Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help explain Basic NPV Calculation. Lawson is a UK based wine and spirits company. It seeks to create a fine wine division to enhance

Please help explain

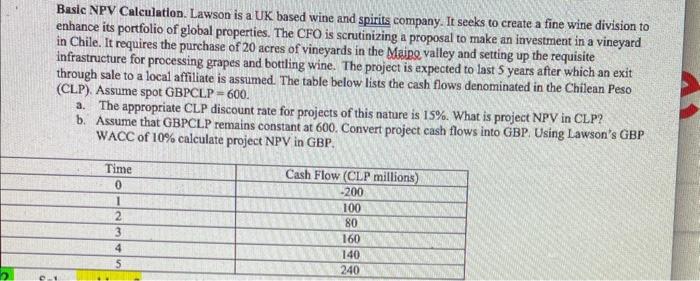

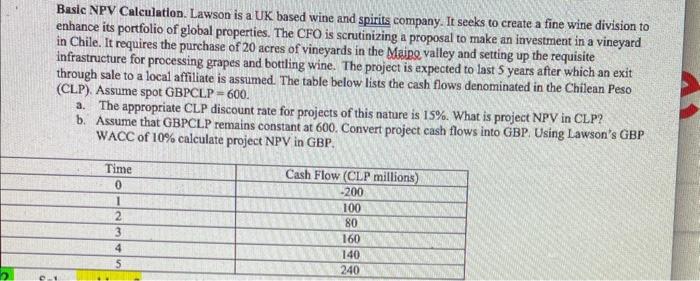

Basic NPV Calculation. Lawson is a UK based wine and spirits company. It seeks to create a fine wine division to enhance its portfolio of global properties. The CFO is scrutinizing a proposal to make an investment in a vineyard in Chile. It requires the purchase of 20 acres of vineyards in the Maipe valley and setting up the requisite infrastructure for processing grapes and bottling wine. The project is expected to last 5 years after which an exit through sale to a local affiliate is assumed. The table below lists the cash flows denominated in the Chilean Peso (CLP). Assume spot GBPCLP =600. a. The appropriate CLP discount rate for projects of this nature is 15%. What is project NPV in CLP? b. Assume that GBPCLP remains constant at 600 . Convert project cash flows into GBP. Using Lawson's GBP WACC of 10% calculate project NPV in GBP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started