Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help fill in the blank boxes with an explanation of how you got each answer. The last 2 drop down bars say yeso and

Please help fill in the blank boxes with an explanation of how you got each answer. The last 2 drop down bars say yeso and is enough/is not enough. I just need all of the boxes filled in.

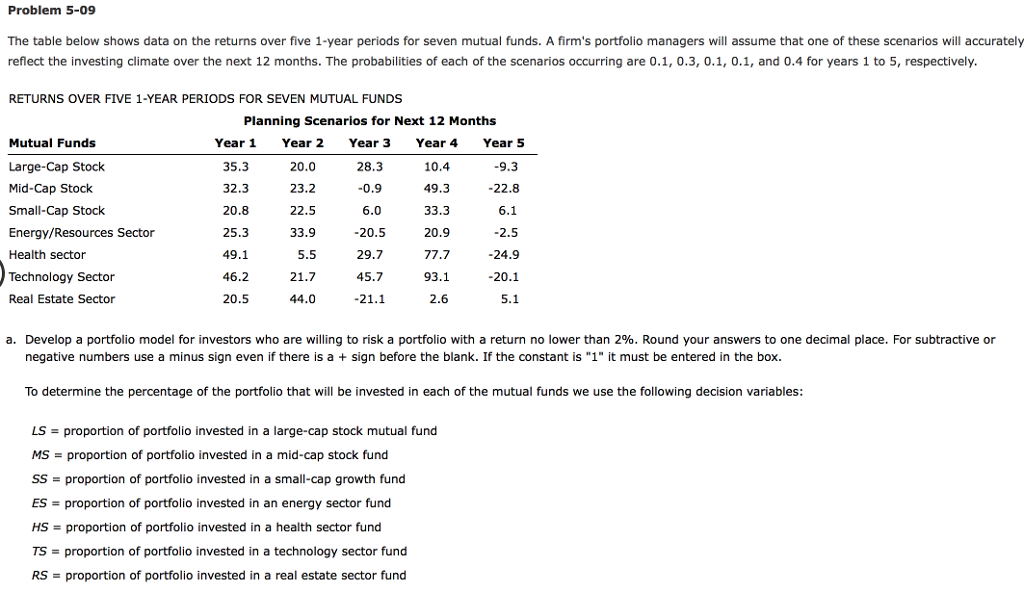

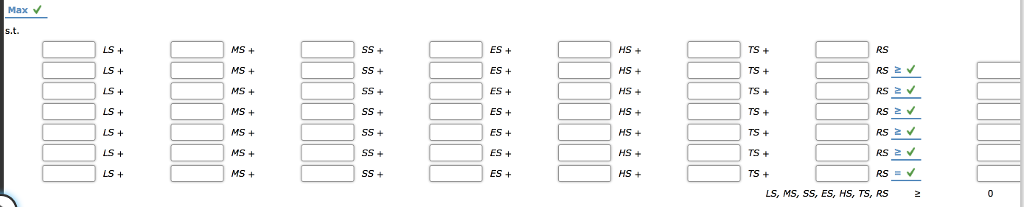

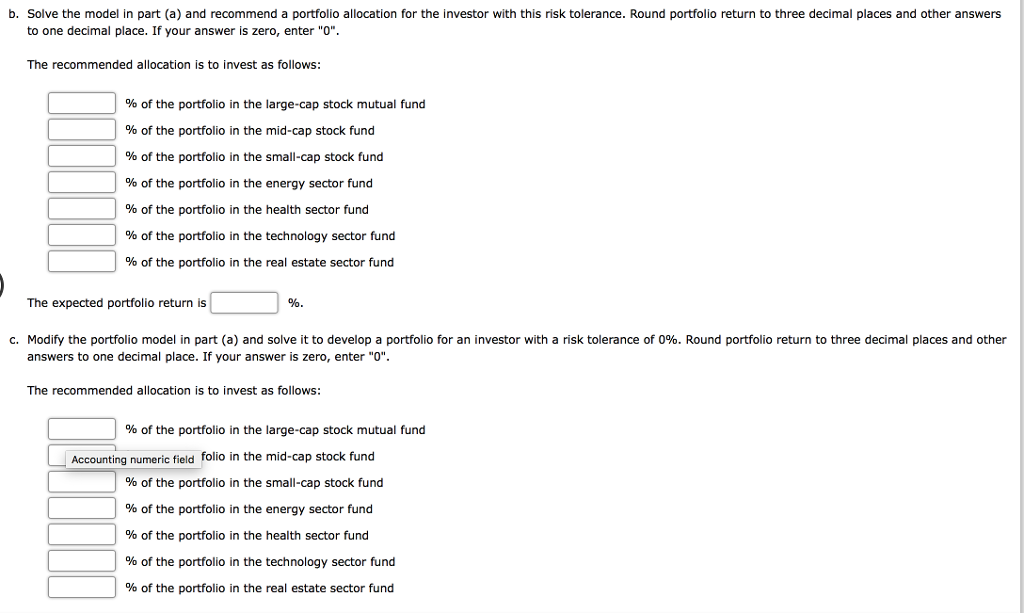

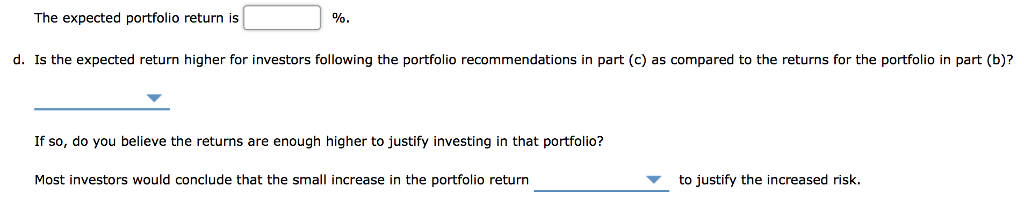

Problem 5-09 The table below shows data on the returns over five 1-year periods for seven mutual funds. A firm's portfolio managers will assume that one of these scenarios will accurately reflect the investing climate over the next 12 months. The probabilities of each of the scenarios occurring are 0.1, 0.3, 0.1, 0.1, and 0.4 for years 1 to 5, respectively RETURNS OVER FIVE 1-YEAR PERIODS FOR SEVEN MUTUAL FUNDS Planning Scenarios for Next 12 Months Mutual Funds Large-Cap Stock Mid-Cap Stock Small-Cap Stock Energy/Resources Sector Health sector Technology Sector Real Estate Sector Year 1 Year 2 Year 3 Year 4 Year5 35.3 32.3 20.8 25.3 49.1 46.2 20.5 20.0 23.2 22.5 33.9 5.5 21.7 44.0 10.4 49.3 33.3 20.9 77.7 93.1 2.6 9.3 -0.9 6.0 20.5 29.7 45.7 -21.1 -22.8 2.5 24.9 -20.1 5.1 a. Develop a portfolio model for investors who are willing to risk a portfolio with a return no lower than 2%. Round your answers to one decimal place. For subtractive or negative numbers use a minus sign even if there is asign before the blank. If the constant is "1" it must be entered in the box. To determine the percentage of the portfolio that will be invested in each of the mutual funds we use the following decision variables LS- proportion of portfolio invested in a large-cap stock mutual fund MS-proportion of portfolio invested in a mid-cap stock fund ss- proportion of portfolio invested in a small-cap growth fund ES- proportion of portfolio invested in an energy sector fund HS = proportion of portfolio invested in a health sector fund TS-proportion of portfolio invested in a technology sector fund RS-proportion of portfolio invested in a real estate sector fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started