Answered step by step

Verified Expert Solution

Question

1 Approved Answer

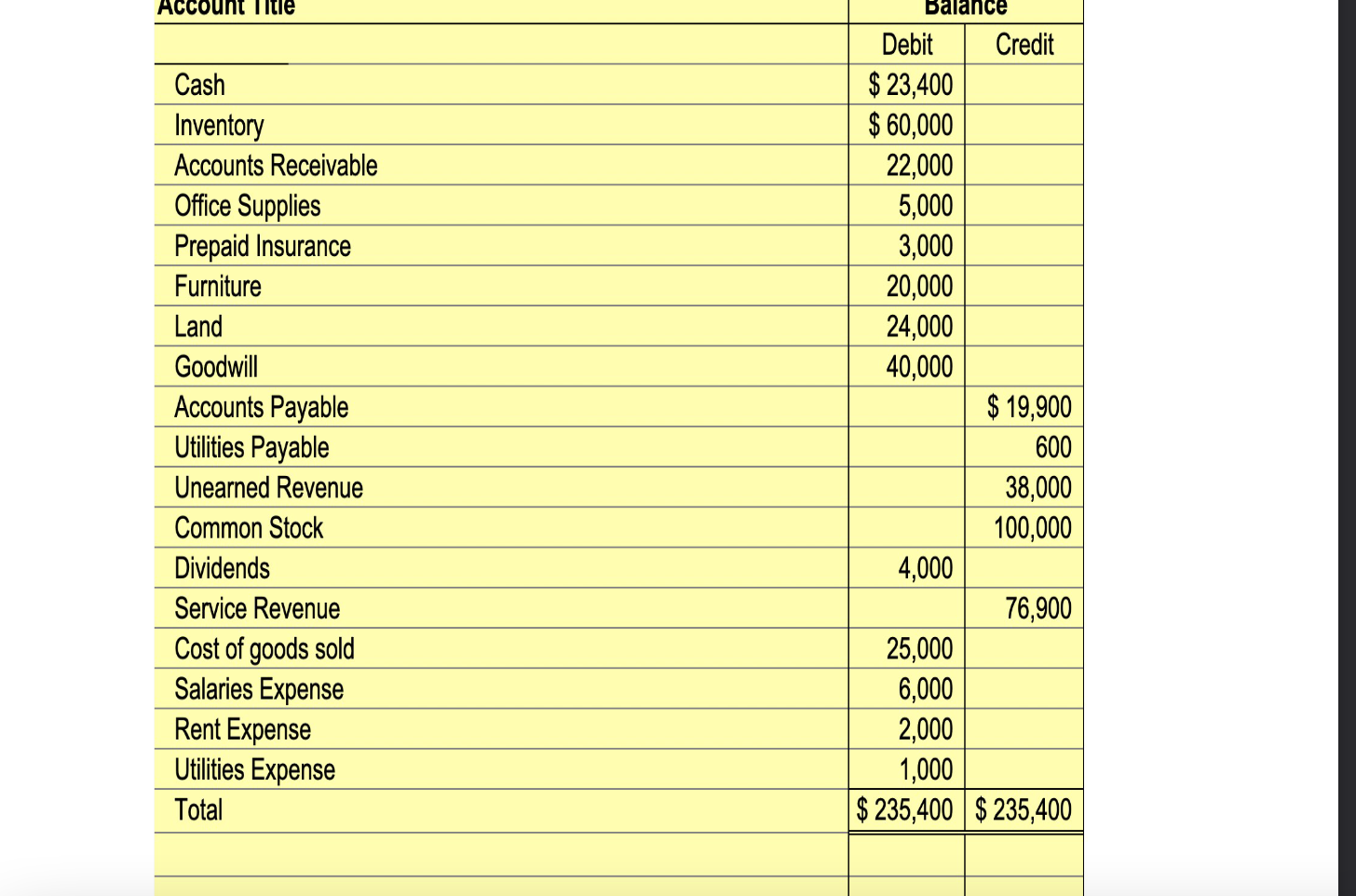

Please help find these three answers Thank you begin{tabular}{|l|r|r|} hline & multicolumn{1}{c|}{ Debit } & Credit hline Cash & $23,400 & hline Inventory

Please help find these three answers

Thank you

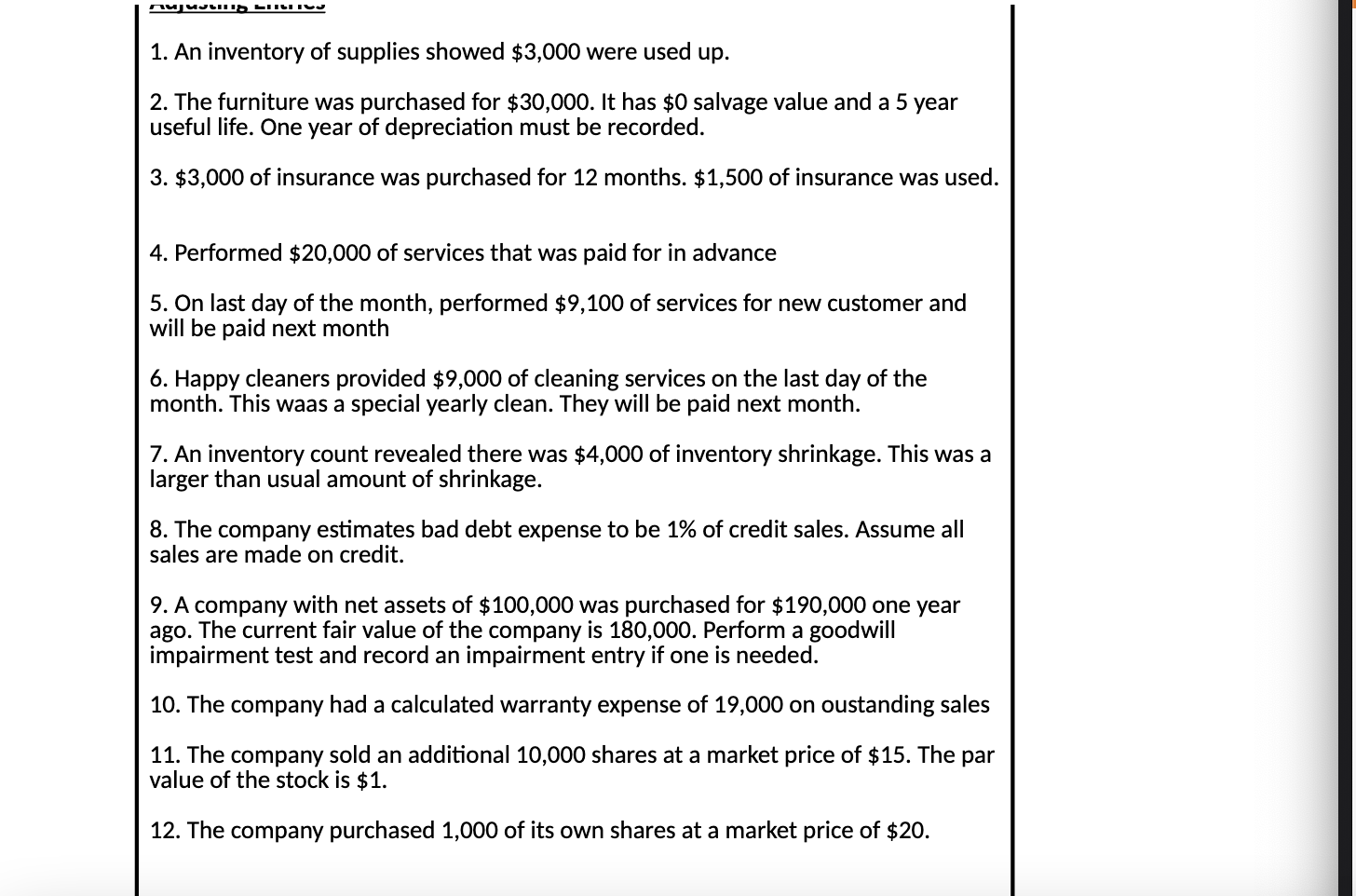

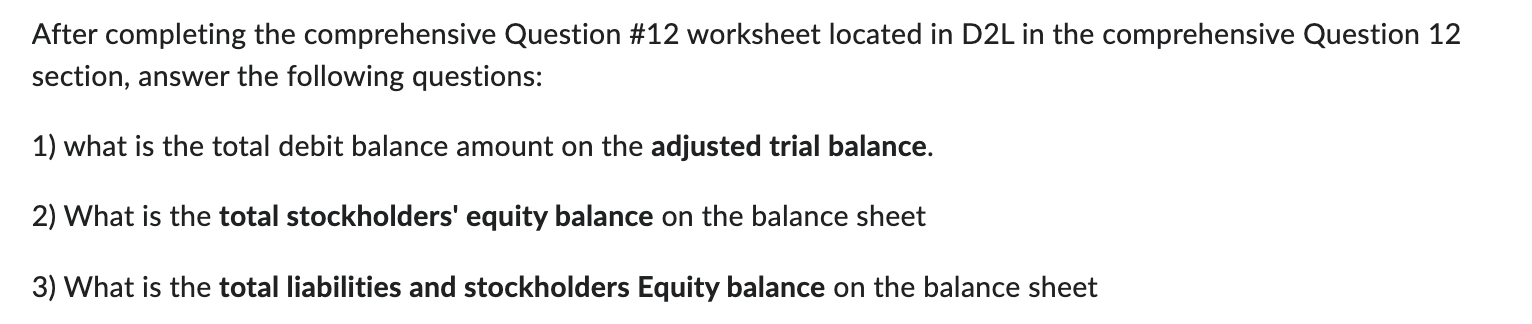

\begin{tabular}{|l|r|r|} \hline & \multicolumn{1}{c|}{ Debit } & Credit \\ \hline Cash & $23,400 & \\ \hline Inventory & $60,000 & \\ \hline Accounts Receivable & 22,000 & \\ \hline Office Supplies & 5,000 & \\ \hline Prepaid Insurance & 3,000 & \\ \hline Furniture & 20,000 & \\ \hline Land & 24,000 & \\ \hline Goodwill & 40,000 & \\ \hline Accounts Payable & & $19,900 \\ \hline Utilities Payable & & 600 \\ \hline Unearned Revenue & & 38,000 \\ \hline Common Stock & & 100,000 \\ \hline Dividends & 4,000 & \\ \hline Service Revenue & & 76,900 \\ \hline Cost of goods sold & 25,000 & \\ \hline Salaries Expense & 6,000 & \\ \hline Rent Expense & 2,000 & \\ \hline Utilities Expense & 1,000 & \\ \hline Total & $235,400 & $235,400 \\ \hline & & \\ \hline \end{tabular} 1. An inventory of supplies showed $3,000 were used up. 2. The furniture was purchased for $30,000. It has $0 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,500 of insurance was used. 4. Performed $20,000 of services that was paid for in advance 5. On last day of the month, performed $9,100 of services for new customer and will be paid next month 6. Happy cleaners provided $9,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,000 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 1% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $190,000 one year ago. The current fair value of the company is 180,000 . Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 19,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $15. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $20. After completing the comprehensive Question \#12 worksheet located in D2L in the comprehensive Question 12 section, answer the following questions: 1) what is the total debit balance amount on the adjusted trial balance. 2) What is the total stockholders' equity balance on the balance sheet 3) What is the total liabilities and stockholders Equity balance on the balance sheet \begin{tabular}{|l|r|r|} \hline & \multicolumn{1}{c|}{ Debit } & Credit \\ \hline Cash & $23,400 & \\ \hline Inventory & $60,000 & \\ \hline Accounts Receivable & 22,000 & \\ \hline Office Supplies & 5,000 & \\ \hline Prepaid Insurance & 3,000 & \\ \hline Furniture & 20,000 & \\ \hline Land & 24,000 & \\ \hline Goodwill & 40,000 & \\ \hline Accounts Payable & & $19,900 \\ \hline Utilities Payable & & 600 \\ \hline Unearned Revenue & & 38,000 \\ \hline Common Stock & & 100,000 \\ \hline Dividends & 4,000 & \\ \hline Service Revenue & & 76,900 \\ \hline Cost of goods sold & 25,000 & \\ \hline Salaries Expense & 6,000 & \\ \hline Rent Expense & 2,000 & \\ \hline Utilities Expense & 1,000 & \\ \hline Total & $235,400 & $235,400 \\ \hline & & \\ \hline \end{tabular} 1. An inventory of supplies showed $3,000 were used up. 2. The furniture was purchased for $30,000. It has $0 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,500 of insurance was used. 4. Performed $20,000 of services that was paid for in advance 5. On last day of the month, performed $9,100 of services for new customer and will be paid next month 6. Happy cleaners provided $9,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,000 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 1% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $190,000 one year ago. The current fair value of the company is 180,000 . Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 19,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $15. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $20. After completing the comprehensive Question \#12 worksheet located in D2L in the comprehensive Question 12 section, answer the following questions: 1) what is the total debit balance amount on the adjusted trial balance. 2) What is the total stockholders' equity balance on the balance sheet 3) What is the total liabilities and stockholders Equity balance on the balance sheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started