Answered step by step

Verified Expert Solution

Question

1 Approved Answer

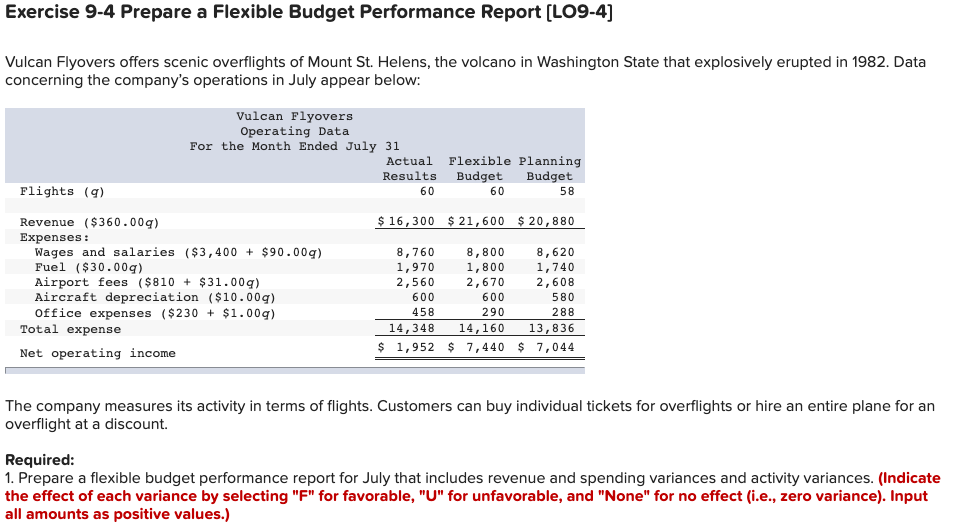

Please help! Exercise 9-4 Prepare a Flexible Budget Performance Report (LO9-4] Vulcan Flyovers offers scenic overflights of Mount St. Helens, the volcano in Washington State

Please help!

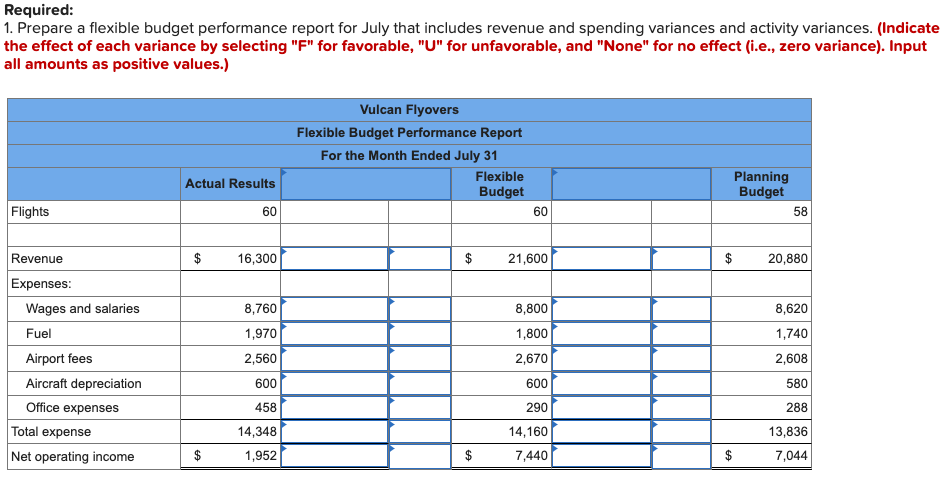

Exercise 9-4 Prepare a Flexible Budget Performance Report (LO9-4] Vulcan Flyovers offers scenic overflights of Mount St. Helens, the volcano in Washington State that explosively erupted in 1982. Data concerning the company's operations in July appear below: Vulcan Flyovers Operating Data For the Month Ended July 31 Actual Flexible Planning Results Budget Budget 60 60 58 Flights (9) $ 16,300 $ 21,600 $ 20,880 Revenue ($360.009) Expenses : Wages and salaries ($3,400 + $90.00) Fuel ($30.00) Airport fees ($810 + $31.009) Aircraft depreciation ($10.00) Office expenses ($230 + $1.00) Total expense Net operating income 8,760 8,800 1,970 1,800 2,560 2,670 600 600 290 14,348 14,160 1,952 $ 7,440 8,620 1,740 2,608 580 288 13,836 $ 7,044 458 $ The company measures its activity in terms of flights. Customers can buy individual tickets for overflights or hire an entire plane for an overflight at a discount. Required: 1. Prepare a flexible budget performance report for July that includes revenue and spending variances and activity variances. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Required: 1. Prepare a flexible budget performance report for July that includes revenue and spending variances and activity variances. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Vulcan Flyovers Flexible Budget Performance Report For the Month Ended July 31 Flexible Budget Actual Results Planning Budget Flights 60 Revenue $ 16,300 $ 21,600 $ 20,880 Expenses: Wages and salaries 8,800 8,760 1,970 Fuel 2,560 Airport fees Aircraft depreciation Office expenses Total expense Net operating income 8,620 1,740 2,608 580 288 1,800 2,670 600 290 14,160 7,440 600 458 14,348 1,952 13,836 7,044 $ $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started