Answered step by step

Verified Expert Solution

Question

1 Approved Answer

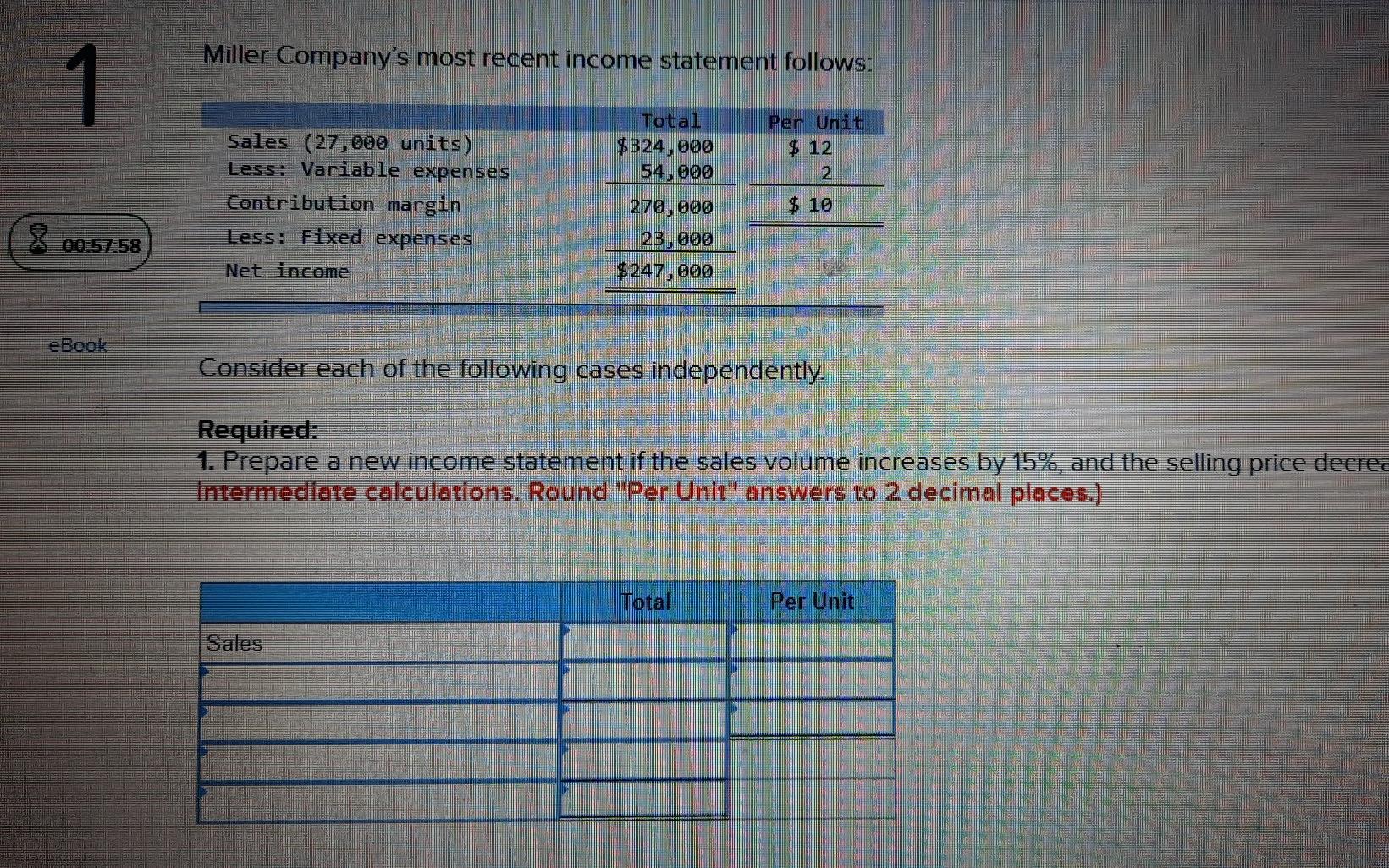

please help for 1 and 2. thanks so much Miller Company's most recent income statement follows: 1 Per Unit $ 12 2 Sales (27,000 units)

please help for 1 and 2. thanks so much

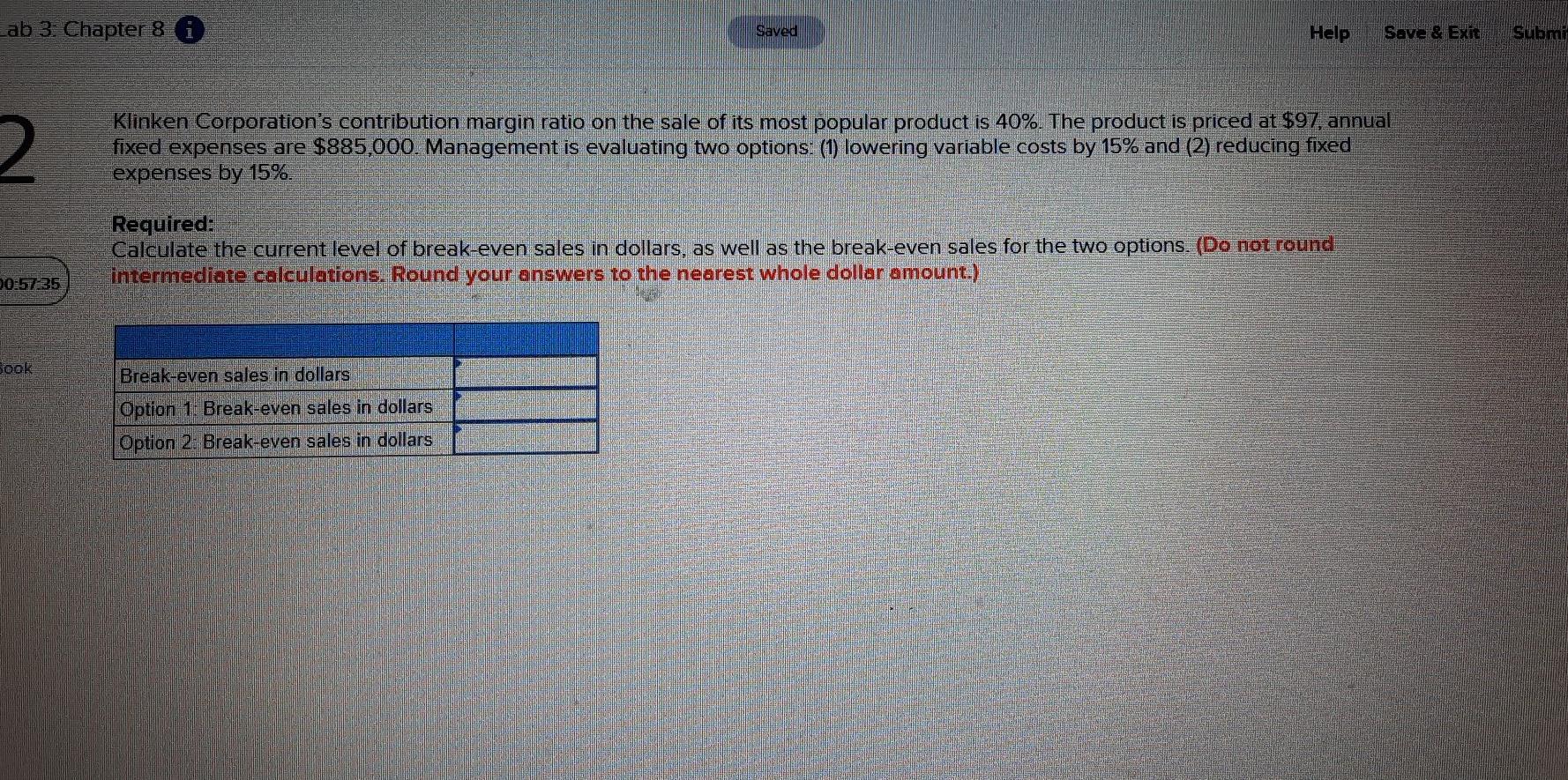

Miller Company's most recent income statement follows: 1 Per Unit $ 12 2 Sales (27,000 units) Less: Variable expenses Contribution margin Less: Fixed expenses Net income Total $324,000 54,000 270,000 23,000 $247,000 $ 10 8 00:57:58 eBook Consider each of the following cases independently. Required: 1. Prepare a new income statement if the sales volume increases by 15%, and the selling price decrea intermediate calculations. Round "Per Unit" answers to 2 decimal places.) Total Per Unit Sales Lab 3: Chapter 8 i Saved Help Save & Exit Submi 2 Klinken Corporation's contribution margin ratio on the sale of its most popular product is 40%. The product is priced at $97, annual fixed expenses are $885,000. Management is evaluating two options: (1) lowering variable costs by 15% and (2) reducing fixed expenses by 15%. Required: Calculate the current level of break-even sales in dollars, as well as the break-even sales for the two options. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) 00:57:35 Sook Break-even sales in dollars Option 1. Break-even sales in dollars Option 2: Break-even sales in dollarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started