Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help finishing this! thanks! Exercise 11-7A (Static) Cash dividends for preferred and common shareholders LO 11-3 Weaver Corporation had the following stock issued and

please help finishing this! thanks!

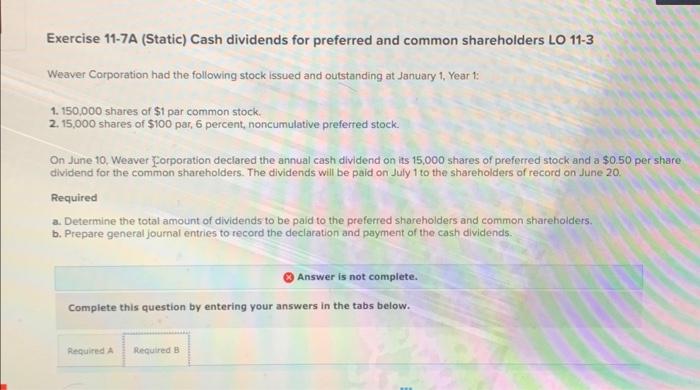

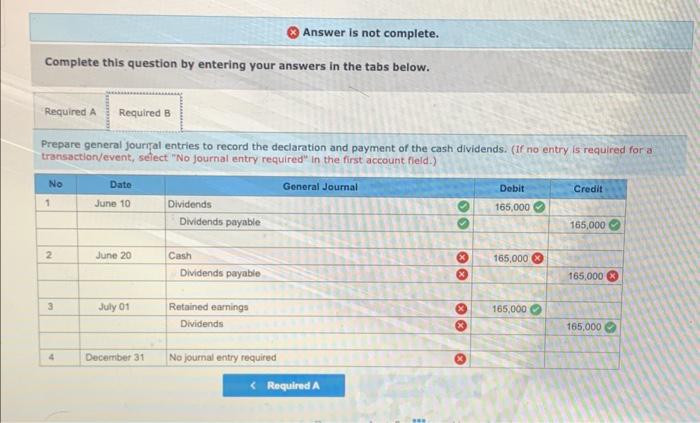

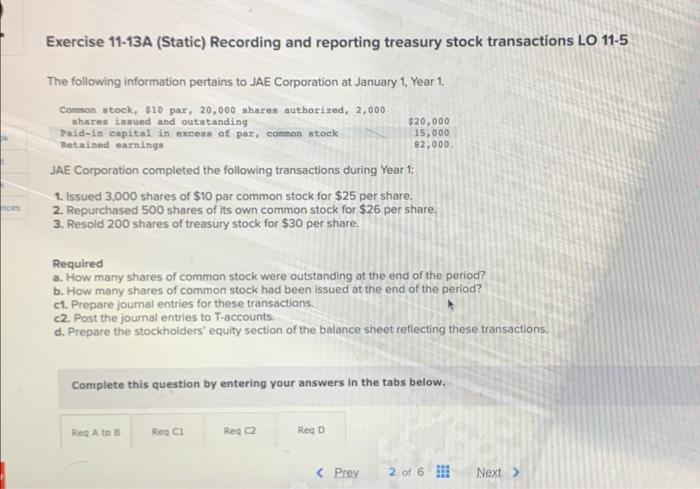

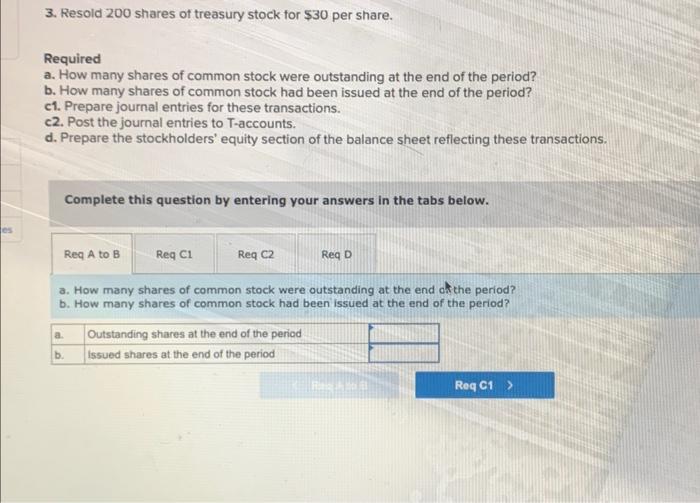

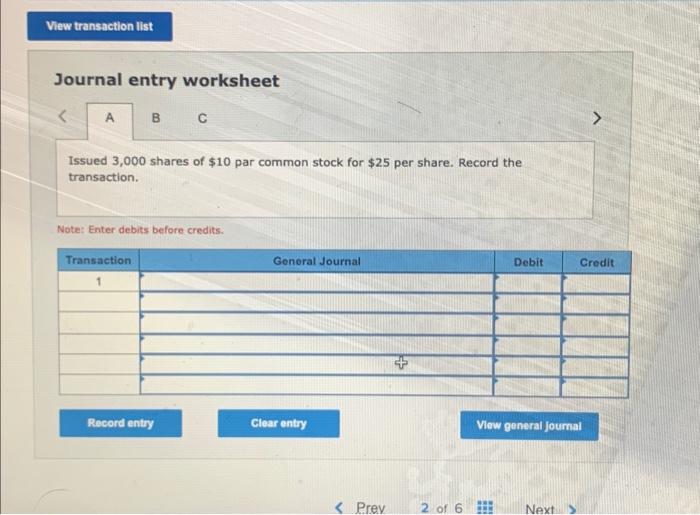

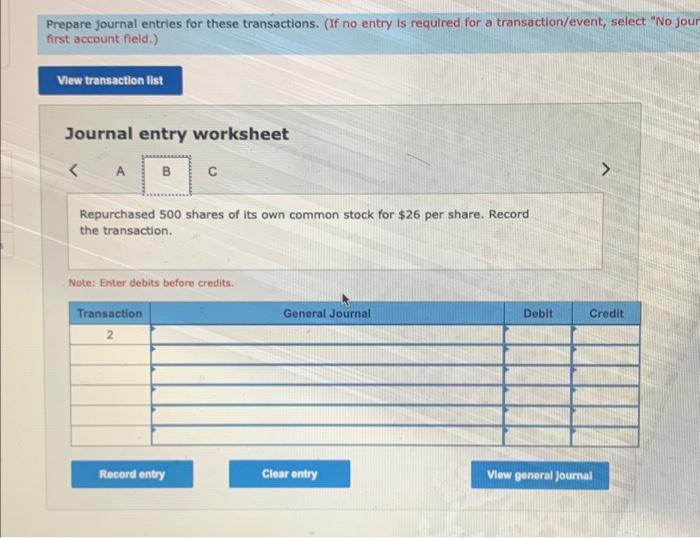

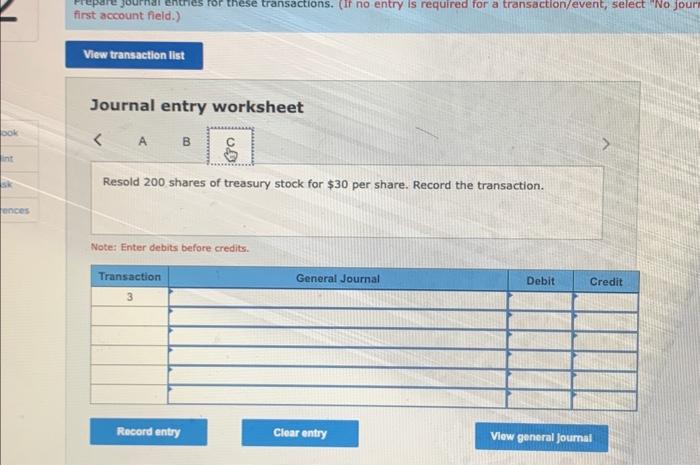

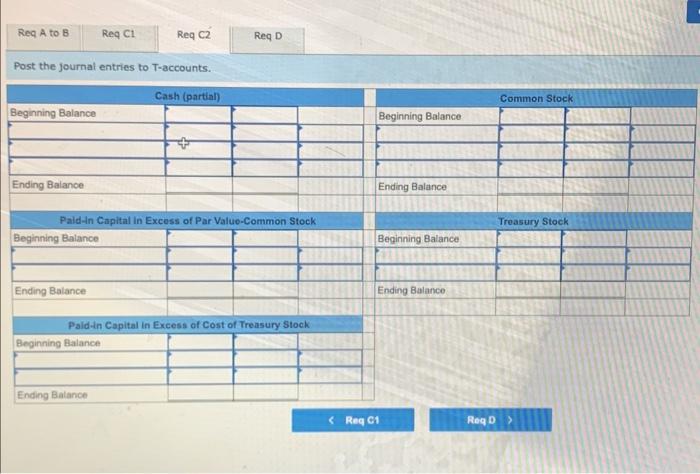

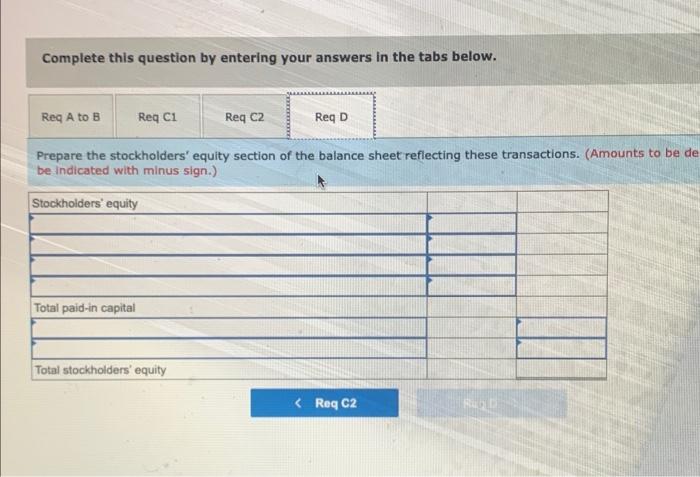

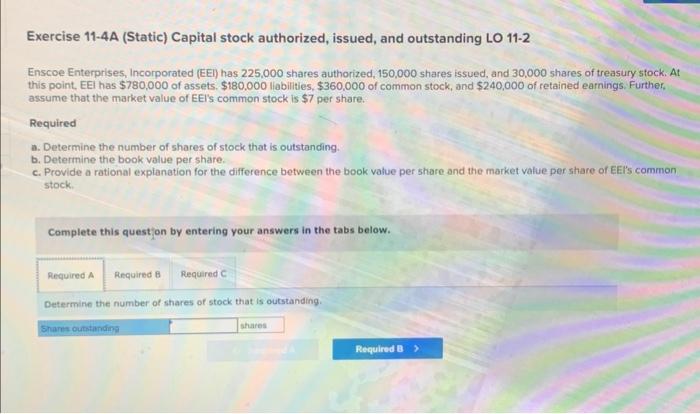

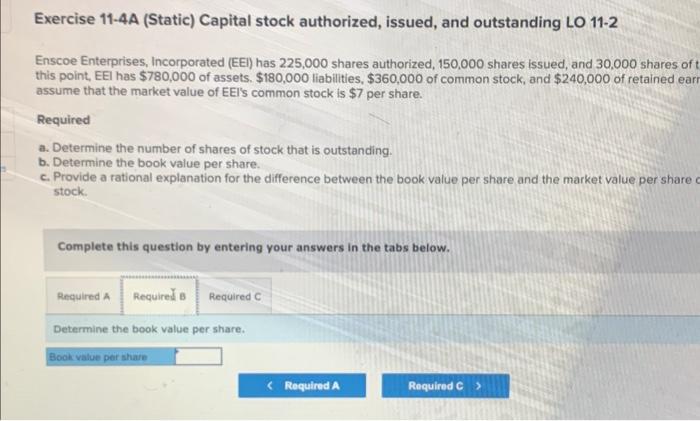

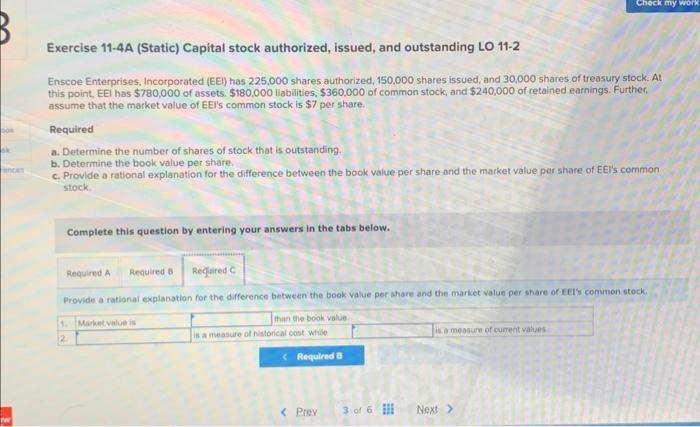

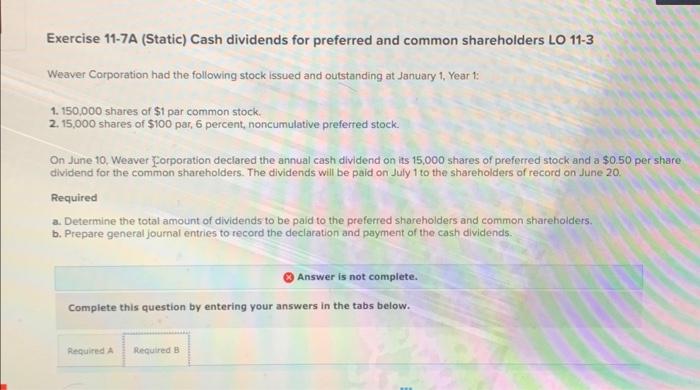

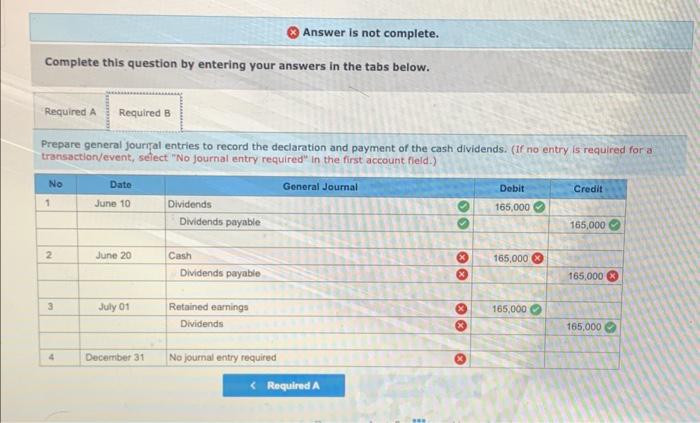

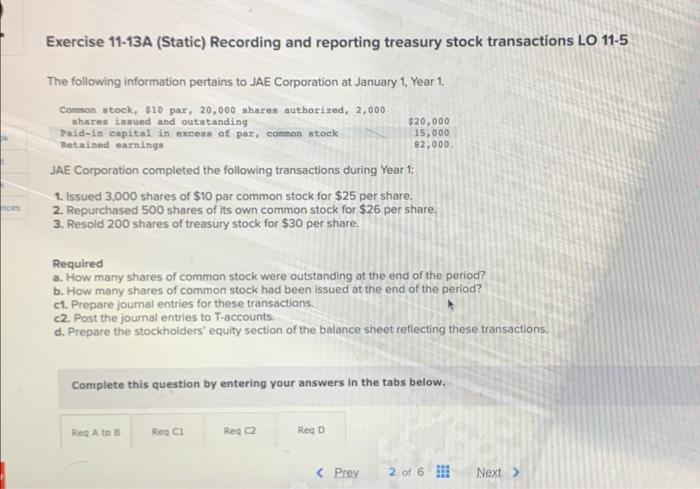

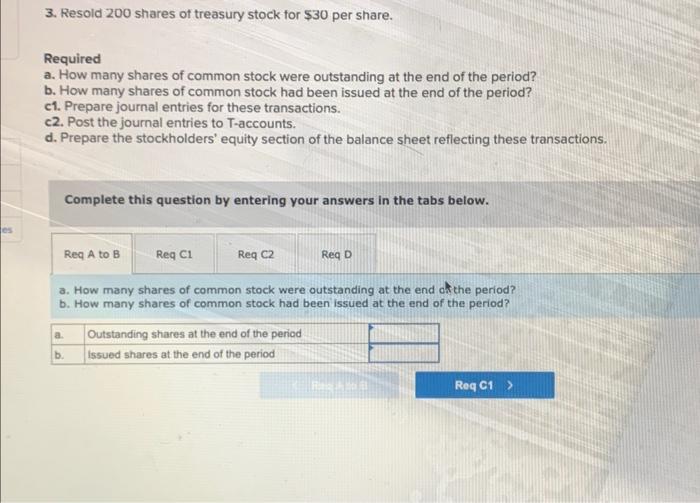

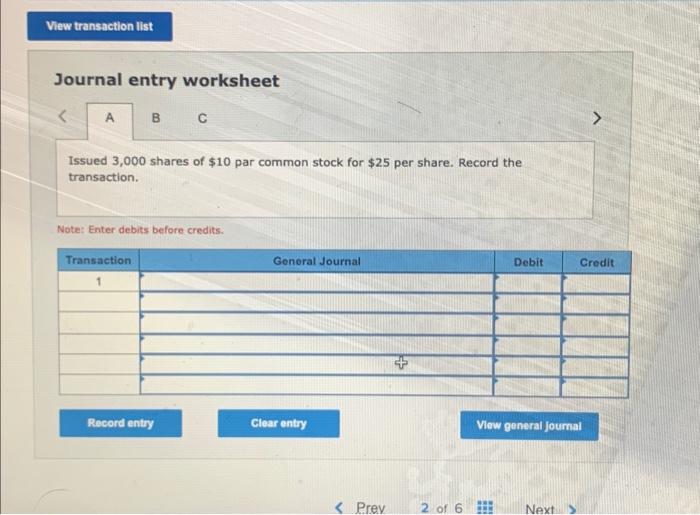

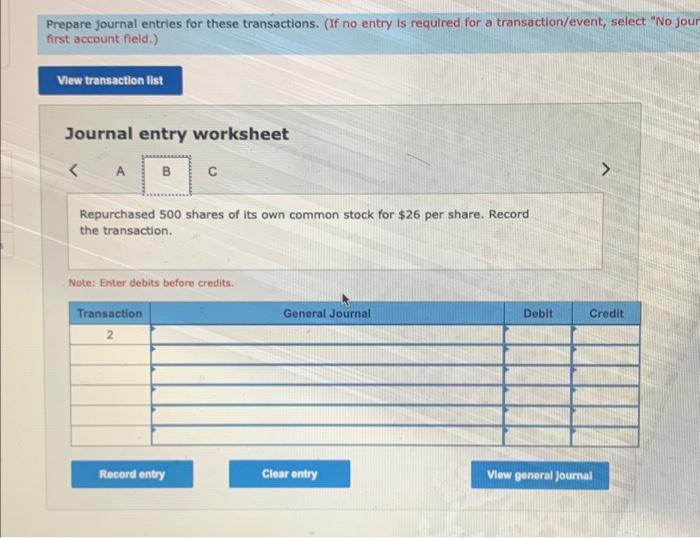

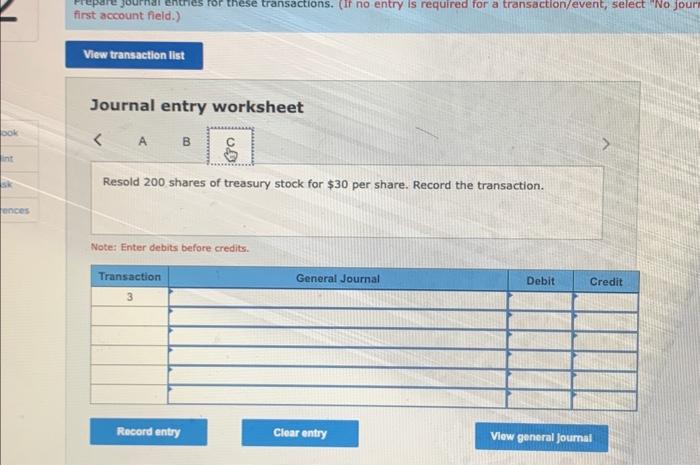

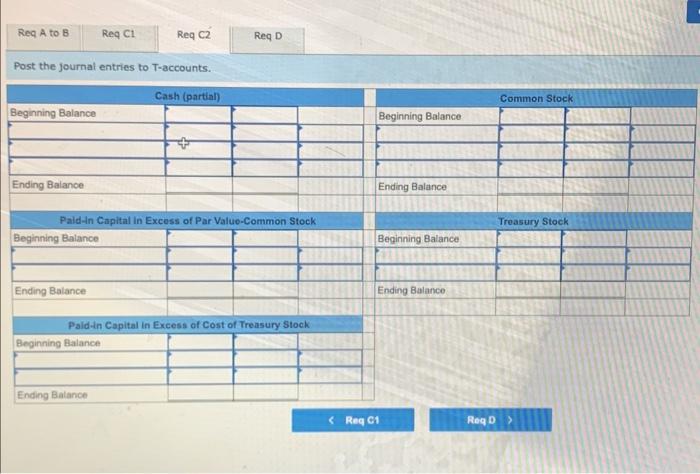

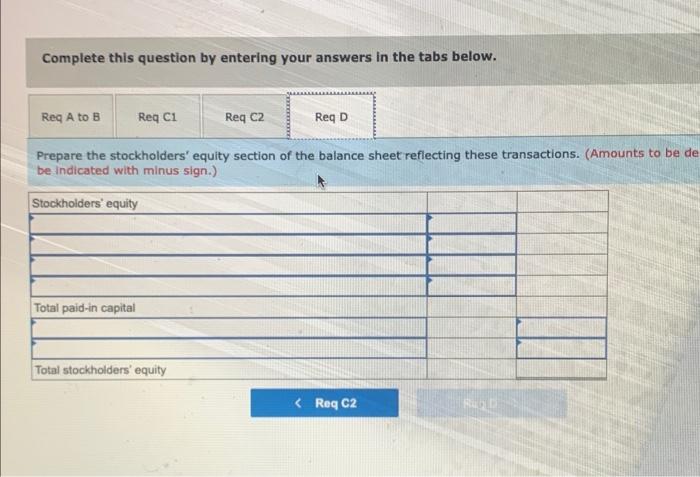

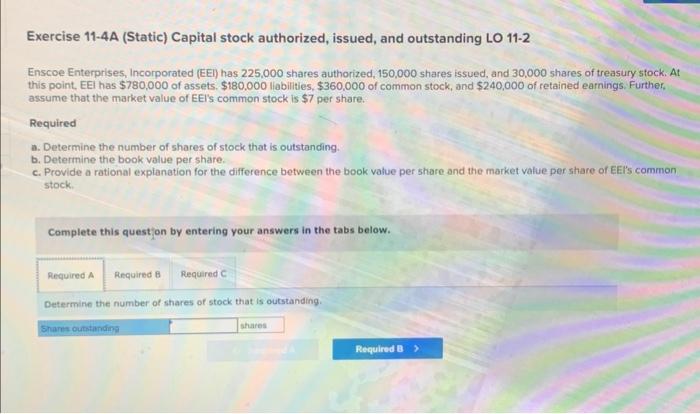

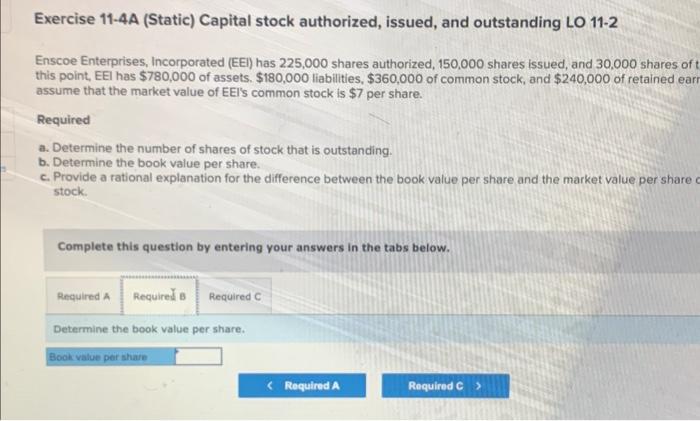

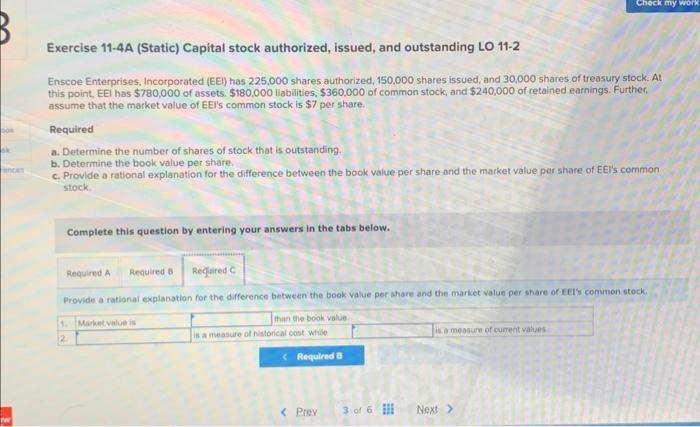

Exercise 11-7A (Static) Cash dividends for preferred and common shareholders LO 11-3 Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 1. 150,000 shares of $1 par common stock. 2. 15,000 shares of $100 par, 6 percent, noncumulative preferred stock. On June 10, Weaver Forporation declared the annual cash dividend on its 15,000 shares of preferred stock and a $0.50 per share dividend for the common shareholders. The dividends will be paid on July 1 to the shareholders of record on June 20. Required a. Determine the total amount of dividends to be paid to the preferred shareholders and common shareholders. b. Prepare general joumal entries to record the declaration and payment of the cash dividends. Answer is not complete. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Prepare general jouryal entries to record the declaration and payment of the cash dividends. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Exercise 11-13A (Static) Recording and reporting treasury stock transactions LO 11-5 The following information pertains to JAE Corporation at January 1, Year 1. JAE Corporation completed the following transactions during Year 1: 1. Issued 3,000 shares of $10 par common stock for $25 per share. 2. Repurchased 500 shares of its own common stock for $26 per share. 3. Resold 200 shares of treasury stock for $30 per share. Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? ct. Prepare journal entries for these transactions. c2. Post the journal entries to T-accounts. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. Complete this question by entering your answers in the tabs below. Journal entry worksheet Issued 3,000 shares of $10 par common stock for $25 per share. Record the transaction. Note: Enter debits before credits. Prepare journal entries for these transactions. (If no entry is required for a transaction/event, select "No jou first account field.) Journal entry worksheet Repurchased 500 shares of its own common stock for $26 per share. Record the transaction. Note: Enter debits before credits. first account field.) Journal entry worksheet Resold 200 shares of treasury stock for $30 per share. Record the transaction. Note: Enter debits before credits. Post the journal entries to T-accounts. Complete this question by entering your answers in the tabs below. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. (Amounts to be be indicated with minus sign.) Exercise 11-4A (Static) Capital stock authorized, issued, and outstanding LO 11-2 Enscoe Enterprises, incorporated (EEI) has 225,000 shares authorized, 150,000 shares issued, and 30,000 shares of treasury stock. At this point, EEI has $780,000 of assets. $180,000 liabilities, $360,000 of common stock, and $240,000 of retained earnings. Further, assume that the market value of EEl's common stock is $7 per share. Required a. Determine the number of shares of stock that is outstanding. b. Determine the book value per share. c. Provide a rational explanation for the difference between the book value per share and the market value per share of EEl's common stock. Complete this question by entering your answers in the tabs below. Determine the number of shares of stock that is outstanding. Exercise 11-4A (Static) Capital stock authorized, issued, and outstanding LO 11-2 Enscoe Enterprises, Incorporated (EEI) has 225,000 shares authorized, 150,000 shares issued, and 30,000 shares of this point, EEl has $780,000 of assets. $180,000 liabilities, $360,000 of common stock, and $240,000 of retained ear assume that the market value of EEI's common stock is $7 per share. Required a. Determine the number of shares of stock that is outstanding. b. Determine the book value per share. c. Provide a rationat explanation for the difference between the book value per share and the market value per share stock. Complete this question by entering your answers in the tabs below. Determine the book value per share. Exercise 11-4A (Static) Capital stock authorized, issued, and outstanding LO 11-2 Enscoe Enterprises, Incorporated (EE) has 225,000 shares authorized, 150,000 shares issued, and 30,000 shares of treasury stock. At this point, EEl has $780,000 of assets. $180,000 liablities, $360,000 of common stock, and $240,000 of retained earnings. Further, assume that the market value of EEl's common stock is $7 per share. Required a. Determine the number of shares of stock that is outstanding. b. Determine the book value per share. c. Provide a rational explanation for the difference between the book value per share and the market value per share of EEI's common stock. Complete this question by entering your answers in the tabs below. Provide a rational explanation for the difference between the book value per share and the market value per share of Ect's commen stock. Exercise 11-7A (Static) Cash dividends for preferred and common shareholders LO 11-3 Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 1. 150,000 shares of $1 par common stock. 2. 15,000 shares of $100 par, 6 percent, noncumulative preferred stock. On June 10, Weaver Forporation declared the annual cash dividend on its 15,000 shares of preferred stock and a $0.50 per share dividend for the common shareholders. The dividends will be paid on July 1 to the shareholders of record on June 20. Required a. Determine the total amount of dividends to be paid to the preferred shareholders and common shareholders. b. Prepare general joumal entries to record the declaration and payment of the cash dividends. Answer is not complete. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Prepare general jouryal entries to record the declaration and payment of the cash dividends. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Exercise 11-13A (Static) Recording and reporting treasury stock transactions LO 11-5 The following information pertains to JAE Corporation at January 1, Year 1. JAE Corporation completed the following transactions during Year 1: 1. Issued 3,000 shares of $10 par common stock for $25 per share. 2. Repurchased 500 shares of its own common stock for $26 per share. 3. Resold 200 shares of treasury stock for $30 per share. Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? ct. Prepare journal entries for these transactions. c2. Post the journal entries to T-accounts. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. Complete this question by entering your answers in the tabs below. Journal entry worksheet Issued 3,000 shares of $10 par common stock for $25 per share. Record the transaction. Note: Enter debits before credits. Prepare journal entries for these transactions. (If no entry is required for a transaction/event, select "No jou first account field.) Journal entry worksheet Repurchased 500 shares of its own common stock for $26 per share. Record the transaction. Note: Enter debits before credits. first account field.) Journal entry worksheet Resold 200 shares of treasury stock for $30 per share. Record the transaction. Note: Enter debits before credits. Post the journal entries to T-accounts. Complete this question by entering your answers in the tabs below. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. (Amounts to be be indicated with minus sign.) Exercise 11-4A (Static) Capital stock authorized, issued, and outstanding LO 11-2 Enscoe Enterprises, incorporated (EEI) has 225,000 shares authorized, 150,000 shares issued, and 30,000 shares of treasury stock. At this point, EEI has $780,000 of assets. $180,000 liabilities, $360,000 of common stock, and $240,000 of retained earnings. Further, assume that the market value of EEl's common stock is $7 per share. Required a. Determine the number of shares of stock that is outstanding. b. Determine the book value per share. c. Provide a rational explanation for the difference between the book value per share and the market value per share of EEl's common stock. Complete this question by entering your answers in the tabs below. Determine the number of shares of stock that is outstanding. Exercise 11-4A (Static) Capital stock authorized, issued, and outstanding LO 11-2 Enscoe Enterprises, Incorporated (EEI) has 225,000 shares authorized, 150,000 shares issued, and 30,000 shares of this point, EEl has $780,000 of assets. $180,000 liabilities, $360,000 of common stock, and $240,000 of retained ear assume that the market value of EEI's common stock is $7 per share. Required a. Determine the number of shares of stock that is outstanding. b. Determine the book value per share. c. Provide a rationat explanation for the difference between the book value per share and the market value per share stock. Complete this question by entering your answers in the tabs below. Determine the book value per share. Exercise 11-4A (Static) Capital stock authorized, issued, and outstanding LO 11-2 Enscoe Enterprises, Incorporated (EE) has 225,000 shares authorized, 150,000 shares issued, and 30,000 shares of treasury stock. At this point, EEl has $780,000 of assets. $180,000 liablities, $360,000 of common stock, and $240,000 of retained earnings. Further, assume that the market value of EEl's common stock is $7 per share. Required a. Determine the number of shares of stock that is outstanding. b. Determine the book value per share. c. Provide a rational explanation for the difference between the book value per share and the market value per share of EEI's common stock. Complete this question by entering your answers in the tabs below. Provide a rational explanation for the difference between the book value per share and the market value per share of Ect's commen stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started