Question

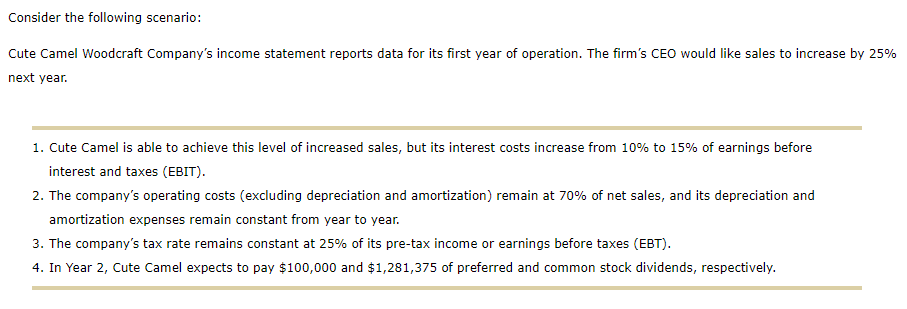

Please Help! For drop down questions below, the options are : -In Year 2, if Cute Camel has 5,000 shares of preferred stock issued and

Please Help!

For drop down questions below, the options are :

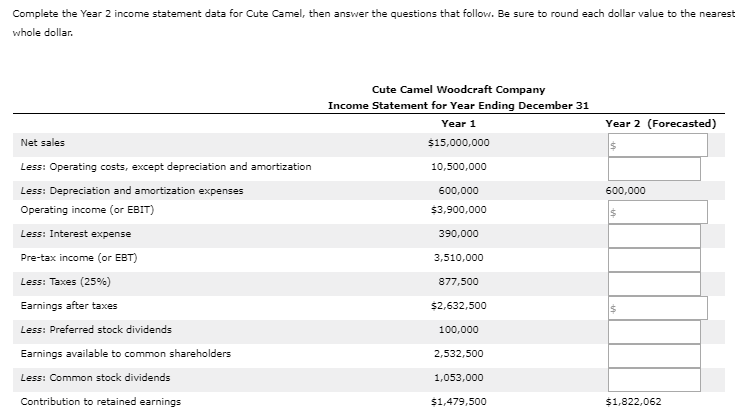

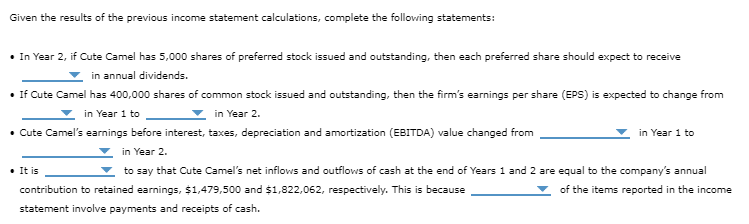

-In Year 2, if Cute Camel has 5,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive ($20.00 , $40.00 , $30.00 , or $50.00) in annual dividends.

-If Cute Camel has 400,000 shares of common stock issued and outstanding, then the firms earnings per share (EPS) is expected to change from ($6.58 , $8.78 , $9.75, or $6.33) in Year 1 to ($10.68, $8.01, $7.76, or $12.56) in Year 2

-Cute Camels earnings before interest, taxes, depreciation and amortization (EBITDA) value changed from ($14,400,000 , $4,777,500 , $4,500,000 , or $6,532,500) in Year 1 to ($8,228,437 , $16,328,437 , $5,625,000 , or $19,503,750) in Year 2

-It is (Correct or Incorrect) to say that Cute Camels net inflows and outflows of cash at the end of Years 1 and 2 are equal to the companys annual contribution to retained earnings, $1,479,500 and $1,822,062, respectively. This is because (All but one , or All) of the items reported in the income statement involve payments and receipts of cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started