please help fill in any blue amounts possible

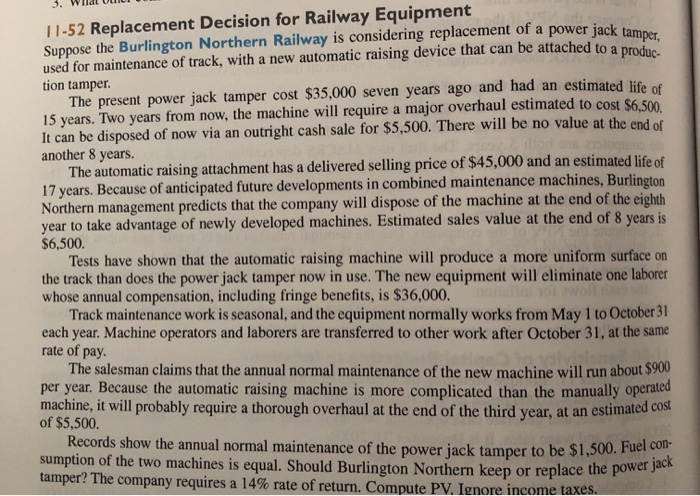

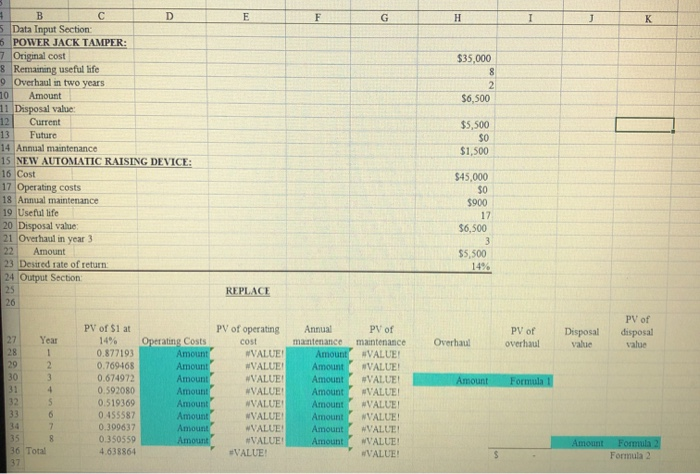

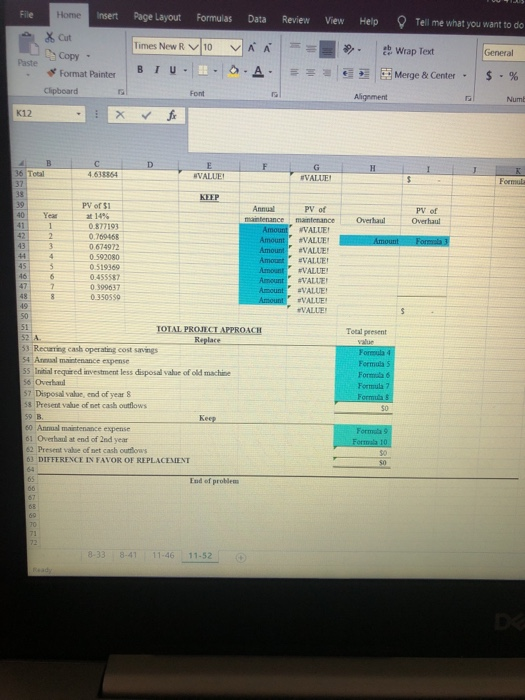

11-52 Replacement Decision for Railway Equipment used for maintenance of track, with a new automatic raising device that can be attached to a produc- Suppose the Burlington Northern Railway is considering replacement of a power jack tamper, tion tamper The present power jack tamper cost $35,000 seven years ago and had an estimated life of 15 years. Two years from now, the machine will require a major overhaul estimated to cost $6,500 It can be disposed of now via an outright cash sale for $5,500. There will be no value at the end of another 8 years. The automatic raising attachment has a delivered selling price of $45,000 and an estimated life of 17 years. Because of anticipated future developments in combined maintenance machines, Burlington Northern management predicts that the company will dispose of the machine at the end of the eighth year to take advantage of newly developed machines. Estimated sales value at the end of 8 years is $6,500. Tests have shown that the automatic raising machine will produce a more uniform surface on the track than does the power jack tamper now in use. The new equipment will eliminate one laborer whose annual compensation, including fringe benefits, is $36,000. Track maintenance work is seasonal, and the equipment normally works from May 1 to October 31 each year. Machine operators and laborers are transferred to other work after October 31, at the same rate of pay. The salesman claims that the annual normal maintenance of the new machine will run about $900 per year. Because the automatic raising machine is more complicated than the manually operated machine, it will probably require a thorough overhaul at the end of the third year, at an estimated cost of $5,500 Records show the annual normal maintenance of the power jack tamper to be $1,500. Fuel com sumption of the two machines is equal. Should Burlington Northern keep or replace the power jack tamper? The company requires a 14% rate of return. Compute PV. Ignore income taxes. TE E F G H 1 J K $35,000 8 2 $6,500 $5,500 $0 $1,500 B D 5 Data Input Section 6 POWER JACK TAMPER: 7 Original cost 8 Remaining useful life 9 Overhaul in two years 10 Amount 11 Disposal value 12 Current 13 Future 14 Annual maintenance 15 NEW AUTOMATIC RAISING DEVICE: 16 Cost 17 Operating costs 18 Annual maintenance 19 Useful life 20 Disposal value 21 Overhaul in year 3 22 Amount 23 Desired rate of return 24 Output Section 25 26 $45,000 $0 $900 17 $6,500 3 $5,500 14% REPLACE PV of $1 at PV of overhaul Overhaul PV of disposal value Disposal value 1 Amount Formula 1 27 Year 28 29 2 30 3 31 4 32 5 33 6 7 35 8 36 Total 37 0.877193 0.769-168 0.674972 0.592080 0.519369 0.455587 0.309637 0.350559 4.638864 Operating costs Amount Amount Amount Amount Amount Amount Amount Amount PV of operating Annual cost maintenance WVALUE! Amount WVALUE! Amount WVALUE! Amount WVALUE Amount WVALUE Amount WVALUE Amount WVALUE Amount #VALUE! Amount #VALUE PV of maintenance #VALUE! #VALUE! VALUE #VALUE! VALUE WVALUE! #VALUE! WVALUE WVALUE! Amount Formula Formula 2 File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Times New R V10 VA Wrap Text General Paste of out Copy Format Painter Clipboard BLU- a A Merge & Center - $ - % Font Alignment Numb K12 I #VALUE! $ Formu KEEP Overhaul PV of Overhaul Amount Form 3 B D F 36 Total #VALUE! 37 38 39 PV of $1 Annual 40 Year at 14% maintenance 41 1 0.877193 Amount 42 2 0.769-463 Amount 43 3 0.674972 Amount 44 4 0.592080 Amount 45 3 0.519360 Aumont 46 6 0.455532 Amount 7 0.399637 Amount 48 8 0.350550 Amount 449 SO 51 TOTAL PROJECT APPROACH 52 A Replace 53 Recurring cash operating cost savings 54 Amal maintenance espense SS Initial required investment less disposal value of old machine 56 Overhaul 57 Disposal value, end of year 8 58 Present value of net cash outflows 59 B 60 Annual maintenance expense 01 Overhaul at end of 2nd year 62 Presentate of net cash outflows 63 DIFFERENCE IN FAVOR OF REPLACEMENT PV of maintenance WVALUE! #VALUE #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! VALLEI $ Tocal present Formula 4 Formula Forma Formula Formula 50 Keep Formu Formula 10 50 End of problem 03 06 67 69 70 71 8-33 11-46 11.52