Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help For the purposes of U S. tax law, examples of depreciable assets are (select all that apply) a large desk that we expect

please help

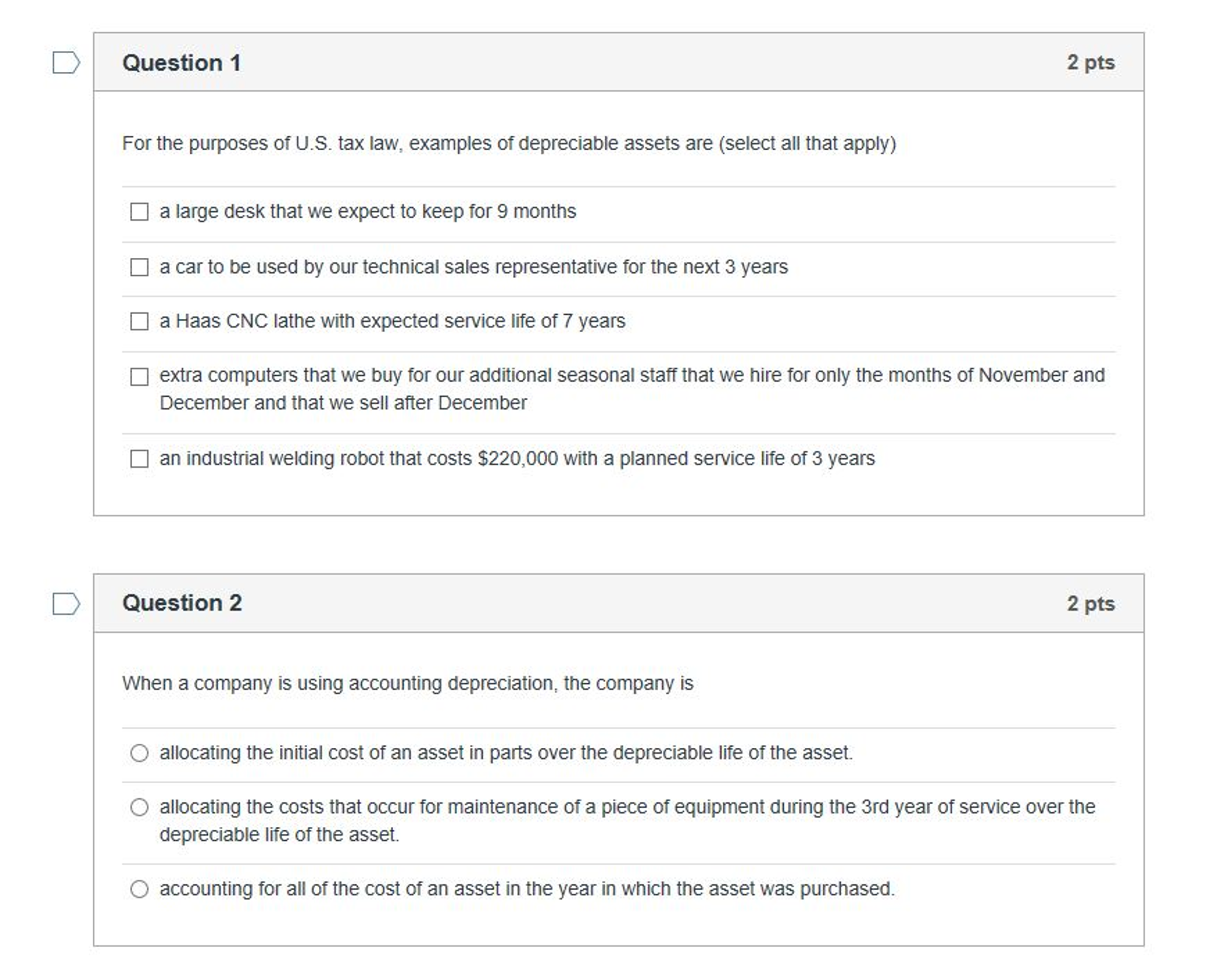

For the purposes of U S. tax law, examples of depreciable assets are (select all that apply) a large desk that we expect to keep for 9 months a car to be used by our technical sales representative for the next 3 years a Haas CNC lathe with expected service life of 7 years extra computers that we buy for our additional seasonal staff that we hire for only the months of November and December and that we sell after December an industrial welding robot that costs $220,000 with a planned service life of 3 years When a company is using accounting depreciation, the company is allocating the initial cost of an asset in parts over the depreciable life of the asset. allocating the costs that occur for maintenance of a piece of equipment during the 3rd year of service over the depreciable life of the asset. accounting for all of the cost of an asset in the year in which the asset was purchased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started