Answered step by step

Verified Expert Solution

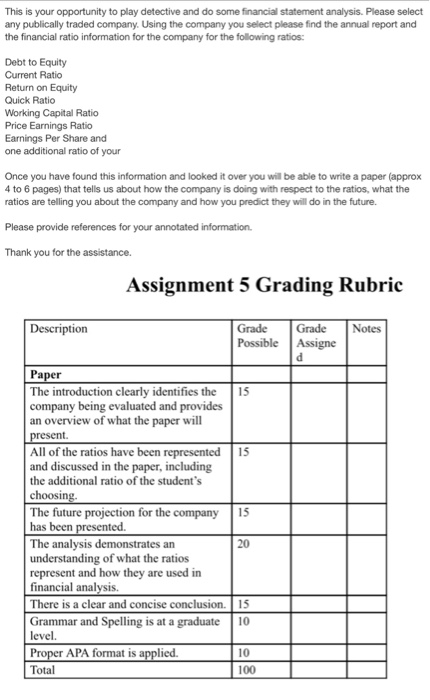

Question

1 Approved Answer

Please help explain on the numbers below how the company is doing. A page or two please to get me started. Once you have found

Please help explain on the numbers below how the company is doing. A page or two please to get me started.

Once you have found this information and looked it over you will be able to write a paper that tells us about how the company is doing with respect to the ratios, what the ratios are telling you about the company and how you predict they will do in the future.

Please provide references for your annotated information.

Thank you for the assistance.

I'm calculating the mentioned ratios for McDoanlds Corp (December 2015).

Current Ratio = Current Assets / Current Liabilities=> 9,643,000/2,950,450 = 3.268315

Acid Test Ratio (Quick Ratio) = (Current assets Inventory) / Current Liabilities=> (9,643,000- 100,100) / 2,950,450 = 3.234388

Account Receivable Turnover = Sales/Account Receivable=> 25,413,000/1,298,700 = 19.56803

Average Collection Period = 365/ Account Receivable Turnover=> 365/19.56803 = 18.65287

Inventory Turnover = Cost of Goods sold / Average InventoryCost of Goods sold = Cost of Revenue = 15,623,800

Average Inventory = (Inventory of 2014 + Inventory of 2015)/2 = (110,000+100,100)/2 = 105,050Inventory Turnover = 15,623,800/105,050 = 148.7272

Debt Ratio = Total Liabilities / Total Assets=> 30,850,800/37,938,700 = 0.8131749

Times Interest Earned = EBIT / Interest Expense=>As no intereset expense mentioned in the balance sheet, we can't calculate it.

Total Asset Turnover = Revenue / Total Assets=> 25,413,000/37,938,700 = 0.6698437

Fixed Asset Turnover = Revenue / Net Fixed Asset=> 25,413,000/(37,938,700 - 9,643,000) = 0.8981223

Gross Profit Margin = Gross Profit / Revenue=> 9,789,200/25,413,000 = 0.3852044

Operating Profit Margin = Operating Profit / Revenue=> 7,145,500/25,413,000 = 0.2811749

Net Profit Margin = Net Profit / Revenue=> 4,529,300/25,413,000 = 0.1782276

Operating Return on Assets = EBIT / Average Total Assets [Average total assets = (Assets of 2014 + Assets of 2015)/2]=> 6,555,700 / (37,938,700 + 34,227,400)/2 = 0.1816836

ROE = Net Income / Shareholder's equity=> 4,529,300/7,087,900 = 0.6390186

P/E Ratio = (Number of shares x current price)/Net Income=>(16,600*$128.83) / 4,529,300 = 0.472165

Market to book-value = Market Value of shares / Book value of shares=> (16600*128.83) / 7,087,900 = 0.3017223

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started