PLEASE HELP! Financial Accounting Problem!!!!

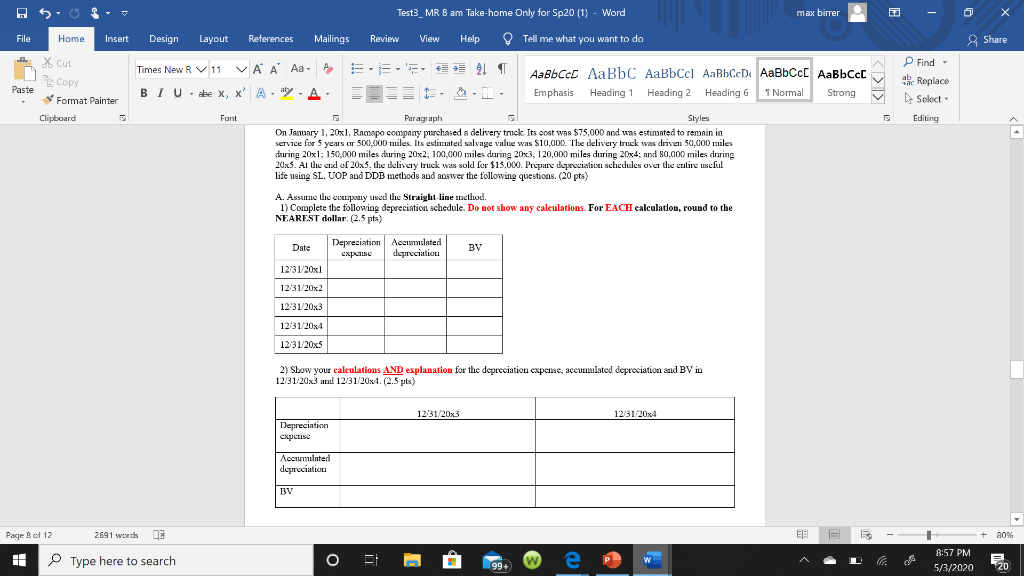

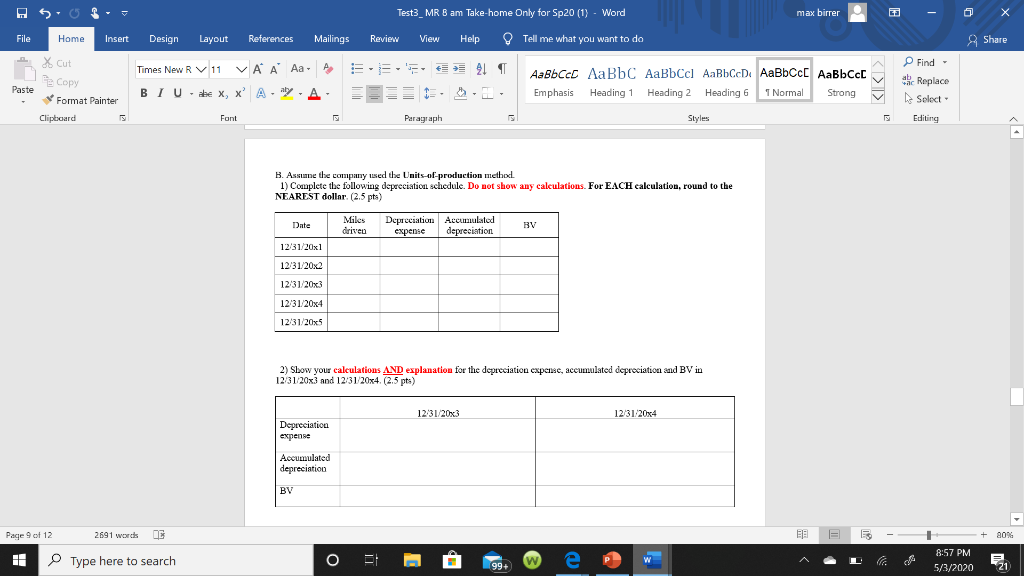

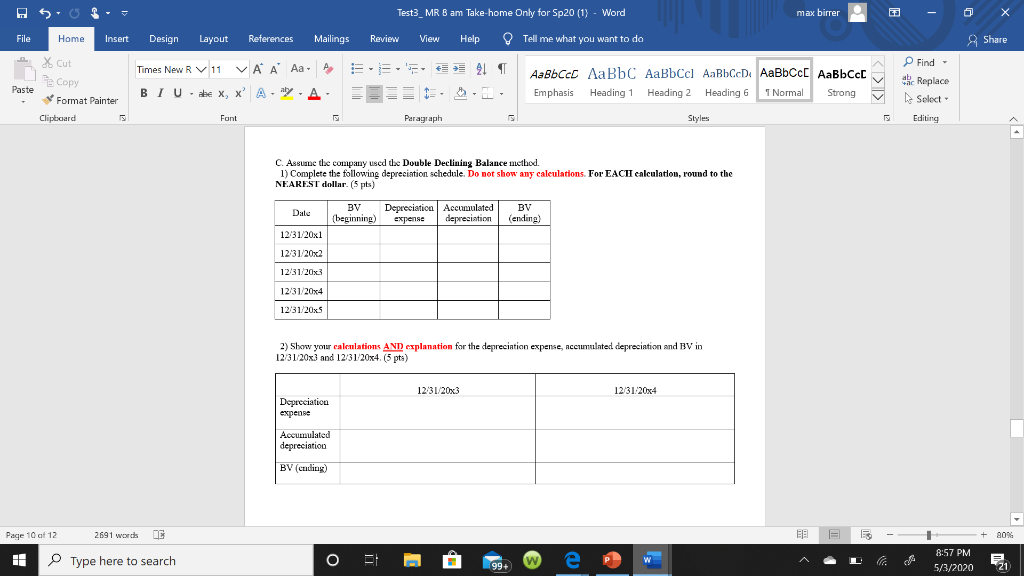

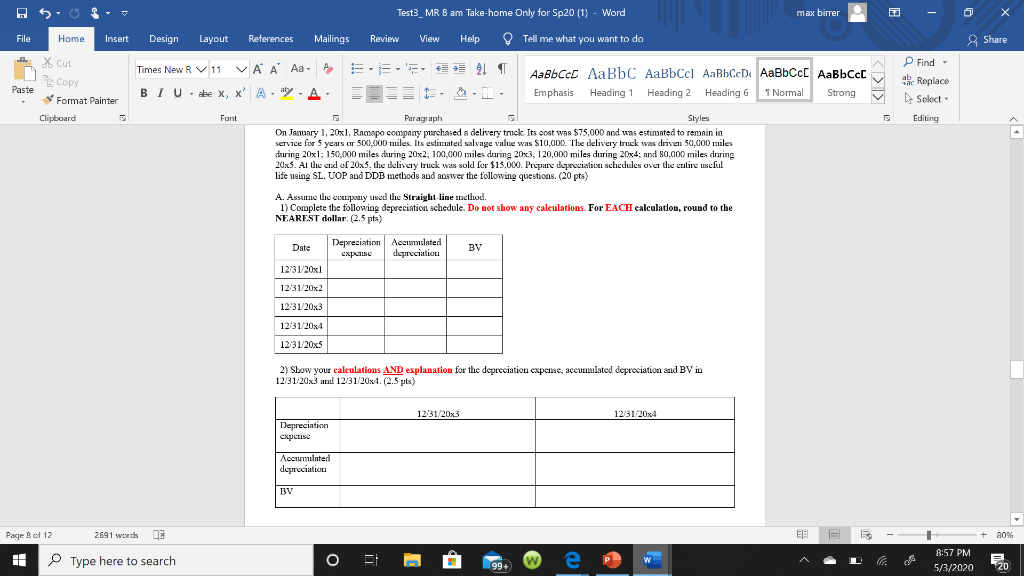

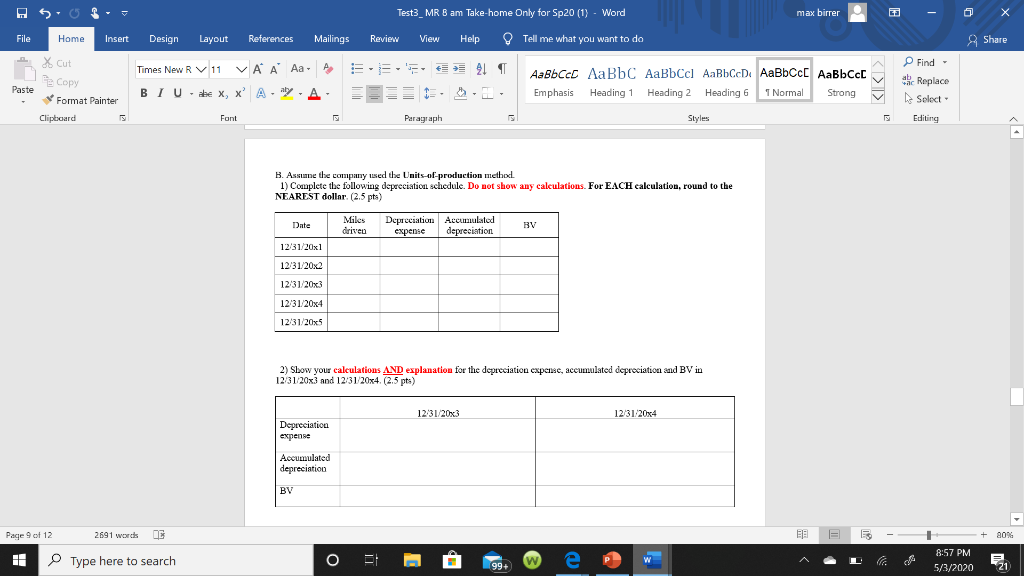

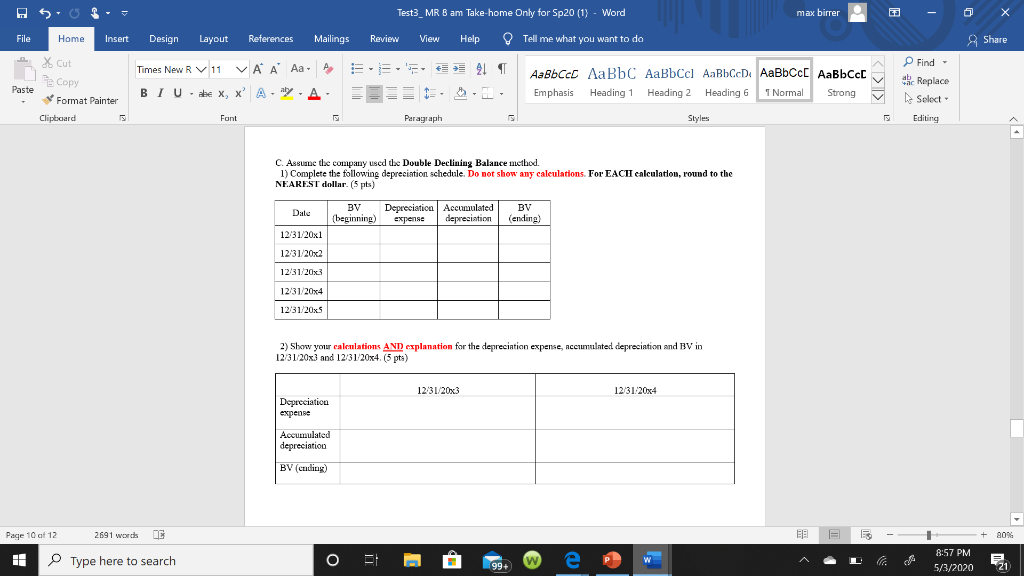

Test3_MR B am Take-home Only for Sp20 (1) - Word max birrer - 0 X Share File Insert Design Layout References Mailings Review View Help Tell me what you want to do Home X Cut A 3. 21 Copy Times New R V 11 VA A Aa BIU - * X, X Aay. A Aabbccc AaBb C AaBbCcl AaBbCcDc AaBbCcL AaBbCcc Emphasis Heading 1 Heading 2 Heading 6 T Normal Strong P Find - ab Replace Select Paste Format Painter Clipboard Font 5 Editing Paragraph Styles On January 1, 20x1, Ramapo company purchased a delivery truck Its coat was $75,000 and was estimated to remain in service for 5 years or 50X),000 miles. Its estunted salvage value was $10,000). The delivery truck was driven 50.000 miles during 20x1: 150,000 miles during 20x2,100,000 miles during 20x3, 120,000 miles during 20x4; and 80,000 miles during 20x3. Ale do 20x S. Uue delivery trusk w old for $15,000. Prepare greciation schedules over de cutire useful life using SL. UOP od DDB methods and answer the following questions. (20 pta) A. Assume the only used the Straight line nethod. 1) Complete the following depreciation schedule. Do not show any calculations. For EACH calculation, round to the NEAREST dollar. (2.5 pts) Date Depreciation expuse Accumulated deciation BV 12/31/2011 12/31/20x2 12/31/20x3 12/31/20x4 1231/20x5 2) Slow your calculations AND explanation for the depreciation expense, accumulated depreciation and BV in 1231/20x3 and 123120x4. (2.5 pls) 12/31/20x3 12/3120x4 Depreciation CXPCESO Accumulated deureciation Page 9 of 12 2691 words E 9 - + 20% 11 Type here to search A L 8:57 PM S 5/3/2020 20 Test3_MR B am Take-home Only for Sp20 (1) - Word max birrer - 0 X Share Insert Design Layout References Mailings Review View Help Tell me what you want to do File - Paste Home X Cut 3.' 41 P Find - e Copy Times New R V 11 VA A Aa. BIU - *ex, x' Aaly - A AaBbcec Aa Bbc AaBbCcl AaBbcc AaBbccc AaBbccc Emphasis Heading 1 Heading 2 Heading 6 T Normal Strong - Select Format Painter Clipboard Font Paragraph Styles 5 Editing B. Assume the company used the Units-of-production method 1) Complete the following depreciation schedule. Do not show any calculations. For EACH calculation, round to the NEAREST dollar (2.5 pts) Date Miles driven Depreciation expense Accumulated depreciation BV 12/31/20x1 12/31/20x2 12/31/20x3 12/31/20x4 12/31/20x5 2) Slow your calculations AND explanation for the depreciation expense, accumulated depreciation and BV in 12/31/20x3 and 12/31/20x4. (2.5 pts) 12/31/20x3 12/3120x4 Depreciation expense Accumulated depreciation Page 9 of 12 2691 words E 9 - + 20% 11 Type here to search O 8:57 PM EL O 199W A e L 5/3/2020 21 Test3_MR B am Take-home Only for Sp20 (1) - Word max birrer - 0 X Share Insert Design Layout References Mailings Review View Help Tell me what you want to do File - Paste Home X Cut ^ 41 P Find - e Copy Times New R V 11 VA A Aa BIUtex, x Aay. A .'. DE AaBbcec Aa Bbc AaBbCcl AaBbcc AaBbccc AaBbccc Emphasis Heading 1 Heading 2 Heading 6 T Normal Strong Select Format Painter Clipboard Font Paragraph Styles 5 Editing C. Assuane the company used the Double Declining Balance method. 1) Complete the following depreciation schedule. Do not show any calculations. For EACH calculation, round to the NEAREST dollar (5 pts) Dale BV (beginning) Depreciation expense Accumulated depreciation BV (ending) 12/31/20x1 12/31/20x2 12/31/20x3 12/31/20x4 12/31/20x5 2) Show your calculations AND explanation for the depreciation expense, Accumulated depreciation and BV in 123120x3 and 12/31/20x4. (5 pta) 12:31/20x3 12/31/20x4 Depreciation expense Accumulated depreciation BV (ending) 2691 words E 9 - + 20% Page 10 of 12 11 Type here to search A L 8:57 PM 5/3/2020 21