Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help Exercise 6-11A (Algo) Events related to the acquisition, use, and disposal of a tangible plant asset: Straight-line depreciation LO 6-2, 6-5 City Taxi

Please help

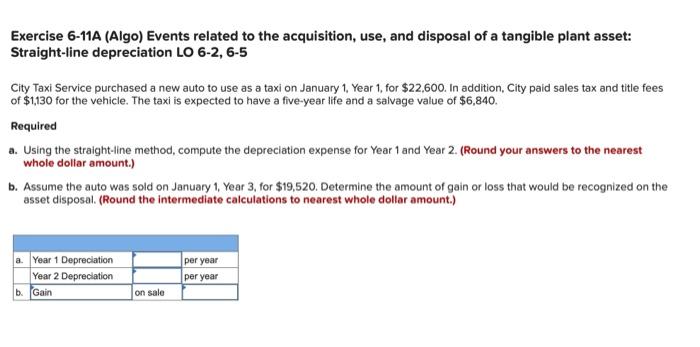

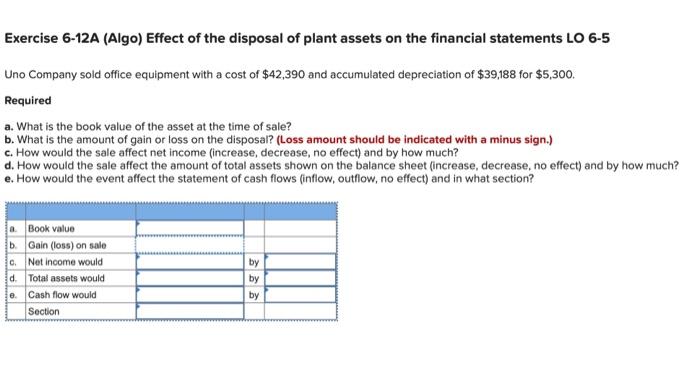

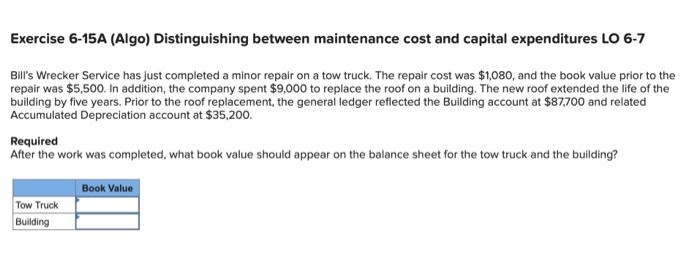

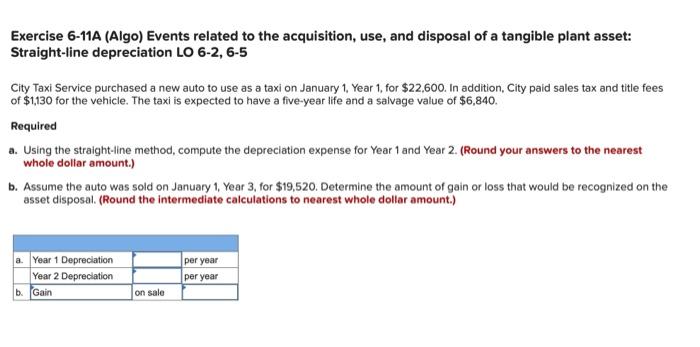

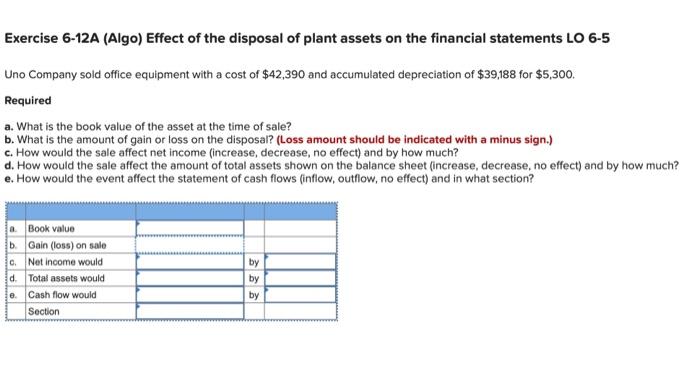

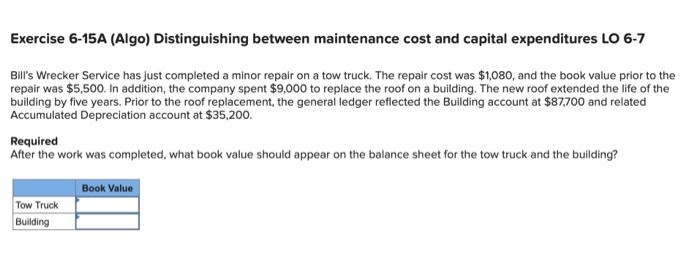

Exercise 6-11A (Algo) Events related to the acquisition, use, and disposal of a tangible plant asset: Straight-line depreciation LO 6-2, 6-5 City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $22.600. In addition, City paid sales tax and title fees of $1,130 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $6,840. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. (Round your answers to the nearest whole dollar amount.) b. Assume the auto was sold on January 1 Year 3 for $19,520. Determine the amount of gain or loss that would be recognized on the asset disposal. (Round the intermediate calculations to nearest whole dollar amount.) a. Year 1 Depreciation Year 2 Depreciation b. Gain per year per year on sale Exercise 6-12A (Algo) Effect of the disposal of plant assets on the financial statements LO 6-5 Uno Company sold office equipment with a cost of $42,390 and accumulated depreciation of $39,188 for $5,300. Required a. What is the book value of the asset at the time of sale? b. What is the amount of gain or loss on the disposal? (Loss amount should be indicated with a minus sign.) c. How would the sale affect net income increase, decrease, no effect) and by how much? d. How would the sale affect the amount of total assets shown on the balance sheet increase, decrease, no effect) and by how much? e. How would the event affect the statement of cash flows (inflow, outflow, no effect) and in what section? a. Book value b Gain (loss) on sale c. Net Income would d. Total assets would e. Cash flow would Section by by by Exercise 6-15A (Algo) Distinguishing between maintenance cost and capital expenditures LO 6-7 Bill's Wrecker Service has just completed a minor repair on a tow truck. The repair cost was $1,080, and the book value prior to the repair was $5,500. In addition, the company spent $9,000 to replace the roof on a building. The new roof extended the life of the building by five years. Prior to the roof replacement, the general ledger reflected the Building account at $87,700 and related Accumulated Depreciation account at $35,200. Required After the work was completed, what book value should appear on the balance sheet for the tow truck and the building? Book Value Tow Truck Building

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started