Please help!

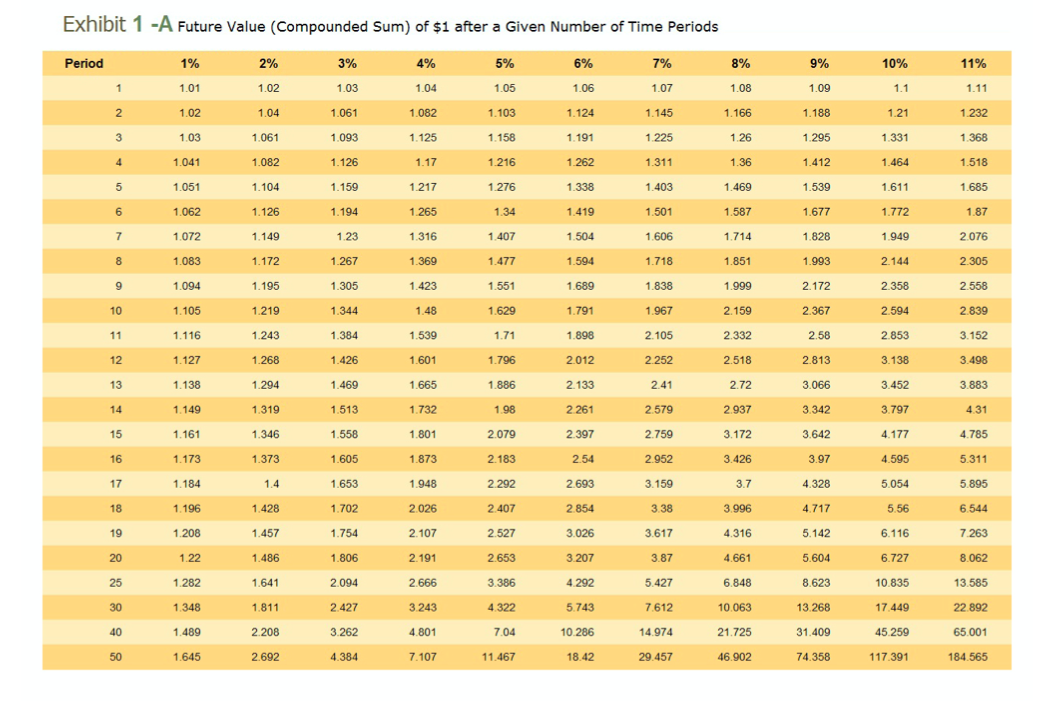

Exhibit A:

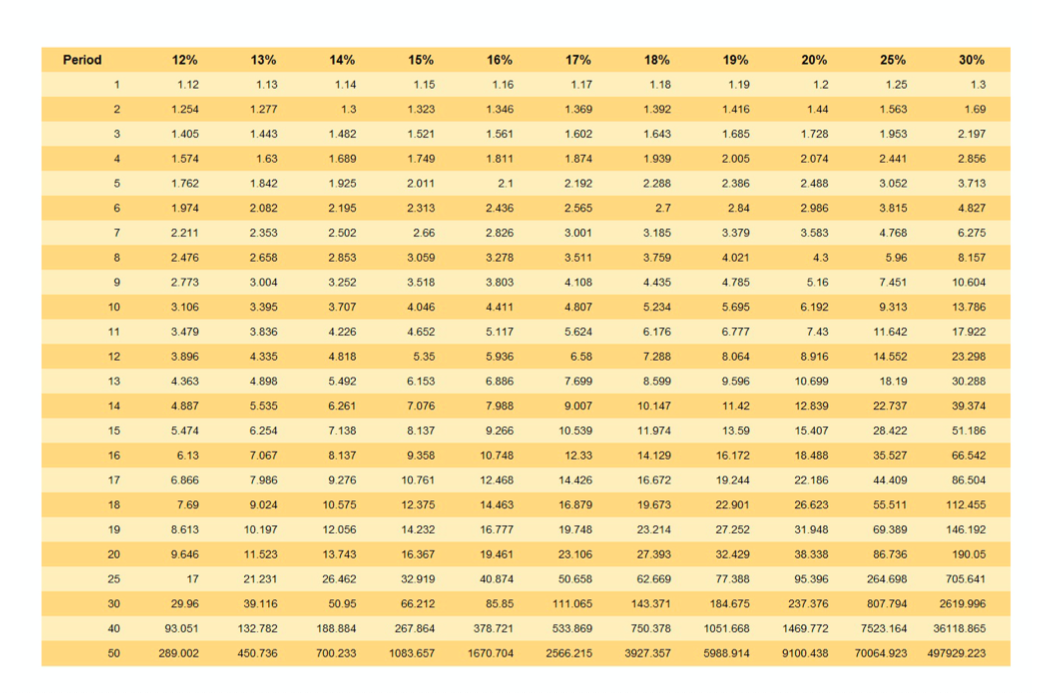

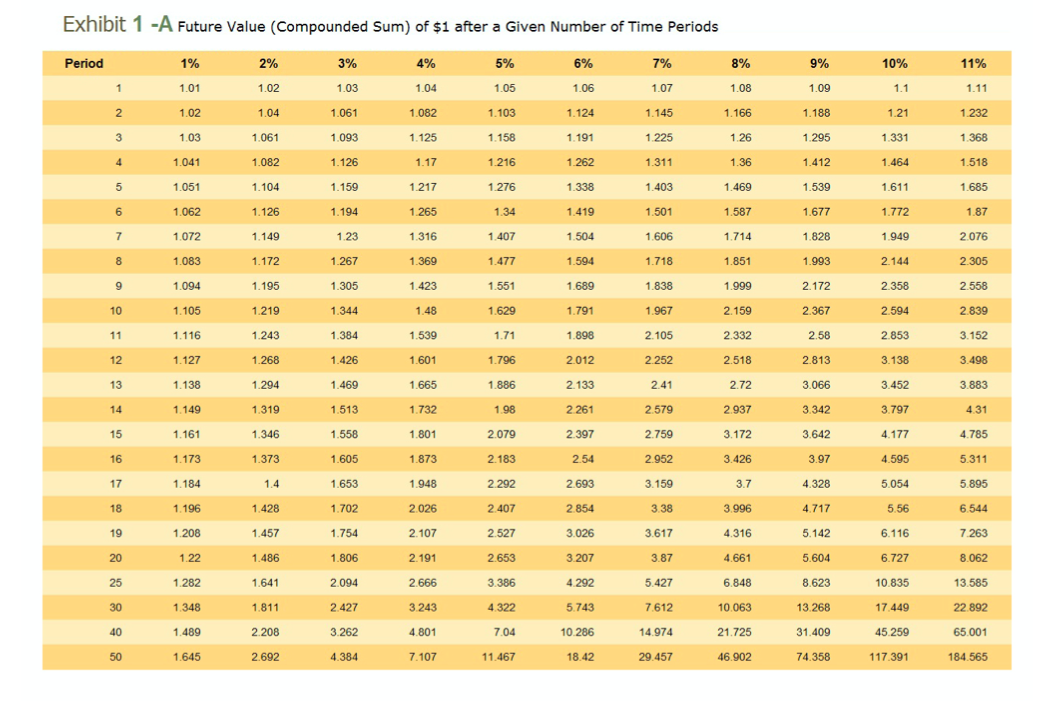

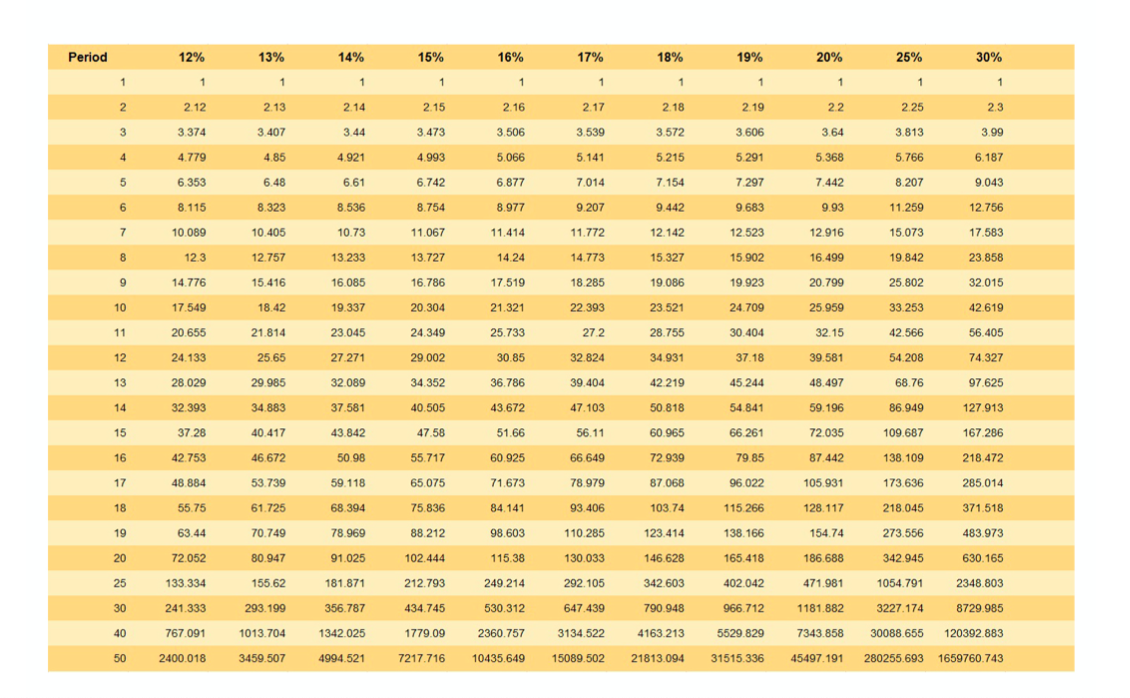

Exhibit B

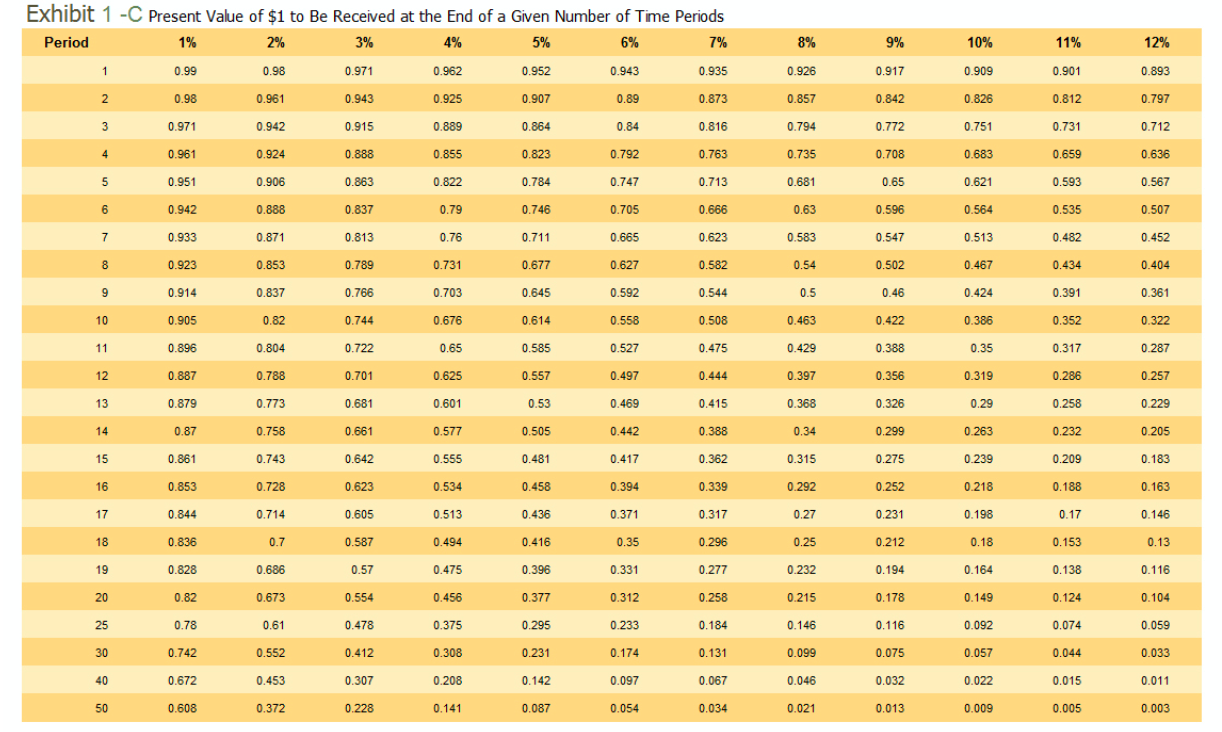

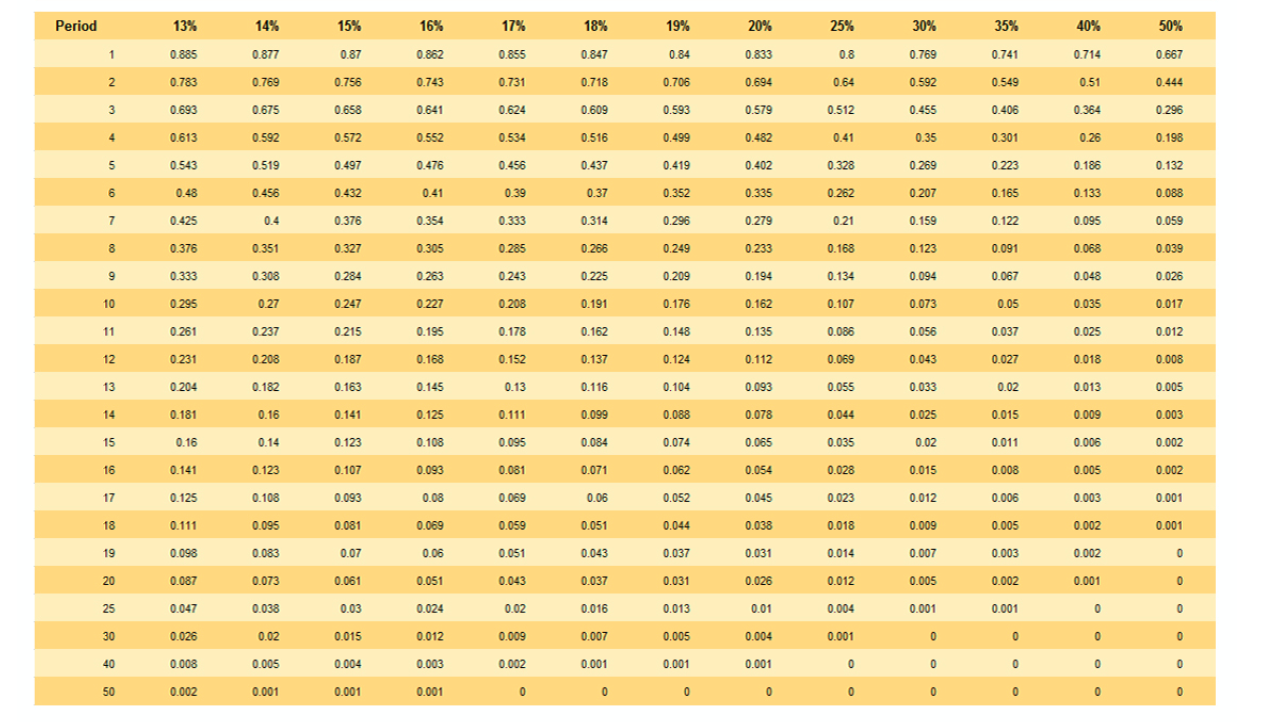

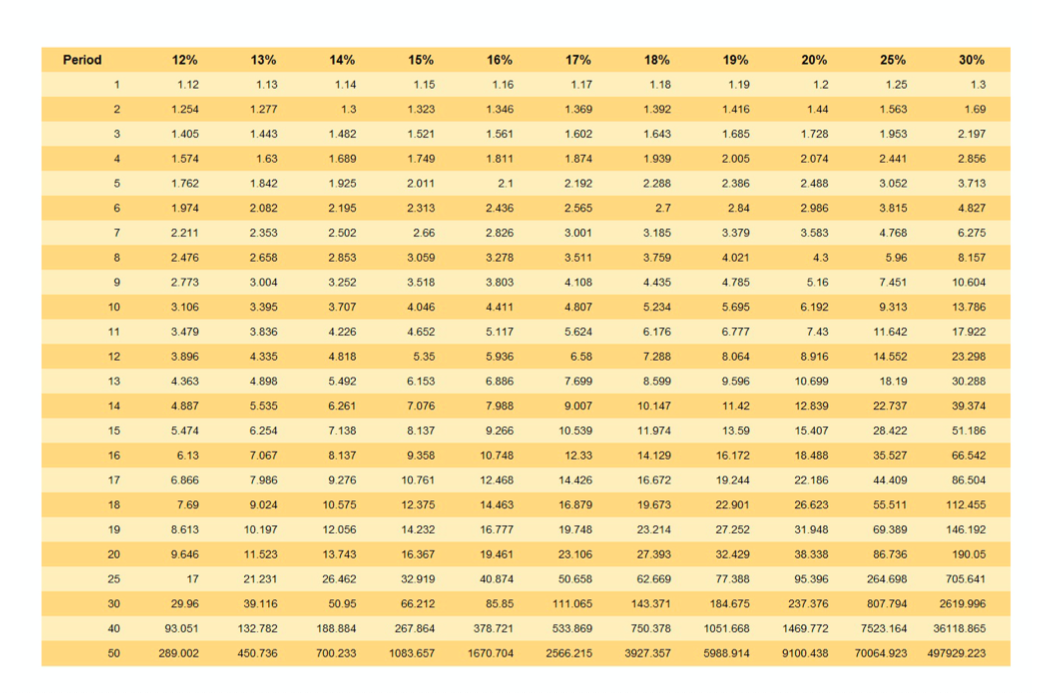

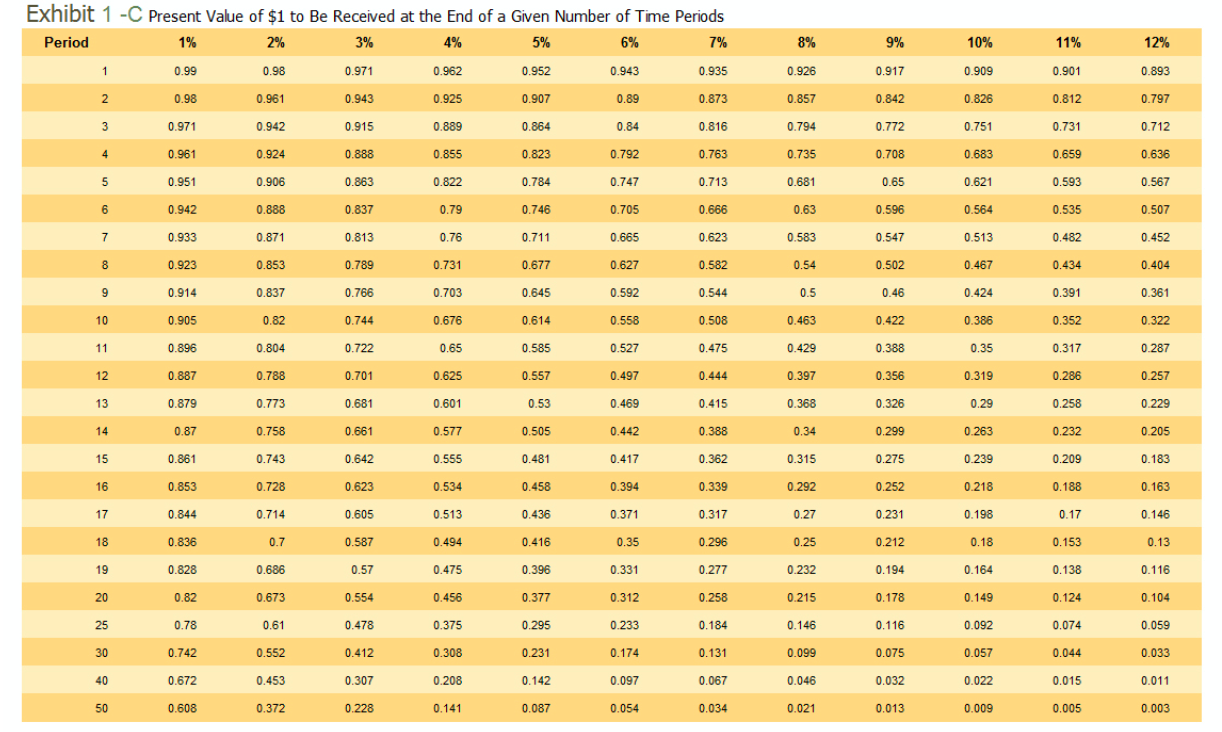

Exhibit C

Exhibit C

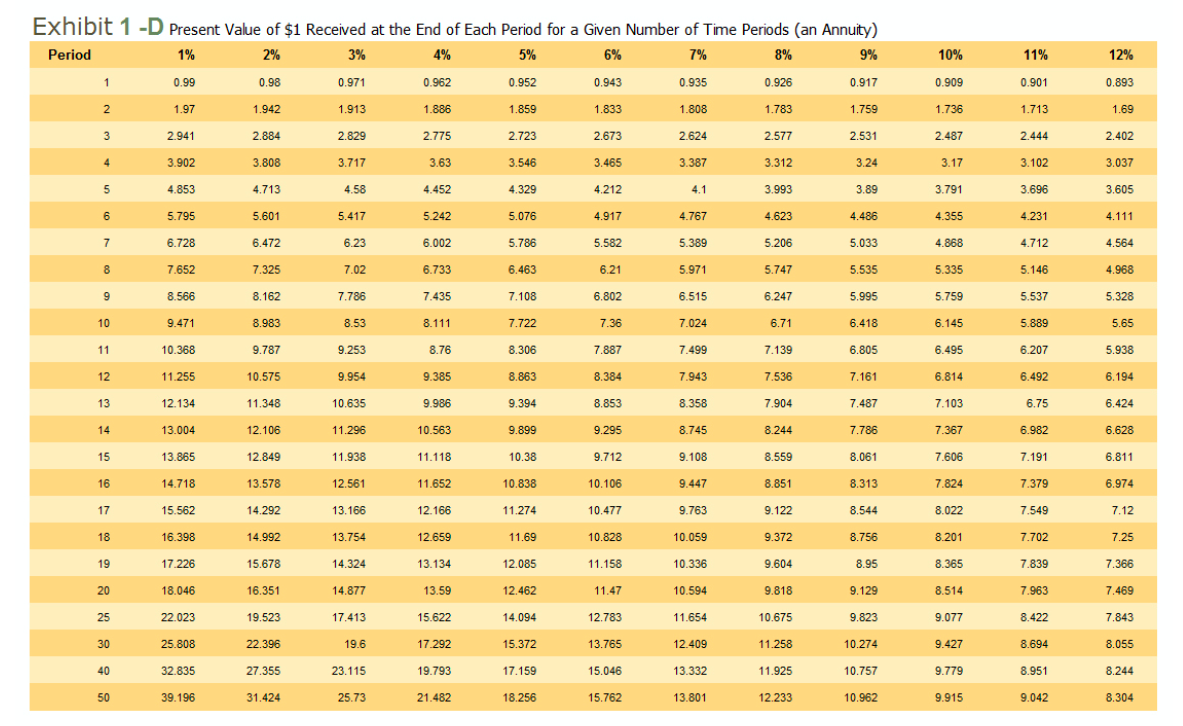

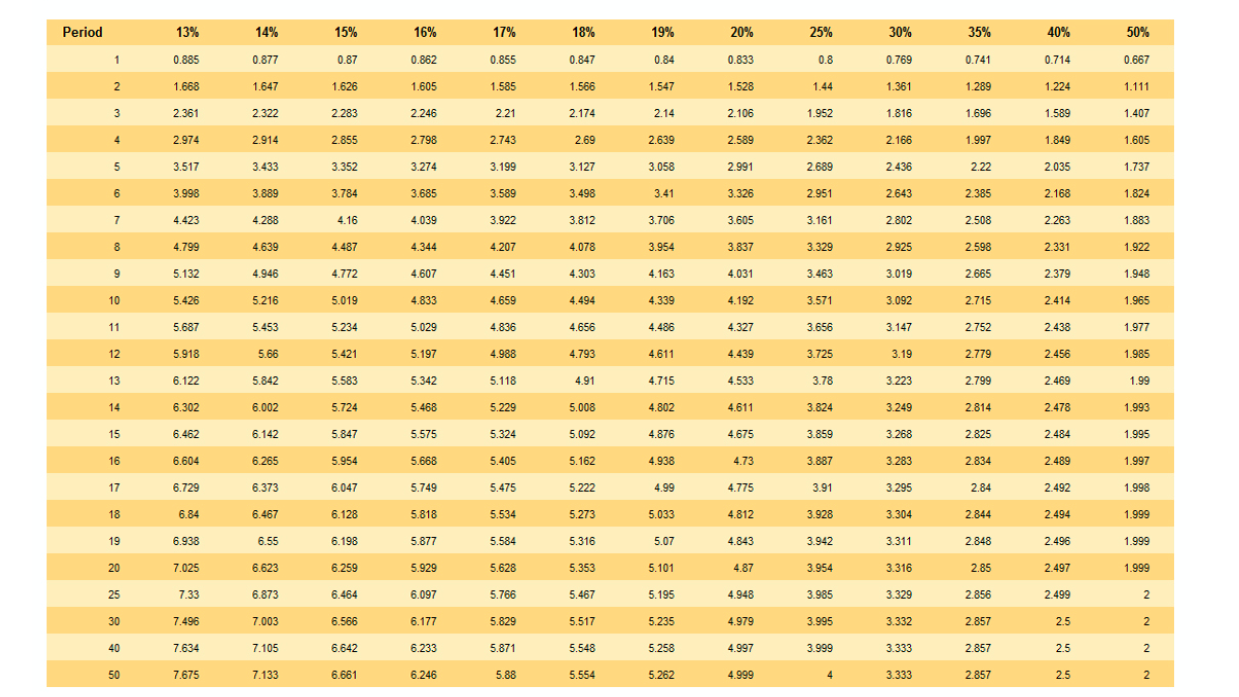

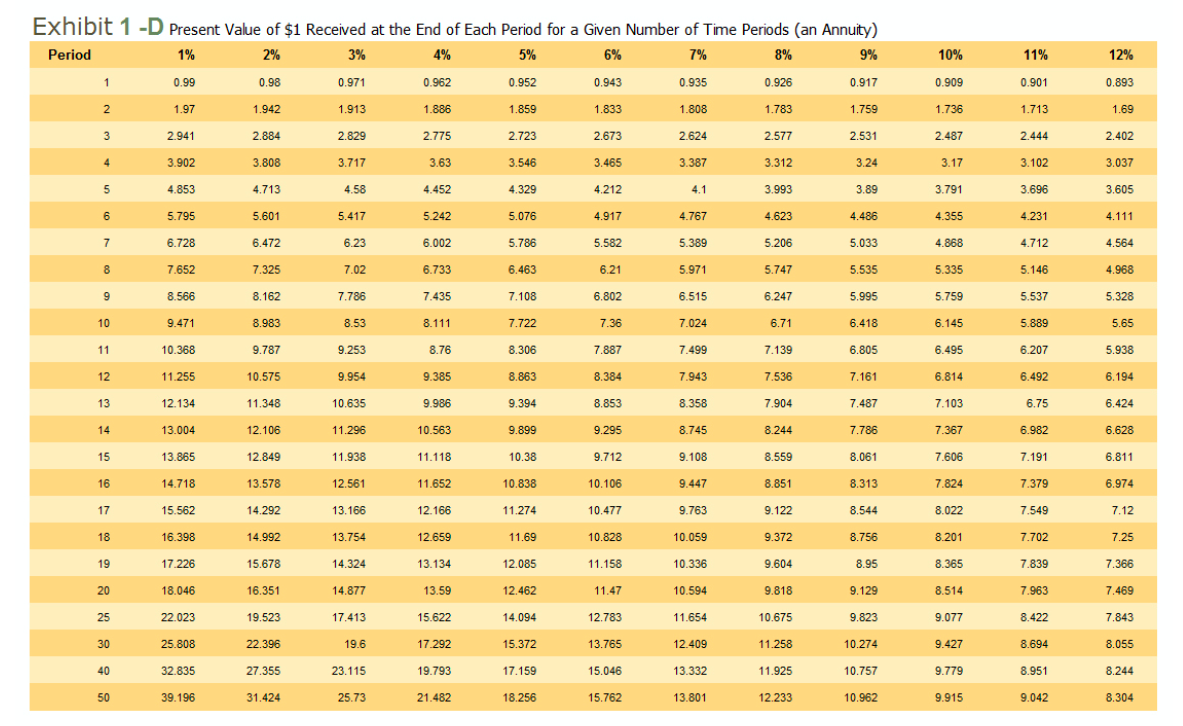

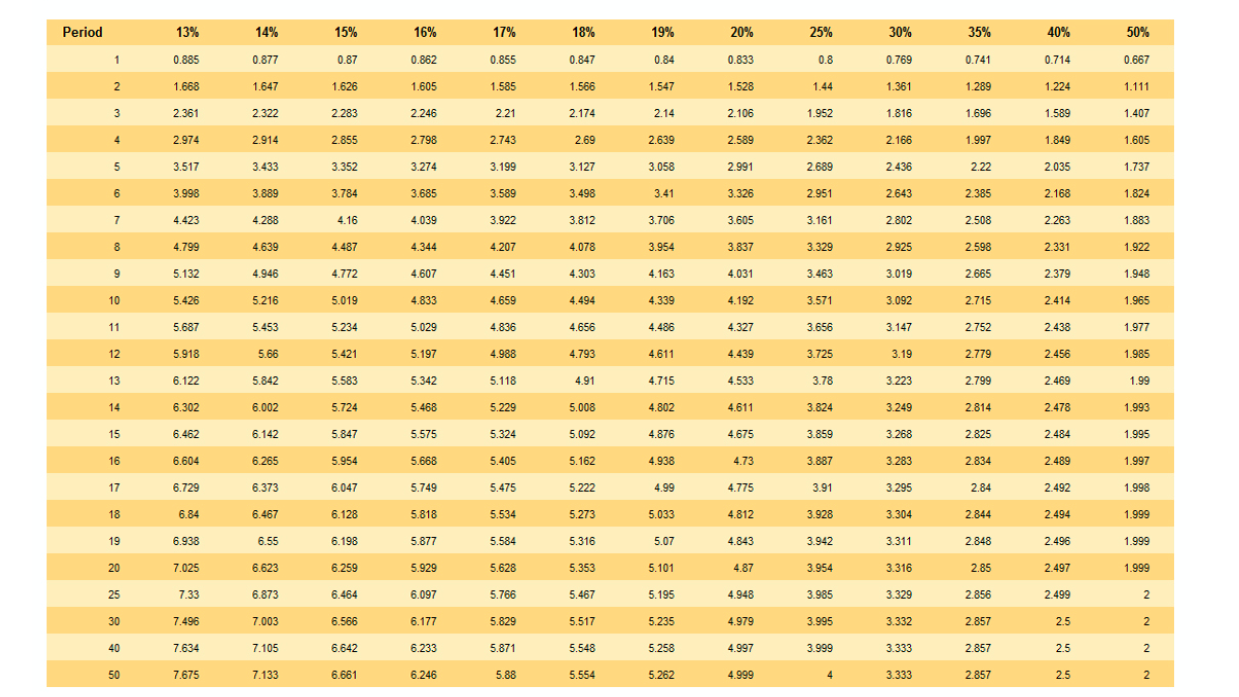

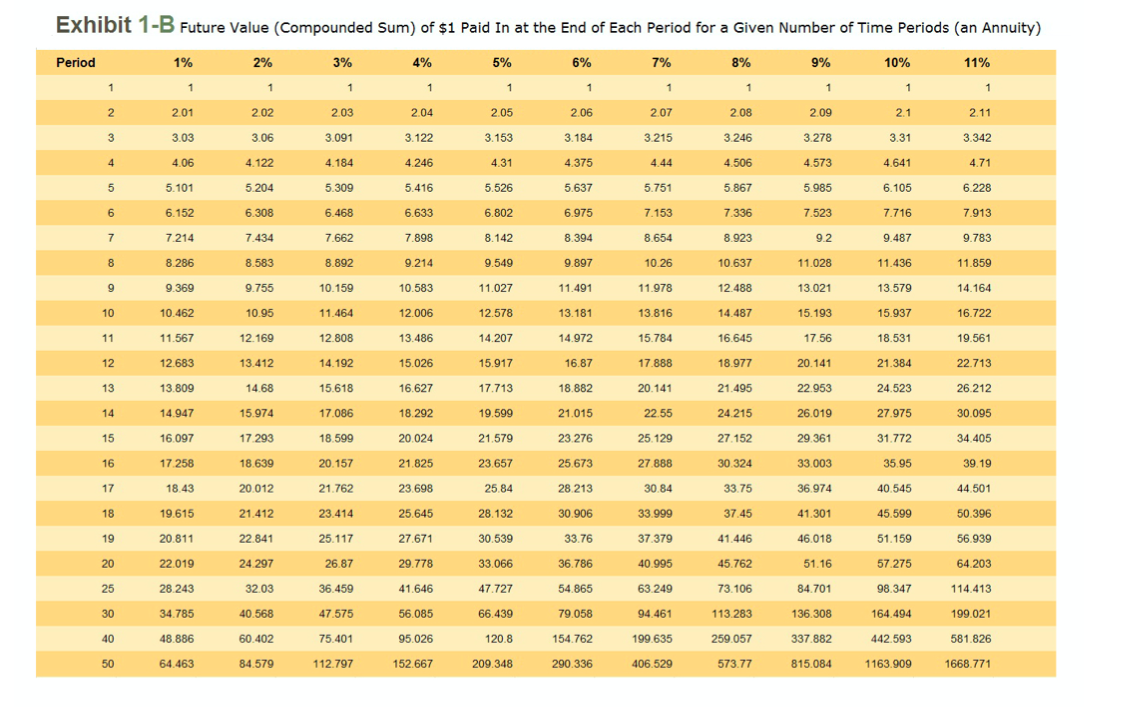

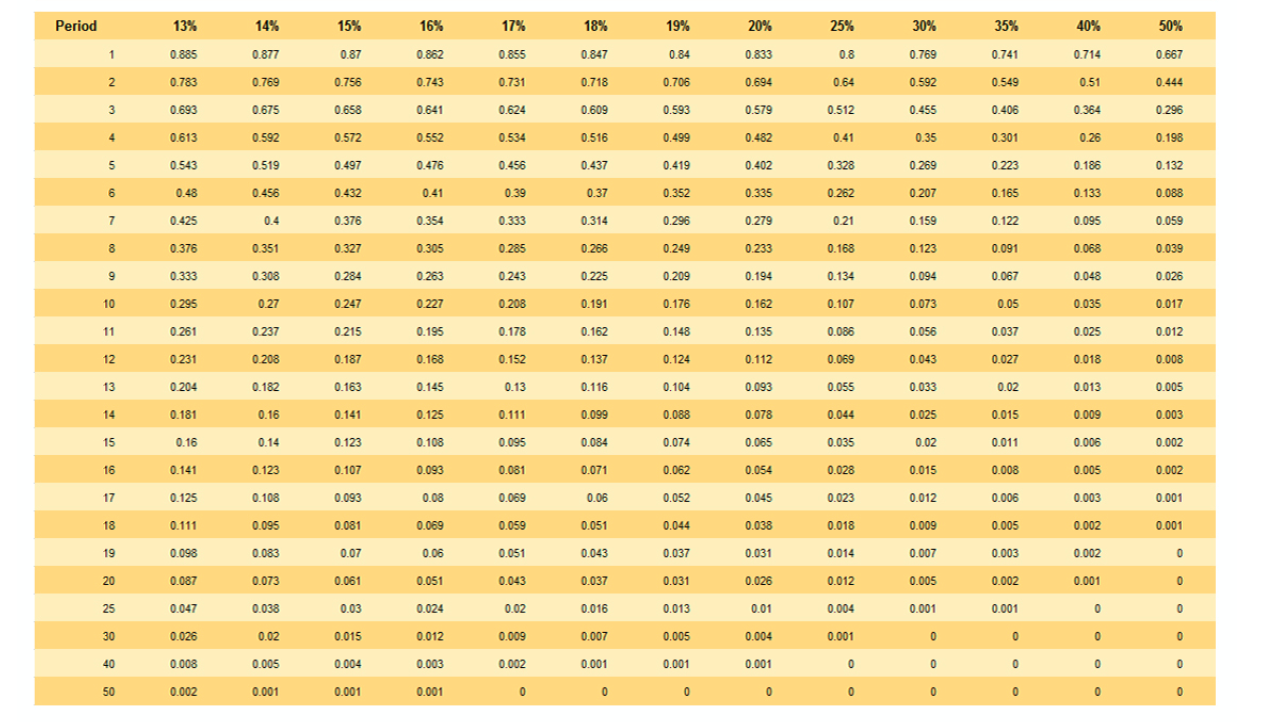

Exhibit D

Exhibit D

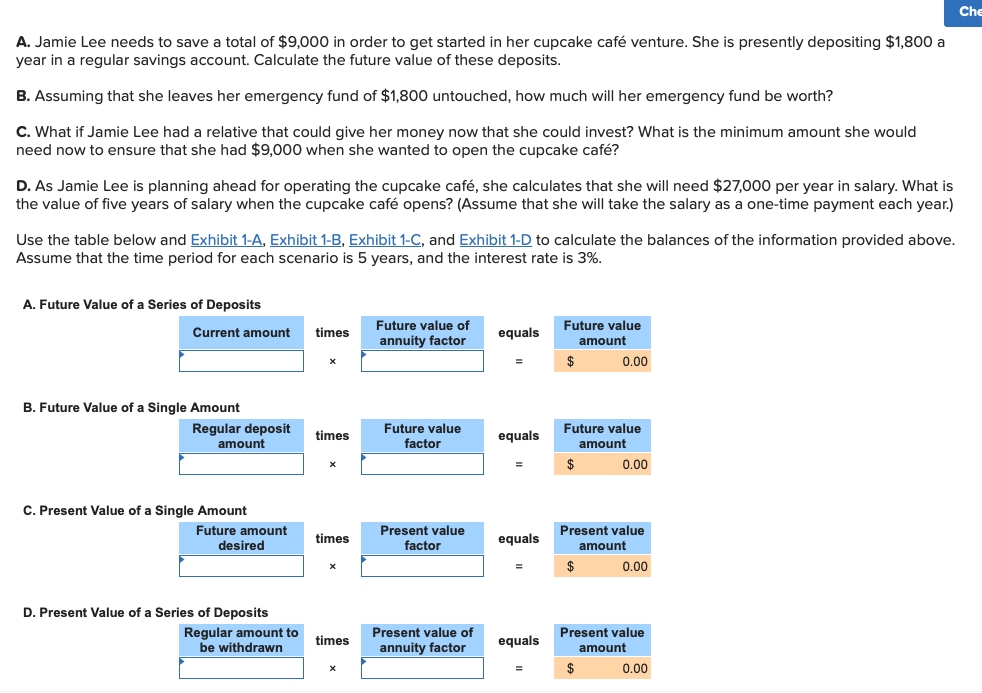

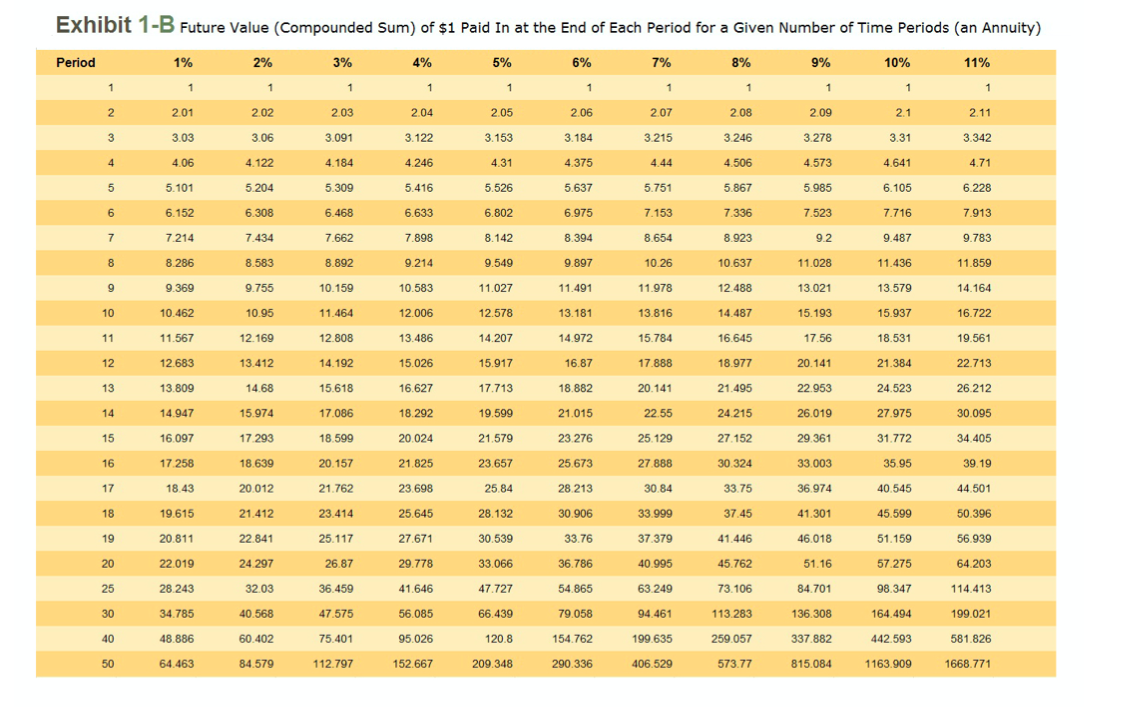

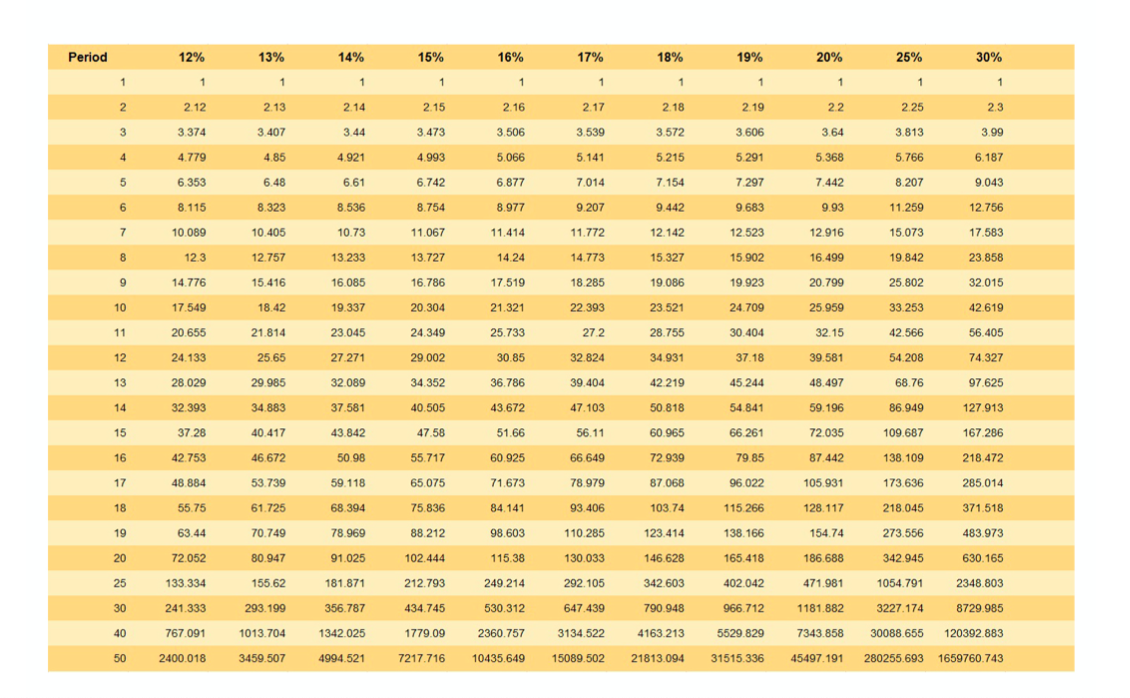

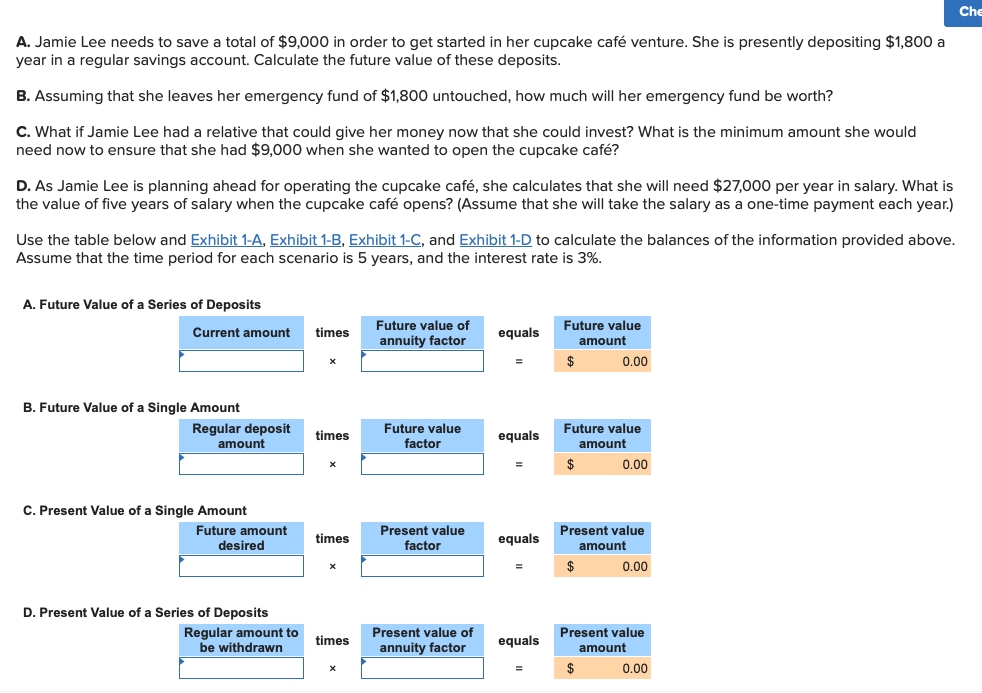

Che A. Jamie Lee needs to save a total of $9,000 in order to get started in her cupcake caf venture. She is presently depositing $1,800 a year in a regular savings account. Calculate the future value of these deposits. B. Assuming that she leaves her emergency fund of $1,800 untouched, how much will her emergency fund be worth? C. What if Jamie Lee had a relative that could give her money now that she could invest? What is the minimum amount she would need now to ensure that she had $9,000 when she wanted to open the cupcake caf? D. As Jamie Lee is planning ahead for operating the cupcake caf, she calculates that she will need $27,000 per year in salary. What is the value of five years of salary when the cupcake caf opens? (Assume that she will take the salary as a one-time payment each year.) Use the table below and Exhibit 1-A, Exhibit 1-B, Exhibit 1-C, and Exhibit 1-D to calculate the balances of the information provided above. Assume that the time period for each scenario is 5 years, and the interest rate is 3%. A. Future Value of a Series of Deposits Current amount times Future value of annuity factor equals Future value amount 0.00 B. Future Value of a Single Amount Regular deposit amount times Future value factor equals Future value amount 0.00 C. Present Value of a Single Amount Future amount desired times Present value factor equals Present value amount $ 0.00 X D. Present Value of a Series of Deposits Regular amount to be withdrawn times Present value of annuity factor equals Present value amount $ 0.00 Exhibit 1 -A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods Period 1% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1 1.01 2% 1.02 1.04 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.1 1.11 2 1.02 1.061 1.082 1.124 1.145 1.166 1.188 1.21 1.232 1.103 1.158 3 1.03 1.061 1.093 1.125 1.191 1 225 1.26 1295 1.331 1.368 4 1.041 1.082 1.126 1.17 1.216 1.262 1.311 1.36 1.412 1.464 1.518 5 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.685 6 1.062 1.126 1.194 1.265 1.34 1.419 1.501 1.587 1.677 1.772 1.87 7 1.072 1.149 1.23 1.316 1.407 1.504 1.606 1.714 1.828 1.949 2076 8 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 2.305 9 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 2.558 10 1.105 1.219 1.344 1.48 1.629 1.791 1.967 2.159 2.367 2.594 2.839 11 1.116 1.243 1.384 1.539 1.71 1.898 2.105 2.332 2.58 2.853 3.152 12 1.127 1.268 1.426 1.601 1.796 2012 2.252 2.518 2.813 3.138 3.498 13 1.138 1.294 1.469 1.665 1.886 2.133 2.41 2.72 3.066 3.452 3.883 14 1.149 1.319 1.513 1.732 1.98 2 261 2.579 2.937 3.342 3.797 4.31 15 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 4.785 16 1.173 1.373 1.605 1.873 2.183 2.54 2.952 3.426 3.97 4.595 5.311 17 1.184 1.4 1.653 1.948 2.292 2.693 3.159 3.7 4.328 5.054 5.895 18 1.196 1.428 1.702 2.407 2854 3.38 3.996 4.717 5.56 6.544 2.026 2.107 19 1.208 1.457 1.754 2.527 3.026 3.617 4.316 5.142 6.116 7263 20 1.22 1.486 1.806 2.191 2.653 3.207 3.87 4.661 5.604 6.727 8,062 25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 13.585 22.892 30 1.348 1.811 2.427 3.243 4.322 5.743 7.612 13 268 17.449 10.063 21.725 40 1.489 2.208 3.262 4.801 7.04 10.286 14.974 31.409 45.259 65.001 50 1.645 2.692 4.384 7.107 11,467 18.42 29.457 46.902 74.358 117.391 184,565 Period 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 1 1.12 1.13 114 1.15 1.16 1.17 1.16 1.19 12 1.25 13 2 1254 1277 13 1.323 1346 1.369 1.392 1.416 144 1.563 1.69 3 1.405 1.443 1.482 1561 1.602 1643 1.685 1.728 1963 2197 1.521 1.749 1574 11.63 1.689 1811 1.874 1.939 2005 2.074 2441 2856 5 1762 1.842 1925 2011 21 2192 2268 2386 2488 13052 3713 6 1974 2.082 2195 2313 2436 2565 27 2.84 2.966 3815 4627 7 2211 2.353 2.502 266 2826 3001 3.165 3379 3.583 4766 6275 8 2.476 2658 2853 3050 3276 3.511 3.750 1021 43 5.6 8.157 10604 9 2773 3004 3252 13516 3803 4435 4786 5.16 7451 4.108 4607 10 3.395 3707 4411 5234 15.696 6.192 9313 13.76 4.046 4.652 5.117 5.624 6.777 7.43 11 642 17922 3.106 3479 3896 4.363 4.887 3.836 4.335 4.898 4.226 4.818 12 6.176 7288 15.35 5936 658 8 064 8916 14.552 23 296 13 5.492 6153 6866 8599 9596 10 600 18 19 30 288 7699 9.007 14 5.536 6.261 17.076 7968 10 147 11.42 22.737 30 374 15 5.474 6.254 7.138 8. 137 926 10.539 11.974 13.59 12.839 15.407 18.488 28.422 51.186 6 6. 13 7.067 8.137 9356 10.748 12.33 14.129 16.172 35.527 6. 542 17 7966 12468 14426 22 16 44 400 10.761 12375 18 70 9024 14.463 26.623 9276 10.575 12.056 13.743 19244 22.901 27 262 5511 16879 19.748 9 6613 10.197 14 232 16.777 31.946 69 369 20 9.646 16.367 19461 23.106 16672 19.673 23 214 27.393 62 669 143371 750 378 32.429 38.338 11.523 21.231 86.736 6 504 112 455 146.192 190.05 705641 2619996 36118 865 25 17 25 462 32919 40 874 50 658 95.36 264 696 30 39.116 20.96 93.051 807.794 50 95 188.884 66 212 267.864 | 85 85 378.721 77.388 184.675 1051668 111.065 533.869 | 237.376 1469.772 40 132.782 7523.164 50 269.002 450.736 700 233 1083.657 1670 704 2566 215 3927.357 5968.914 9100 438 70064.923 497929 223 Exhibit 1-B Future Value (Compounded Sum) of $1 Paid In at the End of Each Period for a Given Number of Time Periods (an Annuity) Period 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1% 1 1 1 1 1 1 1 1 1 1 1 1 2 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.1 2.11 3 3.03 3.06 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.31 3.342 4 4.06 4 184 4.246 4.31 4.375 4.44 4.506 4.573 4.641 4.71 4.122 5.204 5 5.101 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 7 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.2 9.487 9.783 8 8.286 8.583 8.892 9.214 9.549 9.897 10.26 10.637 11.028 11.436 11.859 9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 10 10.462 10.95 11,464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 11 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.56 18.531 19.561 11.567 12.683 12 13.412 14.192 15.026 15.917 16.87 17.888 18.977 20.141 21.384 22.713 13 13.809 14.68 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 14 14.947 15.974 17.086 18.292 19.599 21.015 22.55 24.215 26.019 27.975 30.095 15 16.097 17.293 20.024 21.579 23 276 25.129 27.152 29.361 31.772 34.405 18.599 20.157 16 17.258 18 639 21.825 23.657 25.673 27 888 30 324 33.003 35.95 39.19 17 18.43 20.012 21.762 23.698 25.84 28.213 30.84 33.75 36.974 40.545 44 501 18 19,615 21.412 23.414 25.645 28.132 30.906 33.999 37.45 41.301 45.599 50.396 19 20.811 22.841 25.117 27.671 30.539 37.379 46.018 51.159 56.939 33.76 36.786 41.446 45.762 20 22.019 24 297 26.87 29.778 33.066 40.995 51.16 57.275 64.203 114.413 25 28.243 32.03 36.459 41.646 47.727 54.865 63 249 73. 106 84.701 98.347 30 34.785 40 568 47.575 56.085 66.439 94.461 113.283 136.308 164.494 199.021 79.058 154.762 40 48.886 60.402 75.401 95.026 120.8 199.635 259.057 337.882 442.593 581.826 50 64.463 84.579 112.797 152.667 209.348 290.336 406.529 573.77 815.084 1163.909 1668.771 Period 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 1 1 1 1 1 1 1 1 1 1 1 2 212 213 214 215 2.16 2.17 219 22 2.25 23 2.18 3572 3 3.407 344 3.473 3.506 3.539 13.64 3813 399 3374 4.779 3606 5291 4 485 4921 5.066 5.141 5215 5766 6.187 5.368 7442 6.353 648 4.993 6.742 8.754 6551 6.877 7014 718 797 8207 19043 6 8115 8323 8.536 8.977 9207 9442 9663 993 11.250 12.756 7 10 069 10.405 10.73 11.067 11.414 11.772 12.142 12523 12916 15.073 17.583 123 12757 13 233 13.727 14.24 773 15 902 19842 23.858 15.327 19066 g 14.776 16.085 16.786 17.519 18.265 16.499 20.799 25.959 25.802 32015 10 19337 20.304 21.321 22 303 23.521 19.923 24.709 30.404 12 619 15.416 18.42 21.814 2565 17.549 20.655 24.133 11 23.045 24.349 272 28.755 32.15 56.405 12 27 271 37.16 29.002 34.352 25.733 30.85 36.786 43.672 32 824 39.404 74.327 97.625 33 253 42.566 54.208 68.76 | B6 949 13 26.020 29 965 34 931 42 219 50.818 60 965 32.089 45 244 54.84] 14 32 303 34.883 37.581 40.505 39 581 | 48.497 59.196 72.035 187 442 47.103 127913 15 37 26 40.417 43.842 47.56 51.6 6.11 6 261 100 687 167.266 16 42.753 46 672 50 98 55.717 60 925 6 649 72 939 79 85 138.109 218472 17 46.84 9 118 65.075 71673 105 931 173 636 265.014 18 53.739 61.725 70.749 80 947 155.62 78.979 193.406 110 285 68 394 78 78.969 91.025 84.141 96.603 371518 87 068 103 74 123.414 96022 115 266 138 166 128 117 154.74 19 218.045 273.566 483973 20 75 836 188.212 102.444 212.793 434.745 130.033 146 628 55.75 63.44 | 72.052 133 334 241.333 767.091 165418 16 666 115.38 249.214 25 181.871 1356.787 1342.025 402 042 966.712 30 292.105 647.439 3134.522 293 199 342.945 1054.791 3227.174 342 603 790.948 4163 213 630.165 | 2348.803 18729.985 1530.312 471.981 1181.882 7343 858 40 1013.704 1779 09 2360.757 5529 829 30066.655 120392 883 150 2400.018 3459 507 4994.521 7217.716 10435.649 15089.502 21813.094 31515.336 45497 191 280255.693 1659760.743 8% 9% 10% 11% 12% Exhibit 1 - Present Value of $1 to Be Received at the End of a Given Number of Time Periods Period 1% 2% 3% 4 5% 6% 7% 0.971 0.962 0.935 2. 0.89 0.84 1 0.99 0.98 0.952 0.943 0.926 0.917 0.909 0.901 0.893 0.98 0.961 0.943 0.925 0.907 0.873 0.857 0.842 0.826 0.812 0.797 3 0.971 0.942 0.915 0.889 0.864 0.816 0.794 0.772 0.751 0.731 0.712 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.65 0.621 0.593 0.567 6 0.942 0.888 0.837 0.79 0.746 0.705 0.666 0.63 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.76 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.54 0.502 0.467 0.434 0.404 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.5 0.46 0.424 0.391 0.361 10 0.905 0.82 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 11 0.896 0.804 0.722 0.65 0.585 0.527 0.475 0.429 0.388 0.35 0.317 0.287 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 13 0.879 0.773 0.681 0.601 0.53 0.469 0.415 0.368 0.326 0.29 0.258 0.229 14 0.87 0.758 0.661 0.577 0.505 0.442 0.388 0.34 0.299 0.263 0.232 0.205 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.27 0.231 0.198 0.17 0.146 18 0.836 0.7 0.587 0.494 0.416 0.35 0.296 0.25 0.212 0.18 0.153 0.13 19 0.828 0.686 0.57 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 20 0.82 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 25 0.78 0.61 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.885 0.877 0.87 0.862 0.855 0.847 0.84 0.833 0.8 0.769 0.741 0.714 0.667 2 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.64 0.592 0.549 0.51 0.444 3 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.512 0.455 0.406 0.364 0.296 4 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.41 0.35 0.301 0.26 0.198 5 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.328 0.269 0.223 0.186 0.132 6 0.48 0.456 0.432 0.41 0.39 0.37 0.352 0.335 0.262 0.207 0.165 0.133 0.088 7 0.425 0.4 0.376 0.354 0.333 0.314 0.296 0.21 0.159 0.122 0.095 0.059 0.279 0.233 8 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.168 0.123 0.091 0.068 0.039 9 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.134 0.094 0.067 0.048 0.026 10 0295 0.27 0.247 0.227 0.191 0.176 0.162 0.107 0.073 0.05 0.035 0.017 0.208 0.178 11 0.261 0.237 0.215 0.195 0.162 0.148 0.135 0.086 0.037 0.025 0.012 0.056 0.043 12 0.231 0.208 0.187 0.168 0.152 0.124 0.112 0.069 0.027 0.137 0.116 0.008 0.005 13 0.204 0.182 0.163 0.145 0.13 0.104 0.093 0.033 0.02 0.018 0.013 0.009 0.055 0.044 14 0.181 0.16 0.141 0.125 0.111 0.099 0.088 0.078 0.025 0.015 0.003 15 0.16 0.14 0.123 0.108 0.095 0.084 0.074 0.065 0.035 0.02 0.011 0.006 0.002 16 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.028 0.015 0.008 0.005 0.002 17 0.125 0.108 0.093 0.08 0.069 0.06 0.052 0.045 0.023 0.012 0.006 0.003 0.001 18 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.018 0.009 0.005 0.002 0.001 19 0.098 0.083 0.07 0.06 0.051 0.043 0.037 0.031 0.014 0.007 0.002 0 20 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.012 0.005 0.003 0.002 0.001 0.001 0 0 25 0.047 0.038 0.03 0.024 0.02 0.016 0.013 0.01 0.004 0.001 0 0 30 0.026 0.02 0.015 0.012 0.009 0.007 0.005 0.004 0.001 0 0 0 0 40 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0 0 0 0 0 50 0.002 0.001 0.001 0.001 0 0 0 0 0 0 0 0 2% 3% 4% 6% 7% 9% 10% 11% 12% Exhibit 1 - Present Value of $1 Received at the End of Each Period for a Given Number of Time Periods (an Annuity) Period 1% 5% 8% 0.99 2 1 0.98 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 1.97 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.69 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.444 3.102 4 3.902 3.808 3.717 3.63 3.546 3.465 3.387 3.312 3.24 3.17 3.037 5 4.853 4.713 4.58 4.452 4.329 4.1 3.993 3.89 3.791 3.696 3.605 4.212 4.917 6 5.795 5.601 5.417 5.242 5.076 4.767 4.623 4.486 4.355 4.111 7 6.728 6.472 6.23 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.231 4.712 5.146 4.564 8 7.652 7.325 7.02 6.733 6.463 6.21 5.971 5.747 5.535 5.335 4.968 9 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 10 9.471 8.983 8.53 8.111 7.722 7.36 7.024 6.71 6.418 6.145 5.889 5.65 11 10.368 9.787 9.253 8.76 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.75 6.424 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 15 13.865 12.849 11.938 11.118 10.38 9.712 9.108 8.559 8.061 7.606 7.191 6.811 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.12 18 16.398 14.992 13.754 12.659 11.69 10.828 10.059 9.372 8.756 8.201 7.702 7.25 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.95 8.365 7.839 7.366 20 18.046 16.351 14.877 13.59 12.462 11.47 10.594 9.818 9.129 8.514 7.963 7.469 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 30 25.808 22.396 19.6 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 50 39.196 31.424 25.73 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 8.304 Period 13 1498 15% 16% 17% 18% 19% 20*2 25% 30% 35% 40% 50% 0.85 0.877 0.87 0.862 0.855 0.847 0.84 0.333 0.3 0769 0741 0714 0.667 2 1.666 1.647 1.626 1.605 1.585 1.666 1.547 1.528 1.44 1.36] 1289 1224 1.111 3 251 2322 2283 2246 221 2.17. 21- 2.106 1.952 1816 1.696 1.58 1.407 2972 2914 23.5 2798 2.743 2.68 2.639 2-29 2362 2166 1997 1.849 1.605 5 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.99] 2689 2.436 222 2.035 1.737 3.998 3.869 3.784 3.685 3.589 3.496 3.41 3.326 2951 2643 2385 2168 1.824 4.423 L288 2.16 4.039 3.922 3.812 3.706 3.E05 3.151 2802 2508 2263 1.883 4.799 4.629 ...87 4.344 4.207 4.078 3.954 3.837 3.329 2925 2598 2331 1.92 9 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.463 3.019 2665 2379 1.946 10 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 3.571 3.092 2.715 2414 1.965 11 5.87 SA-3 234 5.029 4. 836 4.6ES 4.4$ 27 366 3.147 2752 2438 1.977 12 5.918 5.66 5.421 5.197 4.938 4.611 4.439 3.725 3.19 2779 2466 1.98 4.793 4.91 13 6.122 5.842 5.583 5.342 5.118 4.715 4.533 3.78 3223 2.799 2.469 1.9 14 6.302 6.002 5. 724 5.468 5.229 5.003 4. 802 4.611 3.824 3249 2.814 2.478 1.993 15 6.462 6.142 5.347 5575 5.324 5.092 4.876 4.675 3.269 3268 2825 2484 1.995 6.604 265 5.954 5.E68 5.405 5.162 4.938 4.73 3.887 3263 2834 2489 1.997 17 679 6.373 6.047 5.749 5.475 5.222 49 4.775 3.91 3295 2.84 2.492 1.998 13 6.84 6.467 6.128 5.818 5.534 5.23 5.033 4.312 3928 3.304 2.844 2494 1.99 19 6.938 6.5 5. 198 5.877 5.584 5.316 5.07 4.343 3942 3.311 2848 2496 1.999 20 7.025 62-9 5.628 5.101 487 3.316 2.8 2497 1.999 6.623 6.873 5.929 | 6.097 5.363 5.467 3.954 3.965 25 7.33 6.46 5.766 5. 195 4.946 3329 2856 2.499 2 30 7.496 7.003 666 6.177 5.829 5.517 5235 4.979 3995 3.32 2857 25 2 40 7.634 7.105 E-42 6.233 5.871 5.548 5.28 1997 3999 3333 2857 25 50 7575 7.133 E. 661 6246 5.8 5. 554 5.262 A.999 a 3323 2857 25 Che A. Jamie Lee needs to save a total of $9,000 in order to get started in her cupcake caf venture. She is presently depositing $1,800 a year in a regular savings account. Calculate the future value of these deposits. B. Assuming that she leaves her emergency fund of $1,800 untouched, how much will her emergency fund be worth? C. What if Jamie Lee had a relative that could give her money now that she could invest? What is the minimum amount she would need now to ensure that she had $9,000 when she wanted to open the cupcake caf? D. As Jamie Lee is planning ahead for operating the cupcake caf, she calculates that she will need $27,000 per year in salary. What is the value of five years of salary when the cupcake caf opens? (Assume that she will take the salary as a one-time payment each year.) Use the table below and Exhibit 1-A, Exhibit 1-B, Exhibit 1-C, and Exhibit 1-D to calculate the balances of the information provided above. Assume that the time period for each scenario is 5 years, and the interest rate is 3%. A. Future Value of a Series of Deposits Current amount times Future value of annuity factor equals Future value amount 0.00 B. Future Value of a Single Amount Regular deposit amount times Future value factor equals Future value amount 0.00 C. Present Value of a Single Amount Future amount desired times Present value factor equals Present value amount $ 0.00 X D. Present Value of a Series of Deposits Regular amount to be withdrawn times Present value of annuity factor equals Present value amount $ 0.00 Exhibit 1 -A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods Period 1% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1 1.01 2% 1.02 1.04 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.1 1.11 2 1.02 1.061 1.082 1.124 1.145 1.166 1.188 1.21 1.232 1.103 1.158 3 1.03 1.061 1.093 1.125 1.191 1 225 1.26 1295 1.331 1.368 4 1.041 1.082 1.126 1.17 1.216 1.262 1.311 1.36 1.412 1.464 1.518 5 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.685 6 1.062 1.126 1.194 1.265 1.34 1.419 1.501 1.587 1.677 1.772 1.87 7 1.072 1.149 1.23 1.316 1.407 1.504 1.606 1.714 1.828 1.949 2076 8 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 2.305 9 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 2.558 10 1.105 1.219 1.344 1.48 1.629 1.791 1.967 2.159 2.367 2.594 2.839 11 1.116 1.243 1.384 1.539 1.71 1.898 2.105 2.332 2.58 2.853 3.152 12 1.127 1.268 1.426 1.601 1.796 2012 2.252 2.518 2.813 3.138 3.498 13 1.138 1.294 1.469 1.665 1.886 2.133 2.41 2.72 3.066 3.452 3.883 14 1.149 1.319 1.513 1.732 1.98 2 261 2.579 2.937 3.342 3.797 4.31 15 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 4.785 16 1.173 1.373 1.605 1.873 2.183 2.54 2.952 3.426 3.97 4.595 5.311 17 1.184 1.4 1.653 1.948 2.292 2.693 3.159 3.7 4.328 5.054 5.895 18 1.196 1.428 1.702 2.407 2854 3.38 3.996 4.717 5.56 6.544 2.026 2.107 19 1.208 1.457 1.754 2.527 3.026 3.617 4.316 5.142 6.116 7263 20 1.22 1.486 1.806 2.191 2.653 3.207 3.87 4.661 5.604 6.727 8,062 25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 13.585 22.892 30 1.348 1.811 2.427 3.243 4.322 5.743 7.612 13 268 17.449 10.063 21.725 40 1.489 2.208 3.262 4.801 7.04 10.286 14.974 31.409 45.259 65.001 50 1.645 2.692 4.384 7.107 11,467 18.42 29.457 46.902 74.358 117.391 184,565 Period 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 1 1.12 1.13 114 1.15 1.16 1.17 1.16 1.19 12 1.25 13 2 1254 1277 13 1.323 1346 1.369 1.392 1.416 144 1.563 1.69 3 1.405 1.443 1.482 1561 1.602 1643 1.685 1.728 1963 2197 1.521 1.749 1574 11.63 1.689 1811 1.874 1.939 2005 2.074 2441 2856 5 1762 1.842 1925 2011 21 2192 2268 2386 2488 13052 3713 6 1974 2.082 2195 2313 2436 2565 27 2.84 2.966 3815 4627 7 2211 2.353 2.502 266 2826 3001 3.165 3379 3.583 4766 6275 8 2.476 2658 2853 3050 3276 3.511 3.750 1021 43 5.6 8.157 10604 9 2773 3004 3252 13516 3803 4435 4786 5.16 7451 4.108 4607 10 3.395 3707 4411 5234 15.696 6.192 9313 13.76 4.046 4.652 5.117 5.624 6.777 7.43 11 642 17922 3.106 3479 3896 4.363 4.887 3.836 4.335 4.898 4.226 4.818 12 6.176 7288 15.35 5936 658 8 064 8916 14.552 23 296 13 5.492 6153 6866 8599 9596 10 600 18 19 30 288 7699 9.007 14 5.536 6.261 17.076 7968 10 147 11.42 22.737 30 374 15 5.474 6.254 7.138 8. 137 926 10.539 11.974 13.59 12.839 15.407 18.488 28.422 51.186 6 6. 13 7.067 8.137 9356 10.748 12.33 14.129 16.172 35.527 6. 542 17 7966 12468 14426 22 16 44 400 10.761 12375 18 70 9024 14.463 26.623 9276 10.575 12.056 13.743 19244 22.901 27 262 5511 16879 19.748 9 6613 10.197 14 232 16.777 31.946 69 369 20 9.646 16.367 19461 23.106 16672 19.673 23 214 27.393 62 669 143371 750 378 32.429 38.338 11.523 21.231 86.736 6 504 112 455 146.192 190.05 705641 2619996 36118 865 25 17 25 462 32919 40 874 50 658 95.36 264 696 30 39.116 20.96 93.051 807.794 50 95 188.884 66 212 267.864 | 85 85 378.721 77.388 184.675 1051668 111.065 533.869 | 237.376 1469.772 40 132.782 7523.164 50 269.002 450.736 700 233 1083.657 1670 704 2566 215 3927.357 5968.914 9100 438 70064.923 497929 223 Exhibit 1-B Future Value (Compounded Sum) of $1 Paid In at the End of Each Period for a Given Number of Time Periods (an Annuity) Period 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1% 1 1 1 1 1 1 1 1 1 1 1 1 2 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.1 2.11 3 3.03 3.06 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.31 3.342 4 4.06 4 184 4.246 4.31 4.375 4.44 4.506 4.573 4.641 4.71 4.122 5.204 5 5.101 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 7 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.2 9.487 9.783 8 8.286 8.583 8.892 9.214 9.549 9.897 10.26 10.637 11.028 11.436 11.859 9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 10 10.462 10.95 11,464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 11 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.56 18.531 19.561 11.567 12.683 12 13.412 14.192 15.026 15.917 16.87 17.888 18.977 20.141 21.384 22.713 13 13.809 14.68 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 14 14.947 15.974 17.086 18.292 19.599 21.015 22.55 24.215 26.019 27.975 30.095 15 16.097 17.293 20.024 21.579 23 276 25.129 27.152 29.361 31.772 34.405 18.599 20.157 16 17.258 18 639 21.825 23.657 25.673 27 888 30 324 33.003 35.95 39.19 17 18.43 20.012 21.762 23.698 25.84 28.213 30.84 33.75 36.974 40.545 44 501 18 19,615 21.412 23.414 25.645 28.132 30.906 33.999 37.45 41.301 45.599 50.396 19 20.811 22.841 25.117 27.671 30.539 37.379 46.018 51.159 56.939 33.76 36.786 41.446 45.762 20 22.019 24 297 26.87 29.778 33.066 40.995 51.16 57.275 64.203 114.413 25 28.243 32.03 36.459 41.646 47.727 54.865 63 249 73. 106 84.701 98.347 30 34.785 40 568 47.575 56.085 66.439 94.461 113.283 136.308 164.494 199.021 79.058 154.762 40 48.886 60.402 75.401 95.026 120.8 199.635 259.057 337.882 442.593 581.826 50 64.463 84.579 112.797 152.667 209.348 290.336 406.529 573.77 815.084 1163.909 1668.771 Period 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 1 1 1 1 1 1 1 1 1 1 1 2 212 213 214 215 2.16 2.17 219 22 2.25 23 2.18 3572 3 3.407 344 3.473 3.506 3.539 13.64 3813 399 3374 4.779 3606 5291 4 485 4921 5.066 5.141 5215 5766 6.187 5.368 7442 6.353 648 4.993 6.742 8.754 6551 6.877 7014 718 797 8207 19043 6 8115 8323 8.536 8.977 9207 9442 9663 993 11.250 12.756 7 10 069 10.405 10.73 11.067 11.414 11.772 12.142 12523 12916 15.073 17.583 123 12757 13 233 13.727 14.24 773 15 902 19842 23.858 15.327 19066 g 14.776 16.085 16.786 17.519 18.265 16.499 20.799 25.959 25.802 32015 10 19337 20.304 21.321 22 303 23.521 19.923 24.709 30.404 12 619 15.416 18.42 21.814 2565 17.549 20.655 24.133 11 23.045 24.349 272 28.755 32.15 56.405 12 27 271 37.16 29.002 34.352 25.733 30.85 36.786 43.672 32 824 39.404 74.327 97.625 33 253 42.566 54.208 68.76 | B6 949 13 26.020 29 965 34 931 42 219 50.818 60 965 32.089 45 244 54.84] 14 32 303 34.883 37.581 40.505 39 581 | 48.497 59.196 72.035 187 442 47.103 127913 15 37 26 40.417 43.842 47.56 51.6 6.11 6 261 100 687 167.266 16 42.753 46 672 50 98 55.717 60 925 6 649 72 939 79 85 138.109 218472 17 46.84 9 118 65.075 71673 105 931 173 636 265.014 18 53.739 61.725 70.749 80 947 155.62 78.979 193.406 110 285 68 394 78 78.969 91.025 84.141 96.603 371518 87 068 103 74 123.414 96022 115 266 138 166 128 117 154.74 19 218.045 273.566 483973 20 75 836 188.212 102.444 212.793 434.745 130.033 146 628 55.75 63.44 | 72.052 133 334 241.333 767.091 165418 16 666 115.38 249.214 25 181.871 1356.787 1342.025 402 042 966.712 30 292.105 647.439 3134.522 293 199 342.945 1054.791 3227.174 342 603 790.948 4163 213 630.165 | 2348.803 18729.985 1530.312 471.981 1181.882 7343 858 40 1013.704 1779 09 2360.757 5529 829 30066.655 120392 883 150 2400.018 3459 507 4994.521 7217.716 10435.649 15089.502 21813.094 31515.336 45497 191 280255.693 1659760.743 8% 9% 10% 11% 12% Exhibit 1 - Present Value of $1 to Be Received at the End of a Given Number of Time Periods Period 1% 2% 3% 4 5% 6% 7% 0.971 0.962 0.935 2. 0.89 0.84 1 0.99 0.98 0.952 0.943 0.926 0.917 0.909 0.901 0.893 0.98 0.961 0.943 0.925 0.907 0.873 0.857 0.842 0.826 0.812 0.797 3 0.971 0.942 0.915 0.889 0.864 0.816 0.794 0.772 0.751 0.731 0.712 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.65 0.621 0.593 0.567 6 0.942 0.888 0.837 0.79 0.746 0.705 0.666 0.63 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.76 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.54 0.502 0.467 0.434 0.404 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.5 0.46 0.424 0.391 0.361 10 0.905 0.82 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 11 0.896 0.804 0.722 0.65 0.585 0.527 0.475 0.429 0.388 0.35 0.317 0.287 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 13 0.879 0.773 0.681 0.601 0.53 0.469 0.415 0.368 0.326 0.29 0.258 0.229 14 0.87 0.758 0.661 0.577 0.505 0.442 0.388 0.34 0.299 0.263 0.232 0.205 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.27 0.231 0.198 0.17 0.146 18 0.836 0.7 0.587 0.494 0.416 0.35 0.296 0.25 0.212 0.18 0.153 0.13 19 0.828 0.686 0.57 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 20 0.82 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 25 0.78 0.61 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.885 0.877 0.87 0.862 0.855 0.847 0.84 0.833 0.8 0.769 0.741 0.714 0.667 2 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.64 0.592 0.549 0.51 0.444 3 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.512 0.455 0.406 0.364 0.296 4 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.41 0.35 0.301 0.26 0.198 5 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.328 0.269 0.223 0.186 0.132 6 0.48 0.456 0.432 0.41 0.39 0.37 0.352 0.335 0.262 0.207 0.165 0.133 0.088 7 0.425 0.4 0.376 0.354 0.333 0.314 0.296 0.21 0.159 0.122 0.095 0.059 0.279 0.233 8 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.168 0.123 0.091 0.068 0.039 9 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.134 0.094 0.067 0.048 0.026 10 0295 0.27 0.247 0.227 0.191 0.176 0.162 0.107 0.073 0.05 0.035 0.017 0.208 0.178 11 0.261 0.237 0.215 0.195 0.162 0.148 0.135 0.086 0.037 0.025 0.012 0.056 0.043 12 0.231 0.208 0.187 0.168 0.152 0.124 0.112 0.069 0.027 0.137 0.116 0.008 0.005 13 0.204 0.182 0.163 0.145 0.13 0.104 0.093 0.033 0.02 0.018 0.013 0.009 0.055 0.044 14 0.181 0.16 0.141 0.125 0.111 0.099 0.088 0.078 0.025 0.015 0.003 15 0.16 0.14 0.123 0.108 0.095 0.084 0.074 0.065 0.035 0.02 0.011 0.006 0.002 16 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.028 0.015 0.008 0.005 0.002 17 0.125 0.108 0.093 0.08 0.069 0.06 0.052 0.045 0.023 0.012 0.006 0.003 0.001 18 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.018 0.009 0.005 0.002 0.001 19 0.098 0.083 0.07 0.06 0.051 0.043 0.037 0.031 0.014 0.007 0.002 0 20 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.012 0.005 0.003 0.002 0.001 0.001 0 0 25 0.047 0.038 0.03 0.024 0.02 0.016 0.013 0.01 0.004 0.001 0 0 30 0.026 0.02 0.015 0.012 0.009 0.007 0.005 0.004 0.001 0 0 0 0 40 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0 0 0 0 0 50 0.002 0.001 0.001 0.001 0 0 0 0 0 0 0 0 2% 3% 4% 6% 7% 9% 10% 11% 12% Exhibit 1 - Present Value of $1 Received at the End of Each Period for a Given Number of Time Periods (an Annuity) Period 1% 5% 8% 0.99 2 1 0.98 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 1.97 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.69 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.444 3.102 4 3.902 3.808 3.717 3.63 3.546 3.465 3.387 3.312 3.24 3.17 3.037 5 4.853 4.713 4.58 4.452 4.329 4.1 3.993 3.89 3.791 3.696 3.605 4.212 4.917 6 5.795 5.601 5.417 5.242 5.076 4.767 4.623 4.486 4.355 4.111 7 6.728 6.472 6.23 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.231 4.712 5.146 4.564 8 7.652 7.325 7.02 6.733 6.463 6.21 5.971 5.747 5.535 5.335 4.968 9 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 10 9.471 8.983 8.53 8.111 7.722 7.36 7.024 6.71 6.418 6.145 5.889 5.65 11 10.368 9.787 9.253 8.76 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.75 6.424 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 15 13.865 12.849 11.938 11.118 10.38 9.712 9.108 8.559 8.061 7.606 7.191 6.811 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.12 18 16.398 14.992 13.754 12.659 11.69 10.828 10.059 9.372 8.756 8.201 7.702 7.25 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.95 8.365 7.839 7.366 20 18.046 16.351 14.877 13.59 12.462 11.47 10.594 9.818 9.129 8.514 7.963 7.469 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 30 25.808 22.396 19.6 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 50 39.196 31.424 25.73 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 8.304 Period 13 1498 15% 16% 17% 18% 19% 20*2 25% 30% 35% 40% 50% 0.85 0.877 0.87 0.862 0.855 0.847 0.84 0.333 0.3 0769 0741 0714 0.667 2 1.666 1.647 1.626 1.605 1.585 1.666 1.547 1.528 1.44 1.36] 1289 1224 1.111 3 251 2322 2283 2246 221 2.17. 21- 2.106 1.952 1816 1.696 1.58 1.407 2972 2914 23.5 2798 2.743 2.68 2.639 2-29 2362 2166 1997 1.849 1.605 5 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.99] 2689 2.436 222 2.035 1.737 3.998 3.869 3.784 3.685 3.589 3.496 3.41 3.326 2951 2643 2385 2168 1.824 4.423 L288 2.16 4.039 3.922 3.812 3.706 3.E05 3.151 2802 2508 2263 1.883 4.799 4.629 ...87 4.344 4.207 4.078 3.954 3.837 3.329 2925 2598 2331 1.92 9 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.463 3.019 2665 2379 1.946 10 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 3.571 3.092 2.715 2414 1.965 11 5.87 SA-3 234 5.029 4. 836 4.6ES 4.4$ 27 366 3.147 2752 2438 1.977 12 5.918 5.66 5.421 5.197 4.938 4.611 4.439 3.725 3.19 2779 2466 1.98 4.793 4.91 13 6.122 5.842 5.583 5.342 5.118 4.715 4.533 3.78 3223 2.799 2.469 1.9 14 6.302 6.002 5. 724 5.468 5.229 5.003 4. 802 4.611 3.824 3249 2.814 2.478 1.993 15 6.462 6.142 5.347 5575 5.324 5.092 4.876 4.675 3.269 3268 2825 2484 1.995 6.604 265 5.954 5.E68 5.405 5.162 4.938 4.73 3.887 3263 2834 2489 1.997 17 679 6.373 6.047 5.749 5.475 5.222 49 4.775 3.91 3295 2.84 2.492 1.998 13 6.84 6.467 6.128 5.818 5.534 5.23 5.033 4.312 3928 3.304 2.844 2494 1.99 19 6.938 6.5 5. 198 5.877 5.584 5.316 5.07 4.343 3942 3.311 2848 2496 1.999 20 7.025 62-9 5.628 5.101 487 3.316 2.8 2497 1.999 6.623 6.873 5.929 | 6.097 5.363 5.467 3.954 3.965 25 7.33 6.46 5.766 5. 195 4.946 3329 2856 2.499 2 30 7.496 7.003 666 6.177 5.829 5.517 5235 4.979 3995 3.32 2857 25 2 40 7.634 7.105 E-42 6.233 5.871 5.548 5.28 1997 3999 3333 2857 25 50 7575 7.133 E. 661 6246 5.8 5. 554 5.262 A.999 a 3323 2857 25

Exhibit C

Exhibit C

Exhibit D

Exhibit D