please help

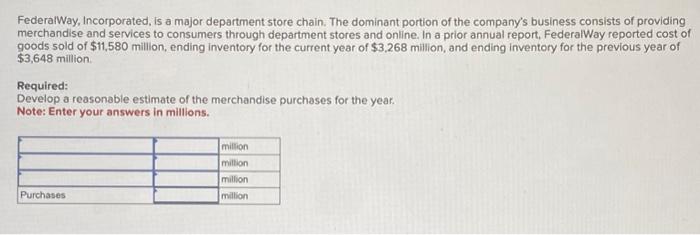

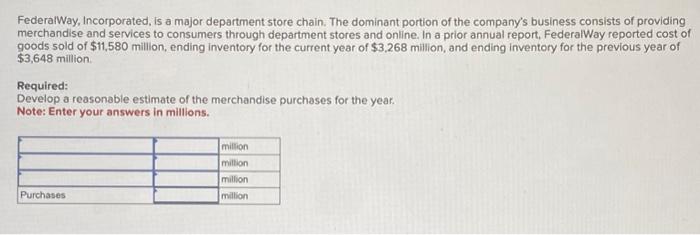

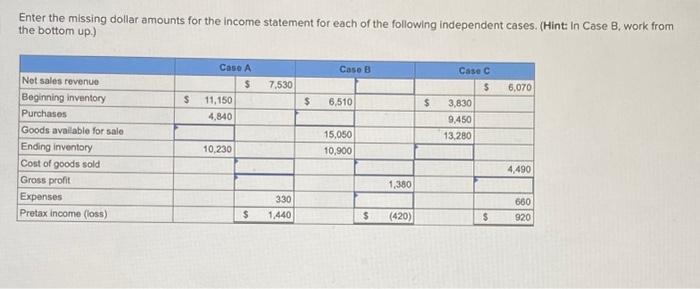

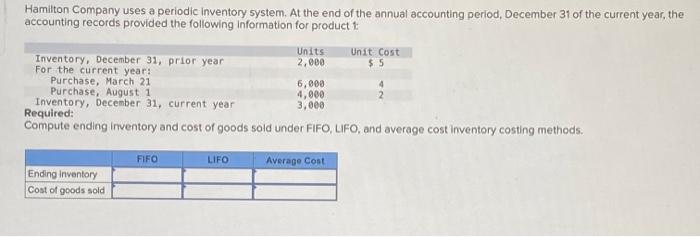

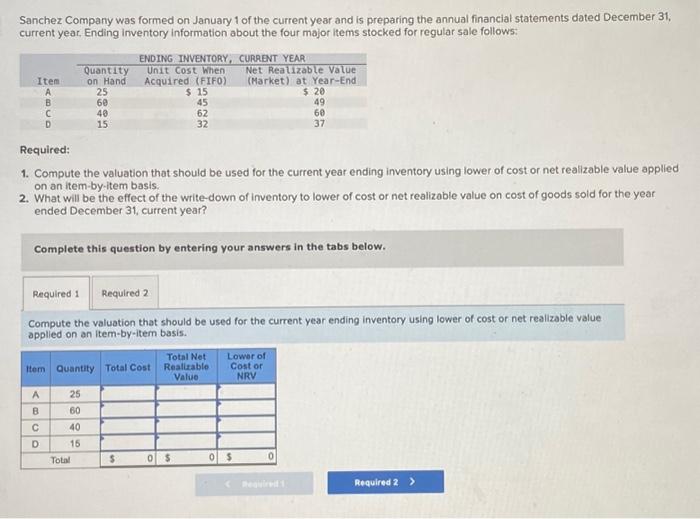

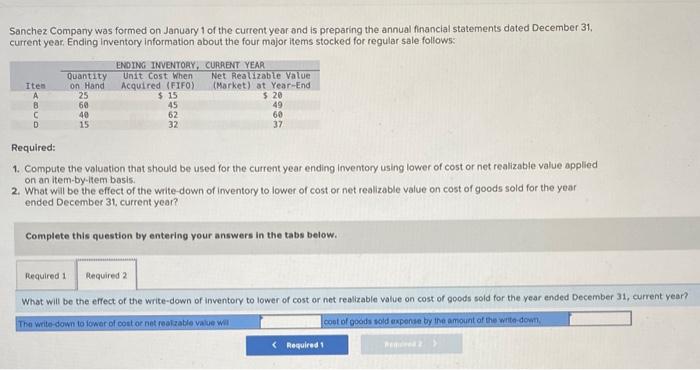

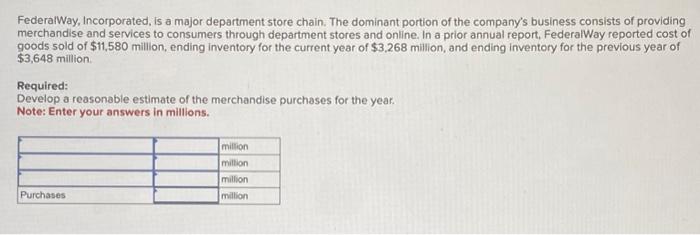

FederalWay, Incorporated, is a major department store chain. The dominant portion of the company's business consists of providing merchandise and services to consumers through department stores and online. In a prior annual report, FederalWay reported cost of goods sold of $11,580 million, ending inventory for the current year of $3,268 million, and ending inventory for the previous year of $3,648 million. Required: Develop a reasonable estimate of the merchandise purchases for the year. Note: Enter your answers in millions. Enter the missing dollar amounts for the income statement for each of the following independent cases. (Hint: In Case B, work from the bottom up.) Hamilton Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product : Compute ending imventory and cost of goods sold under FIFO, LIFO, and average cost inventory costing methods. Sanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31 , current year, Ending inventory information about the four major items stocked for regular sale follows: Required: 1. Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31 , current year? Complete this question by entering your answers in the tabs below. Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. Sanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31. current year: Ending inventory information about the four major items stocked for regular sale follows: Required: 1. Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31 , current year? Complete this question by entering your answers in the tabs below