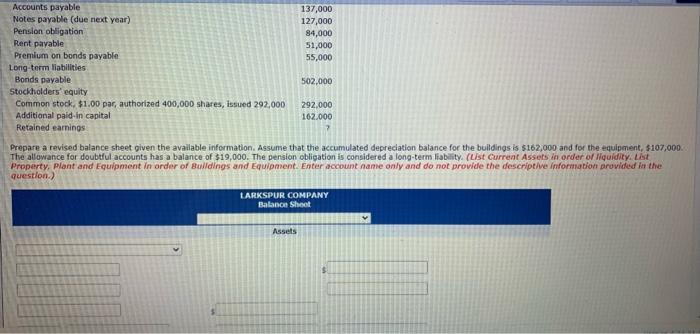

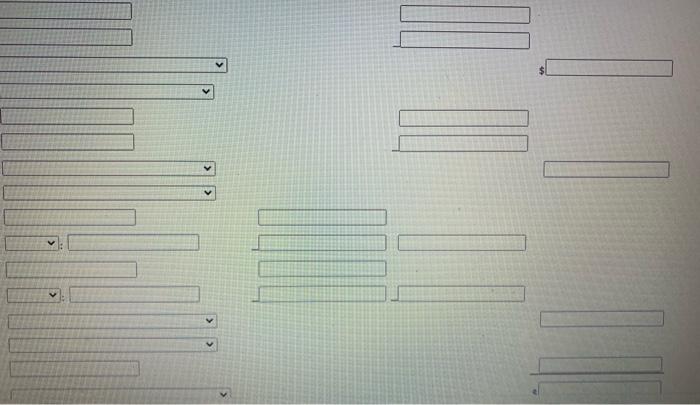

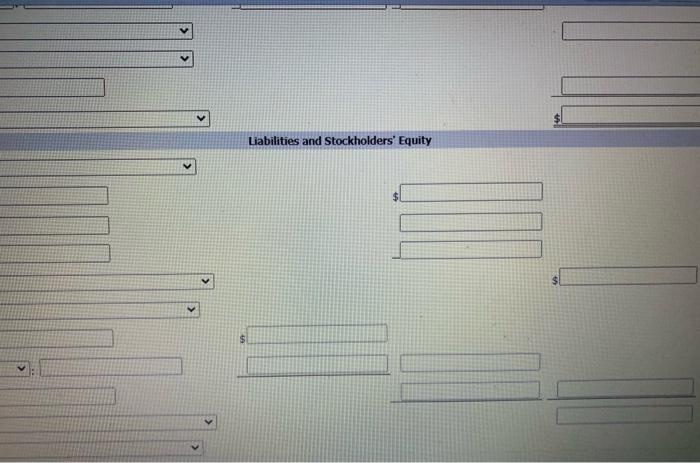

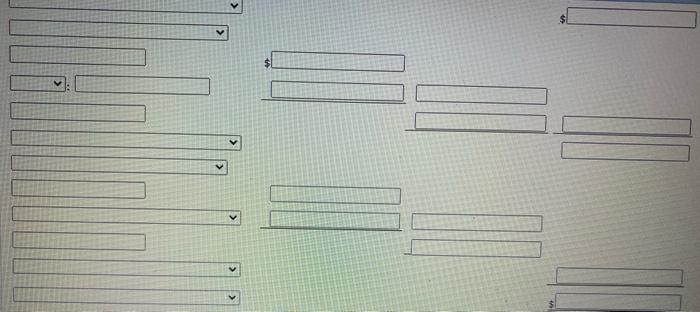

Exercise 5-5 Larkspur Company has decided to expand its operations. The bookkeeper recently completed the following balance sheet in order to obtain additional funds for expansion LARKSPUR COMPANY BALANCE SHEET FOR THE YEAR ENDED 2020 Current assets Cash $232,000 Accounts receivable (net) 342,000 Inventory (lower-of-average-cost-or-market) 403,000 Equity Investments (marketable) at cost (fair value $122,000) 142,000 Property, plant, and equipment Buildings (net) 572,000 Equipment (net) 162,000 Land held for future use 177.000 Intangible assets Goodwill B2.000 Cash surrender value of life insurance 92,000 Prepaid expenses 14,000 Current liabilities Accounts payable 137,000 Notes payable (due next year) 127,000 Pension obligation 14.000 Rent payable 51,000 Premium on bonds payable 55,000 Long-term liabilities Bonds payable 502,000 137,000 127,000 84,000 51,000 55,000 Accounts payable Notes payable (due next year) Pension obligation Rent payable Premium on bonds payable Long-term liabilities Bonds payable Stockholders' equity Common stock. $1.00 par, authorized 400,000 shares, issued 292,000 Additional paid-in capital Retained earnings 502.000 292.000 162.000 Prepare a revised balance sheet given the available information. Assume that the accumulated depreciation balance for the buildings is $162,000 and for the equipment, $107.000 The allowance for doubtful accounts has a balance of $19,000. The pension obligation is considered a long-term liability. (List Current Assets in order of liquidity Lt Property, plant and Equipment in order of Buildings and Equipment. Enter account name only and do not provide the descriptive information provided in the question.) LARKSPUR COMPANY Balance Sheet Assets Liabilities and Stockholders' Equity $ $ Exercise 5-5 Larkspur Company has decided to expand its operations. The bookkeeper recently completed the following balance sheet in order to obtain additional funds for expansion LARKSPUR COMPANY BALANCE SHEET FOR THE YEAR ENDED 2020 Current assets Cash $232,000 Accounts receivable (net) 342,000 Inventory (lower-of-average-cost-or-market) 403,000 Equity Investments (marketable) at cost (fair value $122,000) 142,000 Property, plant, and equipment Buildings (net) 572,000 Equipment (net) 162,000 Land held for future use 177.000 Intangible assets Goodwill B2.000 Cash surrender value of life insurance 92,000 Prepaid expenses 14,000 Current liabilities Accounts payable 137,000 Notes payable (due next year) 127,000 Pension obligation 14.000 Rent payable 51,000 Premium on bonds payable 55,000 Long-term liabilities Bonds payable 502,000 137,000 127,000 84,000 51,000 55,000 Accounts payable Notes payable (due next year) Pension obligation Rent payable Premium on bonds payable Long-term liabilities Bonds payable Stockholders' equity Common stock. $1.00 par, authorized 400,000 shares, issued 292,000 Additional paid-in capital Retained earnings 502.000 292.000 162.000 Prepare a revised balance sheet given the available information. Assume that the accumulated depreciation balance for the buildings is $162,000 and for the equipment, $107.000 The allowance for doubtful accounts has a balance of $19,000. The pension obligation is considered a long-term liability. (List Current Assets in order of liquidity Lt Property, plant and Equipment in order of Buildings and Equipment. Enter account name only and do not provide the descriptive information provided in the question.) LARKSPUR COMPANY Balance Sheet Assets Liabilities and Stockholders' Equity $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started